Justin Sullivan/Getty Images News

Snap (NYSE:SNAP) is a seemingly unlikely victim of the tech crash. The stock did not trade at such egregious valuations at the peak yet has still managed to crash 85%. The latest negative price action has been driven by the predicted guidance miss only 1 month after initiating guidance. Still though, there is much value to be had here, as the company continues to grow users at an enviable rate. The stock is quite cheap here in an eventual recovery to stronger growth rates. This is the kind of stock I have been buying in the Best of Breed portfolio to take advantage of the tech crash.

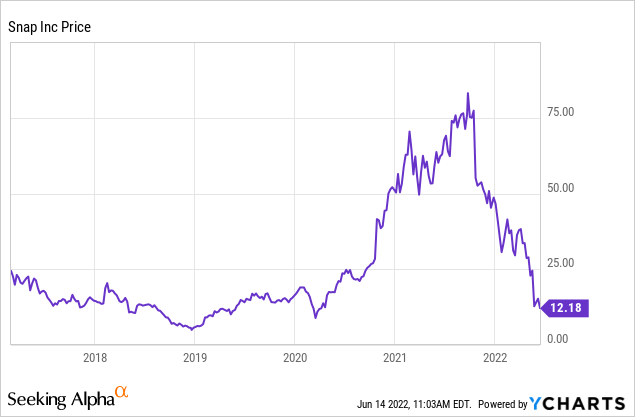

SNAP Stock Price

SNAP peaked above $80 per share but has somehow fallen 85% down to around $12 per share.

I previously covered the stock in March, when I rated it a strong buy on valuation. The stock has since been cut in half. At these prices, the stock is priced lower than its $17 IPO price in 2017. The stock is priced as if growth will never return for the company, but such an outlook is arguably too pessimistic.

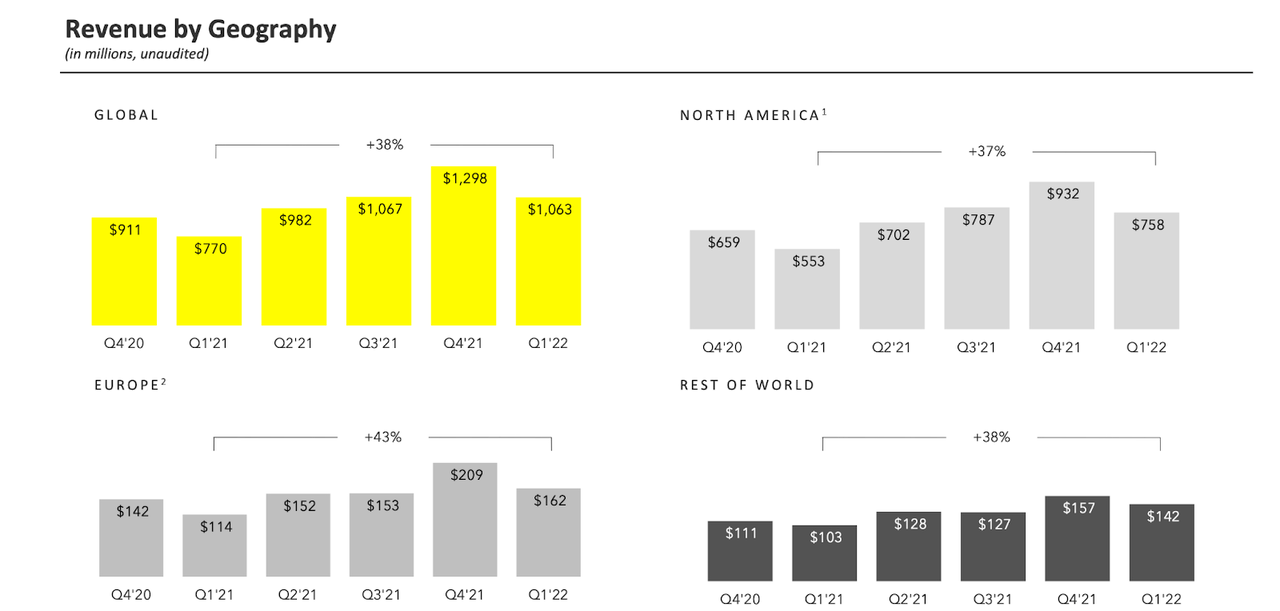

SNAP Stock Key Metrics

The latest quarter saw SNAP deliver solid 38% revenue growth. That came in squarely within management’s guidance.

Snapchat 2022 Q1 Presentation

The strong growth came on the back of 18% average daily active user growth. The 4% sequential growth is particularly impressive when compared with the stalling sequential growth at Meta (META) and sequential declines at Pinterest (PINS).

Snapchat 2022 Q1 Presentation

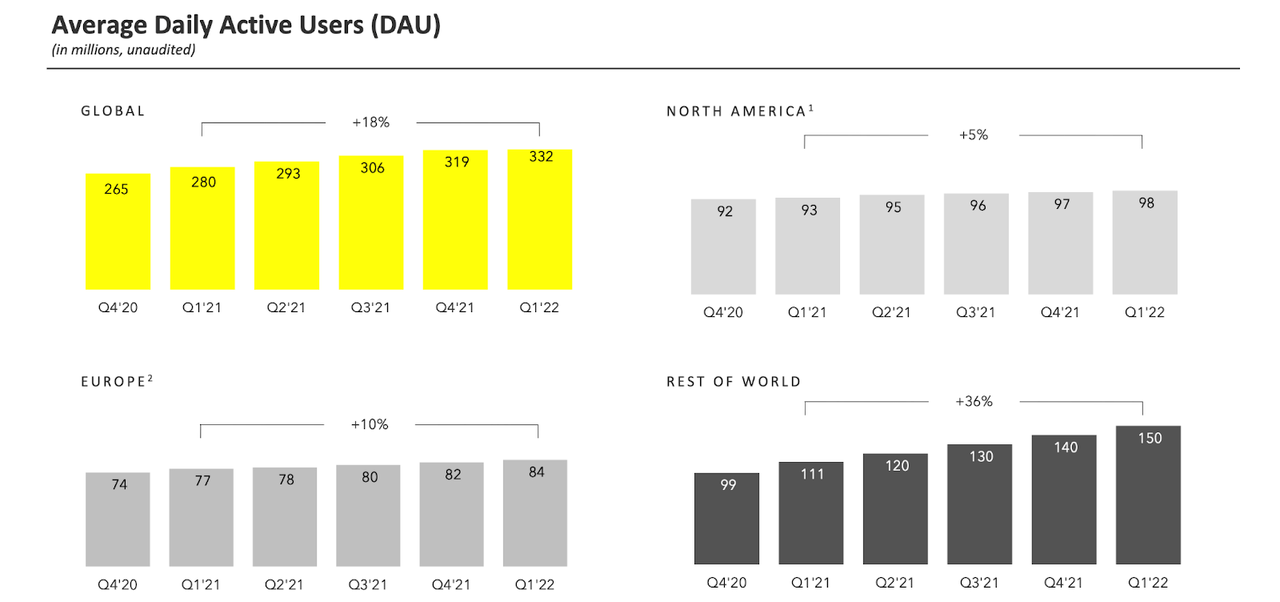

SNAP was still not profitable on a non-GAAP basis but did generate a 6% adjusted EBITDA margin.

Snapchat 2022 Q1 Presentation

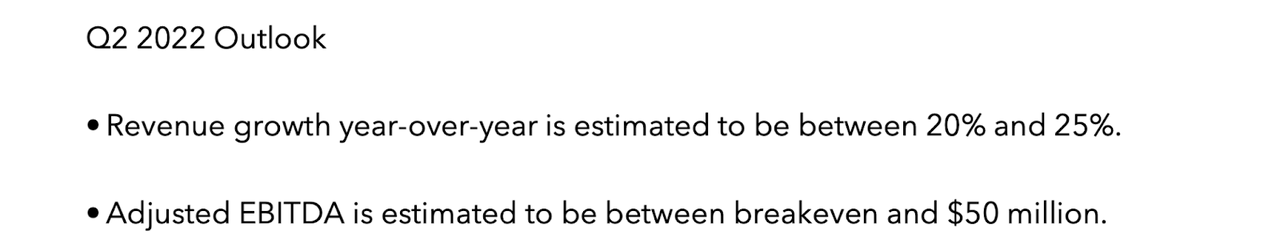

At the time, SNAP guided for revenue growth of up to 25% in the second quarter.

Snapchat 2022 Q1 Presentation

Why Is Snap Stock Down?

Those earnings results were released on April 21st. Just one month later on May 23rd at an investor conference, SNAP stated the following:

The macroeconomic environment has definitely deteriorated further and faster than we expected when we issued our guidance for the second quarter. So even though our revenue continues to grow year-over-year in the second quarter, it’s likely that revenue and EBITDA will come in below the low end of our guidance range. So certainly something that we’re working through along with many other businesses that are impacted, of course, by the supply chain issues, inflation, concerns about interest rates, the war in Ukraine, et cetera. So there’s a lot to deal with in the macro environment today, but we’re staying focused and really on the long-term and investing through it.

The second quarter spans from the months of April to June. At the time of the above conference, SNAP had already made it through 2 of those 3 months, on top of already making it through April when it first initiated guidance. I assume SNAP had achieved around 25% revenue growth or greater in April at the time of initiating guidance, meaning that growth must have slowed down tremendously in May for the company to now expect growth to come below 20%. Compare the expected growth with the 64% growth in 2021 and 38% growth in the first quarter, and it is easy to see why investors were spooked by the announcement.

Is Snap Stock Undervalued Now?

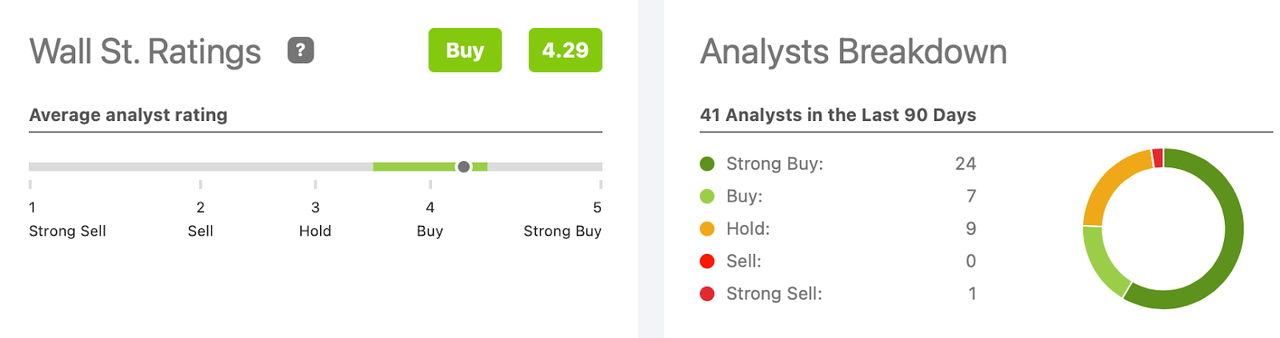

Even so, the stock has fallen so much that Wall Street analysts are still bullish on the stock, with an average 4.29 rating out of 5.

Seeking Alpha

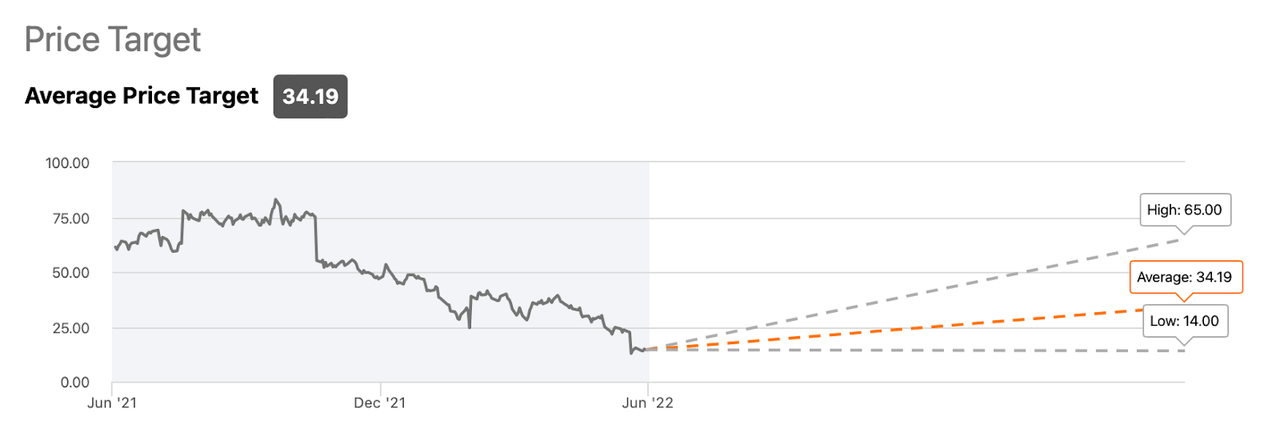

The average price target of $34.19 per share implies around 185% upside.

Seeking Alpha

Does SNAP Stock Have A Future?

To answer that question, we need to understand the headwinds facing the company currently. SNAP saw growth decelerate from 64% in 2021 to 38% in the first quarter of 2022 due to the iOS data privacy changes. SNAP is now guiding for another steep deceleration in growth rates moving forward due to market conditions. I still have confidence that SNAP will be able to work through the iOS changes over time. It is arguable that the difficulties from the market conditions are near term and will subside over time as well. The key point to consider is that SNAP is still growing its user base at healthy rates – the absence of user growth would make the bullish thesis much harder to get behind. Wall Street consensus estimates call for growth to accelerate next year to 38%.

Seeking Alpha

Is SNAP Stock A Buy, Sell, or Hold?

SNAP still isn’t profitable here, though it does have $5 billion of cash on its balance sheet ($1.3 billion of net cash). Most of the convertible debt carries a 0.125% interest rate or no interest at all, with a conversion price ranging $93.90 to $121.02 per share over the next 5-6 years. The balance sheet, on account of the low interest obligation, is much stronger than it looks. The company is also generating cash – the financial solvency risk here is arguably low. I can see the stock generating a 30% net margin over the long term. Based on a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see SNAP trading at around 13x sales next year, implying a stock price of $58 per share and upside of 380%. Shares outstanding are growing by 5% annually, which may eat into that projected return. The other main risk here is that of competition. Because SNAP is not nearly as profitable as META, I view it to have greater exposure to existential risk which might occur if it fails to resonate with younger generations. That has not proven to be the case as evidenced by the strong DAUs growth, but as someone who does not use the product myself, I admit that its product looks very similar to offerings from META or TikTok. Investors should keep a close eye on DAUs growth, as deterioration in that metric as compared to peers would be a red flag.

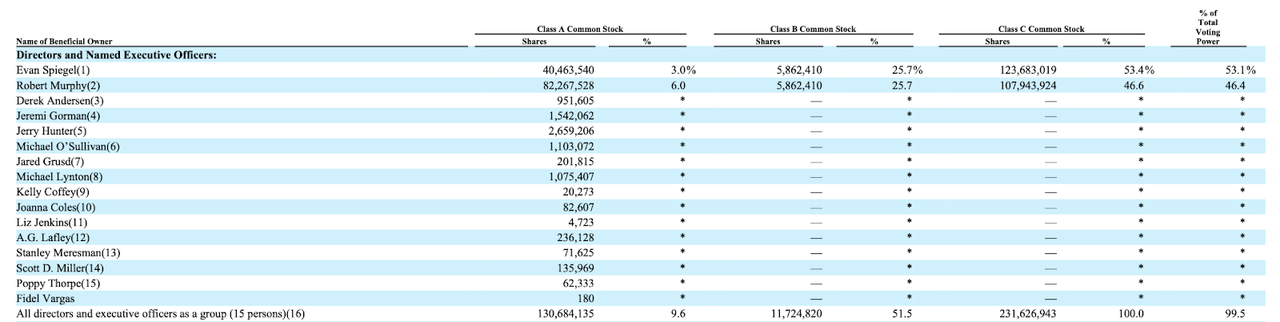

An additional thing to note is that insiders own a substantial stake in the company. CEO Evan Spiegel and CTO Robert Murphy collectively own 366 million shares, equating to more than 20% of shares outstanding.

Snapchat 2021 10-K

High insider ownership could be a driver for strong long-term returns, as the management team is incentivized to create long-term value.

I rate the stock a strong buy with substantial upside over the long term, even if near-term returns are likely to be muted until there is evidence of a recovery in growth rates. I have been adding to tech stocks like SNAP to the Best of Breed portfolio, as I continue to search for gems in the beaten-up tech sector.

Be the first to comment