Alex Potemkin/E+ via Getty Images

Introduction

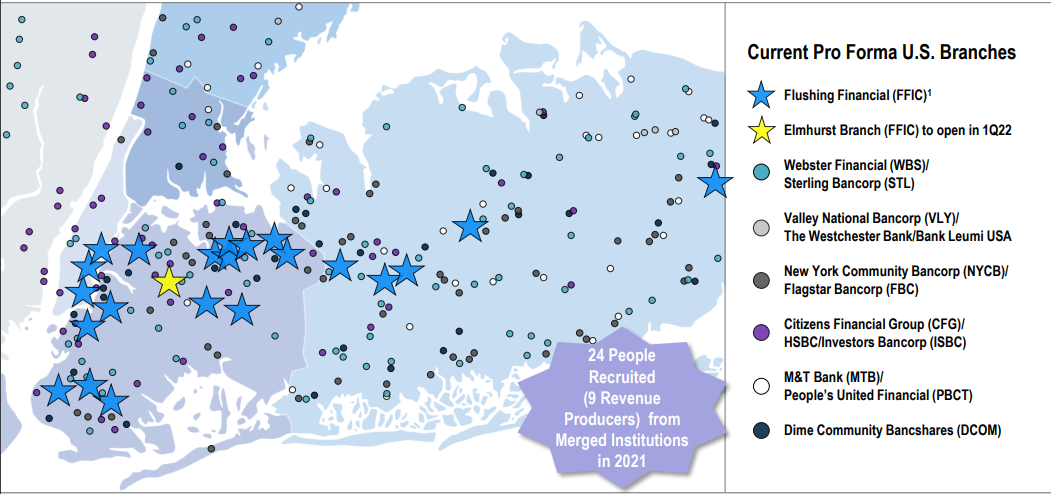

Flushing Financial (NASDAQ:FFIC) is a full-service commercial bank in the state of New York where it operates 24 branches (as well as one online bank).

FFIC Investor Relations

The bank’s balance sheet now exceeds $8B making it one of the larger regional banks and I wanted to have a closer look at this bank’s earnings profile and loan book. I was pleasantly surprised as the average LTV ratio of the real estate portfolio is exceptionally low and this adds a layer of safety to the stock as an investable asset.

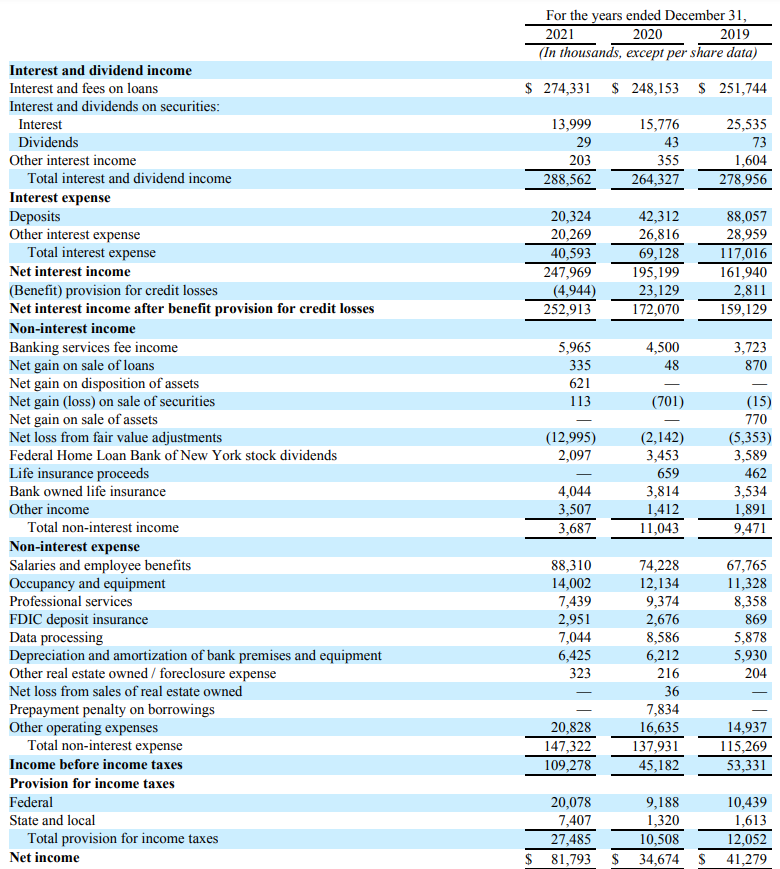

A decent earnings profile in 2021, helped by the reversal of older provisions

In 2021, Flushing Financial saw its net interest income increase by in excess of 25% thanks to improving margins and an expanded balance sheet as FFIC acquired a small bank in 2020. With a net interest income of almost $248M, the bank’s NII is more than 50% higher than in 2019.

FFIC Investor Relations

Flushing Financial reported a non-interest income of $3.7M and a non-interest expense of $147.3M, which is mainly related to staff expenses. The non-interest income tends to be held back by a loss from fair value adjustments which fluctuates on an annual basis as these are related to hedges.

The pre-tax and pre-loan loss provision income was just under $105M which compares very favorably to the sub-$70M result in 2020 and the $56M in FY 2020 as the much higher net interest income is really boosting the results.

Whereas the bank had to record some loan loss provisions in both 2019 and 2020, it was able to reverse some of those provisions in 2021 and this boosted the pre-tax income by $4.9M to $109.3M. On an after-tax basis, FFIC reported a net income of just under $82M which works out to be $2.59 per share. At the current share price, Flushing Financial is trading at just nine times its earnings for FY 2021 but keep in mind the reversal of loan loss provisions obviously is a non-recurring item. That being said, the low-risk profile of the loan portfolio will likely keep future provisions and loan losses limited and even on a ‘normalized’ basis the EPS would clearly exceed $2/share.

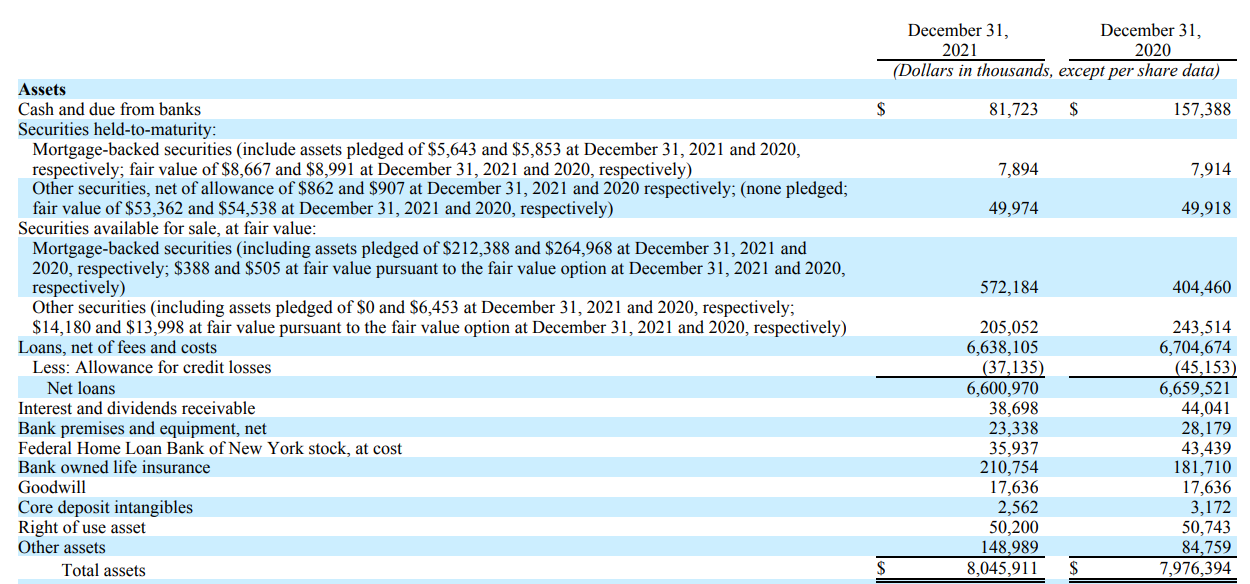

The loan book is heavily weighted toward real estate, but the loan quality seems to be high

The earnings profile looks good, but I obviously also want to make sure Flushing Financial is underwriting loans with a decent risk profile so I needed to dive a bit deeper into the balance sheet. As mentioned in the introduction, the total balance sheet size of Flushing Financial exceeds $8B and as you can see in the image below, roughly $910M is invested in either cash or securities that are supposed to be relatively liquid.

FFIC Investor Relations

I’m mainly interested in the $6.6B loan book and the apparent low loan loss provision of just $37M which represents just over half the loan book.

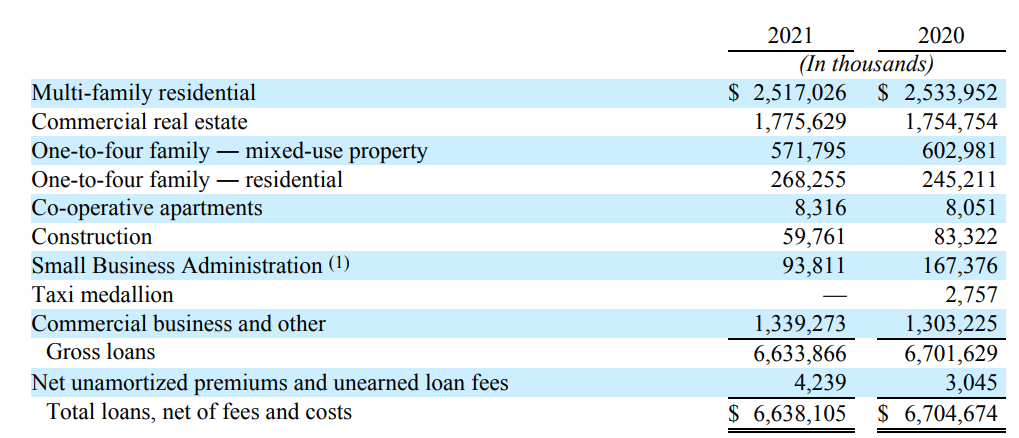

FFIC Investor Relations

A substantial portion of the loan book (almost 40%) consists of residential real estate and with an additional $1.8B in commercial real estate and mixed use properties, it’s clear the balance sheet if very weighted toward real estate assets. We also see $93.8M in SBA loans and these should be risk free and roll off during the year.

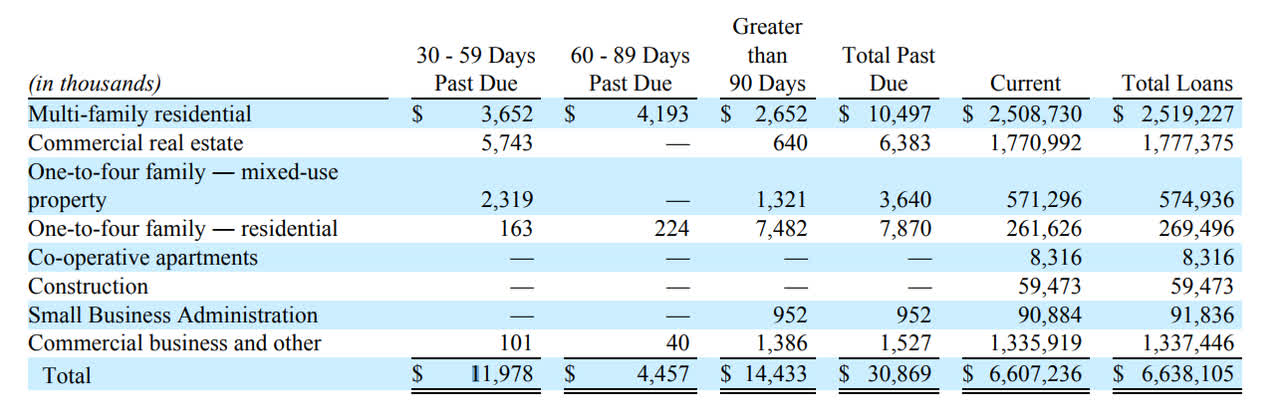

An important metric to determine the quality of the loan book is to look at how many loans are actually classified as “past due” as that provides a good look under the hood. Much to my surprise the total amount of loans past due exceeded $30M. That’s not very high given the $6.6B+ loan book size, but it appears to be low compared to the $37M in loan loss allowances.

FFIC Investor Relations

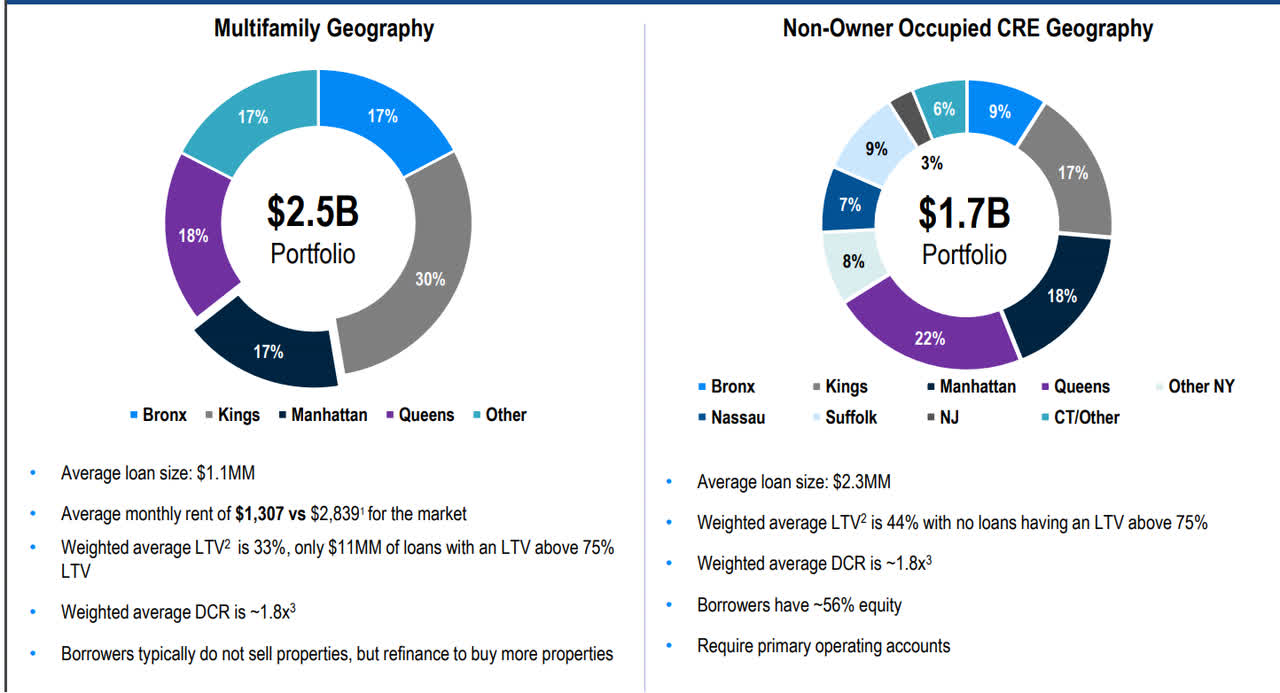

The main reason for the loan loss allowance is the exceptionally low LTV ratio in the real estate portfolio. The average LTV ratio of the residential portfolio is just around 33% with only a fraction of the loans having an LTV ratio exceeding 75%. We see a similar ratio in the commercial real estate portfolio with an LTV ratio of 44% and zero loans with an LTV exceeding 75%.

FFIC Investor Relations

To explain this in simple terms: The $2.5B residential portfolio is backed by $7.5B in properties. So even if there are defaults in that loan portfolio, the foreclosed assets would have to be sold at a 70% loss to fair value before seeing any noticeable impact on Flushing’s financial results. So with $10.5M in residential loans past due, on average there would be $30M in real estate as collateral. This greatly reduces the risk of the bank being on the hook for losses and this explains why both the loan loss provisions have traditionally been low, and why the total amount of allowances on the balance sheet is relatively low compared to the total amount of loans past due.

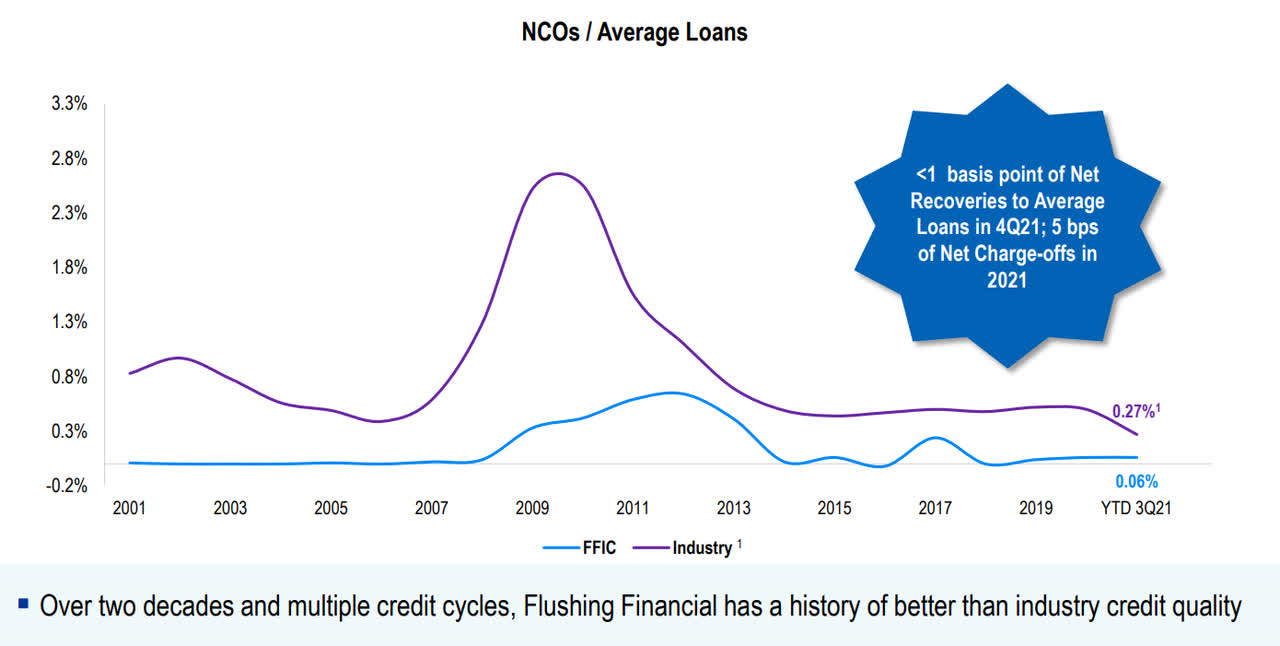

And as you can see below, Flushing Financial has a long-standing tradition of lower net charge-offs than the sector.

FFIC Investor Relations

Investment thesis

Flushing Financial hadn’t popped up on my radar before but I’m getting increasingly interested in the player in the New York banking landscape. Both the dividend yield (almost 4%) and the earnings ratio are attractive while the bank is trading at just 1.1 times its tangible book value. All these metrics make sense for a “normal” bank, but I think Flushing Financial is safer than most of its peers due to the very low LTV ratios in its loan book and a premium valuation appears to be warranted here.

I have no position in Flushing Financial, but the bank has been added to my watch list as the asset quality stands out.

Be the first to comment