Maskot/DigitalVision via Getty Images

Investment Thesis

The Embracer Group (OTCPK:THQQF) develops and publishes PC, console, and mobile games. Through its 115 internal studios within ten operative groups, the company has a catalog of roughly 850 franchises, namely Saints Row, Dead Island, Darksiders, Metro, World War Z, and Borderlands. It also publishes and distributes films.

Embracer has been quietly acquiring small studios and developers as a means of growing. Management have been extremely successful at incorporating these businesses, and currently have a large pipeline of games under development. Most recently in February, they acquired Asmodee for c.€3bn.

I believe that the fundamentals of this business are extremely strong, with genuinely substantial cash flow growth ahead. This will allow the business to grow its bottom line further while also buying back shares. Currently, its stock seems markedly undervalued relative to the growth ahead and so presents an opportunity to generate alpha.

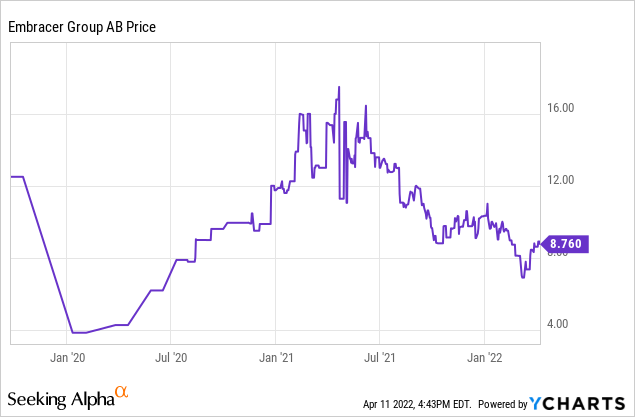

As such, I discuss why investors should capitalize on the recent fall in share price to acquire a great, growing business which the markets are yet to price correctly.

The Gaming Industry

According to Accenture, the gaming industry has now reached $300bn in size, with the number of gamers growing 23% in the last 3 years. Accenture are forecasting further growth of 15% in the next 2 years, due to greater importance given by society to gaming within culture and entertainment. Demand within the gaming industry is sticky, with gamers spending sixteen hours-a-week on average playing. A strong pipeline of games is paramount to absorbing this growth due to the competition present.

Surveying gamers, Accenture found demographics are slowly changing, with 60% of new gamers being women, compared to 61% of long time gamers being male. This will create new opportunities to sell to a new demographic, while also allowing the current offering to be marketed to more people.

The Gaming industry is going through extreme levels of consolidation, with the major players acquiring smaller competitors. We have seen SONY acquire Bungie, Take-Two (TTWO) acquire Zynga (ZNGA) and Microsoft (MSFT) in the process of acquiring Activision Blizzard (ATVI). The reason for this is clear, in order to take advantage of the growth we are seeing in the market, one must have the franchises that can entice consumers in.

Embracer’s large catalog and product pipeline will mean they are at the forefront of this growth, and the diversity in titles should maximize the potential customer base.

Macro Considerations

According to the BBC, the Chinese government has banned under-18s from playing online games for more than one hour a day. Accenture has found China to be one of the big 4 gaming markets and so the impact will likely be noticeable. This said, the impact has yet to be quantified given the recency of the news.

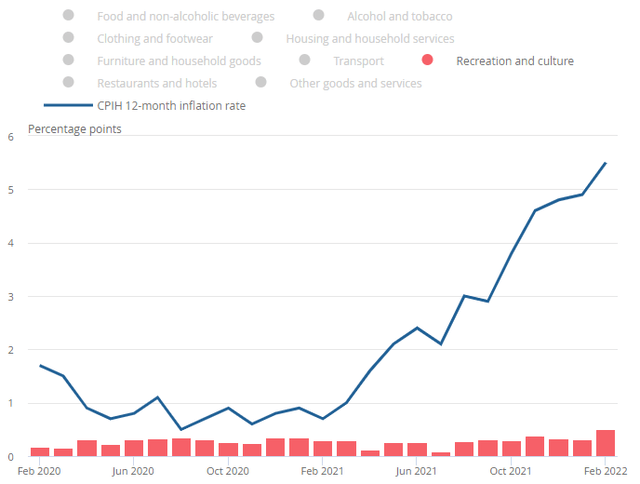

Furthermore, it would not be a stock analysis in 2022 without mentioning inflation. The Office of National Statistics within the UK has found that inflation within the gaming industry (labeled as recreation and culture below) has lagged behind inflation within the economy as a whole. This suggests that companies are finding it difficult to increase prices, likely given the level of competition in the market and uniformity in prices. Although the impact of this will not be known for several months, the ability to exploit high margin areas of the business will be key to offsetting this, for example through micro transactions.

CPI v. recreation and culture in the UK (ONS, UK)

Embracer has been investing heavily within the mobile gaming space where micro transactions are more prevalent, this will mean they can continue to sell add-ons once development of the games has ceased and thus benefit from the higher margins.

Embracer Is Quietly Doing Its Thing

Embracer has been quietly amassing quite the portfolio of brands. Among its AAA titles are Borderlands, Darksiders and Metro. These are incredibly popular tier two games, below the likes of Call of Duty etc, which are household names. Furthermore, Embracer is not done yet, they are targeting 25 AAA titles in the next 5 years and have 216 games under development. As a result of this, the pipeline is huge and diversified. This means there is no reliance on any one franchise to grow revenues.

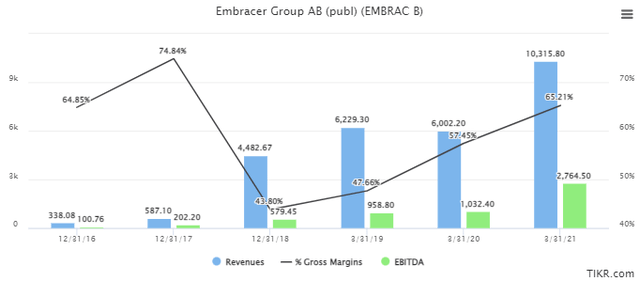

Embracer’s financial performance is incredibly good. They have been able to grow revenue at a CAGR of 98.3% over the past 5 years, this has been driven by the business’s acquisitive nature, having acquired over 100 studios. Management has a real talent for identifying and incorporating these studios within the group, while maintaining the independence that allowed them to create games that people want to play. Ken Rumph, an analyst at Jefferies, calls their unique strategy “anti-synergies” and “aggressively decentralized”.

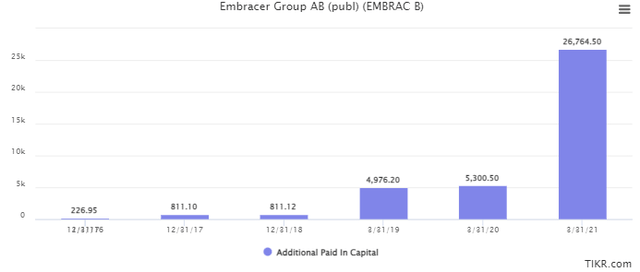

Embracer 5 year performance (Tikr Terminal)

As the table above shows, the business has been able to grow its EBITDA and gross margins through these acquisitions. This indicates that the acquisitions are directly creating shareholder wealth on the bottom line, as opposed to just revenue growth.

Additionally, another reason for the margin and EBITDA expansion is the nature of game development. The process requires in-house developer teams who are usually isolated from the operational side. This means Embracer can easily incorporate these acquisitions by leaving the developers untouched, while merging their operational departments such as marketing and HR. Thus, successfully integrating businesses is notably easier than in other industries.

Significantly, one would assume that the company must be heavily indebted in order to grow as it has, but the business actually has a SEK -13bn net debt position. Therefore, there are no liquidity risks.

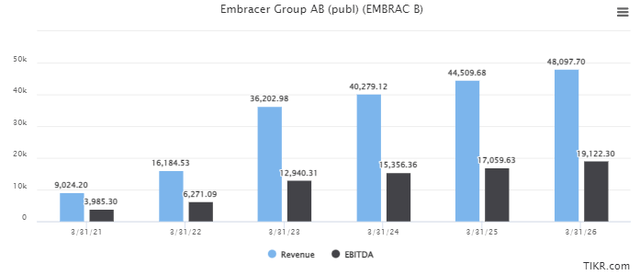

It is difficult to forecast Embracer’s future performance given the level of M&A conducted by the business, management have stated they are seeking further deals but must be at the correct price. Below we have the consensus analyst numbers:

Analyst consensus for revenue and EBITDA (Tikr Terminal)

What we see is continued strong growth at a CAGR of 31.3%, with EBITDA even more impressive at 32.1%. This will give the business a war chest to either continue to acquire studios or buy back shares. It already has c.17% of its market cap as cash ready to deploy and so we are not concerned about this growth needing to be driven by debt.

Overall, Embracer’s financials are incredibly impressive. They have been growing at triple digits, with analysts forecasting strong double digits which they should have no concerns achieving based on their current studios alone. Importantly, this is not debt driven and the transactions are of the highest quality producing incremental improvements in cash flows and margins.

Elephant In The Room

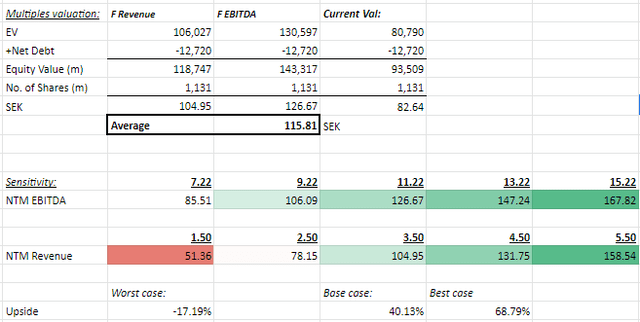

So what is wrong with this investment when everything sounds so amazing? share count dilution. The reason Embracer has been able to grow as it has without debt is because it finances its acquisitions through issuing shares. Warning, the following graph may be shocking to some:

Shares issued in the last 5 years (Tikr Terminal)

The reason for this is to align interests between the target business and The Group, the target’s management are offered shares in Embracer as consideration. This will mean developers, who are the real ‘assets’ within the company, remain and stay motivated. This will incentivize innovation, and from what we have seen so far, it has succeeded.

Although this has a negative impact on the share price, Embracer’s free cash flow is growing, and growing quickly. As a result of this, soon they will be able to finance more through cash and also support investors through buybacks. This does however mean investors must be patient, a deal can be struck at any time and within days a significant dilution could occur.

Who Are The Competition?

All studios within the gaming industry are vying for consumer time, no two games are the same but all have the potential to become the next big thing.

There are three market leaders within the industry, when we consider sales in 2021: ATVI, Nintendo (NTDOY) and EA. The two things they all have is a marquee franchise (or multiple) and a general focus on mainstream games. The biggest criticism of Embracer is that they do not have the first.

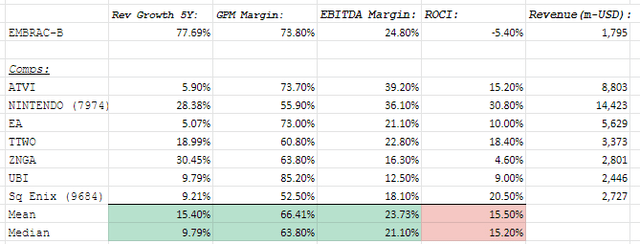

Comparable companies (Tikr Terminal)

Although Embracer may be on the back foot franchise wise, its KPIs are strong. We note far superior revenue growth, and better margins on the top and bottom line. The reason for this is a difference in strategy. For example, ATVI’s business is driven by timeless games such as WoW, complemented by new flagship releases like Call of Duty. By contrast, Embracer’s games are more niche and so can command a premium and not require discounting, with their growth supplemented by acquisitions.

Which strategy is better? well both if done correctly. Embracer would do anything to have Call of Duty within its portfolio. However, so far their ability to identify talent and valuable franchises have meant they can be just as profitable (if not more) pursuing acquisitions.

Valuation

Embracer’s financials are materially driven by the acquisitions it makes and so a DCF model would not be appropriate. As a result, we have valued the business on a NTM EV/EBITDA model, as well as NTM EV/Revenue multiple. The reason for considering revenue also is because a takeover is not ruled out. A larger studio, such as Sony, would look to acquire the IP and top line revenue, knowing that they could implement the necessary efficiencies to improve margins.

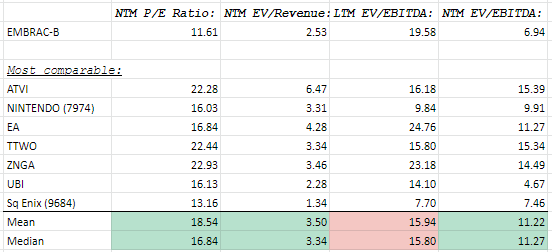

As we note below, Embracer is cheaper in every metric. The reason for this I believe is due to the market’s view on the dilution of shares and also the lack of marquee titles. This being said, we have established that Embracer are following a different strategy to the market and are actually outperforming in key metrics.

Trading comparables (Tikr Terminal)

Based on this valuation approach, we come to a share price of SEK 126.67 and 104.95. This suggests a base case upside of 40.13%.

Valuation calculation (Author’s own calculation)

Our sensitivity analysis suggests even at a discount of 2x/1x to the market comparatives, alpha can still be achieved. Importantly, were Embracer to acquire greater revenue and EBITDA during the year through transactions , they would become more greatly undervalued.

Therefore, I believe Embracer presents a fantastic proposition, partnering genuinely fantastic financials with a reasonable valuation. The icing on the cake is the downside risk being reduced.

Investment Risks/Impediments

Dilution will likely continue in the near term, although not to the extent of recent transactions. Enterprising investors should consider the impact of this and their own investing timeline. This said, over the long term, I firmly believe the cash flow generation should reward investors.

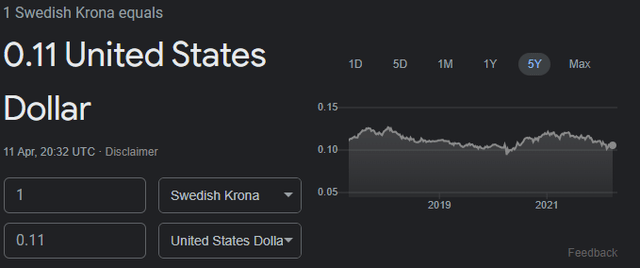

The company is based in Sweden and reports its figures in Swedish Krona. Hence, there could be FX risks for international (e.g., U.S.) investors. However, the SEK/USD rate has been mostly stable over the past few years, hardly ever deviating by more than 10% during a 1-year period, while over the past five years, it has in aggregate changed by just over 1%.

SEK:USD 5Y chart (Google Finance)

Closing Thoughts

The Embracer Group is one of the most fascinating businesses I have ever researched. It is growing at an astronomical rate as a result of almost flawless M&A activity, and is doing so going against all post-M&A ‘rules’. Unlike most businesses however, it is actually translating growth into EBITDA and FCF. This said, nothing comes for free in the market and so the impact of dilution will likely restrain the share price from soaring. At the current share price however, we are confident in rating this a strong Buy.

Be the first to comment