Scott Olson

Investment Thesis

Stanley Black & Decker (NYSE:SWK) is a tough turnaround story. The company has fallen on some hard times, reporting a $2.5 billion free cash flow loss YTD. Its third quarter results were accompanied by yet another guidance cut.

Stanley Black & Decker’s stock has dropped 36% since its disastrous second quarter results. Even with reinvested dividends, the stock has had zero returns since its 2013 highs. During the same time, the S&P 500 has returned an impressive 170%.

Management has made progress on their turnaround plans since I last covered the company. But inventory levels are still very high. The company’s debt burden is double its leverage target. This may be a passable income investment. Other than that, I don’t see a compelling reason to buy or hold this right now.

Third Quarter Update

Stanley Black & Decker’s third quarter results were decent. The company beat expectations on its top and bottom lines. Its non-GAAP EPS was $0.76, ahead of management’s $0.72 guidance. The business also completed its headcount reduction. This was a major part of its cost savings plan.

The company made significant changes to its portfolio in the last year. The business acquired MTD Holdings and Excel Industries in early December. It also completed the divestiture of its security business in the last quarter. This means that its current results aren’t directly comparable to last year. Fortunately, management released organic growth metrics. These metrics remove revenues related to acquisitions and divestitures. This should give us some insight into core trends within the business.

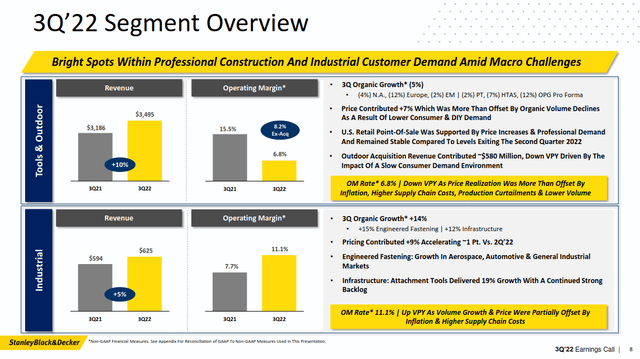

Stanley Black & Decker Q3 2022 Earnings Deck

Stanley Black & Decker’s largest risk is its Tools and Outdoor segment. The cohort accounts for 85% of the company’s revenues. The segment reported organic revenue declines of 5%, including a 12% slump in European sales. The main cause of these headwinds is a significant drop in demand and unit volume. Volume fell by 12% in the quarter. This more than offset the company’s attempts to increase prices. DIY and consumer demand were the hardest hit. The bright spot appears to be professional demand, which continues to stay strong for now.

But the worst part of Stanley Black & Decker’s results was its free cash flow. The business lost $540 million on its core operations in the quarter. This brings its YTD free cash flow loss to over $2.5 billion. It appears that this has started to turn around. Management said that free cash flow finally turned positive in September. They expect this to continue in the fourth quarter.

I’m not surprised by these results. It’s what you’d expect given the tough environment. But earnings are likely to continue falling.

Another Big Guidance Cut

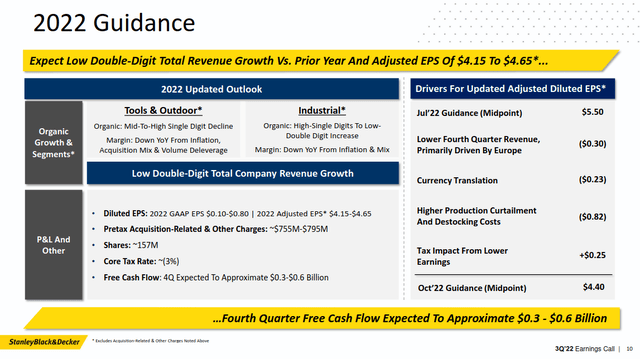

What accompanied these results was another round of major guidance cuts. Stanley Black & Decker had previously projected some profitability for the fourth quarter. Management guided for an implied fourth quarter EPS of about 92 cents. Now, the business expects to lose money in the fourth quarter, with an implied 27 cent loss. This is a concerning shift in expectations.

Stanley Black & Decker Q3 2022 Earnings Deck

The business attributes these costs to a number of factors. These include further revenue declines, centered in Europe. Management also plans to make aggressive production cuts. These cuts will stop their bloated inventory from spiraling further out of control.

Management expects to generate a midpoint of $450 million in free cash flow in the fourth quarter. This is off by almost $800 million from their previous implied guidance. This major cut reflects the business’s difficulty generating cash from its operations.

Overall, the company’s full year EPS guidance was slashed to just $4.40, down 64% from the start of the year. This guidance is substandard. But it reflects the major changes management is making to improve the business. Some short term pain is necessary to keep the company stable in the long term.

What’s The Outlook?

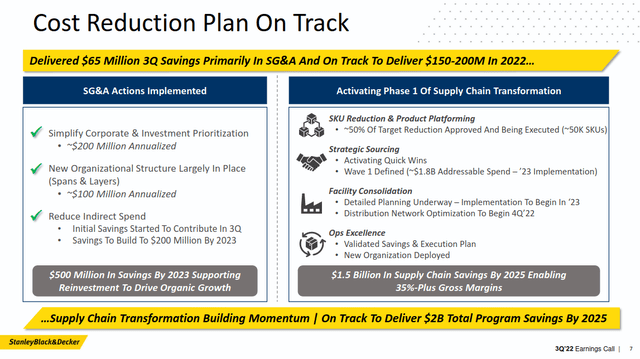

The most important part of Stanley Black & Decker’s results is its turnaround progress. The business has cut its operating expenses by 13% since the first quarter. These are projected to drive $500 million in savings by 2023. As I’ve said before, I’m confused as to why these costs hadn’t already been cut. Stanley Black & Decker has already been restructuring for well over a decade at this point.

Stanley Black & Decker Q3 2022 Earnings Deck

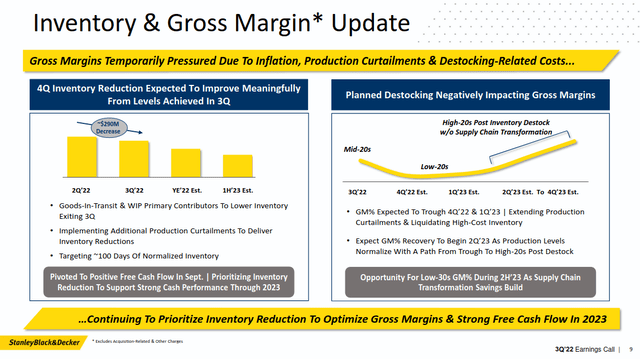

But my core concern is the company’s execution. I don’t think the business is well positioned for the current environment. Consumer spending is under pressure, and the housing market is cooling. This removes a major source of demand at a point when the company’s inventory is near all time highs. Reducing this bloated inventory is the next major step in the turnaround.

Stanley Black & Decker Q3 2022 Earnings Deck

Management is prioritizing cash generation, even if it requires aggressive inventory cuts. These liquidations will put extreme pressure on their gross margins. Management discussed these dynamics on their earnings call.

We believe there’s $1.5 billion of inventory that still needs to be liquidated. You could look at history and even say that number might be as high as $2 billion. So it’s somewhere in that range of $1.5 billion to $2 billion. We are going to aggressively pursue that. There will be some pain to our margins in the short term as we go through this transition, and the pain might be even a little more challenging if we see further top line deterioration in 2023.

Management realizes that they need to make major cuts to inventory. At the same time, they’re cutting production to prevent more products from piling up. The company started action on about 50,000 SKUs.

But there are still some risks to this plan. The company has $6.3 billion in inventory on hand. Yes, this is down by $290 million since the second quarter. But it’s still higher than at any point before the second quarter. In terms of days, the company has 188 days of inventory on its balance sheet. This has more than doubled from prepandemic levels.

What I’m worried about is the potential for “further top line deterioration in 2023.” In short, management is hoping that demand doesn’t drop off further. I’m worried that the environment may decline faster than the company can destock. If that happens, Stanley Black & Decker could take major losses.

I also don’t know if I trust management’s projections. It’s clear that management is still doing damage control after their horrendous second quarter. Their prior projections have been so wildly off that I’m taking a more cautious view. At the very least, I want to see more progress on their inventory reduction plans.

Are Shares Cheap Enough?

Stanley Black & Decker has seen its stock fall 54% YTD. But shares haven’t gotten much cheaper. At the beginning of the year, the company expected to earn $12.25 in EPS. This would give shares an apparent forward P/E of 13.3 times. Now, guidance has been cut to just $4.40 in EPS. Shares are trading at a forward P/E of 17 times. The company has an unimpressive ROIC of 4.8%. This indicates a poor track record of managing investors’ money.

I still have an issue with the company’s debt burden. Its balance sheet has over $8.3 billion in debt. This is a LTM debt to EBITDA of 4.2 times, well above its long term target of two times. Management says that repaying debt is their primary capital allocation priority.

This debt gives the business an enterprise value of about $19 billion. I don’t believe that this valuation is cheap. It’s difficult to tell where earnings will land. But the company has a five year prepandemic average free cash flow of $757 million. Adjusting for debt, this would give the company a free cash flow yield of only 4%. This valuation has room to fall if Stanley Black & Decker returns to its historical norms.

Notes On The Dividend

Stanley Black & Decker has gathered a lot of interest from dividend investors as its price has fallen. The company raised its dividend for 55 consecutive years. I understand that this seems like a solid dividend investment. But I still recommend caution.

The company’s dividend is likely safe. Its payout costs the company about $120 million per quarter. This should be well covered if management meets their free cash flow targets. But I think it’s unlikely to increase much in the near future. Management has been clear that debt reduction is their primary capital allocation priority.

I will reiterate that I don’t put much weight on “dividend king” status. It’s nice that the company has paid out a dividend for over 50 years. But it doesn’t matter much if the company’s fundamentals are lacking. I’d rather buy a business with better fundamentals and growth prospects. I don’t care if it only has a dividend record of 15 or 20 years. Beyond a certain point, management’s commitment to their dividend is clear. After 20 or 30 years, the number of payments becomes a type of vanity metric. I don’t think that it’s a useful fundamental indicator in this situation.

I don’t think that this alone makes Stanley Black & Decker a bad pick. But I believe that buying this stock is a bet on a successful turnaround. I wouldn’t recommend buying this for yield alone. We aren’t in a ZIRP environment anymore, and there are other alternatives for getting a yield of 4%.

Final Verdict

Stanley Black & Decker is a difficult turnaround story. This quarter was passable, but the guidance cut was not a good sign. I’d hoped that management threw all their bad news into their second quarter report. That doesn’t seem to be the case. I’m waiting for a quarter without more missed estimates or another guidance cut.

I think this is getting closer to a buy. But the company’s inventory position is still a concern. Shareholder returns might be low for some time. I’m waiting for more clarity on where the company’s results will land after restructuring. This stock might be fine for an income investor who is betting on a quick economic recovery. But right now, I’m not buying or holding any shares.

Be the first to comment