spooh

As I consider my upcoming retirement in a few years, I am interested in creating an income stream that pays regular high yield distributions (preferably >8% annual yield). There are many options available to long-term investors and depending on your risk tolerance and time frame, some alternatives may make more sense than others. Some high yield income investments that I own include BDCs, REITs, and CEFs of various flavors, including bond funds, equity funds, and some that are a blend of each.

Another asset class that offers a high yield income steam can come from MLPs (Master Limited Partnerships), which are most often pipeline companies that transport oil or natural gas. Pipeline MLPs have generally steady income streams that offer investors a high yield distribution. Most (but not all) MLPs are in the oil and gas transport industry because changes to the tax code in 1986 enabled them to structure as partnerships. This tax structure also offers benefits to investors who hold MLPs in taxable accounts. Unit holders in MLPs receive a K-1 form at tax time that shows the tax structure of the distributions they received during the previous year.

Why invest in MLPs now?

The energy sector has performed the best of any sector in the S&P 500 since the start of 2022. Although the S&P 500 Energy Sector index (XLE) is down -18% since June 1 (compared to a -6% decline in the overall S&P 500 index), the energy sector is still the top performing one this year and the only sector to show a gain. Oil supplies are tight because of the Russian invasion of Ukraine and for a variety of other reasons that you can read more about here. The price of oil is likely to remain high in the short-term and although demand may pullback somewhat, the longer-term outlook for demand is expected to increase again as the global economy resumes its recovery.

Energy demand continues to rebound post-Covid as more people are travelling and returning to the office. On the other hand, fears of recession and demand destruction from inflation and higher gas prices has had a bearish impact on the sector. In my opinion, which is backed up by Goldman Sachs, fears of a recession are overblown and already priced in.

“We believe it is premature for commodities to succumb to recession concerns when the global economy is still growing and markets remain in deficit on strong demand,” said Goldman Sachs Group Inc. analysts, including Jeffrey Currie, in a note to clients.

Why Buy a CEF of MLPs?

There are some advantages to purchasing MLPs by using a CEF (closed end fund) that holds them. One of those advantages is that there are no pesky K-1s at tax time, and no UBTI, which makes them more appropriate to be held in tax-exempt accounts like an IRA. Also, MLPs vary in the amount and frequency of distributions that they pay out. A CEF can use leverage and adjust the holdings in its portfolio to smooth out those variations to pay a regular steady (typically quarterly or sometimes monthly) distribution.

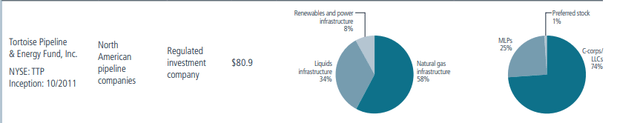

In searching for a CEF that holds MLPs as an investment vehicle in my IRA, I decided to take a look at several different ones to compare and contrast before deciding on Tortoise Pipeline & Energy Fund (NYSE:TTP). Currently, the distribution yield for TTP is 9% and the fund is trading at a discount of -15%. The YTD price performance is 13.59% and the 1-year price performance is 10.7%.

TTP overview (fund website)

MLPs also tend to offer some protection from inflation as explained in the 2021 annual report for Tortoise Ecofin funds:

With inflation increasing throughout the year, many investors began to recognize midstream as an asset class with inflation protection. Pipelines typically have long-term contracts with inflation protection from regulated tariff escalators. Additionally, tariffs on regulated liquid pipelines typically include an inflation escalator. This allows increases aligned with the Producer Price Index (PPI) offering some protection from inflation. Through November 2021, the PPI increased by 9.0% from the prior year which could be a material driver of cash flows in 2022.

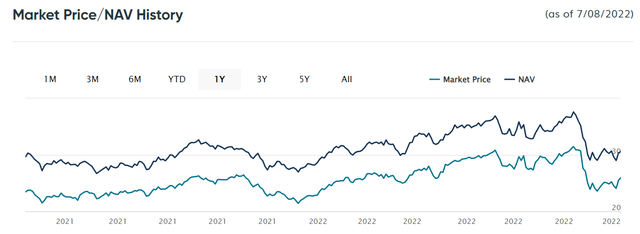

Another reason to consider a CEF with MLP holdings is because the funds often trade at a discount to NAV, while the underlying holdings if purchased individually would not provide that extra cushion in the price to book value. For TTP, the discount to NAV has been hovering around the -15% discount level for most of the past year.

TTP Price/NAV history (TTP fund website)

Peer Comparison

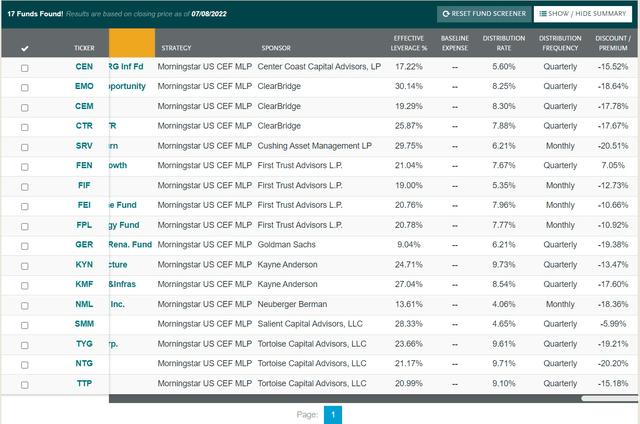

According to a fund screener that I used on CEFConnect.com to identify CEFs that hold pipeline MLPs, there are currently 17 to choose from.

MLP funds from fund screener (CEFConnect)

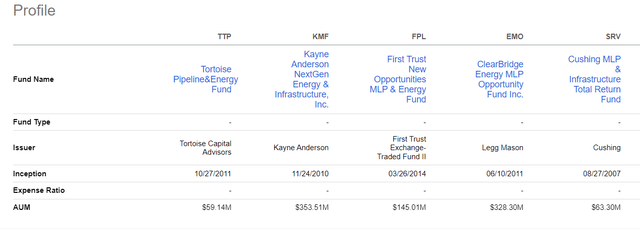

Of those 17, I chose four to compare to TTP, each of which is from a different sponsor. For purposes of this comparison, I wanted high yield distributions of at least 6% and a similar size (under $350M in AUM) to TTP. The four that I chose to compare include ClearBridge Energy MLP Opportunity Fund Inc. (EMO), Cushing MLP & Infrastructure Total Return Fund (SRV), First Trust New Opportunities MLP & Energy Fund (FPL), and Kayne Anderson NextGen Energy & Infrastructure, Inc. (KMF).

Comparison of 5 MLP funds (Seeking Alpha)

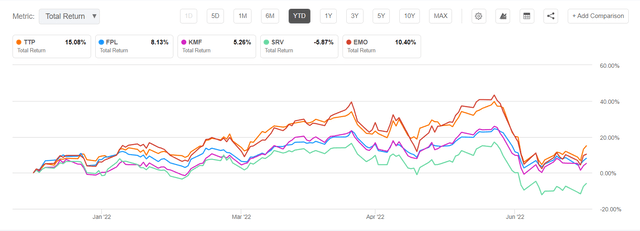

Out of these 5, the YTD and 1-year price performance of TTP was the best (and beat a couple others that I also looked at). Going back more than one year the performance for TTP was not as good, but I am interested in the future, not the past when it comes to investing.

YTD Total Return comparison (Seeking Alpha)

Based on the S&P MLP Index, the 1-year total return as of July 8, 2022 was about 13%. For TTP as of July 8 the total return sits at about 19%. MLPs typically follow the price of oil (which is a proxy for energy demand) so over the past few weeks the NAV and market price of TTP have retreated, offering a buying opportunity for investors.

As energy demand picks up again with summer travel season and pent-up leftover post-pandemic activity ramping up, the energy sector is benefiting. That trend can be seen over the past year, with the exception of a month-long retreat in June as recession fears and the impact of higher gas prices put a dent in energy demand.

Oil price and energy demand (Seeking Alpha)

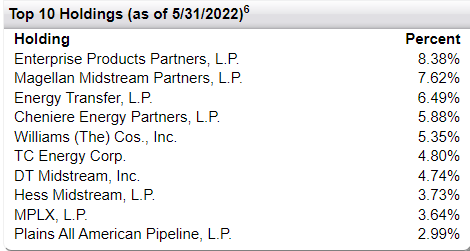

The top 10 holdings for each of the 5 funds are somewhat similar. Here are the top 10 holdings for TTP as of 3/31/22. You will see many of these also appear as top 10 holdings in each of the other 4 funds.

TTP top 10 holdings (TTP fund fact sheet)

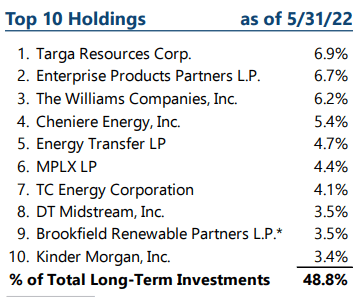

Here are the top 10 for FPL:

FPL top 10 holdings (FPL fund website)

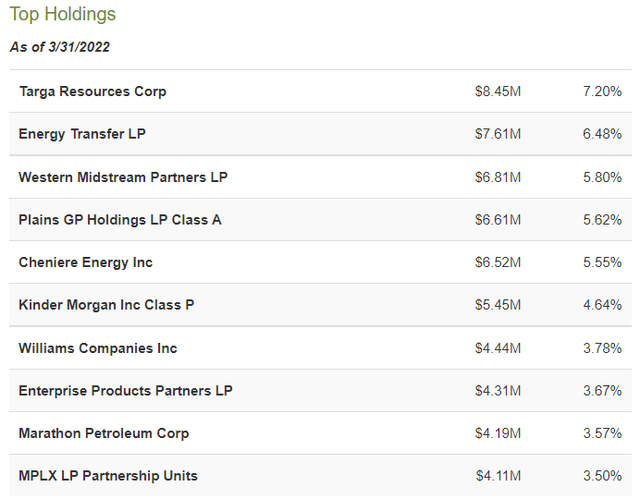

This is the KMF top 10:

KMF top 10 holdings (fund fact sheet)

The top 10 for EMO:

EMO top 10 holdings (CEFConnect)

The top 10 holdings in SRV:

SRV top 10 holdings (CEFConnect)

The ONEOK (OKE) and Enbridge (ENB) holdings are two of the top 10 holdings that stand out as differentiators for TTP. EMO is the only other fund of the 5 that I compared that includes ENB as a top 10 holding. None of the other four besides TTP include OKE in its top 10. OKE is one of the oldest midstream companies in the US and is one of the best for generating long-term consistent returns according to this recent article.

TTP Assets and Coverage

As of June 30, 2022, the TTP fund had $89 million in unaudited total assets, and the total asset value was $67.4M or $30.26 per share. Effective leverage for the fund is 23.3% as of 7/1/22. The asset coverage ratio is required to be at least 300% for senior secured debt and as of 7/1/22 that coverage ratio is 602%. For preferred stock (including debt and preferred) that coverage ratio must exceed 225% and as of 7/1/22 is 427%.

The fund invests 58% in natural gas pipelines, 34% in liquids, and 8% in renewables.

TTP portfolio mix (2021 Annual Report)

Back in November 2020, SA contributor Stanford Chemist penned an article regarding a proposed merger between TTP and another Tortoise fund, NDP, which would have changed the portfolio mix. Apparently, that merger was never completed and the TTP fund’s performance has improved considerably in the 18 months or so since then.

Distributions

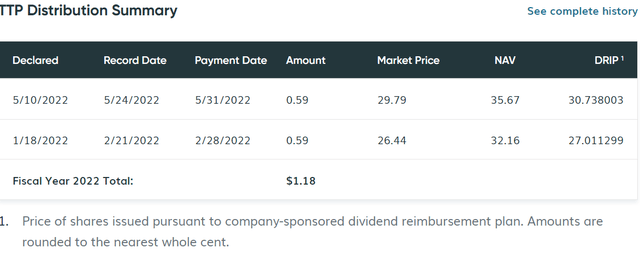

TTP distributes a fixed amount quarterly, currently $0.59 per common share. The distribution in January of this year was raised to $0.59 from the previous quarter when the amount distributed was $0.37, amounting to a nearly 60% increase over the previous quarter. The 2nd quarter distribution of $0.59 was paid on May 31. Under the company’s DRIP plan, those distributions were reinvested at prices below NAV.

TTP Distributions (fund website)

Summary

The inclusion of an MLP-based fund in a tax-exempt portfolio such as an IRA is a useful consideration for those investors seeking long-term sustainable high-yield income, especially at the present time. With the recent pullback in oil prices and fears of a possible recession impacting energy demand in the short-term, there is a buying opportunity in MLP funds like TTP. The underlying assets continue to generate distribution yields in excess of 6% while the market prices have come down. Energy demand continues to improve as the global economy recovers from a post-pandemic world while energy supplies remain tight.

Due to the shifting policies related to fossil fuels and high capital expenditures required to increase energy supplies using pipelines, there is some downside risk to investing in MLPs, however, I believe that the long-term potential for growth due to a resurgence in energy demand outweighs the risks. The TTP fund from Tortoise Ecofin is one of the best CEFs that holds pipeline MLPs as its core holdings for generating high yield distributions for those investors seeking income.

Be the first to comment