André Muller/iStock Editorial via Getty Images

Published on the Value Lab 12/6/22

Rubis (OTCPK:RBSFY) is totally unfazed by the situations in the commodity market. The worst impacts in the form of price caps have barely moved the needle, and the resumption in mobility is a boon to the company as a recovery play. With resilience in an economic reversal, especially with the last years being such depressed comps, the company is rock-solid as an all-weather addition to the portfolio. There are reinvestment opportunities into the terminal business, and the SARA segment continues to be an opportune exposure in the current market.

A Look At Results

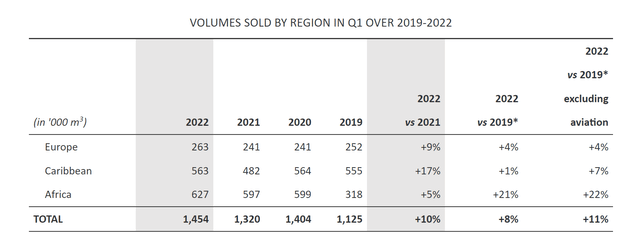

The company is experiencing broad volume growth. Relying on unit margins for profit, those have declined only slightly by 3% due to price caps, primarily in Madagascar. However, throughput from the aviation recovery is doing wonders for the company, and bitumen is holding strong despite the infrastructure reversal.

Highlights (Q1 2022 Trading Update)

Tourism exposed areas like the Caribbean have seen the strongest recovery due to depressed comps, but mobility in Africa as well, where lockdowns were quite severe these last couple of years to limit the strain on an undeveloped healthcare system, has meant a decent recovery there as well. Europe also benefits from the return to mobility.

These volumes primarily concern the retail segment, but there have been developments in the terminal business as well. Rubis operates key terminals in Rotterdam, and their capacity is expanding now for biofuels in order to offtake production from Shell (SHEL) which is beginning to produce them at their Pernis refinery. This is slightly at the expense of storage space now, where utilisation levels are at 100%, but it represents an attractive reinvestment opportunity and the only way to service this new contract. In addition to refinishing their current terminals, Rubis is also increasing capacity in both Antwerp and Rotterdam. These infrastructure assets continue to grow in value. Despite the lessened capacity for the time being, revenues have come in with a 1.4% growth with the promise of not only growth in the future but good visibility on that growth thanks to the Shell contract.

SARA revenues connected to logistics and shipping operations, as well as trading, are up 48%, with the refinery operations at almost full capacity and producing their stable, regulated margins from the French Antilles. As before, this segment should be expected to be the main driver of outperformance for the HY when we receive more comprehensive disclosure.

Final Remarks

Kenya was a point of concern for some analysts listening in on the trading update. The CEO of Rubis for Kenya was deported because they were under investigation for creating a bad price environment for Kenyans due to the way they were handling volumes and exports. Volumes grew however, as we saw when we looked into this in our last article, in stark contrast to accusations that they have limited supply. These investigations will likely result in nothing, and Rubis does not recognise any operational risk here as there hasn’t been wrongdoing, which can be corroborated even with the most public of figures from the company.

Gross profit grew this quarter by 7%, which spells good things for the EBITDA where the company operates almost entirely on fixed assets with littler commodity exposure and vertical integration in their logistics and shipping exposure. The multiple is now around 7.5x, which is low especially considering capacity expansions in Rubis’ terminals. This is a valuable asset-heavy company that deserves infrastructure valuation recognition. A 7.5x multiple does not represent that when terminal assets alone have traded for 10x and the retail business is relatively electrification resistant due to geography. We remain comfortably long.

If you thought our angle on this company was interesting, you may want to check out our service, The Value Lab. We focus on long-only value strategies, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our group of buy-side and sell-side experienced analysts will have lots to talk about. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment