wdstock

Before the market opens on July 21st of this year, the management team at telecommunications conglomerate AT&T (NYSE:T) is due to report financial performance covering the second quarter of the company’s 2022 fiscal year. This marks a significant time for the enterprise considering that this will be the first quarter in which the company’s financial results don’t reflect the results of WarnerMedia, an enterprise that was ultimately merged into Discovery to create Warner Bros. Discovery (WBD). Instead, for the short time during the quarter that Warner Media was still part of AT&T, its operations will be factored into the discontinued operations category of the company’s financial results. Regardless, this will give shareholders the opportunity to see the telecommunications giant add to the standalone business that it has ultimately become. Leading up to that, there are some things that investors should pay attention to. These are specific details about the company that will go a long way to determining whether the business still makes for an attractive investment prospect or not.

AT&T Q2 earnings – Keep an eye out on key growth areas

Even prior to AT&T’s official divestiture of WarnerMedia, I maintained that the real opportunity for investors was not in the entertainment side of the conglomerate but in the telecommunications aspect that would remain after the deal was completed. So far, this call has played out well. While shares of Warner Bros. Discovery are down double digits, shares of AT&T have generated a return for investors, inclusive of dividends, of 7.9%. To make matters more impressive, that comes at a time when the S&P 500 is down by 14.9%. But this does not mean that things will remain easy moving forward. The fact of the matter is that there is going to be a lot of pressure on the company to perform in some key areas. One of these, undoubtedly, is the fiber unit the company has.

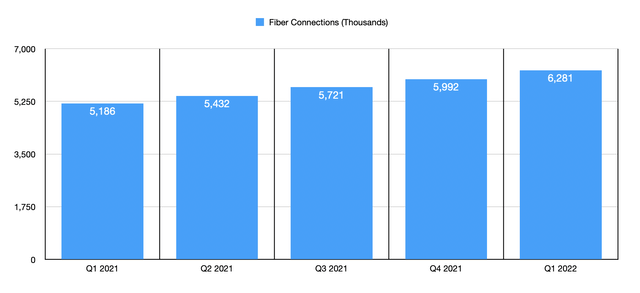

Author – SEC EDGAR Data

At present, AT&T is a leading player in the fiber broadband space. The company’s goal is currently to hit 30 million locations by the end of its 2025 fiscal year. This represents more than a doubling compared to what the company had in 2021. Of course, we can rely on management getting crafty with how to expand. One recent deal involved a public-private partnership to install fiber in Boonville, Indiana in what is ultimately a $4.4 million contract that will reach roughly 4,000 connections. This followed an even larger $39.6 million contract covering Vanderburgh County in Indiana whereby that county will contribute $9.9 million of the funding for the enterprise over the next two years. But of course, there’s a difference between locations and actual connections. At the end of the latest quarter, the company had 6.28 million connections established. The company has been adding between 246,000 and 289,000 connections to its network every quarter. If we assume this increases modestly to 300,000, the company would add just 4.5 million by the end of 2025, taking the ultimate connection count to 10.78 million by that time. This all comes at a time when the company is also expanding its C-band spectrum, with a forecast of between 70 million and 75 million people covered by the end of this year and for this figure to grow to around 200 million by the end of 2023.

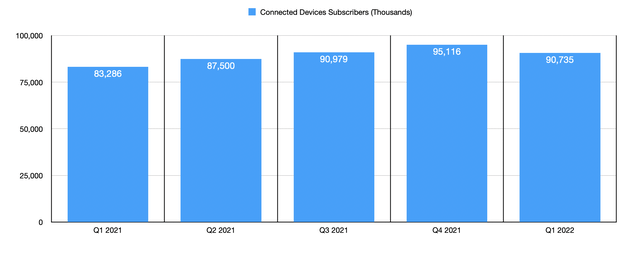

Another growth area for the company that is often overlooked involves its Connected Devices. For those who aren’t familiar with this aspect of the company, I would like to draw your attention to a prior article that I wrote about it. In short, it’s a way for the company to generate additional revenue while targeting the IoT space. In recent quarters, this aspect of the company has been a tremendous growth area for shareholders. From the first quarter of the company’s 2021 fiscal year to the first quarter of its 2022 fiscal year, the number of Connected Devices the company registered increased by 8.9% from 83.29 million to 90.74 million. And that comes even after 8.8 million were lost in the second quarter of the year as a result of the company ending its support for 3G devices. In all likelihood, this aspect of the company will continue to grow at a nice rate for the foreseeable future.

Author – SEC EDGAR Data

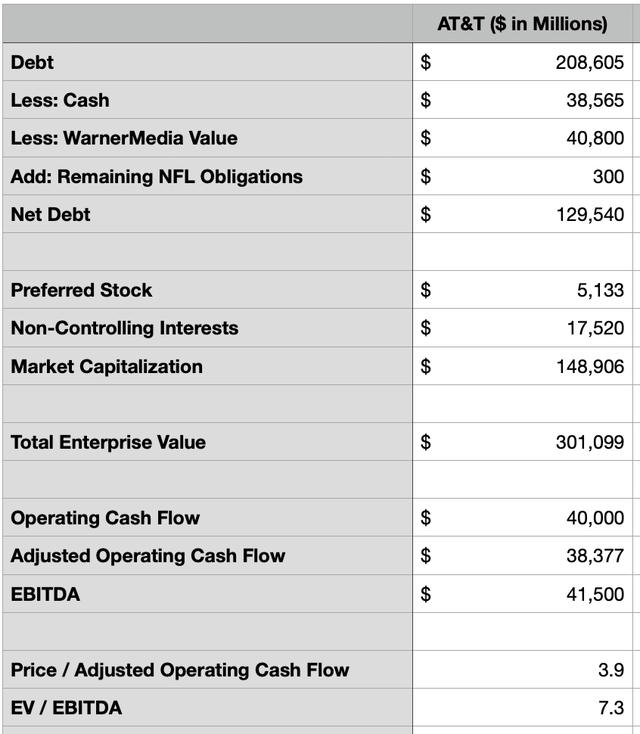

Debt is important

There were multiple reasons for AT&T to rid itself of WarnerMedia. One of the biggest what is so that management could pay down debt. As part of the deal, the telecommunications company received $40.4 billion in consideration, with $38.8 billion in the form of cash and $1.6 billion in the form of debt assumption by Warner Bros. Discovery. As I have detailed in prior articles, this could have a significant positive impact on the company’s leverage situation. Without factoring in the prospect of excess cash flow in the latest quarter, I estimated that this maneuver could bring the company’s effective net debt down from $170.04 billion to $129.64 billion.

Already, management has been working on reducing debt to some degree. On March 31st of this year, for instance, the company announced the redemption of $1.96 billion of debt with a 3% annual interest rate on it. This was ultimately completed on April 30th. On April 11th, the company paid down $750 million worth of debt. It also paid $9.04 billion toward global notes outstanding that had interest rates ranging from 2.625% to 4.45%. On April 13th, the company decided to pay down $7.35 billion associated with a term loan and $2 billion associated with another loan. And in May of this year, it announced a tender offer covering 63 different series of senior notes with a combined maximum redemption of $8.7 billion. Not only does this significantly reduce risk for shareholders, it also will lower annual interest expenses considerably. Even at a weighted average interest rate of 3%, paying down debt by $40.4 billion would reduce cash outlays by the company, on a pre-tax basis, in the amount of $1.2 billion annually.

AT&T shares still have tremendous upside

I tend to run a very concentrated portfolio, with only between five and 10 holdings at a time in it. At this point in time, my portfolio consists of six different companies, with AT&T being the 5th largest at 15.6% of my investments. Naturally, I am incredibly bullish about the company’s prospects moving forward. And if management can succeed in posting strong results for this quarterly release, I think that argument will be solidified. But of course, it helps to put things in context. Using the same valuation approach that I used in a prior article but updating for current market values, I calculated that the company is trading at a price to adjusted operating cash flow multiple of 3.9 and at an EV to EBITDA multiple of 7.3.

Author – SEC EDGAR Data

This assessment is based on adjusted operating cash flow of $38.4 billion and EBITDA of 41.5 billion, both on a forward basis for the current fiscal year. By comparison, competitor Verizon Communications (VZ) is trading at a forward price to operating cash flow multiple of 5.8 and at a forward EV to EBITDA multiple of 8.7. Even if we assume that AT&T should trade at the same level as Verizon, this would imply upside, using these multiples, of between 40.3% and 49.5%. And that excludes any distributions that shareholders receive in the meantime. At the current payout, this works out to an additional 5.4% annually moving forward.

Takeaway

At this point in time, I believe that AT&T offers investors tremendous upside potential. The company is extremely healthy at this point in time and, absent any major unforeseen events, I suspect that the future for the business will be rather bright. Of course, that picture could change at any point in time. And because of that, investors would be wise to keep an eye out on certain key metrics. The metrics I covered in this article are, in my opinion, some of the most important. Even if management can come awfully close to hitting these, I think upside potential is on the table.

Be the first to comment