TkKurikawa/iStock Editorial via Getty Images

Woori Financial (NYSE:WF) is the smallest of the big four Korean banks which historically has traded below its peers in terms of valuation for two reasons: (1) worse performance metrics and (2) government ownership of shares. All four of the banks have announced quarterly earnings already and given a review of first half performance, and it seems that Woori may be taking a turn for growth. Additionally, government ownership is down to just 3.6% of shares outstanding with a stated goal to divest fully by the end of this year.

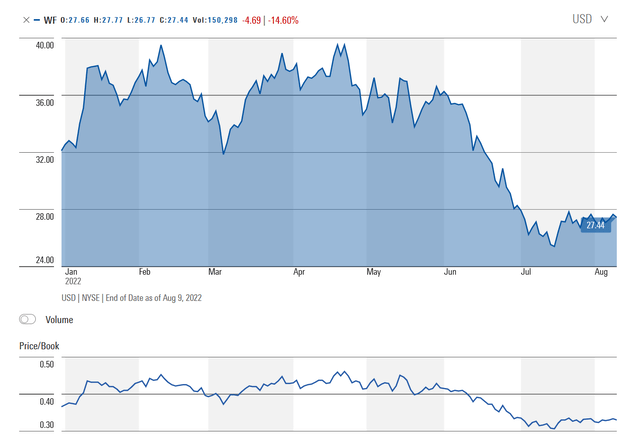

The market currently values Woori at a P/B of 0.33 and a P/E of 4.78 based on just the first half of this year’s earnings. Given rising interest rates and ongoing cost reduction via synergies I think it’s likely they can do at least as much in earnings in the second half which would value WF at a P/E of 1.76 based on an FY22 estimate.

While these valuations are low we should consider that Woori has traded at a discount to book for years so historical averages may be more helpful in getting the picture here. The three year average P/B is 0.36 and the P/E is 4.78. Based on these metrics we can see that Woori trades only slightly below average P/B though if earnings continue at this rate it’s well below average P/E. I think it’s more likely that WF will trade at the peer average P/E which would imply a 172% margin of safety.

Calculations assume a price of WF at $27.00.

Overview of Woori Financial Group and South Korean Banks

Woori is not alone in being discounted here as Korean banks overall trade at a significant discount to book value. Take these data points for instance from a Business Korea article:

The average PER of South Korean bank group stocks for the 10 most recent years is 4.0 whereas those of their counterparts in Germany, Finland, Singapore and the United States are 16.4, 11.4, 11.2 and 10.3, respectively,” it explained, adding, “In addition, the former’s average PBR is 0.36 whereas the figure is as high as 1.61 in the United States and 0.42 in China.

According to their review South Korea bank stocks trade at the second to lowest valuation compared to international peers. The only country with more undervalued banks is Russia. South Korea companies overall have tended to trade with what’s called the Korea Discount due to many of the top Korean companies being family run. Banks in particular were seen to be not shareholder friendly – though this has changed in the recent years as each of the larger Korean banks have made steps to engage in new tactics with regard to shareholders including share buybacks.

We’ve seen at Woori that they’ve targeted an increased dividend payout to 30% and stated in the last earnings call that they are “planning to review a wide variety of shareholder return options once COVID-19 stabilizes.”

I suspect that with changes in capital allocation approaches by South Korean banks, specifically share buybacks which could be hugely accretive, that they should start to trade closer to book value in the next 3-5 years. Rising interest rates are driving further earnings in the near term for deposits at banks. Woori Financial will benefit from this broadly though I think it’s the best pick amongst the bunch. If we look at P/E valuation based on first half earnings alone we can see the disconnect that’s started with WF.

|

Peer Comparison |

Market Cap |

P/B |

1H22 Earnings |

P/E of 1h22 |

|

Woori Financial |

8,413 |

0.33 |

1761 |

4.78 |

| Shinhan Financial Group

(SHG) |

18,805 |

0.39 |

2720 |

6.91 |

|

KB Financial Group (KB) |

18,566 |

0.35 |

2756.00 |

6.74 |

|

Hana Financial |

10,569 |

0.31 |

1727.40 |

6.12 |

|

14,088 |

0.345 |

6.14 |

*Data pulled from company filings.

Here are some other metrics related to first half performance amongst the peers.

|

Peer Comparison |

NIM |

Cost to Income |

Credit Cost Ratio |

Non-performing loans |

NPL Coverage Ratio |

CET-1 |

|

WF |

1.83% |

40.10% |

0.29% |

0.30% |

210% |

11% |

|

SHG |

1.58% |

39.00% |

0.31% |

0.38% |

209% |

12.82% |

|

KB |

1.96% |

46.50% |

0.23% |

0.32% |

222.40% |

12.93% |

|

Hana Financial |

1.80% |

45.30% |

0.23% |

0.37% |

188.40% |

13.18% |

|

Average |

1.79% |

42.73% |

0.27% |

0.34% |

208% |

12% |

*Data pulled from company filings.

Some things I observe from above is that WF has above average net income margins, cost-to-income, and non-performing loans. Credit-cost and CET-1 are a bit higher for them than the group. Overall there is nothing that seems to suggest justification for a wide differential in P/E between Woori and its peers.

But we should put the most recent earnings into more context as WF have been growing net income to record levels in the past year and a half. Net income grew 98% YoY on revenue growth of 22.3% YoY. In their press release for first half results they breakout that first half revenue grew 61% over last year, net income grew 46%.

Earnings are growing at this pace given Woori Financial’s expansion beyond bank services and digitalization efforts. All of the large South Korean banks have been expanding in this way as they look to compete more internationally by offering a more complete suite of offerings. In the conference call they noted that “the contribution of the nonbank business, which was 10% when we first created the holding company, has grown to 17.2% as of 2021 and broadening the profit base of the group.” This organic growth is supported by their low cost deposit base and is driving record earnings. With the company trading at distressed multiples, the compounding potential of earnings for anyone buying in now is high.

Let’s look at an example. Last year’s earnings came in at 2.762b KRW. First half net income was 1.762b KRW. Assuming no additional growth in earnings that would imply earnings of 3.524b KRW which would imply 28% growth for the year. If we apply the three year peer average P/E of 4.78 implied market capitalization would be 12.064b KRW compared to the current market cap around 8.413b KRW – an implied 43% upside assuming no growth. It’s more likely that the end of year figure will be above the 3.524b KRW estimate as interest rates drive earnings higher and organic growth continues within the company. If share repurchases are considered over the next year that could further compound returns as long as valuations remain low. Of note is that peers KB and SHG have both discussed initiating share buybacks this year given low P/B valuation. I think this is a trend opening up across these banks and we should see them beginning to use the lever of buybacks to help drive value given consistent prices below book value.

Government Overhang on Woori Financial Will Unwind This Year

Woori Financial began its process of becoming privatized in December 2014 with the South Korean government retaining around 17% of share outstanding. After many rounds of selling over the years they maintain around a 3.6% interest which they intend to sell out by the end of this year. This large block of shares that have been regularly unloaded has likely caused downward pressure in the name as well as a general discount given government ownership. We can also see that the ratings agencies have been noting this development as well. A note from Fitch in November 2021 highlighted:

The state’s previously strong influence on Woori’s management hindered the consistent execution of strategies, partly due to frequent changes in key managers, who often had less banking experience than those at peers. The state’s influence also led to heightened risk appetite, evident in aggressive credit expansion and delayed exposure reduction to troubled sectors, such as construction, shipping and shipbuilding, until the mid-2010s.

Such influence has reduced noticeably since 2017 when the board started to be controlled by members representing a handful of minority shareholders. More effective checks and balances and risk control have facilitated improvements in Woori’s financial profile to closer to the major local peers, leading us to upgrade the Viability Rating to ‘a-‘ from ‘bbb+’ in July 2021. However, it remains to be seen whether the stability of the board can be maintained without a major or dominant shareholder.

Over the coming years I think we will see Woori Financial become more focused on overall shareholder return and growing their business. Without the overhang of government connection and intervention, management should be able to continue to execute against their growth plans to become a pan-Asian financial leader.

South Korea Real Estate Bubble Risk

There is currently fear of a real estate and economic bubble in South Korea which is hanging over the banks as well. In the event that there is a 20-40% downturn in real estate values as some fear, Woori Financial’s historic connections with the government may be advantageous.

In a scenario where real estate values see that kind of plunge Woori Financial has a few buffers in place that would mitigate impact. To start the company has loan loss reserves of 2.213b KRW. Their real estate exposure is tied to the 45% of their book which is retail loans. Of those loans, 70% are backed by real estate with an average loan-to-value ratio of 42.35%. These values are pretty similar across WF’s peers.

|

Peer Comparison |

Retail Loan Portfolio Size |

LTV Ratio |

Book Secured By RE |

|

WF |

45% |

42.35% |

70% |

|

SHG |

44.40% |

40.70% |

62.30% |

|

KB |

44.40% |

38% |

62.30% |

|

Hana Financial |

49.00% |

41.00% |

— |

| Average |

46% |

40.51% |

65% |

*Data pulled from company filings.

What this means is that if these loans start defaulting they have recourse to real estate valued 55% higher than the loans themselves. If this real estate lost 40% of value the implied LTV would still be 15%. So even if a mass defaults start taking place in their retail portfolio they could theoretically still acquire the real estate and possibly recoup the loan plus 15%.

The LTV ratio of 42% is low compared to most other places in the world for a few reasons highlighted in the company’s filings.

There are three reasons that our loan-to-value ratio is relatively lower (as is the case with other Korean banks) compared to similar ratios in other countries, such as the United States. The first reason is that housing prices are high in Korea relative to average income, so most people cannot afford to borrow an amount equal to the entire value of their collateral and make interest payments on such an amount. The second reason relates to the “jeonse” system, through which people provide a key money deposit while residing in the property prior to its purchase. At the time of purchase, most people use the key money deposit as part of their payment and borrow the remaining amount from Korean banks, which results in a loan that will be for an amount smaller than the appraised value of the property for collateral and assessment purposes. The third reason is that Korean banks discount the appraised value of the borrower’s property for collateral and assessment purposes so that a portion of the appraised value is reserved in order to provide recourse to a renter who lives at the borrower’s property. This is in the event that the borrower’s property is seized by a creditor, and the renter is no longer able to reside at that property.

Real estate values are inflated given the dynamics of the economy there. This article outlines the case well:

Real estate is a sensitive political issue everywhere, but in Seoul it’s explosive. South Korea’s wealth has flowed into real estate to an unusual degree because there are few other options. The country’s domestic stock market is good but not great: The chaebol conglomerates are vastly overrepresented in the overall market (as of March, Samsung Electronics alone represented nearly 34 percent of the entire KOSPI market cap), making it difficult to have stable and diversified investments. Persistent corporate governance issues plaguing the chaebol sometimes lead to share price manipulation, undermining the confidence of public investors in the system. While investing abroad, especially into the red-hot U.S. stock market, is increasingly becoming more popular, the unfamiliarity as well as the foreign exchange rate fluctuation make the returns difficult to anticipate.

South Korea’s unique rental system known as jeonse was formed by legacy economic factors in the past decades which aren’t as applicable now. The system itself remains dominant nonetheless with 71% of all lease transactions being jeonse. Rather than paying rent, the jeonse system sees renters putting down an upfront deposit on the value of the home which is held by the owner for the duration of the lease. Typically leases are two years and expected deposit is 70% of the value of the home. The homeowner takes that deposit and typically invests it with the belief that they can return a sufficient amount during that time on the free deposit. Renters typically purchase homes using the upfront deposit and financing the rest.

With returns on real estate being high and interest rates being low some have taken advantage of this system and driven liquidity into real estate as the asset of choice in the country. The article above noted as well that “since 2017, the average home price in Seoul has increased by 50 percent, the fastest pace in the world.” The fear is that this bubble is not sustainable and is likely to come crashing down.

I’m sharing the broad strokes here as it’s material to the thesis. I believe the risk is mitigated given the severe undervaluation of WF already and the dynamics of their retail book I described above. But I could be wrong and the banks may be on the wrong end of this trend. If that is the case, I believe a final buffer exists in the form of a potential bailout by the South Korean government. Fitch noted that there is “an extremely high probability of support from the Korean government, if required. This view is based on Woori’s systemic importance as one of the country’s largest commercial banks, holding 12% of the banking system’s total loans and 14% of deposits.”

Final Thoughts

I believe that Woori Financial is undervalued at the current prices. I think the real estate bubble fears are likely overestimating the impact to the financials of the company. Additionally, while this risk is broadly the same for all the big four South Korean banks given their similar exposure, WF still trades at a discount to its peers. All of this ignores the growth the company has seen in recently and is likely to continue as they expand their non-bank line of business and digitalization. International expansion is expected to drive core bank growth in the coming years as well, and the South Korean banks are well-positioned to serve as pan-Asian regional institutions. An expansion of capital allocation tactics inclusive of share repurchases amongst the peer group may provide a new lever to return significant value to shareholders given how low they trade against P/B.

With these things in mind I think it’s likely that the three year peer average P/B of 0.36 for the banks is likely to increase in the next couple of years. A conservative estimate of a P/B rating of 0.5 of Woori Financial given their 1H22 equity value of 27.062b KRW would imply a market capitalization of 13.531b KRW. That would imply a 64% margin of safety. I think this is fairly conservative given Woori has traded above 0.40 P/B for most of this year.

If the company continues growing at the pace that it is there’s a possibility of greater returns. With Woori Financial trading for a TTM P/E of 3.24 a reversion to an undemanding P/E of 5 implies a 54% margin of safety.

In the event that there is a collapse in real estate values in South Korea I’m guessing the WF stock could decrease another 20% on fears, though I think the low price on these banks already will help to minimize downside. Additional protections exist in the structuring of the book and reserves which I think should help to give some cushion if this unfolds.

Be the first to comment