courtneyk

Making Lemonade And Squeezing All of the Juice

I maxed my position in Trinseo (NYSE:TSE) yesterday. The company had back-to-back bad news for investors so, between traders selling absent an imminent catalyst and shorts pressing on a weak quarter and a weaker 2H outlook, the stock was way overdone to the downside. For those with a longer-term outlook, the capitulation yesterday on kitchen-sink guidance is a great opportunity.

As inflation raged and interest rates moved higher, credit markets tightened. Trinseo has been going through a massive transition to a specialty chemical player and has one commodity business remaining – styrenics. A couple of weeks ago, analysts were pushing TSE as a long recognizing that a big sale of the last commodity business would put TSE squarely in the specialty chemical space where much higher multiples reside. Moreover, it would strengthen Trinseo’s balance sheet and likely both increase and accelerate their share repurchase program and potentially prompt management to increase the dividend and perhaps pay down some debt, which they have already been doing. When the company issued the press release saying they were putting the sales process for styrenics on a “pause” due to credit market conditions, traders punted the stock and shorts pressed it lower. And when yesterday’s earnings release and conference call saw lowered guidance, and took a very conservative outlook, some holders capitulated and sent the stock to a new 52-week low. Herein lies the opportunity.

The second-half run rate is a super-trough because:

- It has temporary heavy discounting due to stay-at-home goods in the US (appliances and consumer electronics)

- Has the impact of temporary inventories from China built up during the period when China was closed for Covid now dumped on the market

- Temporary peak energy prices in Europe (you can see from the forward curve of energy that this is coming down hard in 2023 and 2024).

- Even in this super trough, you have run-rate EBITDA of $400 million (the implied guidance does not adjust for the inventory timing amount of 35 million+, which is just book accounting). Cash flow in H2 will be very strong as the company built up over $250 million in inventory in H1 which you can see from the chart in the presentation is fully reversing in H2. So in a super-trough, you have $400 million of EBITDA and $70 million in maintenance CAPEX. Normalized EBITDA is $750 million. On a normalized basis where the stock is trading now is 49% free cash flow yield, so trading at 2x cash EPS. The company bought back another 3% of the stock this quarter, and the dividend yield is now 4.25%.

- The share count is now down to 34.9mm shares. The company will sell styrenics as soon as markets improve. The market cap is now below what the value of styrenics is so you get the entire business (ex-styrenics) for free.

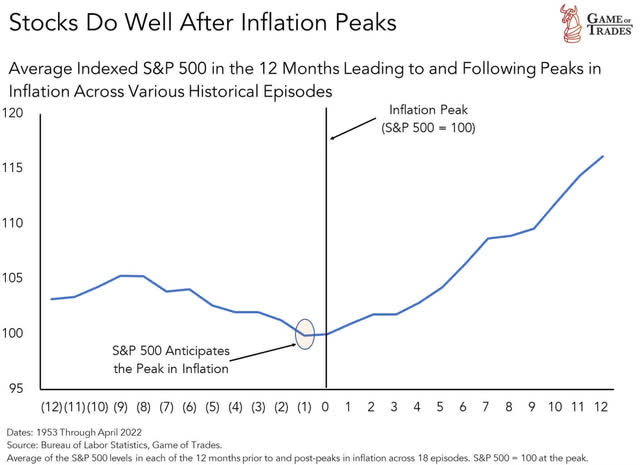

Stocks Do Well After Inflation Peaks (Bureau of Labor Statistics – Game of Trades)

Stocks Do Well After Inflation Peaks (Bureau of Labor Statistics – Game of Trades)

So – What Can We Conclude Post Earnings Call?

The earnings call was constructive despite the stock reaction. They walked through how even at this extreme trough, they generate a 20% FCF yield. Clearly, this quarter is the low. I believe a good portion of the volume yesterday and again today has been shorting (probably momentum players after the heavy pressure with numerous holders getting out after the delay of styrene sale). Some investors have expressed concerns and skepticism about the merits of the long case for Trinseo largely due to the debt (I think short-sellers). The net debt is ~$2 billion at the end of the quarter. Even based on this low guidance, the company will generate over $250/$300 million in FCF in the second half due to working capital. So they will end the year at $1.7 billion. This is 4x TROUGH EBITDA. The company generates $200 million of FCF even at trough conditions without help from working capital. They have no maturities until one in 2024 and then the rest is staggered through 2029. To argue that the debt in this company is problematic is disingenuous and not a reasonable argument. Trinseo bonds are HIGHER today vs a week ago and barely flat to down from Monday. if credit risk had increased here, these bonds would be imploding. This proves the point regarding debt. The ride down to $30 has been humbling, volatile, and unfortunate, but for those looking longer-term or waiting for a chance to get aggressive in Trinseo, I think this will be a great entry-level.

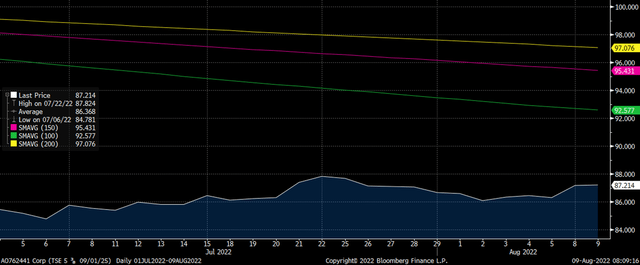

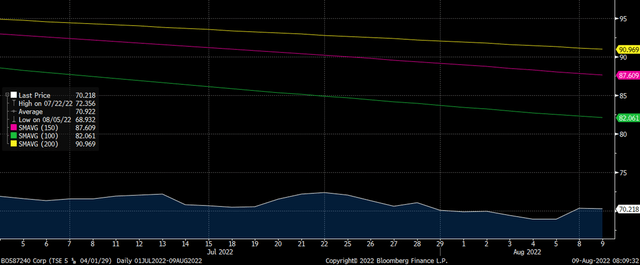

Below is the performance of Trinseo Bonds. Notable, given that fixed income investors tend to calibrate credit risk better than equity investors. Do these bond holders look like they are derisking?

Trinseo’s 2025 and 2029 bonds since the market derisking really started on July 1st:

Trinseo September 2025 Bonds (Bloomberg)

Trinseo April 2029 Bonds (Bloomberg)

So let’s review the bullish setup here

- Shorts have piled onto this stock on the back of the selling of a big holder who appears to have puked their entire position on the back of the delay of the styrene sale

- In a market de-risking of cyclicals over the last eight weeks (according to Goldman Sachs, the second worst period in the last five years) they have pressed this stock down to a valuation never seen before. The stock now also has over 4% dividend yield and the company is buying back 3% of the stock per QUARTER (or 12% per year).

- Most people do not do a thorough analysis so some are shorting on the back of the headline miss for H2 when the underlying cash flow did not see nearly the same revision

- The weakness in the guidance comes mainly from destocking, largely from stay-at-home goods like consumer electronics and appliances. Looking at the prior quarter we can see that this already started in Q1, intensified in Q2, and is very likely to peak in Q3. In addition, the spreads were hurt because of excess product from China due to the timing of lockdowns there. Both of these two issues should normalize from here during Q3 and likely no longer be an issue in Q4.

- While the stock has gone from 50 to 30 over the last few weeks, the bonds have not moved. This shows the fixed income guys realize this is temporary weakness and their credit profile remains strong regardless of the equity guys’ short narrative.

- The company confirmed on the call that styrene deal was delayed because credit markets were shutting down as rates kept going up and the yield curve kept inverting. Today’s CPI shows that inflation has peaked so rates have likely peaked. This also means that the stress on financing markets has likely peaked. The yield curve is already starting to reverse the inversion today with a nice steepening move this morning on the back of the CPI. High yield bonds in Europe have rallied significantly since the large move lower coinciding, unfortunately, with the June 6th when the CEO, in an interview, expressed confidence the deal was going to be completed “mid-year.”

Now, let’s see what can happen from here

- The big seller is done and the smallest amount of buying will start to squeeze the shorts who will find no liquidity to cover. With the one-two punch of delayed sale of styrene and then the guide down, I believe whoever has not sold by now is likely to hold on or add as the stock has bottomed. Even if there is no other buyer, the company still has $200 million left on the buyback which they can begin again tomorrow. They have said and shown they thought it was a great buy at $50 per share. I suspect $30s will be quite tempting for them to be more aggressive in their repurchase. Also, based on the average purchase price, we know TSE was not buying stock for most of Q2 because they front-loaded purchases.

- Peak inflation expectations and a steepening of the curve increases demand for cyclicals, particularly smaller cap cyclicals – game over for the shorts.

- The smallest sign of destocking slowing or ending – game over for the shorts and compelling for long buyers.

- The smallest sign of commodity prices stabilizing will make the customers that have been deferring buying hoping for lower prices come back and buy – game over for the shorts and again, compelling for the longs.

- The smallest sign of financing markets improving and the deal being back on the table – the market cap of TSE is now 20% lower than the likely value for the styrene division alone – complete game over for the shorts and long-buyers scrambling to buy.

- Smallest incremental news of Chinese Covid lockdowns ending – game over for the shorts.

- The smallest sign of the Russian conflict in Ukraine ending as Putin gets his two regions but clearly has no military to expand – collapse in gas prices in Europe and shorts scramble to cover while bidding against long buyers for a small float.

Valuation and Price Target

Normalized EBITDA is $760 million or $490 million of FCF. This is $14 per share in FCF per share. So the stock is trading at 2x FCF (normalized) per share. A normalized multiple is 12x FCF so I believe the stock is worth 6x its current price. However, the upside is likely higher because the bids for styrene were at ~13x FCF so the remaining business before the deal was delayed due to financing markets shutting down. As soon as they re-open, this deal will happen, and the remaining core business will be higher than the 12x. For reference, recent comparable transactions like Celanese’s acquisition of DuPont’s engineering plastics business or Advent’s acquisition of DSM’s engineering plastics business were 20x free cash flow (12.5x EBITDA in the Advent deal and 14x EBITDA in the Celanese deal). So post the styrene sale, the remaining piece is worth at least 16x FCF (I am using a discount to the other deals to be conservative). This would mean the stock is an 8x bagger from here. Of course this is a bull case—but even if we get a portion of the bull case we have quite a compelling return in my view. While we wait for this to play out the company keeps buying back stock, shrinking the float every day, and we get a 4% dividend while we wait.

Final Point On Trinseo Debt

Whether in direct messages or in comments on my articles, the bears constantly point to Trinseo’s debt. So given the reversal in working capital generating so much cash in H2, net debt will be close to $1.7 billion by year-end. This is just over 2x normal EBITDA. While every time a cyclical company goes through a trough, people worry about the debt as the EBITDA is depressed. In this case using trough EBITDA you only get to 4x. This will drop rapidly as the destocking and the current dislocation passes even if end market demand is soft. Trinseo has plenty of liquidity, generates tons of cash even during the trough, and its debt maturities are staggered starting in LATE 2024 and going through 2029. Needless to say, the economy will recover before then. In addition, even if the economy were to continue to be slow, the high yield market has never been shut for more than a couple of months, so as soon as the high yield market reopens, styrene will get sold which gives the company the option to reduce debt faster if they so choose (but they have no need to). Clearly, the bond market understands this, but the equity shorts don’t want to admit this because it does not fit with their hyper-bearish narrative.

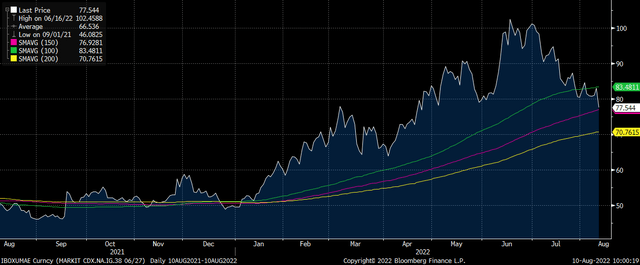

By the way, if you look at high yield spread they are coming in fast, making financing conditions easier (in part due to rate expectations cycle having peaked). Financing markets deteriorated sharply in June, which led to the heavy derisking in cyclical equities. Today, we are all the way back to BEFORE the financing markets got tough in early June. So the shorts can spin all they want, but the truth is that financing markets are today back to a point where the styrene sale can happen again. The chart below is the pricing of CDS (risk of price in financing markets)

Pricing of CDS (risk of price in financing markets) (Bloomberg)

Be the first to comment