whitemay

After our recent update on Legal & General Group Plc and its positive press release, today we focus on another British company in our coverage universe – HSBC (NYSE:HSBC). Last time, despite some good numbers in Q2 and a better outlook, we were not very supportive, and we hope you passed on the investment opportunity. During the Q&A analyst call, HSBC also reiterated its commitment to better shareholder remuneration. However, here at the Lab, with an analysis called Show Me The Story, we were more grounded in facts in our value approach basing underpromised and overperformance (and not the other way around) and favoring other banks within the sector.

With the latest announcement of the UK government, there are more risks to price in. For a better overview of what recently happened, we suggest our readers check up on our previous publication. Today, we are dealing with macro risk implications for HSBC and UK banks.

To sum up, Wall Street sentiment on the British economy has considerably weakened in the last few weeks. Since Liz Truss’s appointment as the new British PM, the UK stock markets have lost approximately $500 billion. Higher interest rates, a weaker currency, and inflation pressure on B2B and B2C are leading the Empire into a recession. More and more investors are more bearish on the banking sector since British banks have withdrawn significant volumes of mortgage products.

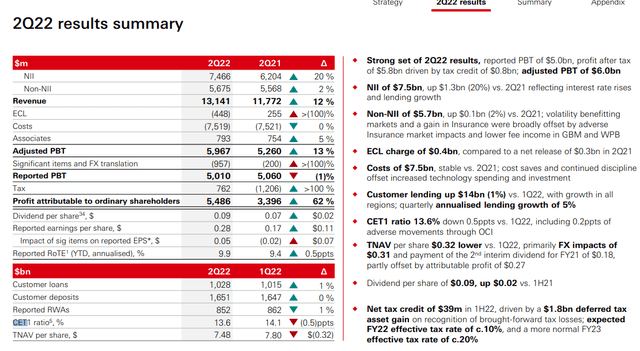

At the end of September, the Bank of England, during the bond market sell-off due to the British Prime Minister’s tax cuts announcement, decided to step into announcing a massive billion bond purchase program that would last for several days. Having reached the last week of purchases, to support the British financial market, the BoE has also established to launch the Temporary Expanded Collateral Repo Facility. This is an instrument that will allow financial institutions such as banks to relieve the pressure on the liquidity of their customers’ Liability Driven Investment funds. We believe that BoE’s new support measures will not give much support to the Gilts. And from a Macro view, this was definitely not supportive of the banking environment. Here at the Lab, we expect mark-to-market losses on bond holdings and as a consequence a negative impact on the bank’s net asset value and their respective capital requirement ratio. There is also a trade-off between higher rates (positive for banks), and possible losses on mortgages (negative for banks). HSBC has a solid capital position and was recently affirmed by Fitch rating too. Despite that, the bank’s CET1 ratio stood at 13.6%, down 50 basis points from Q1 results, and it is not the greatest among EU banks.

On the Micro level, we should price the risk of higher mortgage costs. According to Barclays analysis, customers refinancing will be more than 40% higher over the next year (if we estimated a 5% rate). Considering that in the UK market, around 30% of the total landing are fixed rate mortgages and will expire in the next twelve months, this could further trigger a recession and serious repercussions on discretionary spending.

Conclusion and Valuation

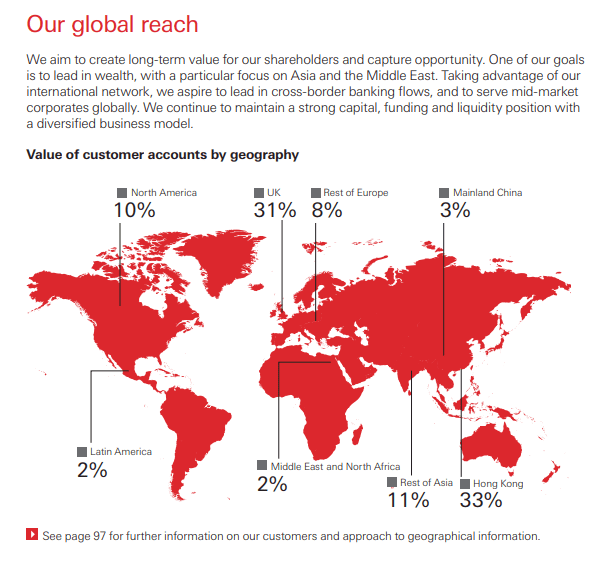

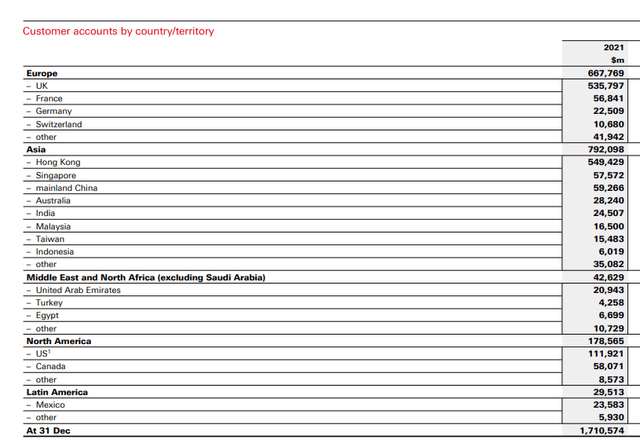

Numbers in hand, the UK represents almost 31% both in value for customers (fig 1) and clientele numbers (fig 2).

HSBC value for customers HSBC clientele numbers

Government credibility will weigh on the company’s stock price and BoE intervention is not the solution, we reaffirm our hold rating at a target price of 505 pence.

Be the first to comment