spooh

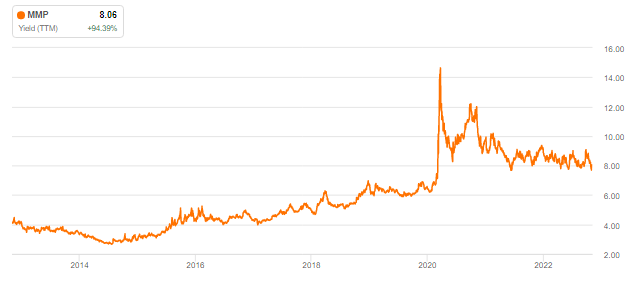

Magellan Midstream Partners (NYSE:MMP) has traded at a high yield for so long that it may be easy to overlook that it is one of the few stocks still trading near 52-week highs. The midstream pipeline company has engaged in an aggressive unit repurchase program – something very atypical for the industry – funded by sizable asset sales. While I expect unit repurchases to slow down considerably moving forward, management appears to have shown a commitment to limit growth capital expenditures over coming years. I find it unlikely for units to continue yielding over 8% if the company commits to generating free cash flow and buying back units. I continue to find MMP highly buyable here.

Heads up: MMP issues a K-1 tax form and may complicate your tax filing process – consider the tax ramifications before investing.

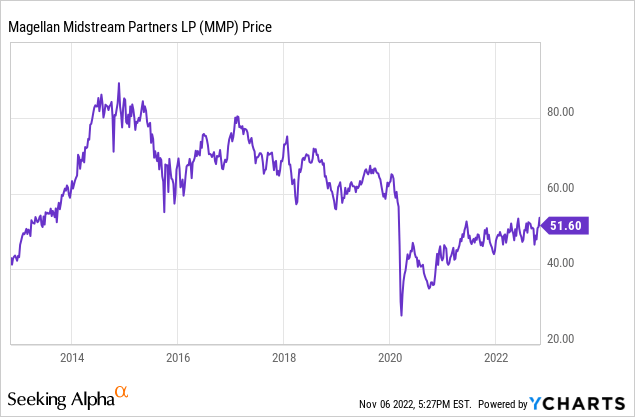

MMP Stock Price

While MMP remains much lower than 2015 highs, the stock is one of the stronger performers this year.

I last covered MMP in July where I explained why I flipped bullish on select midstream operators. MMP has risen slightly since then but arguably not enough.

MMP Stock Key Metrics

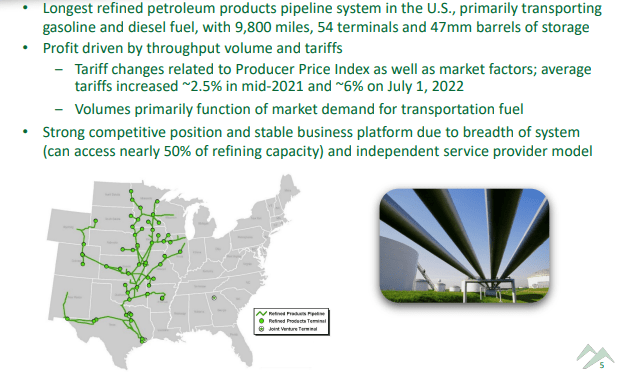

MMP is most well known for having the longest refined petroleum products pipeline system in the country.

August Presentation

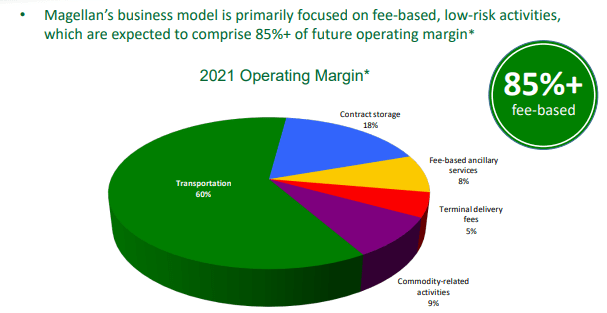

While MMP is technically in the energy sector, its profits are typically far more stable than traditional energy producers because as a “landlord” of pipelines, MMP earns 85% of its margin from fees.

August Presentation

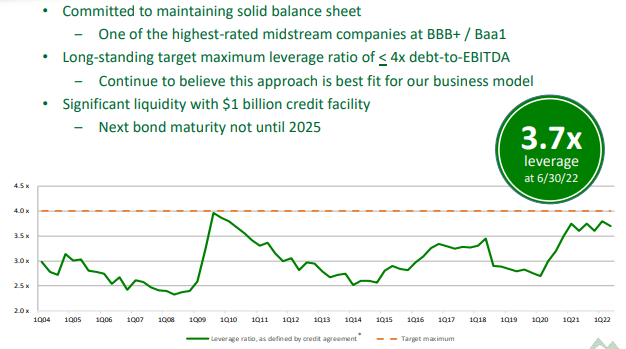

Within the midstream sector, I consider MMP to be one of the lower risk names. That may surprise some investors considering the low 1.25x DCF distribution coverage ratio – but in my opinion leverage and track record are the more important risk factors. MMP maintained a 3.7x debt to EBITDA ratio as of the latest quarter and has kept leverage below 4x for decades.

August Presentation

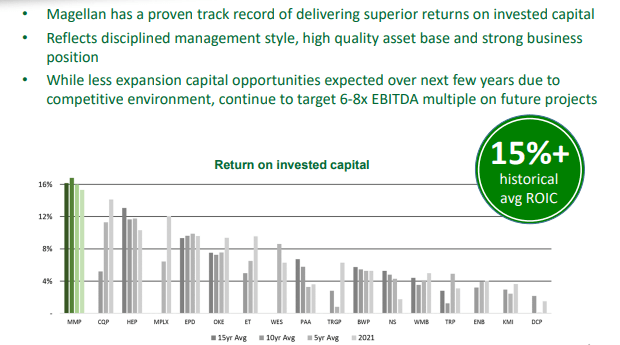

Regarding track record – MMP has the highest historic ROIC, meaning that it has delivered the strongest returns on its growth projects.

August Presentation

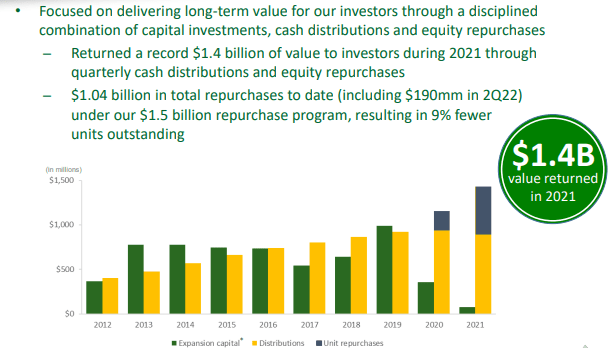

With that in mind, it may surprise some investors to see MMP prioritizing unit repurchases over growth projects this year.

August Presentation

MMP spent $138 million in buybacks in the quarter, bringing its YTD total to $377 million or 3.5% of units outstanding – and that’s after spending big in buybacks in 2021. These unit repurchases were made possible primarily due to a reduction in growth capital spending as well as asset sales. In spite of those asset sales, MMP still grew distributable cash flow (DCF) to $290 million from $277 million. Free cash flow was $273 million versus $252 million. I note that excluding asset sales, free cash flow after distributions YTD was $140 million versus $65.5 million in 2021.

Management also raised guidance on the conference call, now expecting $1.1 billion in DCF for the full year. Even after deducting the projected $90 million in growth capital this year, free cash flow would comfortably cover the approximately $858 million in full-year distributions – and that’s before accounting for any asset sales.

MMP did not give guidance yet for 2023 but did reiterate guidance for annual distribution coverage of at least 1.2 times for the foreseeable future.

Is MMP Stock A Buy, Sell, or Hold?

Even though MMP trades near 52-week highs, its distribution yield remains high compared to historic levels.

Seeking Alpha

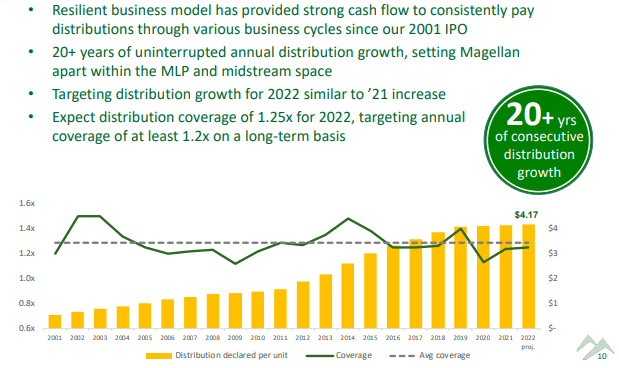

That may surprise some readers considering that MMP has grown its distribution for over 20 consecutive years.

August Presentation

Management has guided for annual growth capital spend to hover around $100 million annually moving forward, noting that it has already budgeted for $100 million in 2023, and $40 million in 2024. Management did hint that 2023 is likely to see growth capital spend higher than $100 million as they budget for additional projects.

I am pleased to see reduced growth capital ambitions, but note that their strong track record means that investors shouldn’t necessarily be concerned if management eventually reverts to old ways.

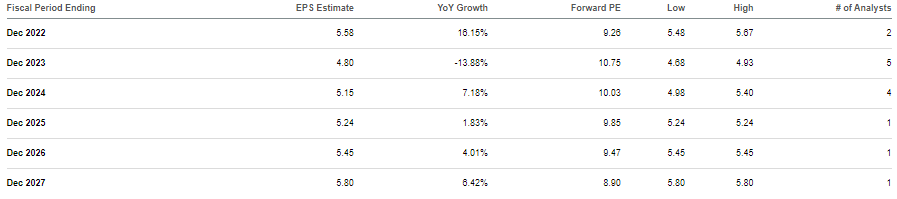

MMP remains a slow-growth company with consensus estimates calling for minimal earnings growth.

Seeking Alpha

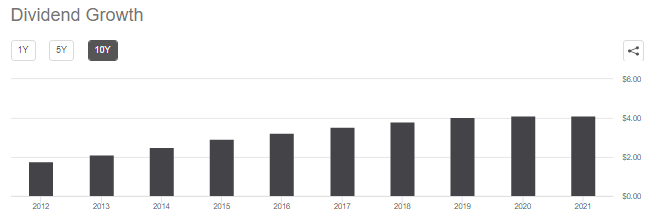

MMP has already significantly slowed down its distribution growth over the past several years.

Seeking Alpha

Those explain the context behind the high 8% yield – that valuation looks understandable considering the minimal forward growth. Yet this is a company which is trading at around 10.5x free cash flow (I have not included any benefit from asset sales). That valuation is too conservative considering the strong balance sheet and high unitholders payout. Over time I could see units re-valuing to a 6.5% yield, implying another 19% potential upside from multiple expansion alone. Throw in the 8% yield, 1-2% growth, and MMP should be able to deliver double-digit total returns for years to come.

What are key risks? I still have the nagging doubts that the current slow growth will eventually morph into negative growth, but that seems unlikely given the greater scrutiny on new pipeline projects and strong commodity pricing. I also suspect that the valuation may be artificially inflated due to some investors mistakenly thinking that aggressive buybacks are sustainable – I expect the pace of buybacks to slow as asset sales slow. Much of the buybacks have merely offset the dilution from asset sales.

I rate MMP as a buy as a lower risk name to consider in the midstream sector.

Be the first to comment