shapecharge

Originally published on July 19, 2022

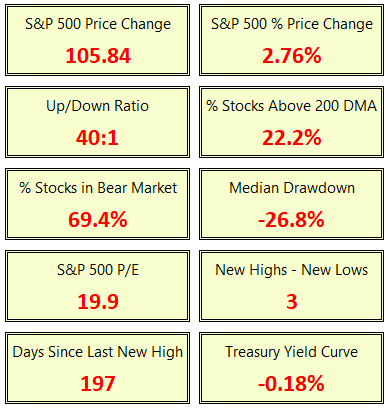

In today’s issue of the 1-Minute Market Report, we point out two key accomplishments. Today was an extremely rare 40:1 up day, and we closed above the June 24 recovery high, which means that this rally has legs.

The Stats

Today was a powerful day in the equity market. The fact that we made a higher high off of the June 16 low tells me that this rally could keep going. But a closer look at the stats above clearly indicates that we have a long way to go before we can say that the bottom is in.

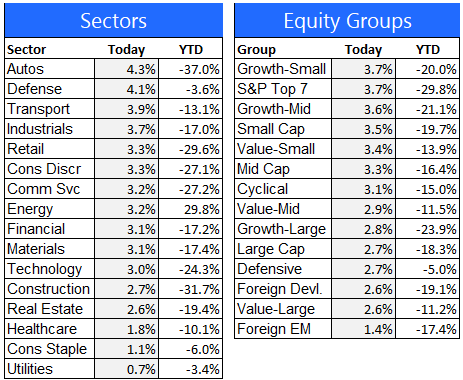

Equity sector and group performance

For this report, I use the expanded sectors as published by Zacks. They use 16 sectors rather than the standard 11. I find that using all 16 gives a fuller picture of which areas of the market are attracting the most buying and selling interest from investors.

For the groups, I separate the stocks in the S&P 1500 Composite Index by shared characteristics like growth, value, size, cyclical, defensive, and domestic vs. foreign.

Automakers and related industries led the charge today, while utilities and staples became a source of funds. Small and mid-cap growth names did well, as did the top 7 stocks by market cap.

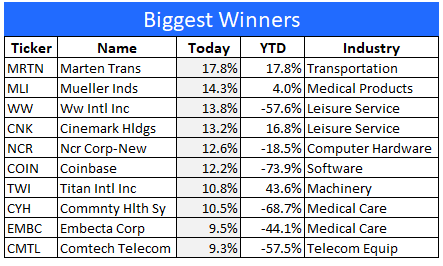

The 10 best-performing stocks today

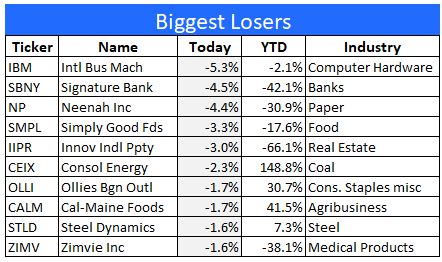

The 10 worst performing stocks today

Final thoughts

It’s too soon to call the bottom for this market cycle, but we’ve had two very strong up days in the last month – June 24th and today. That leaves the S&P 500 7.4% higher than the June 16th close of 1666. I think the time has come for selective bargain hunting.

Are you looking for more high quality ideas? Consider joining The ZenInvestor Top 7, my Marketplace service. The Top 7 is a factor-based trading strategy. Its screening algorithm prioritizes reasonable price first, then the momentum, and finally projected earnings growth. The strategy produces 5-7 names, and rebalances every 4 weeks (13 times per year). The goal is to catch healthy companies that have gone through a rough period, and are now showing signs of making a strong comeback. Join now with a two-week free trial.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment