Drew Angerer

Shares of Twilio (NYSE:TWLO) are in a long-term downtrend and have declined approximately 68% so far in 2022. While Twilio saw explosive top line growth throughout the pandemic, growth has been slowing lately… and it has been a catalyst for shares to revalue lower.

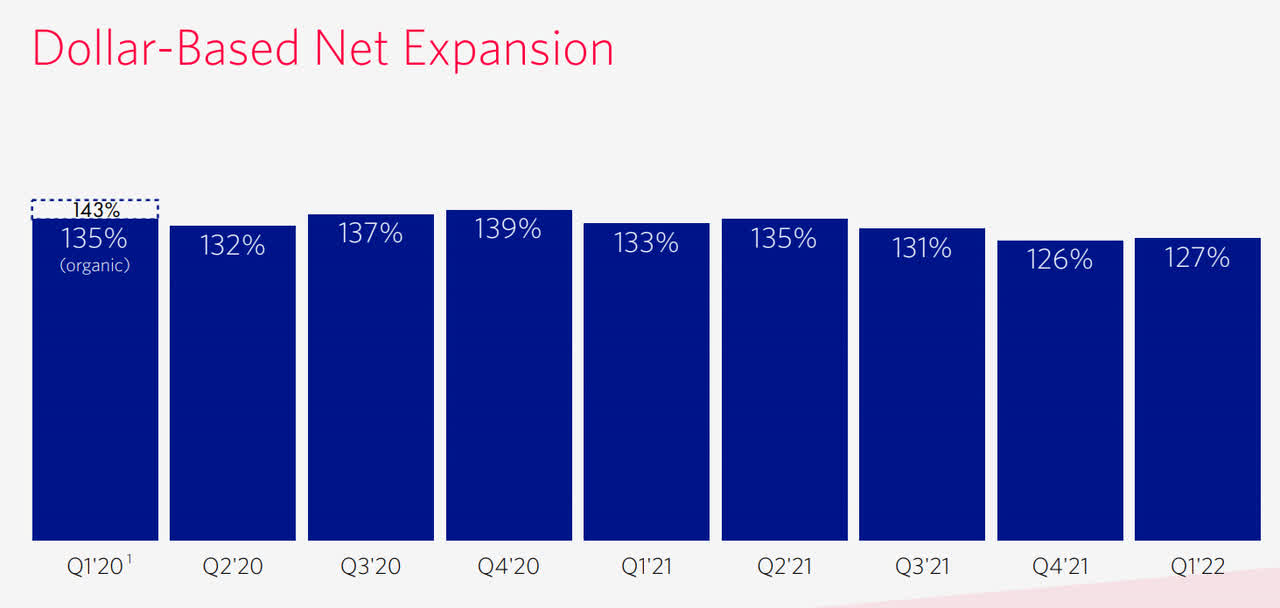

However, Twilio is still going to grow rapidly and customer retention is at a respectable level. Dollar-Based Net Expansion Rates, which measure monetization success, slightly increased in Q1’22 and I expect the company to add a considerable number of new customers going forward. Twilio’s valuation has fallen to such a low level relative to FY 2021 that the firm’s shares may be considered a speculative buy!

Twilio’s financials will continue to improve

Twilio’s core product is an API-based communications platforms that makes it easier for companies to get in touch — through voice, text, chat, video, or email — with their customers. Whether customers receive restaurant reservation confirmations by text, shipping confirmation orders by email or use chat support bots, chances are they are using Twilio’s products.

Twilio monetizes its products and services through a CPaaS model. CPaaS stands for Communications Platform as a Service and Twilio has played a large role in popularizing CPaaS business models that are both developer-friendly and allow for a high degree of customization at a low cost. Companies benefit from the ease of customization and can improve their customer service by using Twilio’s communication products.

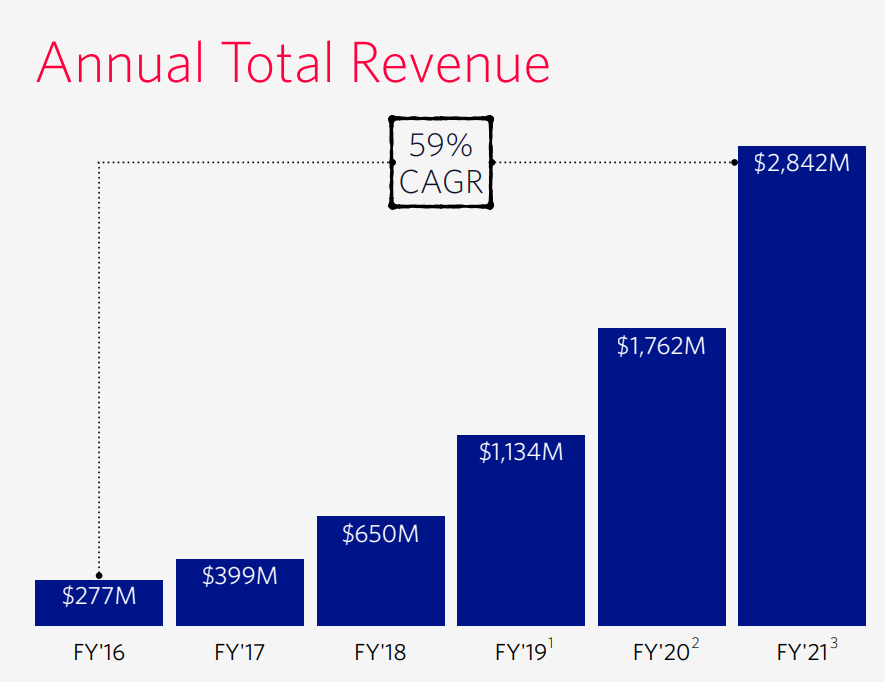

The need for communications with customers obviously increased dramatically during the pandemic and it resulted in strong demand for Twilio’s communication products and services. Soaring customer demand for CPaaS products translated to serious tailwinds for Twilio’s top line growth: between FY 2016 and FY 2021, Twilio increased its revenues by a factor of 10 X to $2.84B.

Twilio

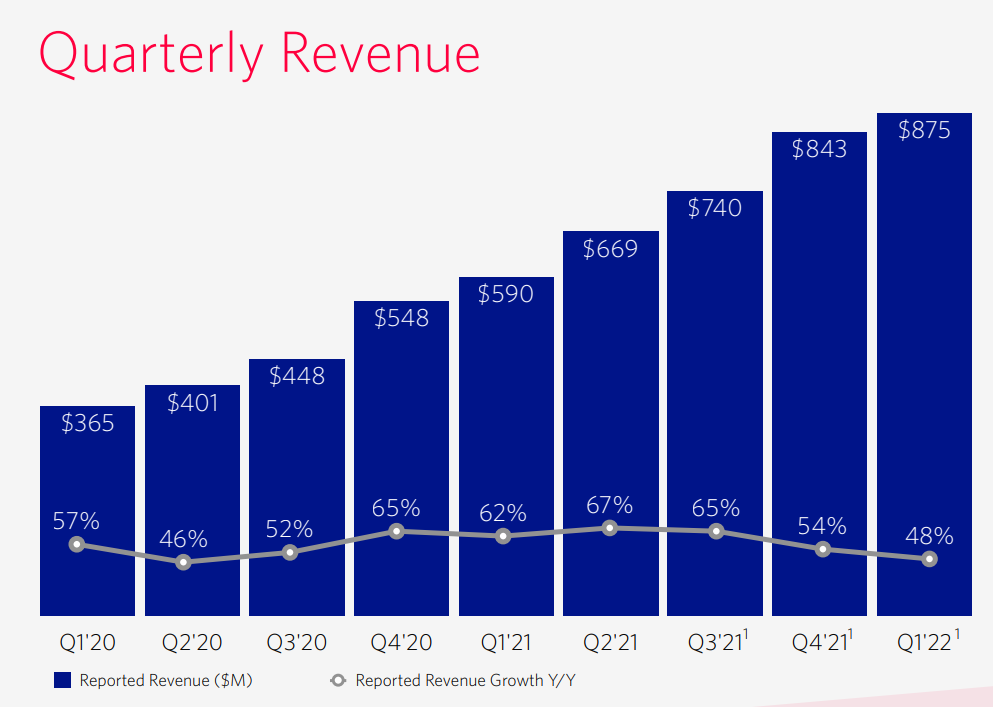

Between Q1’20 and Q1’22 Twilio’s revenues increased at a quarterly rate — not an annual rate — of 11.5%. Due to the end of the pandemic, revenue growth rates have started to drop off in Q1’22 and companies may get a little bit more careful about how they are spending their money as recession fears are brewing. In Q1’22, Twilio’s quarter over quarter revenue growth slowed to just 3.8% and continual revenue headwinds must be expected.

In the longer term, however, I believe strong revenue growth will persist simply because companies have an ever-growing need to be reachable by their customers on whatever communication channel the customer prefers. Being able to communicate with companies through their channel of choice is becoming more important for customers. Companies can use Twilio’s communication tools to differentiate themselves from the competition which improves customer service and boosts conversions.

Twilio

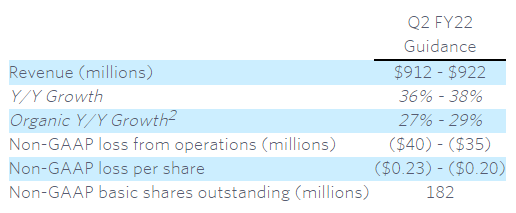

Turning to Twilio’s latest outlook.

The outlook for the second-quarter includes a revenue projection of $912-922 million which implies a quarter over quarter minimum top line growth rate of 4.2% so Twilio does expect a revenue acceleration for Q2’22. Unfortunately, Twilio will is not going to be profitable in FY 2022. EPS estimates indicate that this could change in FY 2023.

Twilio

Strong customer monetization

The single best way to judge how well a CPaaS company is monetizing its customers is by taking a look at a figure called Dollar-Based Net Expansion Rate. Cloud-based companies use different terms to describe what this ratio measures — some call it Net Retention Rate, some call it Dollar-Based Net Retention Rate — but they all measure the same thing.

Twilio’s Dollar-Based Net Expansion Rate measures how much existing customers increase their spending on Twilio’s products and services, from one reporting period to the following and it is usually expressed as a percentage. In Q1’22, Twilio’s Dollar-Based Net Expansion rate was 127%, showing a 1 PP improvement over the prior quarter. This figure means that the average customer increased its spending by 27% from one reporting to the next. Dollar-Based Net Expansion Rates or Net Retention Rates of about 120% are considered quite good in the industry and Twilio is monetizing its customers well.

Twilio

Going forward, new acquisitions and new product roll-outs could result in higher Dollar-Based Net Expansion Rates for Twilio. What I see as a big asset for Twilio is the large customer base that the company has assembled over time. At the end of Q1’22, Twilio had 268 thousand customers using its communication platform, meaning the company on-boarded 33 thousand new clients just in the last year.

Twilio will continue to rapidly

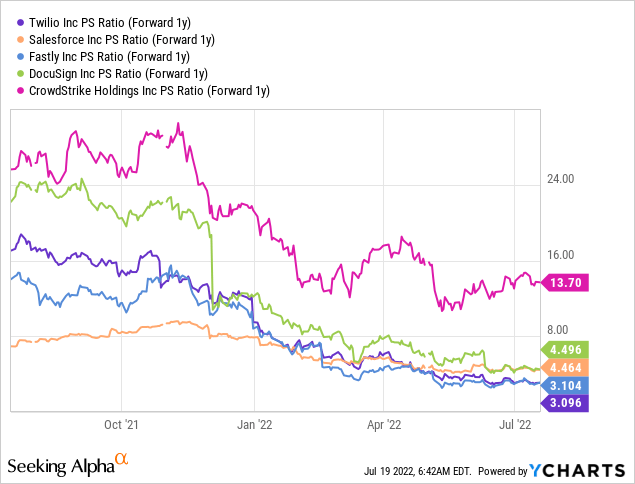

Twilio is expected to grow its revenues to $3.87B in FY 2022 and $5.01B in FY 2023, implying annual growth rates of 36 % and 29%. While top line growth is slowing, the CPaaS company will continue to grow rapidly going forward. Twilio, after a 68% decline in pricing, has a P-S ratio of 3.1 X which is not high for a company that runs a cloud-based business with huge scalability and 30% annual revenue growth rates. Many cloud-based businesses that drive the scalability angle have significantly higher P-S ratios than Twilio.

Risks with Twilio

The biggest risk right now is a slowdown in revenue growth for Twilio as companies may look to generate cost savings in an environment likely heading towards recession. Lacking platform profitability is also an issue for the CPaaS company and economic headwinds may push profits further into the future… which investors may grow increasingly uncomfortable with. What would change my mind about Twilio is if the platform saw negative top line growth and customer monetization rates were to weaken.

Final thoughts

Twilio may be considered a speculative buy right now, but not simply because shares of the CPaaS provider haven fallen 68% year to date. Shares are a buy because Twilio has a healthy core business that is growing and the platform benefits from strong customer monetization rates. The large size of the customer base also gives the company a huge advantage in a recession over other companies that are not as established as Twilio. As Twilio gets closer to actually being profitable, shares have the potential to leave the down-trend and revalue higher. I believe the risk profile is skewed to the upside here!

Be the first to comment