chrisp0/E+ via Getty Images

Investment Thesis

State Street Corporation (NYSE:STT) is a well-established bank with many years of dividend payments and dividend-friendly management policies. However, this giant custodian bank is slowly fading away among its peers and some questionable management decisions are made in the last couple of months. It has a 2.72% dividend yield which can be an average but stable payout for income-seeking investors. In my opinion, STT is a safe investment due to its too big to fail category which means if STT gets into serious trouble the U.S. government will very likely bail it out. This does not guarantee above the average shareholder returns to investors but makes STT a safe investment with minimal bankruptcy risk.

Business Model

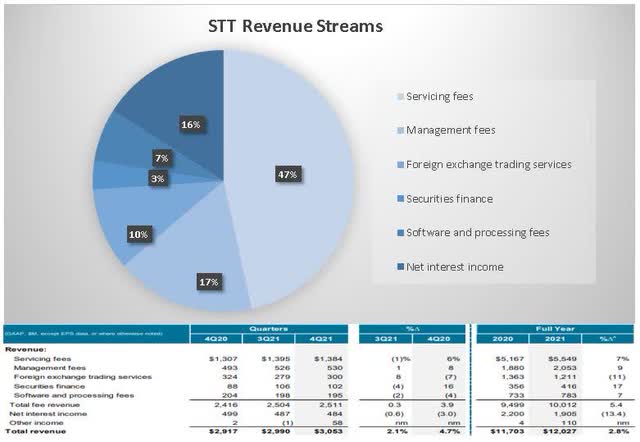

State Street, through its subsidiaries, provides a range of financial products and services to institutional investors worldwide. The company traces its roots to Union Bank, which received a charter in 1792 and it was the third bank to be chartered in Boston. STT is the 12th largest bank in the U.S. by asset size and the largest custodian bank. STT has two core businesses, one is investor services and the other is asset management. Almost half of its revenue comes from service fees such as custody, product accounting, daily pricing and administration, record-keeping, and cash management. 17% of the company’s revenue is recognized from management fees while another significant portion of the revenue (16%) comes from interest income.

4Q and FY 2021 Financial Highlights

Due to the FED’s expected more aggressive interest rate hikes later this year to tackle the current high inflation. This means STT’s interest income will grow significantly, I see at least 20-30% growth from current interest income levels. This is mainly based on interest income levels of STT previously when the interest rates were 1.5-2.5%. In the short term, this interest income growth can balance declining asset management fees for STT.

Financials & Earnings

Q4 results

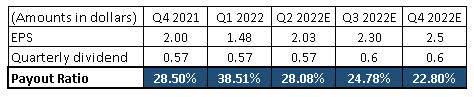

For the fourth quarter, STT beat its estimated EPS by $0.11 and reported a $2.00 EPS. The servicing fees declined compared to Q3 but grew on a year-on-year basis by 6%. The total fee revenue grew by 0.3% for Q4 and 3.9% on a year-on-year basis. The company could grow both its AUM and AUC/A. The other segment (interest income) was under pressure due to the low-interest-rate environment but this trend is changing so 2022 will very likely bring more interest income for STT. The company will announce its first-quarter earnings results on April 14th before the market open. Analysts estimate an EPS of $1.48.

“Despite record low-interest rates and excluding notable items, we delivered meaningful full-year pre-tax margin expansion, positive fee, and total operating leverage and EPS growth in 2021, and we expect to do this again in 2022,” said Ronald O’Hanley – Chairman and CEO. The company could also save $330 million in expenses. If this strong fee growth continues combined with a higher interest rate environment STT is set for a great year in 2022. However, with overall ETF fees and other banking fees getting lower and lower I am not convinced they can maintain these record numbers over the long term (more on this later).

Valuation

The company outperformed its previous EPS estimates 85% of the time in the last 10 years and only underperformed 15% of the time which is surprisingly great compared to its peers. T. Rowe Price Group, Inc. (TROW) outperformed the estimated EPS 75% of the time, Ameriprise Financial, Inc. (AMP) outperformed the estimated EPS 82.5% of the time and Northern Trust Corporation (NTRS) outperformed the estimated EPS only 62.5% of the time in the last 10 years. When STT reported a worse than expected EPS the stock price dropped by an average of 5.3% and the largest drop was 8.53%.

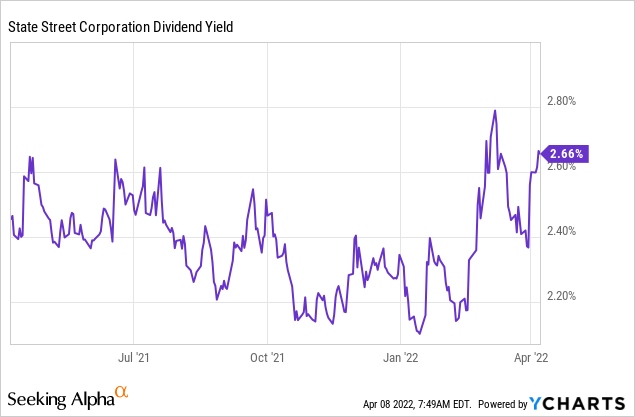

STT has a forward Non-GAAP P/E ratio of 10.16 slightly lower than the sector median of 10.94 and 13% lower than STT’s 5-year average. The difference between STT and its peers’ P/E ratios is minimal, I would not consider this metric a huge valuation gap among these companies. Based on its dividend yield STT traded above 2.6% 11% of the time in the last 12 months so this figure suggests that the current price can be a good buy opportunity for income investors.

In my opinion, based on STT’s current dividend yield it is a buying opportunity but income investors can find better targets with better yields in the same sector. In addition, based on its other valuation metrics such as expense ratio, P/E ratio, and revenue growth, STT is fairly valued at the current price and investors can find better targets for longer-term investments such as AMP or Ares Management Corporation (ARES).

Company-specific Risks

On September 7, 2021, STT announced that they will acquire BBH Investor Services for $3.5 billion in cash. The transaction is subject to the receipt of regulatory approvals and the satisfaction or waiver of other closing conditions. Even after the close of the acquisition, retaining the business and revenue from BBH Investor Services business’ current clients will be hard, many of which have the right to consent to transfer their business to State Street or to transition their business to another provider on short notice. According to most studies, between 70 and 90 percent of acquisitions fail. Most explanations for this depressing number emphasize problems with integrating the two parties involved.

Since the early 2000’s STT has been falling behind its competitors in the asset management segment and the ETF provider segment. Their S&P 500 ETF is more expensive than its competitors. While Vanguard’s S&P 500 ETF and BlackRock’s S&P 500 ETF have an expense ratio of 0.07% per year, STT’s SPDR S&P 500 ETF has an expense ratio of 0.09%. Would you buy the same product with the same features for 30% more? I certainly wouldn’t. In addition, passive investment vehicles are on the rise and passive investments have much less fees than actively managed ones. This will further increase the long-term fee pressure on investment banks such as STT.

My Take on STT’s Dividend

Current dividend

STT is yielding at 2.76% at the moment. We can say it is a fair yield among its peers because some of them are yielding a bit lower such as AMP or NTRS while some of them are a bit higher such as BK or TROW. The highest yield among its peers is TROW’s 3.23%. State Street has been paying a consecutive dividend for an impressive 24 years and has been raising the dividend for 12 consecutive years. The last raise was in mid-July 2021 when the management announced a 9.6% increase from $0.52 to $0.75 per share quarterly.

Future sustainability

Due to STT’s 24-year consecutive dividend payment, we can safely say that the management has a dividend-friendly policy in place. STT’s payout ratio is in the low twenties which leaves plenty of room for future dividend increases. The company usually announces its increase in the third quarter and I expect the management to do so this year as well. According to analysts STT will increase its dividend by approximately 5% from the current $0.57 to $0.60 per share quarterly.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final Thoughts

There is no question in my mind that STT is a stable and secure company with a decent 2.76% dividend yield. Investors in STT should expect slow movements and regular dividend payments, nothing more and nothing less.2022 can be a great year for STT due to the increase in interest income. STT is in the too big to fail category but it is lagging behind its peers for years and I cannot see this trend changing shortly.

Be the first to comment