PeopleImages

Crescent Energy Company (NYSE:CRGY) recently increased its EBITDA guidance for the year 2022, and promised new accretive acquisition and a reduction in the leverage. I ran several financial models, which implied a fair price of close to $30 per share. While there are also risks from shortage of equipment or failure in the assessment of reserves, Crescent looks like a stock that is worth having a careful look at.

Crescent Energy

Crescent Energy is an energy company with assets in over 48 states, predictable cash flow, and a predictable base of production.

Company’s Website

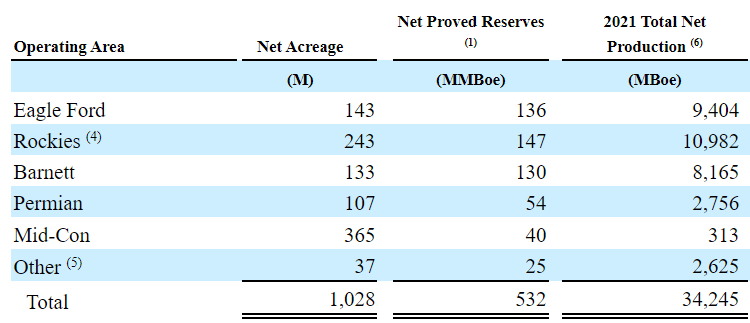

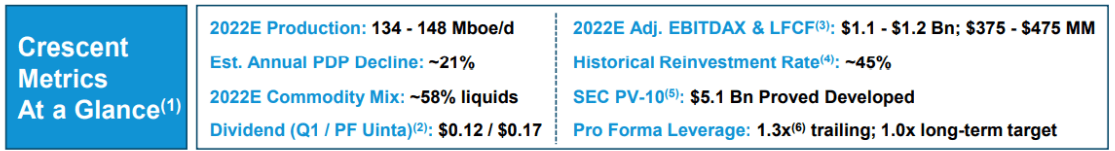

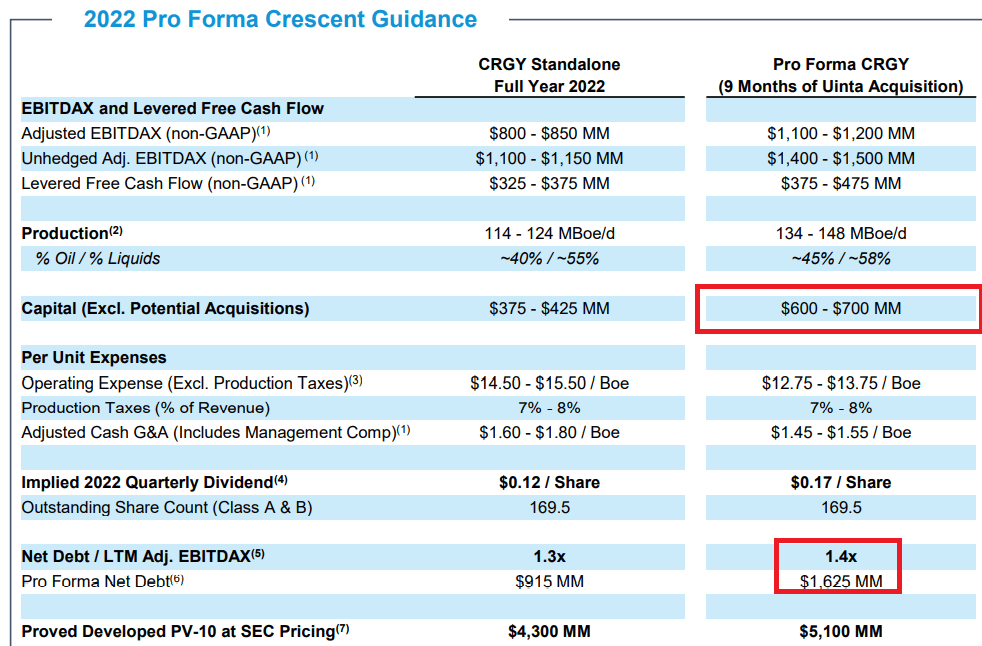

The company’s operating areas include 532 MMBoe and net acreage of 1.028 million. Some of the operating areas are well-known and successful such as the Permian area or the Barnett area. In the last presentation given to investors, management noted reserves worth SEC PV-10 of $5.1 billion as well as expected Adjusted EBITDAX 2022 around $1.1-$1.2 billion.

Presentation To Investors Presentation To Investors

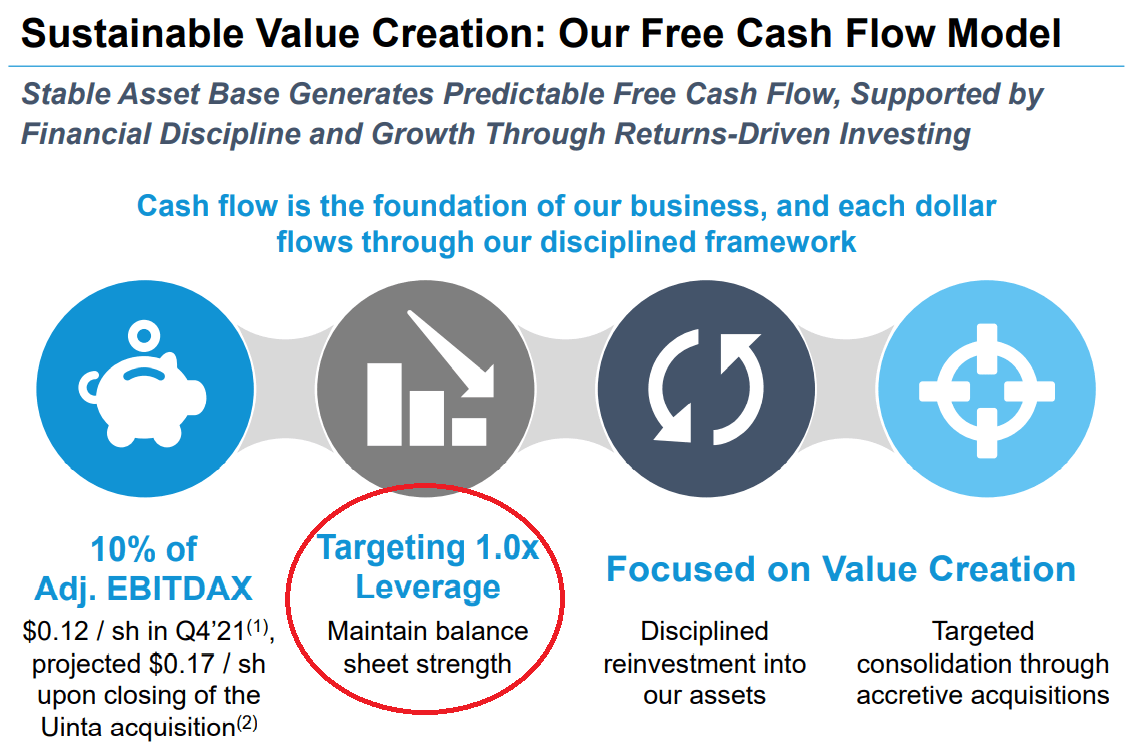

With the oil price increasing at a very decent pace, I became quite interested because Crescent Energy focuses on stable cash flow generation. At the same time, management is targeting low leverage close to 1x EBITDA, which will likely enhance the company’s valuation in the future.

Presentation To Investors

The most recent news is also quite promising. In the last quarterly report, Crescent increased its free cash flow guidance for the year 2022. In my view, if management continues to deliver better and better guidance, the company may create stock demand.

Crescent increased the midpoint of its 2022 outlook for Adjusted EBITDAX and Levered Free Cash Flow by 17% and 35%, respectively, based on the strength of commodity prices. Source: Press Release

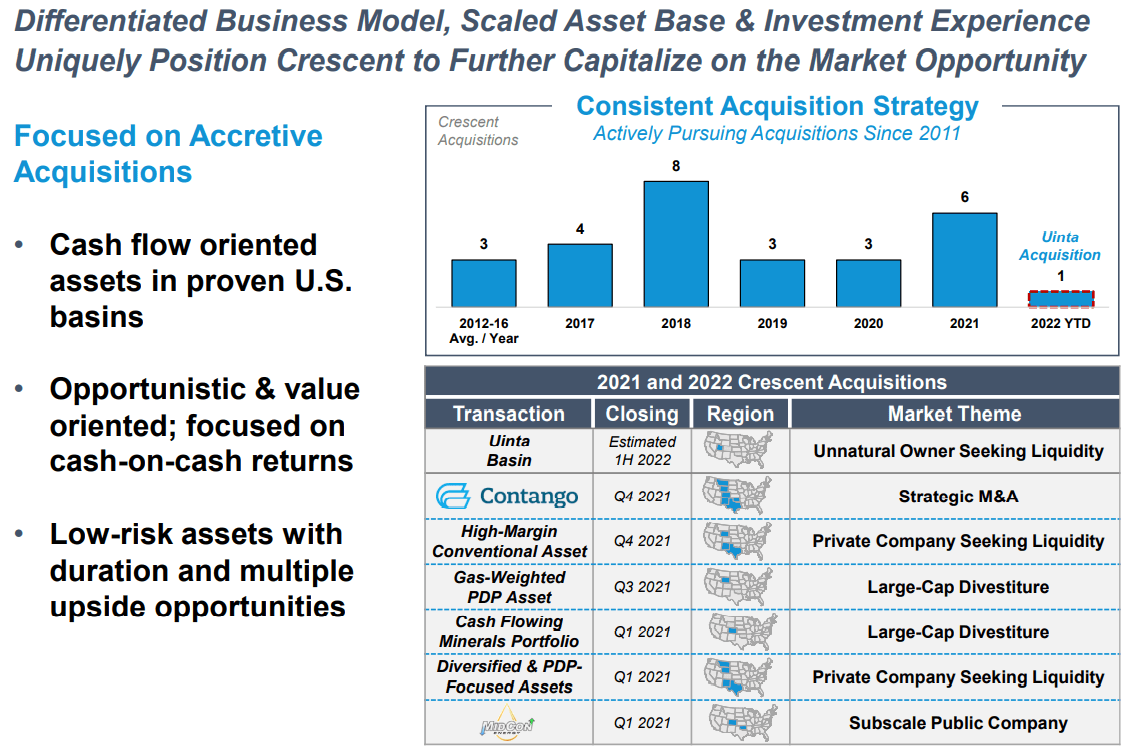

I would apply the previous rationale to the news about mergers and acquisitions. Crescent Energy noted the closure of the acquisition of Uinta Basin assets, which is expected to enhance the company’s scale. Besides, management promised to bring more accretive acquisitions in the coming months.

At the end of March, we closed the accretive acquisition of Uinta Basin assets, which significantly increased our scale and added high margin oil production at a very attractive price. Today, Crescent remains well positioned with scale in high-return basins, a clear framework to return cash to shareholders, a strong balance sheet and a track record of making accretive acquisitions. Source: Press Release

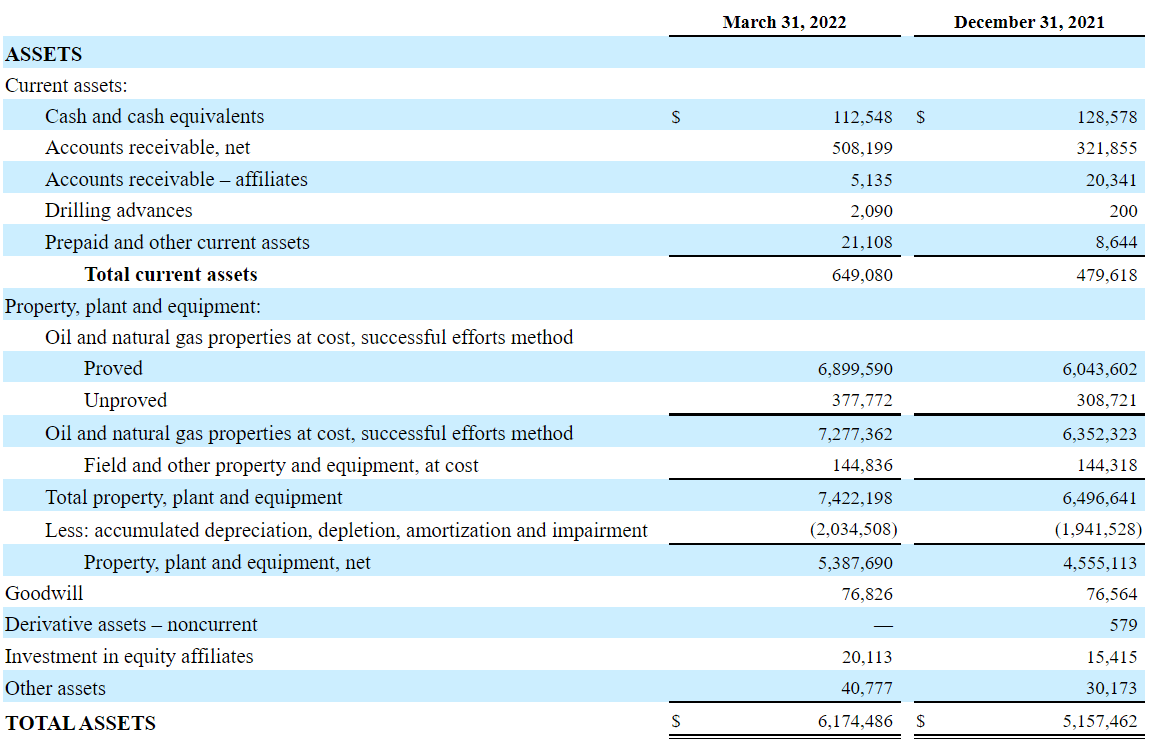

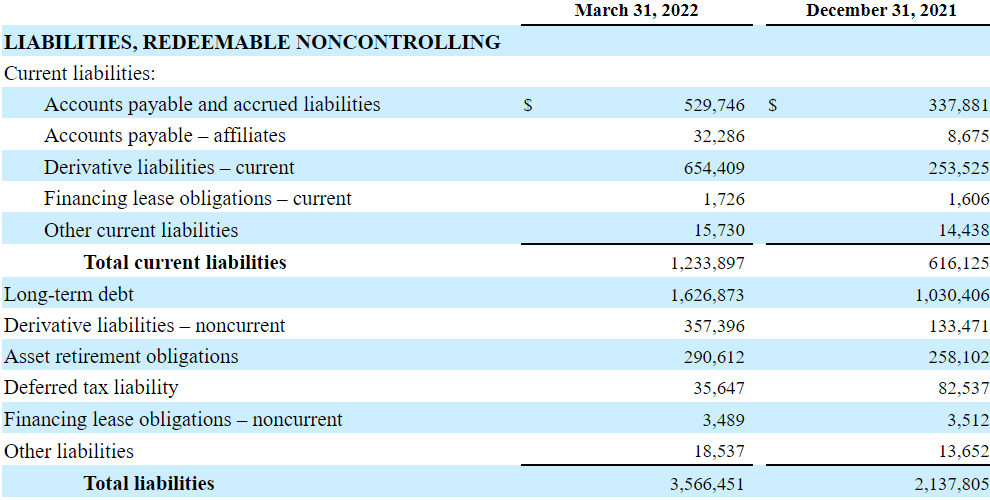

Balance Sheet

As of March 31, 2022, Crescent Energy reported $112 million in cash, proved oil and natural gas properties worth $6.8 billion, and $3.5 million in total liabilities. I believe that the balance sheet looks stable.

10-Q

The long-term debt is equal to $1.62 billion, and the derivative liabilities stand at more than $1 billion. Let’s note that the company did not include the derivative liabilities for the calculation of the net debt, so that the net/ adjusted EBITDA stands at 1.3x-3.4x. I am a bit more conservative.

Presentation To Investors 10-Q

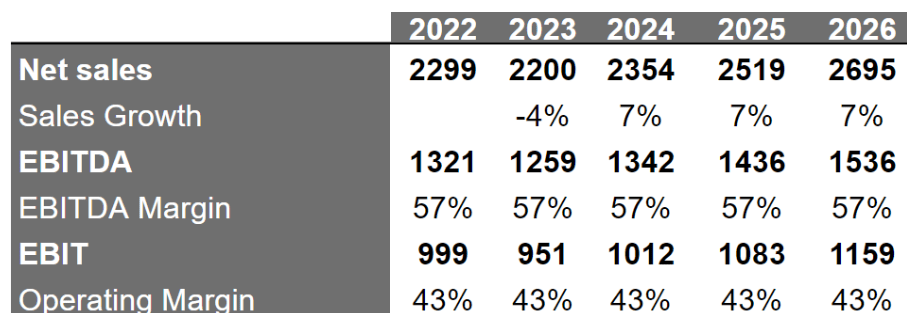

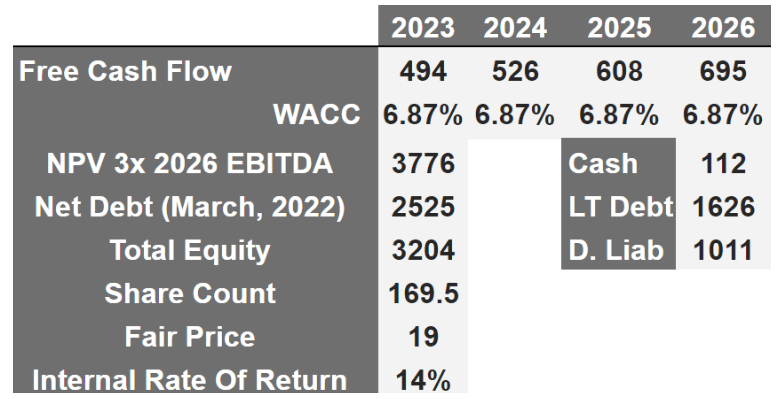

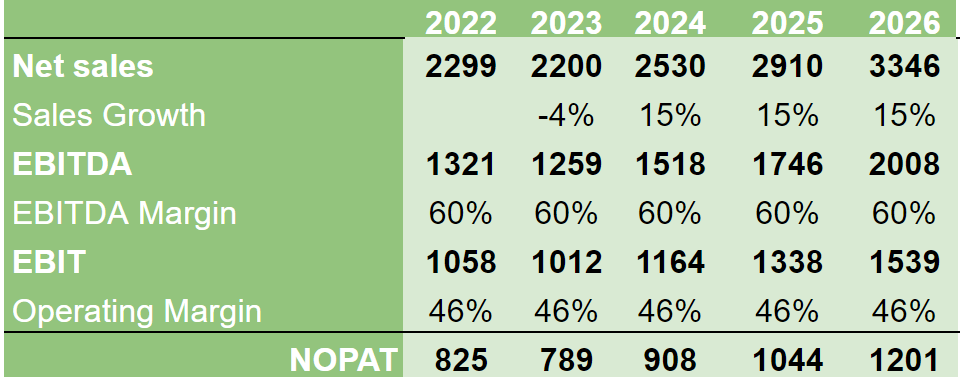

Base Case Scenario With Sales Growth Around 7% Implied A Fair Price Of $19

Under my base case scenario, I assumed that some of Crescent’s drilling opportunities would enhance the company’s production figures. In this regard, let’s note that in December 2021, management noted around 1,528 locations:

As of December 31, 2021, we have identified 1,528 gross (685 net) undrilled locations, including 567 gross (450 net) operated drilling locations. Of our total 685 net locations, 159 net locations are identified as PUD drilling locations as of December 31, 2021. The majority of these locations are on acreage that is held by production. Source: 10-K

In my view, Crescent Energy could also find new production opportunities thanks to more innovation related to horizontal drilling and hydraulic fracture stimulation techniques. Management counts with access to cash and liquidity to support more significant capital expenditures.

As part of our exploration and development operations, we have expanded, and expect to further expand, the application of horizontal drilling and multi-stage hydraulic fracture stimulation techniques as well as enhanced recovery operations. The incremental capital expenditures are generally the result of greater measured depths, additional hydraulic fracture stages in horizontal wellbores and increased volumes of water, CO2 and proppant. Source: 10-K

With the natural gas liquids market growing at 6.2%, and the oil and gas market growing at 8%, in my view, Crescent may grow at 7%. The following texts offer further information about some of the company’s target markets:

The natural gas liquids market share is expected to grow by USD 15.17 billion from 2021 to 2026 at a CAGR of 6.2% as per the latest market report by Technavio. Source: Natural Gas Liquids (NGLS) Market – 45% of Growth to Originate from North America

The global Oil and Gas EPC market is expected to register a significant CAGR 8% during the forecast period 2022-2028. Source: Oil & Gas EPC Market Size 2022 with 8% CAGR

I also assumed an EBITDA margin of 57% and an operating margin of 43%, which resulted in 2026 EBITDA of $1.53 billion.

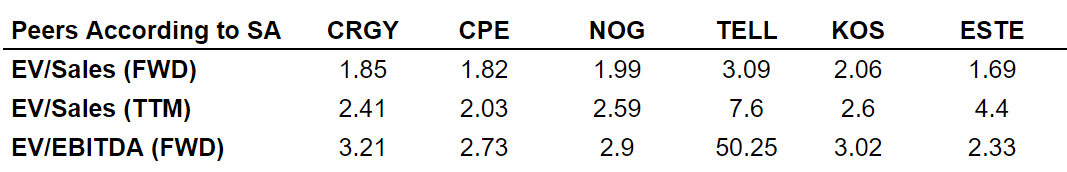

Hohaf

My CAPM model includes a weighted average cost of capital of 6.87% and an exit multiple of 3x. Note that peers trade at close to 2x-3x EBITDA. I don’t believe that my figures are conservative.

SA

If we include cash worth $112 million, the long-term debt, and the derivative liabilities, the implied equity would stand at $3.204 billion. Finally, I obtained an equity per share of $19 and an IRR of 14%.

Hohaf

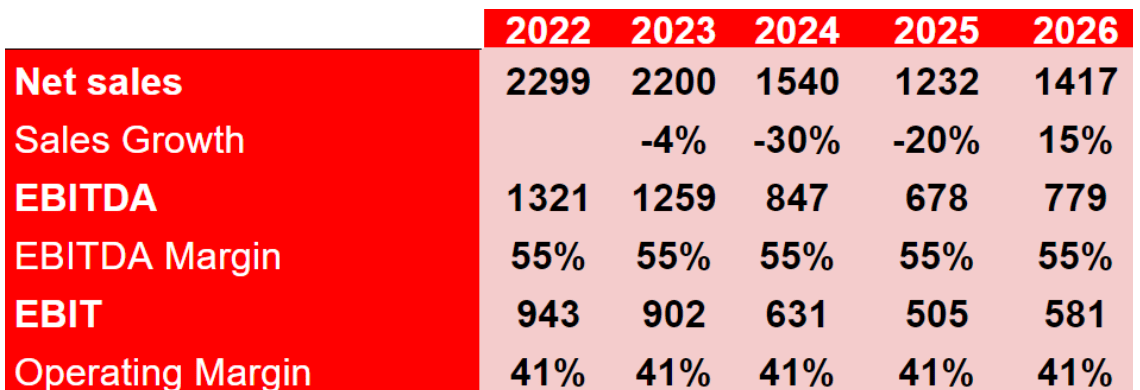

Bearish Cash Scenario: Failure In The Assessment Of Reserves Or Shortage Of Equipment

Crescent Energy recently signed several acquisitions. If the transactions are not properly managed, and expected synergies are not realized, free cash flow may be lower than expected. As a result, certain investors would sell equity, which would lead to a decline in the company’s stock valuation:

If we are not able to successfully integrate the businesses of Contango and Independence in an efficient, cost-effective and timely manner, the anticipated benefits and cost savings of the Merger Transactions may not be realized fully, or at all, or may take longer to realize than expected, and the value of our Class A Common Stock, the revenues, levels of expenses and results of operations may be affected adversely. If we are not able to adequately address integration challenges, we may be unable to successfully integrate Contango’s and Independence’s operations or realize the anticipated benefits of the Merger Transactions. Source: 10-K

Crescent Energy makes a lot of assumptions for estimating oil and gas reserves. Many variables may change in the future, which may lead to a drastic reduction in the reserves valuation. As a result, future production of oil could lower, which would lead to a decline in both revenue and fair valuation. Under this case scenario, I assumed that the company may fail in their assumptions. These risks were assessed in the most recent annual report.

The process of estimating oil and natural gas reserves is complex and requires significant decisions and assumptions in the evaluation of available geological, engineering and economic data for each reservoir. The reports rely upon various assumptions, including assumptions regarding future oil and natural gas prices, our drilling program, production levels, and operating and development costs. In addition, the reserves that we present herein are aggregated from several reports, which were prepared by several engineering firms and therefore may be based on slightly different assumptions and preparation and review procedures. Our ability to develop any identified drilling location is subject to various limitations and any drilling activities we are able to conduct may not be successful. Source: 10-K

Shortages of equipment could occur because the company sometimes leases from third parties. Besides, if the oil price continues to trend higher, the cost of leasing may increase, which would lead to a decline in free cash flow and valuation.

While we currently have excellent relationships with oilfield service companies, there is no assurance that we will be able to contract for such services on a timely basis or that the cost of such services will remain at a satisfactory or affordable level. Shortages or the high cost of equipment, supplies or personnel could delay or adversely affect our development and exploitation operations, which could have a material and adverse effect on our business, financial condition or results of operations.

Under the previous conditions, I included sales growth of -30% in 2024 and -20% in 2025. I also believe that an EBITDA margin of 55% and operating margin of 41% could happen. My results would include 2026 EBITDA of $779 million and 2026 Operating Margin of $581 million.

Hohaf

Let’s also note that under this case, I envision that management would lower their expenditures in capital expenditures. It may have a positive effect on the free cash flow.

Hohaf

My results would include free cash flow around $905 million and $291 million, total equity of $908 million, and a fair price of $5.

Hohaf

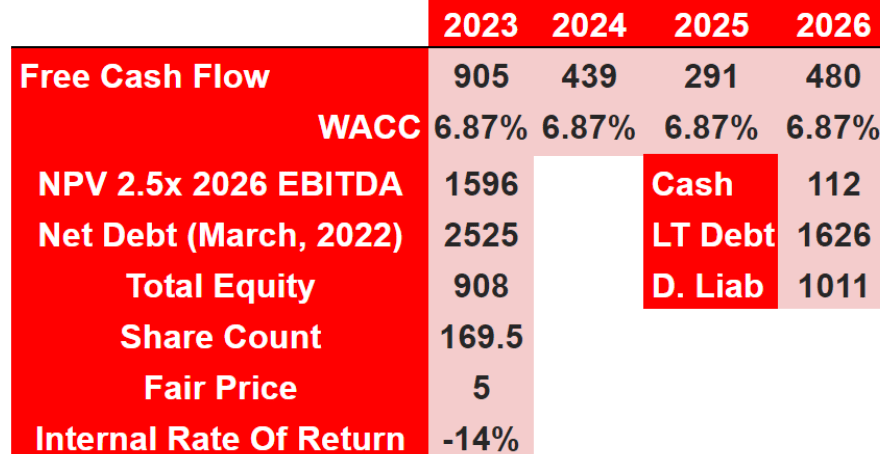

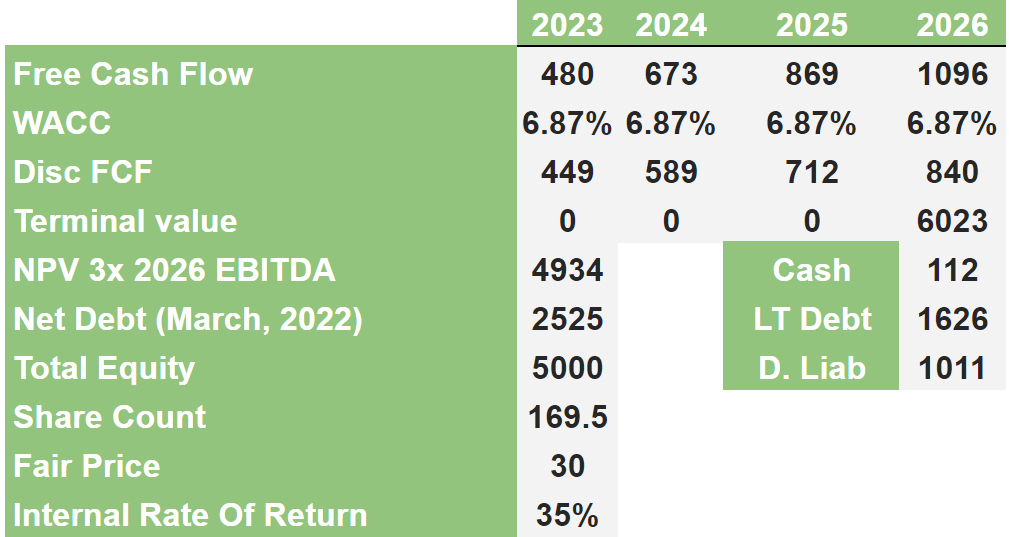

With A Sufficient Number Of Acquisitions, I Obtained A Valuation Of $30 Per Share

Under the best case scenario, in the next four years, Crescent Energy will find more acquisitions like those signed in the past. Besides, management will likely successfully close previous acquisitions, and synergies could enhance future free cash flow.

Presentation To Investors

Under very optimistic conditions, sales growth could stand at 15% from 2024 to 2026. Besides, with sufficient synergies and business combinations, in my view, an operating margin of 46% is achievable. Finally, 2026 NOPAT could be close to $1.201 billion.

Hohaf

With 2023 FCF equal to $480 million and free cash flow around $1.095 billion in 2026, I obtained total equity of $5 billion. The fair price would be equal to $30 per share, and the internal rate of return would be 35%.

Hohaf

Takeaway

Crescent Energy increased its FCF guidance. Management also promised to reduce its leverage in the coming years, which could enhance the company’s fair valuation. Under very optimistic conditions, in my view, with sufficient acquisitions, the stock price could go to $30 per share, and bring an IRR of more than 30%. There are also some risks coming from shortage of equipment or failure in the assessment of reserves. However, in my view, the upside potential in the stock price is enough to justify a position in the stock.

Be the first to comment