4kodiak/iStock Unreleased via Getty Images

After Amazon (NASDAQ:AMZN) announced its proposed stock split, we wrote this article on Seeking Alpha arguing that while splits don’t matter much fundamentally, it allows retail investors to use relatively safe Options strategies. And true to our words and recommendations, we sold a put on Amazon as shown and described below.

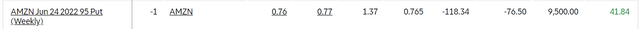

Author’s Account (Author’s Account)

Key data points

- Strike Price: $95

- Expiration Date: June 24th, 2022

- Premium: $1.19/share, for a total of $119. The image above shows $118.34 as that is factoring the transaction cost as well.

In simple words, we are collecting $119 to buy 100 shares of Amazon at $95 if the stock reaches $95 or below by June 24th, 2022. The positive value shown in green in the image above [41.84] is because the same chain is now only valued at 77 cents per share as Amazon’s stock has increased since we sold this put, which puts our strike price farther from the current share price. Not to mention, time decay is in favor of the option seller.

What’s the expected return and possible outcomes?

Return: The premium collected ($119) for setting aside $9,500 represents a return of 1.25% for a little more than week. Most will take that in the current market! Repeating this exercise many times over the year can net a handy profit.

Outcome #1: If Amazon stays above $95 by the expiration date, we retain just the premium above. We will not be obligated to buy the shares.

Outcome #2: If Amazon goes below $95 by the expiration date, we will be forced to buy 100 shares at $95, irrespective of where the stock trades at that time. Keeping the premium netted in mind, the average cost in this case will be $93.81 ($95 minus $1.19).

Outcome #3: As an option seller, one can “buy to close” anytime instead of waiting till the expiration date. Using our screenshot above, if we were to choose this option, we’d walk away with $41.84 instead of $119 but for a much shorter duration. That may be appealing to those who have the time and patience to play short-dated options many times over. But we typically let the option expire before choosing another chain (or another stock).

Why we don’t mind owning Amazon at $95?

- At $95, Amazon will be trading at its pre-pandemic level as shown in the chart above. Sure, some companies did go overboard with hiring during the pandemic boom but in Amazon’s case, that is more pronounced at its retail side. Sure, some of the excesses are gone forever but it is ridiculous to assume the gains and progress made on AWS is worth nothing after 2+ years.

- Speaking of AWS, at current price and below, investors are basically getting Amazon’s retail business for free as detailed here by SA contributor Michael Dolen. AWS and its growth prospects suggest that in a couple of short years, investors will be getting the retail business for free if they buy here.

Be aware of your risks and choices

Bear in mind that selling puts for higher premiums only is a risky business. Liking the underlying stock and being comfortable to own it at the strike price is important because sooner or later, you will get assigned (meaning the stock price goes below the strike price) if you repeat this exercise enough.

Market conditions like the present are not ideal for selling puts as stocks seem to be selling off with no end in sight. However, this is a great market to be selling covered calls for additional income/cushion. So, let’s assume that we get assigned here, meaning we buy 100 shares of Amazon at $95 and the market remains choppy with general downtrend. It’d be an ideal set up to sell covered calls where you choose an expiration date and a selling price of your liking and you get paid for doing so. Covered calls have almost no downside except giving up potential future gains. We will write again about it in detail should we sell one in the near future.

Conclusion

We prefer owning stocks outright for our core portfolio. As surprising (or stupid) as it sounds, Amazon was never a core holding although we’ve made many profitable transactions over the years. However, selling puts with additional cash can be profitable while giving one the liquidity needed to cash in on bargains. Hence, we welcome stock splits and are eagerly looking forward to Google’s (GOOG) (GOOGL) and Tesla’s (TSLA) upcoming splits to be able to use relatively safe options strategies on those big names as well.

Be the first to comment