NiseriN

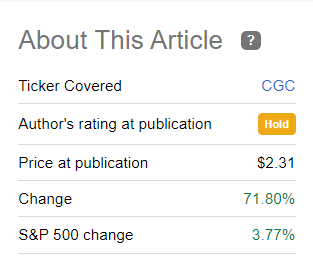

There are generally no one-directional markets. Whenever sentiment gets too bearish and the sounds of bull pain resonate in investor ears, one must get cautious pushing the doom and gloom. That is precisely why we declared victory on bear call and shifted to neutral on Canopy Growth Corporation (NASDAQ:CGC) just as it appeared everything was going right. That shift from a “Sell” to a “Hold” was timely and CGC delivered a barn buster of a rally since then.

Returns Since Last Article (Seeking Alpha)

With the late comer bears taken to the woodshed and another quarter in the bag, we analyze how things stand. After all, we had ended the last article with:

In the eggs and bacon breakfast, the chicken is involved but the pig is committed. STZ is clearly committed here and likely wants to avoid acknowledging the giant error in investing in CGC. This also makes a buyout possible, although we would assume it would come at a zero premium and likely at a price lower from here. That risk though makes us dial back the bearishness here and we are reluctantly upgrading this to a hold/neutral rating. We would look to move to the bear side if we get a strong rally back over $4.00.

Source: Constellation’s Investment Goes Up In Smoke

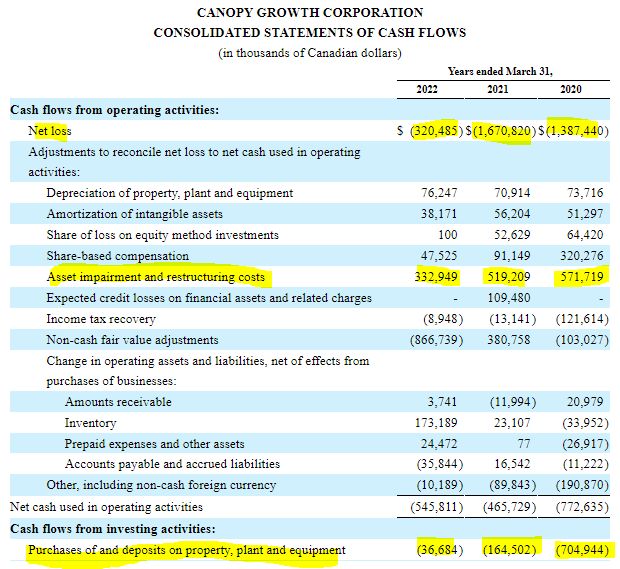

Guess where we are today?

Seeking Alpha

Q1-2023

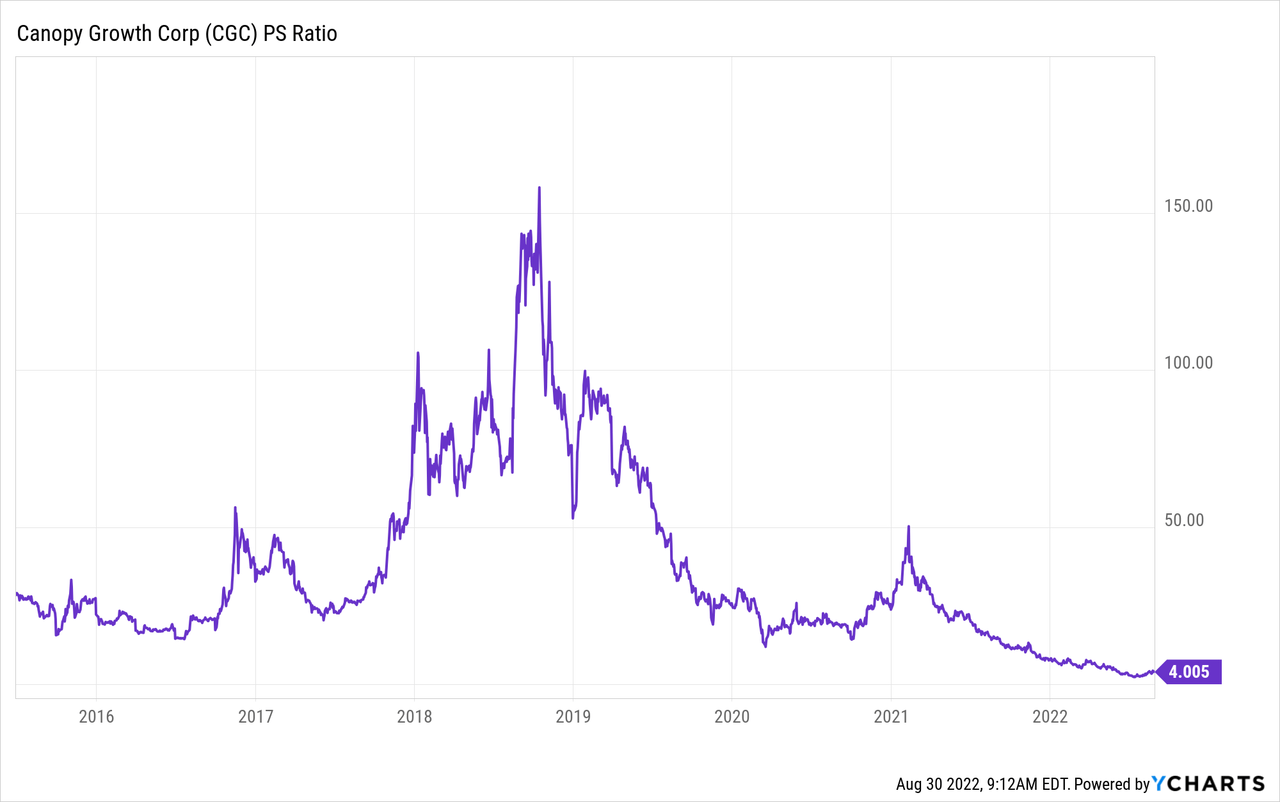

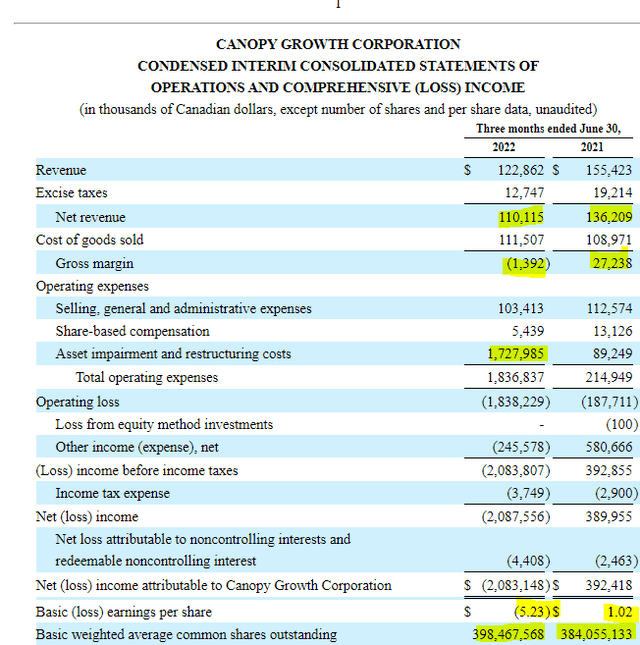

CGC’s fiscal year end is in March, so the current quarter (10-Q link) is Q1 of the fiscal year 2023. The numbers were about as bad as one could expect from CGC. The once vaunted growth story delivered yet another quarter of year over year revenue declines. Revenues contracted a whopping 19%.

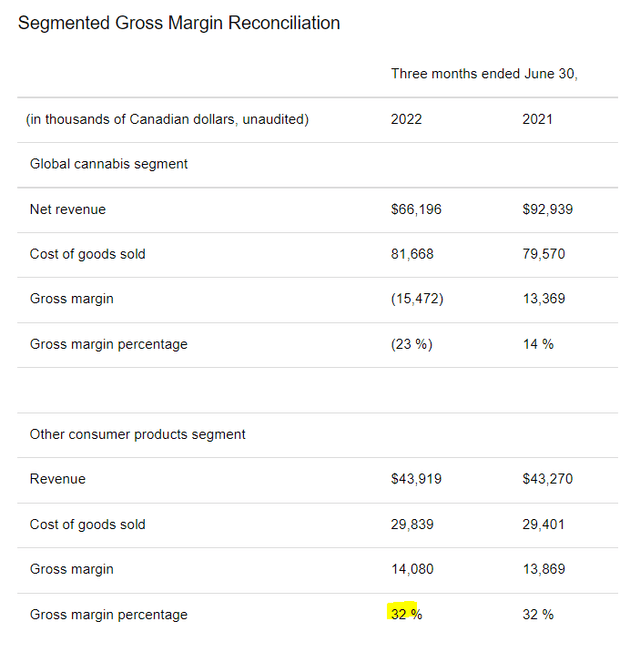

This is something to keep in mind the next time you convince yourself that paying 20X sales for a company makes sense because of growth. CGC’s cost of goods sold expanded even as revenues dropped and gross margins were negative once again.

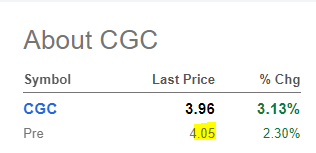

Further down we saw what has become a rather familiar sight to CGC shareholders, another large asset impairment. This one was $1.73 billion and included restructuring costs. For those that might have forgotten. this is CGC’s fourth consecutive year with a large impairment/restructuring charge.

2022 10-K

This one was more than the last 3 years combined. Of course, bulls will argue this was a “non-cash” goodwill impairment. Bears will rightly point out that CGC had paid for that goodwill asset and it is another nail in the coffin. Moving on, we see that CGC’s share count expanded by 14 million, though this does not take into account the post quarter end debt exchange.

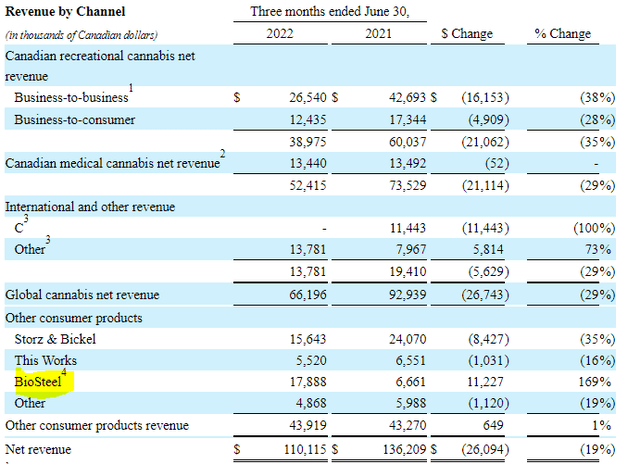

The one positive news in this report was the growth of the BioSteel brand.

This was a welcome development as CGC expanded its retail presence and sealed an exclusive partnership with NHL.

Secured retail agreement with Walmart Stores covering 2,200 stores in 39 states. Entered partnership to become the Official Hydration Partner of the NHL and NHLPA.

Source: CGC Press Release

This segment also is one that is actually making gross profits, so an expansion here will help the company.

Overall it was a dismal report with large losses and another round of impairment, punctuated by one lone bright spot.

Outlook

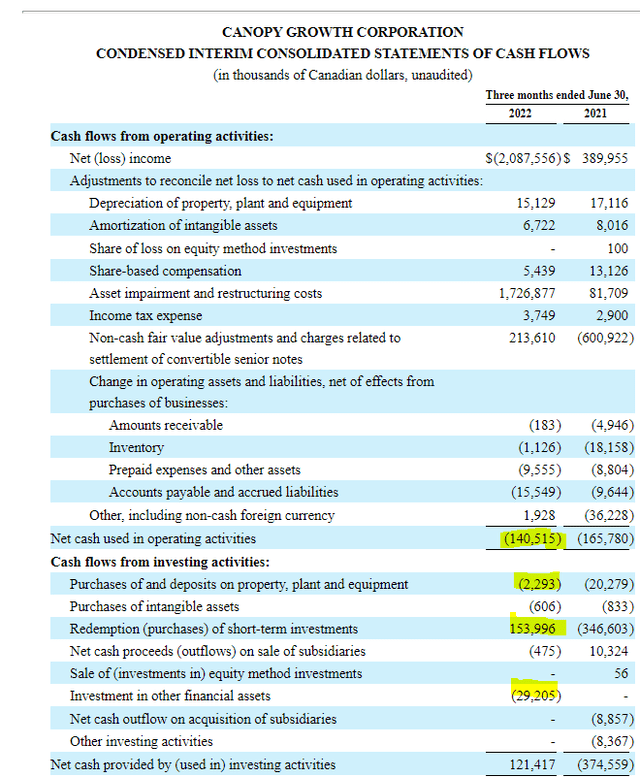

CGC is on a timeline to get things in order before they run out of cash and the cash burn is what we need to look at most closely.

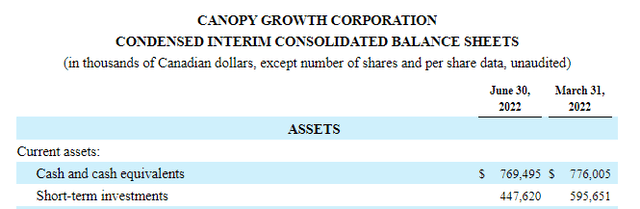

The base business burnt through another $140 million this quarter and other investments totaled about $31.5 million. CGC redeemed $154 million of its short term investments to pay for this. You can see this drop quarter over quarter on the balance sheet.

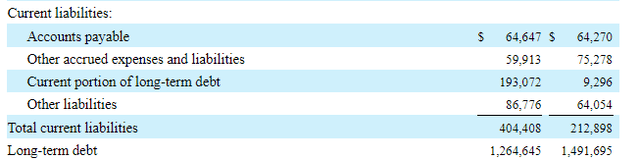

This $1.2 billion is what the whole game is about. That is an offset against the $1.7 billion of total liabilities.

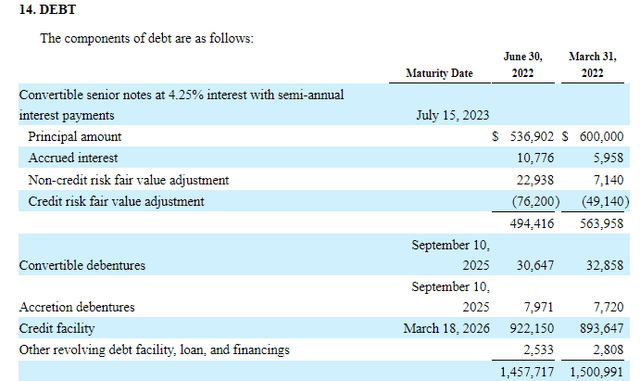

The 10-Q presentation shows $536.9 million of convertible notes due, but the current portion above is only $193 million.

This discrepancy likely comes from notes that were fixed to be exchanged for shares at the end of the quarter. Without this exchange, CGC had very poor odds of making it past June 2023, but now things do look better. Keep in mind though, it is still burning through cash and the interest rate (LIBOR Plus 8%) on the credit facility is rising sharply as the Federal Reserve hikes. Any small improvements in operations will be offset by higher costs there.

Verdict

We expect at least another $300 million of cash burn through the next 3 quarters. Alongside the principal redemption of remaining 2023 notes, CGC will be have $700 million of cash on the balance sheet versus its $1.25 billion of remaining debt. That is not terminal by itself but not worthy of investing either. An optimist would pay 1X sales for this business assuming it can fix its debt issues and improve to profitability.

We are such optimists. We resume our Sell rating on this stock with a price target of $1.00 (1X sales) per share.

Be the first to comment