Edwin Tan

I came across National CineMedia, Inc. (NASDAQ:NCMI) while screening for high dividend-yielding securities.

While National CineMedia has a defensive moat with its long term advertising exclusivity with the 3 largest theatre chains in the U.S., the current capital structure is simply too debt heavy. It is currently trading at 19x consensus Forward EV/EBITDA, 90% more expensive than peers. The net debt stands at $1.1 billion. While there are no signs of imminent default, I fear the company’s capital structure may need to be restructured in the coming quarters as there are large debt maturities from 2023 to 2025 and consumers’ movie-going habits may have changed permanently.

Company Overview

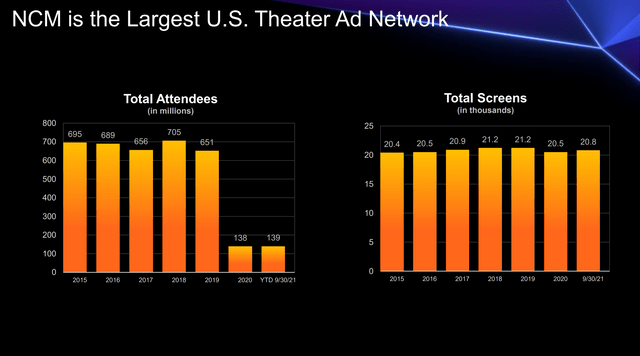

National CineMedia Inc. is the largest U.S. theatre Ad Network with over 20,000 screens in over 1,600 theatres. Prior to the COVID-19 pandemic, NCMI’s advertising network was shown to over 650 million theatre attendees annually (Figure 1).

Figure 1 – NCMI advertising network (NCMI Investor Day Presentation)

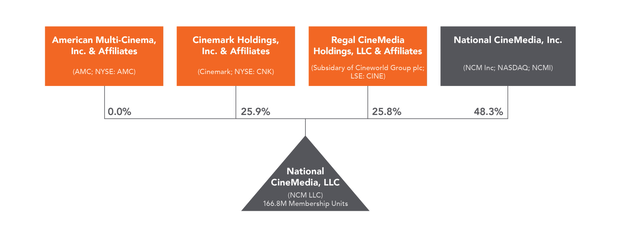

NCMI’s advertising is shown exclusively in the leading national and regional theatre chains including AMC, Cinemark, and Regal. NCMI was created in 2006 as a joint venture between the leading chains (AMC, Cinemark, Regal), and they still own large ownership stakes in the operating business (Figure 2). AMC converted their stake into common shares of NCMI in 2021. The large ownership stakes by the theatre chains and long-term agreements (~17 years remaining with top 3 chains) ensure a stable moat in NCMI’s advertising business.

Figure 2 – NCMI ownership structure (NCMI 2021 Annual Report)

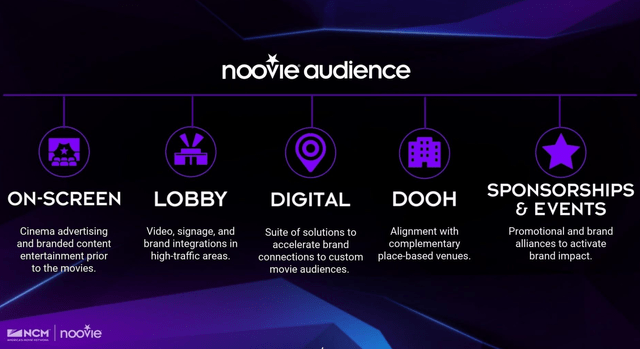

NCMI’s principal business is to sell advertising to national, regional, and local businesses on-screen before movies start, as well as in theater lobbies and digitally (Figure 3).

Figure 3 – NCM’s sources of revenue (NCMI Investor Day Presentation)

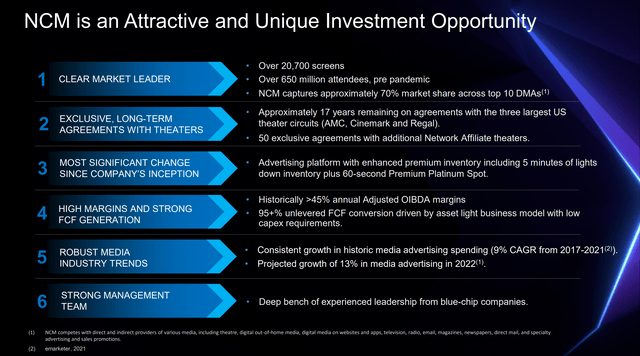

Figure 4 summarizes NCMI’s key investment attributes, according to the company.

Figure 4 – NCMI investment attributes (NCMI Investor Day Presentation)

Unique Advertising Platform

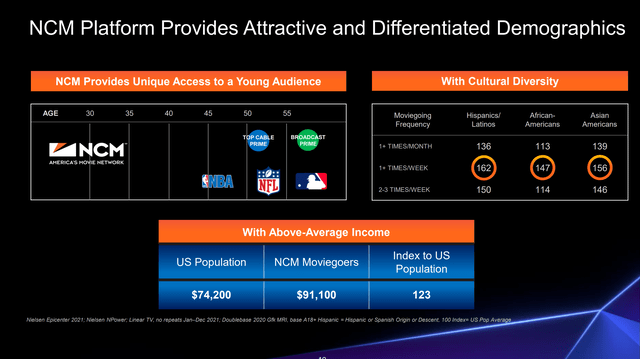

National CineMedia’s advertising network offers a unique, differentiated product to advertisers. In addition to its size (600 million+ audience; 20,000+ screens), NCMI’s network also skews to the coveted 18-34 demographic and higher incomes (Figure 5).

Figure 5 – NCMI platform attributes (NCMI Investor Day Presentation)

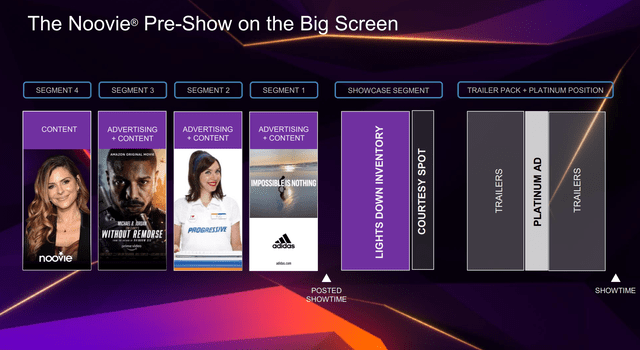

Importantly, NCMI has perfected the monetization of on-screen advertising inventory, with 5 minutes of ‘Lights-Down’ inventory that begins at the advertised showtime, and a premier ‘Platinum’ 60-seconds of advertising embedded near the end of the trailers (Figure 6).

Figure 6 – Illustrative timeline of pre-show advertising (NCMI Investor Day Presentation)

Financials

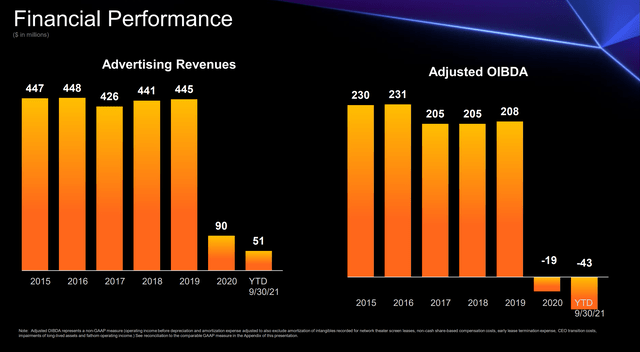

Historically, selling advertising to a captive theatre audience was a good business. Before the COVID-19 pandemic, annual revenues was stable at ~$440 million and Adj. OIBDA margins were over 45% (Figure 7). Management likes to track Adjusted Operating Income Before Depreciation and Amortization (“Adj. OIBDA”), which excludes amortization of intangibles for screen leases, non-cash share compensation, etc.

Figure 7 – Historically Stable Revenues (NCMI Investor Day Presentation)

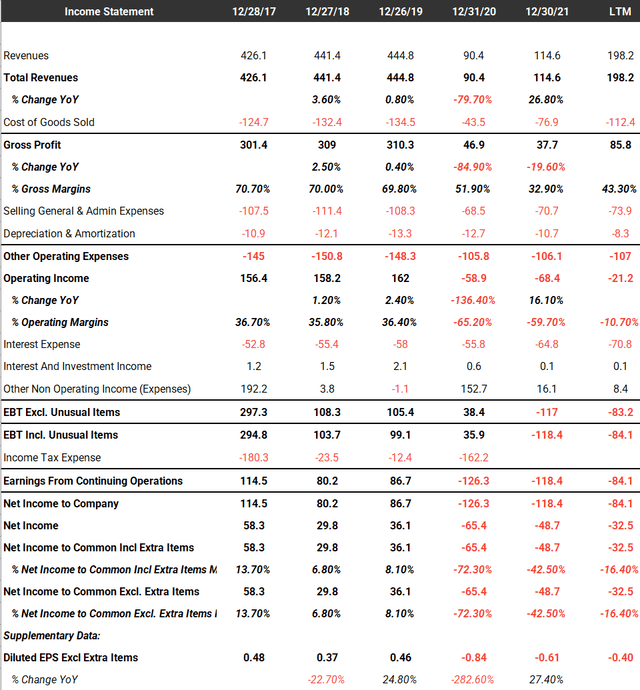

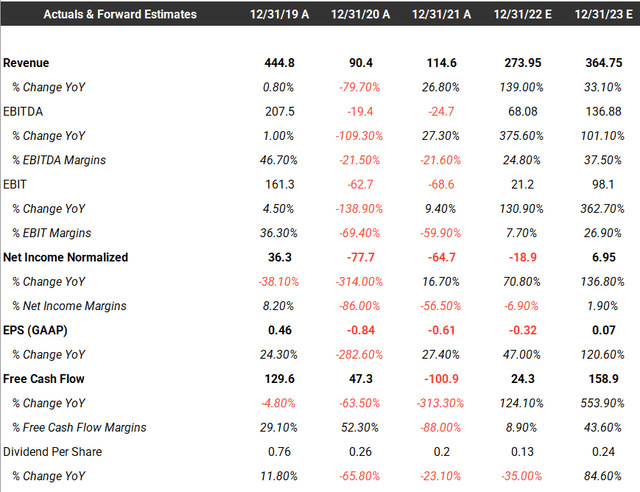

Figure 8 shows historical condensed financials for NCMI. On a GAAP basis, pre-COVID operating margins were over 35% and the company generated over $125 million in free cash flow that supported a generous dividend of $0.68 / share in 2019.

Figure 8 – NCMI condensed financials (tikr.com)

The COVID-19 pandemic was a severe blow to the theatre industry, especially NCMI. In 2020, revenues plummeted by 80% to $90 million and the company recorded a $59 million operating loss. 2021 was not much better, as revenues only recovered to $115 million, a quarter of 2019’s level, and operating loss was $68 million. However, in the last few quarters as COVID restrictions were lifted, theatre attendance has picked up, and so has NCMI’s revenues and operating income.

Post-Pandemic Financials May Have More Upside

On a LTM basis, revenues have recovered to $198 million, and the operating losses have narrowed to $21 million. Analysts expect the recovery to continue, with fiscal 2022 revenue expectations of $274 million versus management guidance of $265 to $285 million for F2022. However, I believe there may be more near-term upside to revenues as movie-goers return to theaters.

Figure 9 – NCMI analyst estimates (tikr.com)

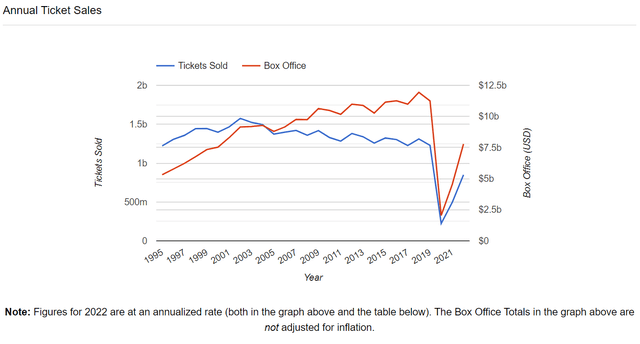

A slew of blockbusters this year like ‘Top Gun: Maverick’ and ‘Thor: Love And Thunder’ have boosted the annualized tickets sold to 850 million, approximately 70% of 2019’s 1.22 billion (Figure 10). If NCMI’s revenues were also to recover to 70% of 2019’s level, that would imply a topline of ~$310 million. Furthermore, additional attendees could drive increased operating leverage, as most of NCMI’s costs (network fees, theatre access fees, SG&A) are relatively constant.

Figure 10 – Movie attendance (the-numbers.com)

Heavy Debt Load Is A Large Valuation Overhang

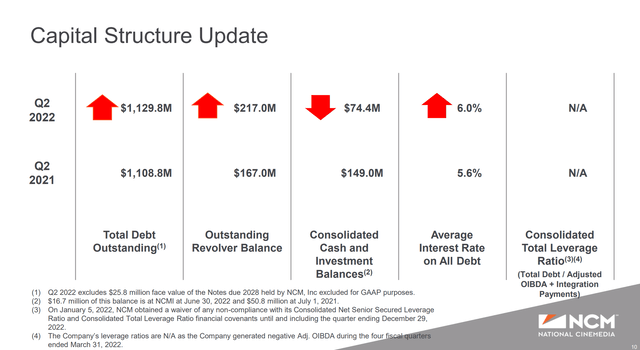

The biggest risk for NCMI is its heavy debt load. Prior to the pandemic, NCMI had $950 million of long-term debt and leases versus $167 million in 2019 EBITDA (5.7x Debt/EBITDA). While high, it was not a major concern as the theatre advertising business was seen as stable and generated large free cash flows (2019 FCF of $130 million). However, due to the pandemic’s impact on movie attendance, net debt have increased to $1.1 billion as the company has borrowed to fund operations and continue paying its dividend (Figure 11).

Figure 11 – Deteriorating Capital Structure (NCMI Q2 investor presentation)

Even if my analysis is correct and 2022 revenues end up at $310 million, I estimate EBITDA would only be ~$95 million (assuming 75% EBITDA margin on the $36 million in incremental revenue above analyst estimates). That translates to staggering 11.9x Net Debt / EBITDA. More than $500 million of debt ($217 million revolver plus $310 million in term loans) are due in the next 3 years. Even more troubling, with increasing interest rates, NCMI’s interest expense is expected to increase as maturing debt is refinanced.

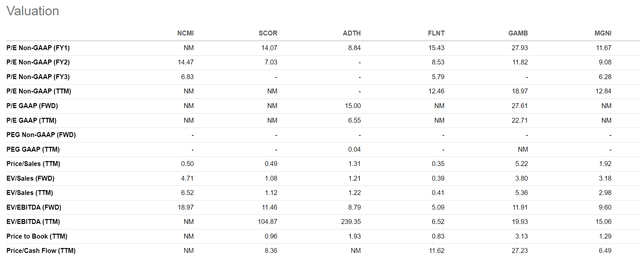

Looking at a comparable group of advertising peers, we see the average EV/EBTIDA for the group is 9.4x, so NCMI, at 14x EV/EBITDA based on my optimistic $95 million EBITDA estimate, is 40% more expensive than peers. On consensus estimates, NCMI is trading at 19x Fwd EV/EBITDA.

Figure 12 – NCMI Peer Valuation (Seeking Alpha)

What Is The Endgame?

Borrowing a tagline from the Marvel blockbuster, what is the ‘Endgame’ for NCMI?

Dividend Continues To Be Cut

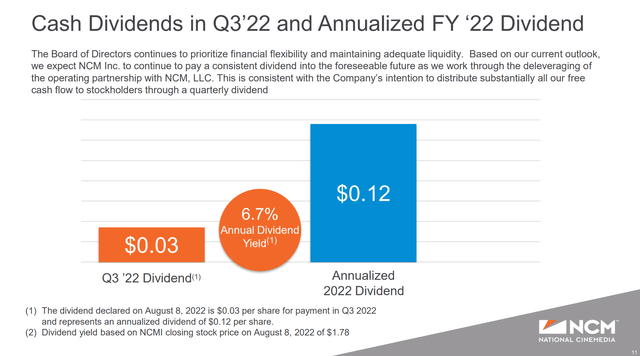

While NCMI’s current dividend of $0.12 / share looks attractive at a 9.5% forward yield (current price of $1.26), with the staggering debt load mentioned above, it may make sense for the company to eliminate the dividend altogether and direct free cash flow to reduce the debt load. At $0.12 per year, cutting the current dividend could save the company ~$10 million.

Figure 13 – Current dividend (NCMI Q2 investor presentation)

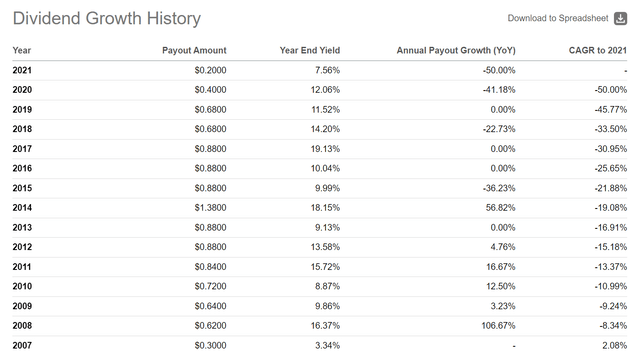

In fact, NCMI has steadily reduced the dividend, from $0.68 in 2019 to $0.40 in 2020, $0.20 in 2021, and now a forward rate of only $0.12 (Figure 14).

Figure 14 – NCMI dividend history (NCMI Q2 investor presentation)

Debt May Need To Be Restructured

More importantly, NCMI may need to restructure its debts and rightsize the capital structure to fit in with the new reality in movie attendance.

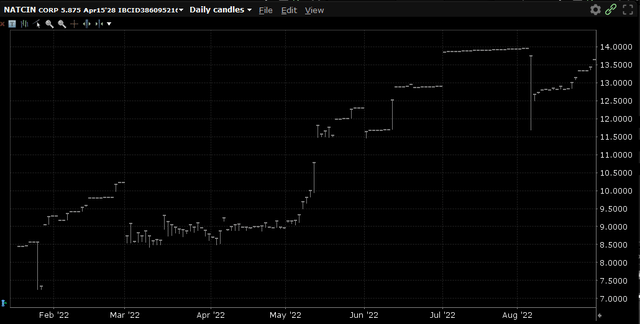

Currently, National CineMedia’s bonds, like the NATCIN 5.875% Apr 2028 shown below in Figure 14, are trading at 74.25 (yielding 13.6%), indicating a very significant risk of default or restructuring.

Figure 14 – NCM 5.875 Apr 2028 bonds (Interactive Brokers)

If NCMI does not default or restructure its debt, the punitive yields NCMI’s bonds currently trade at imply a significant increase in interest expense once the 2023-2025 revolver and term loan maturities are refinanced. NCMI is currently paying an average 6% interest rate on its debt, or $70 million on a LTM basis. With more than $500 million in revolving debt and term loans maturing, every 1% increase in interest rate will translate into $5 million in additional interest expense.

New Normal In Attendance

With pandemic restrictions pretty much lifted across most of the United States, movie attendance have only recovered to ~70% of pre-pandemic levels (Figure 10 above). What if this is the normalized level of movie attendance going forward?

Speaking from personal experience, while I would still go to theatres to see blockbuster movies such as ‘Top Gun: Maverick’, the rise of streaming services such as Netflix (NFLX), Disney+ and HBO Max means many movies have been watched from the comfort of my home, especially those that do not require the ‘theatre experience’.

Upside Risk From Platinum Ads

On the positive side, one risk is that NCMI only introduced the ‘Platinum’ ad product (60 seconds of ads embedded at the end of trailers) in Q4/2019, so the uptake of that inventory was severely impacted by COVID-19. On the recent Q2 earnings call, management noted that the company has now sold the ‘Platinum’ ad spot for the fifth quarter in a row and some to new advertisers that have never advertised with NCMI before. So potentially, the revenue per attendee could exceed 2019 levels, especially if advertisers value the ‘Platinum’ product.

Conclusion

While National CineMedia has a defensive moat with its long term advertising exclusivity with the 3 largest cinema chains in the U.S., the current capital structure is simply too debt heavy. It is currently trading at 19x consensus Fwd EV/EBITDA vs. peers at 9.4x. The debt load, at $1.1 billion net debt, is too heavy and may need to be restructured, as implied by the large yields on its bonds. While there are no signs of imminent default, there are large debt maturities in the next few years that needs to be paid off or rolled over. Furthermore, I have concerns that movie attendance will not return to pre-pandemic levels due to permanent changes in consumer behaviour. Equity investors are advised to stay on the sidelines on NCMI, despite its attractive current dividend yield.

Be the first to comment