1971yes

Investment Thesis

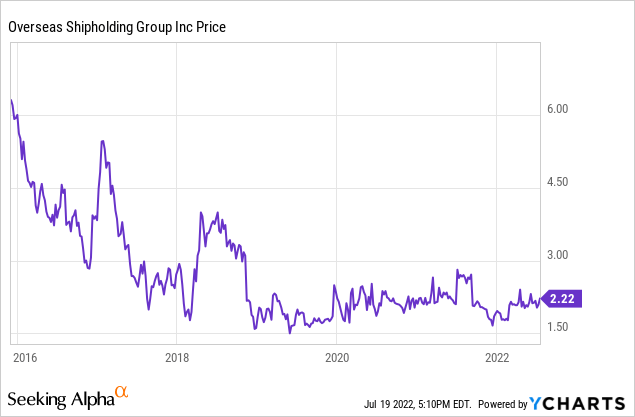

Overseas Shipholding Group (NYSE:NYSE:OSG) represents an interesting opportunity for the enterprising or event-driven investor to buy shares of a company who had a takeout offer at $3/share (current price of ~$2.22). The company recently announced a repurchase program and the CEO has been buying shares in the open market.

Company Description

Overseas Shipholding Group is a provider of energy transportation services delivering crude oil and petroleum products throughout the United States. Its vessel fleet consists of 24 vessels (22 are US Flag vessels), totaling an aggregate of ~1.7M deadweight tonnage (or dwt). OSG primarily charters its vessels through time charters (~70%; more predictable revenues), but also charters voyages at spot rates (~30%; more volatile / unpredictable revenues).

Brief Introduction to US Shipping and the Jones Act

Shipping in the US is subject to the Jones Act, which requires that shipping between US ports is reserved for US Flag vessels that are constructed in the US, owned by companies that are at least 75% owned / controlled by US citizens, and operated by US sailors. As a result, shipping companies who want to operate in the US must monitor the foreign ownership of their common stock to ensure compliance with the Jones Act; otherwise, they might lose the privilege of owning and operating vessels in the United States. Opponents of the Jones Act argue that the regulation is outdated and increases shipping costs; however, it is undeniable that the Jones Act provides something resembling a regulatory moat that allows companies like OSG to operate in and should be of value for certain parties.

Saltchuk Holdings Takeover Offer

The crux of the thesis for OSG is that an informed buyer was willing to pay a price far exceeding OSG’s stock price.

-

On June 30, 2021, Saltchuk Holdings (who owns ~17.5% of OSG’s shares) submitted a non-binding offer to acquire all of OSG for $3.00 per share, which represented a 43% premium.

-

On September 3, 2021, Saltchuk withdrew the bid and suspended discussions with OSG, citing “continued uncertainty with respect to the pace and trajectory of the global pandemic recovery and its effects on the Issuer’s business and operations”.

Investors should take note of publicly announced “take private” offers as they function as price discovery mechanisms. In other words, astute observers will know exactly how much an informed buyer is willing to pay for a business or collection of assets. Some recent “take private” offers include B. Riley’s offer of Lazydays Holdings (which I wrote up here- LAZY: Trading 50% Below Rejected Takeout Offer) and Harold Hamm’s offer to take Continental Resources private.

I would argue that Saltchuk Holdings qualifies as an informed buyer, as it is one of the largest privately owned transportation and distribution companies with ~$2.8B in annual revenues and 7,000 employees. A quick look at the oil markets since September 2021 would show that the global pandemic recovery is well underway and that OSG’s assets are probably more attractive now.

Valuation Analysis

With ~91M shares outstanding and a current stock price of $2.22, the market cap is ~$202M. With ~$450M in debt and $77M in cash, the total enterprise value is ~$575M.

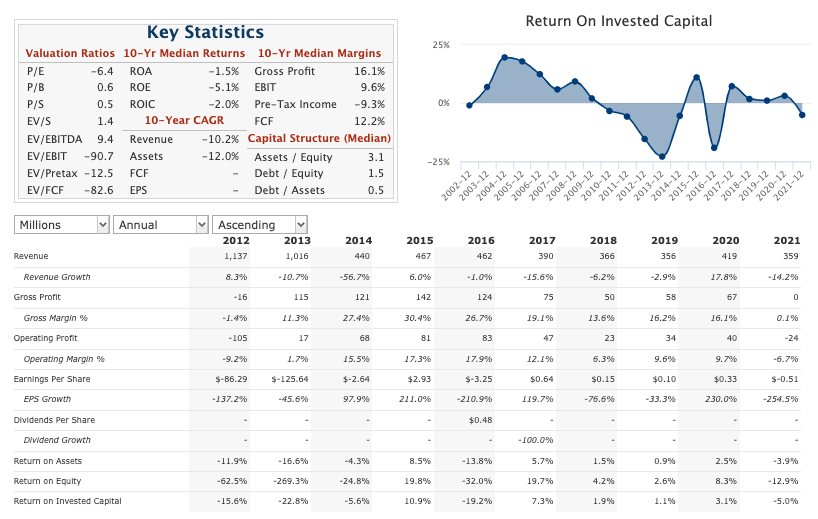

QuickFS

From a valuation perspective, OSG is nothing to be jealous of. It has a history of volatile earnings, which is to be expected given the cyclical nature of the oil transport industry. Some normalized numbers (last 8 years):

- Normalized Annual Revenue: ~$407M

- Annual EPS: $0.28

- ROA/ROE/ROIC: negative single digits

Not looking great. What about looking at the value of its fleet of ships (or NAV)?

Some quick facts about its fleet:

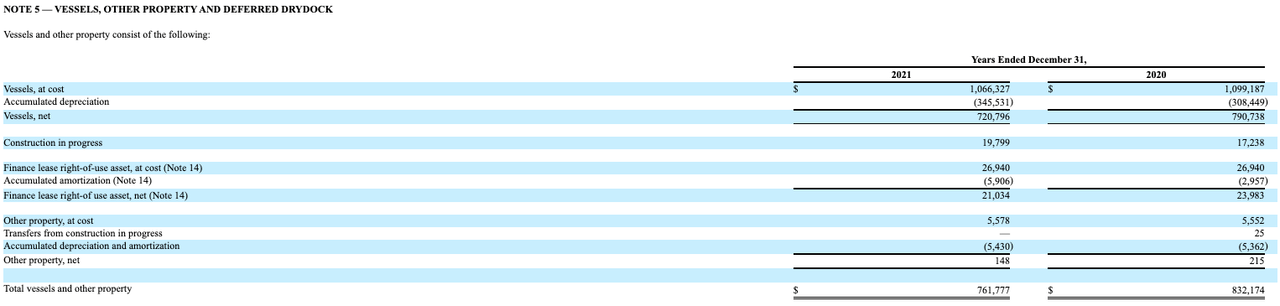

- As of December 31, 2021, the Company’s owned vessel fleet (12 owned, 12 chartered-in; we only care about the owned ships) with a weighted average age of 13.5 years.

- The fleet consists of five Handysize Product Carriers, three crude oil tankers, two lightering ATBs and two ATBs.

- The vessels are recorded at cost and are depreciated to their estimated salvage value on a straight-line basis (~25-30 years).

- The current stated valuation of the fleet is ~$720M.

Form 10-K (2021)

I’m always wary of provided numbers, so I decided to dig around for comparables to come up with a better estimate.

|

Price Per Ship |

Value |

|

|

5 Handysize Product Carriers |

$23M (comparable source) |

$115M |

|

3 Crude Oil Tankers |

$20M (comparable source) |

$60M |

|

2 Refined Product ATBs |

N/A |

|

|

2 Lightering ATBs |

N/A |

|

|

Total |

– |

$175M |

I couldn’t find any comparables for ATBs and as a tourist in the shipping space, I’m not entirely sure where to get better comparables. Those who are more knowledgeable, please drop a comment below.

Based on my crude comparables (which I think are underestimates), my estimated asset value of $175M for the ships is far off the stated $720M. Assuming some value for the ATBs, I will just assume a mid-point value of ~$500M (which is roughly the enterprise value of $575M).

Based on the valuation above, it’s safe to say that OSG:

- Isn’t a great business and shouldn’t be treated as such

- Isn’t trading too far its NAV; even assuming the stated $720M for its fleet, the best-case scenario is that OSG is trading at ~80% of NAV

Readers of my research know I like to be conservative in my estimates, so take the given $720M value with a grain of salt and ideally find better numbers for the value of the ships.

Insider Ownership & Transactions

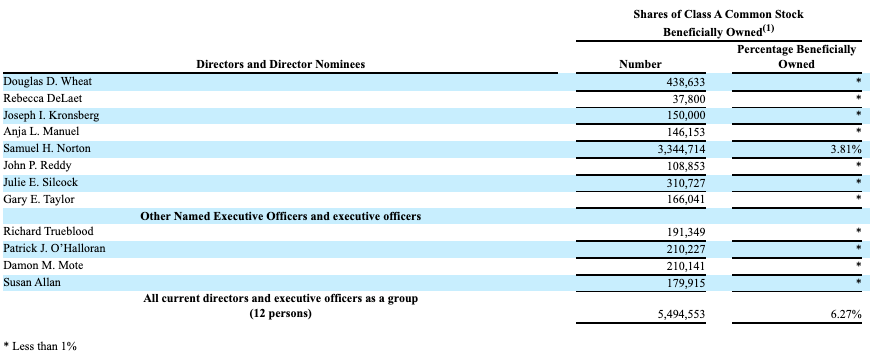

DEF 14A (2022) DEF 14A (2022)

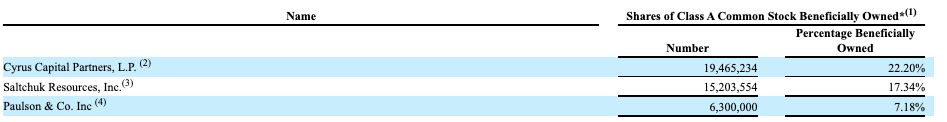

Insiders own ~6% of the shares and major shareholders include Cyrus Capital Partners (22%), Saltchuk Resources (17%), and Paulson & Co. (7%). It would be safe to assume that Saltchuk has a vested interest in eventually making its investment in OSG worthwhile.

OpenInsider

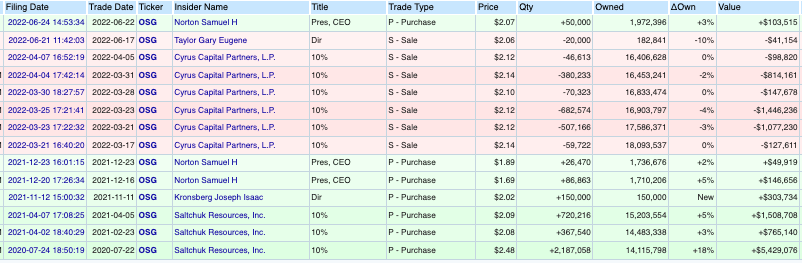

Cyprus Capital has been slowly selling its stake, but insiders were buying in the $2-2.50 range. Interesting to note that the recent purchase by the CEO came after the company announced a repurchase program.

Catalysts

- Another Takeout Offer: given an informed buyer was willing to pay $3 per share for OSG, I would argue that there is value in OSG- it’s just a matter of how the value will be unlocked; the most direct way would be for a larger party such as Saltchuk to absorb OSG into its current operations by taking it private

- Repurchase Program: on June 13, 2022, OSG announced a repurchase program that would allow the company to repurchase up to 5M shares; depending on your valuation of the company, the repurchase could be accretive and help close the gap between price and value

Risks

- Tough Industry and Terrible Business Economics: I normally wouldn’t recommend a shipping company as the underlying economics aren’t great (cyclical, price-takers, lack of moats, etc.), but OSG is potentially interesting for the enterprising investor who is willing to take on more risk as interested parties have shown how much they were willing to pay for it

- Valuation: the value of the underlying ships fluctuate as a function of long-term and short-term supply/demand of the ships, scrap prices, the year the ships were built, etc.; in short, visibility into the true price of the ships are fairly opaque, which makes valuation of the overall company a difficult task

Investment Summary

OSG represents an interesting situation where the current price may not represent its true value, evidenced by the “take private” offer by Saltchuk at a premium to the current price. Saltchuk withdrew its offer, citing uncertainty in the pace and recovery of the global pandemic. However, the overall oil market, which OSG operates in, has clearly rebounded quite well and OSG’s assets should be even more attractive.

To sum up, I believe that there are forces at play that an enterprising investor should look at; namely, an informed buyer offering to buy OSG out at a price ~35% premium to the current price. In addition, the company recently announced a repurchase program and following the announcement, the CEO bought some shares in the open market.

Based on the analysis above, I recommend a cautious long position in (and careful monitoring of) OSG for the enterprising investor, potentially as part of an event-driven portfolio.

Be the first to comment