bloodua/iStock via Getty Images

When it comes to the world of REITs, there are many different flavors that investors can choose from. One particular niche that I find interesting involves those companies that have a large ownership stake in government properties. And one of the few players in this space is Easterly Government Properties (NYSE:DEA). Fundamentally speaking, performance achieved by the company has been rather sound. And despite having a share price that trades at the high end relative to similar firms, and that is not exactly undervalued, the company has still outperformed the broader market over the past several months. Moving forward, I suspect this trend will continue, with the company’s base of government clients serving as a strong foundation for consistent and steadily improving cash flows. Because of this, I have decided to retain my ‘buy’ rating on the firm, indicating my belief that it will probably outperform the broader market in the near future as well.

Recent results have been encouraging

Back in October of last year, I wrote an article that looked favorably upon Easterly Government Properties. In that article, I acknowledged that the company had experienced some mixed financial performance in the prior months, but my overall conclusion was that those results were positive on the whole. Due to the fundamental condition of the company, I decided to rate it a ‘buy’ at the time. So far, that decision has not turned out exactly as I planned. But compared to the market, I consider the situation a modest win. While the S&P 500 is down by 13.2%, shares of Easterly Government Properties have dropped a more modest 7.4%.

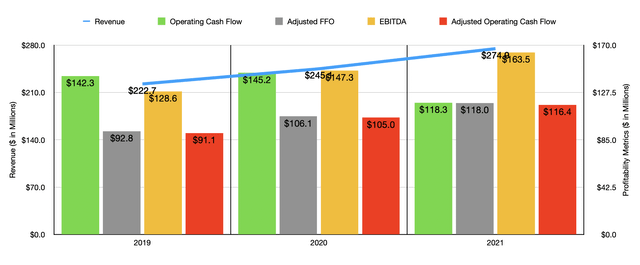

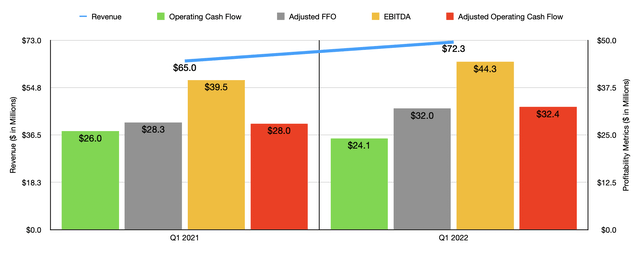

When it comes to evaluating just how things have gone for the enterprise, the first thing we should do is compare its performance for 2021 compared to how the company fared in 2020. In most respects, the firm did quite well. Consider revenue. During 2021, the company generated sales of $274.9 million. That’s 12.2% above the $245.1 million generated in the 2020 fiscal year and it compares to the $222.7 million reported one year before that. It seems as though the company has achieved this growth largely as a result of the acquisition of additional assets. That trend has continued into the current fiscal year, with revenue in the first quarter of 2022 totaling $72.3 million. That’s 11.2% above the $65 million generated for the first quarter of 2021. So far this year, management has acquired five different properties for a combined $164.1 million. Of this amount, $92.7 million was attributed to wholly-owned assets, while most of the rest related to joint venture activities. The remaining $10 million, meanwhile, was attributed to gross development-related investments.

When it comes to profitability, the picture is also been generally positive. Operating cash flow came in at $118.3 million for the 2021 fiscal year. That’s actually down from the $145.2 million achieved one year earlier. But if we adjust for changes in working capital, the metric would have risen from $105 million to $116.4 million. Adjusted FFO, or funds from operations, went from $106.1 million in 2020 to $118 million last year. Meanwhile, EBITDA went from $147.3 million to $163.5 million.

For the 2022 fiscal year, bottom line performance has been mixed but generally positive as well. For instance, operating cash flow did worsen year-over-year, declining from $26 million in the first quarter of 2021 to $24.1 million in the first quarter of this year. But if we adjust for changes in working capital, it would have risen from $28 million to $32.4 million. Meanwhile, adjusted FFO rose from $28.3 million to $32 million. And EBITDA increased from $39.5 million to $44.3 million.

Looking forward to the 2022 fiscal year as a whole, we do know that management has not provided any guidance when it came to sales. But they did say that they planned to make acquisitions in the amount of between $200 million and $250 million for the year. Because of this, it’s likely that revenue will expand. Management has provided guidance when it comes to FFO per share though, with that number forecasted to be between $1.34 and $1.36. At the midpoint, that would imply a reading of $122.6 million. No other guidance was given. But if we apply that same year-over-year growth rate to the other profitability metrics, we should anticipate adjusted operating cash flow of $120.9 million and EBITDA of roughly $169.9 million.

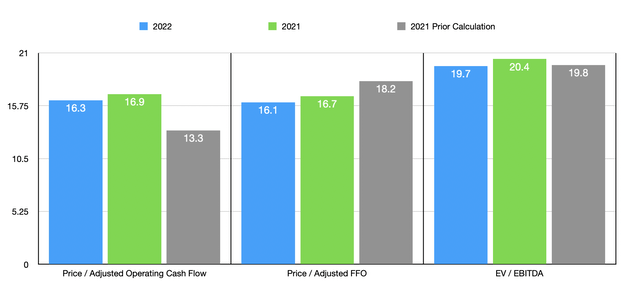

Taking these figures, valuing the company becomes pretty simple. On a forward basis, the firm is trading at a price to adjusted operating cash flow multiple of 16.3. This is down from the 16.9 reading that we get if we rely on 2021 results, but it’s above the 13.3 reading that I got in my prior article. The price to adjusted FFO multiple should be 16.1. That’s lower than the 16.7 reading we get using 2021 results. But it does compare favorably to the 18.8 reading I got in my prior article on the firm. And finally, we have the EV to EBITDA multiple, which comes in at 19.7. Using 2021 results, this figure would be 20.4. And as I mentioned in the prior article on the firm, it would come in at 19.8. As part of my analysis, I also decided to compare the company to five similar firms. On a price to operating cash flow basis, these companies range from a low of 7.5 to a high of 12.3. In this case, Easterly Government Properties was the most expensive of the group. When it comes to the EV to EBITDA approach, the range was from 2.4 to 21.7. And in this case, four of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Easterly Government Properties | 16.9 | 20.4 |

| Highwoods Properties (HIW) | 9.1 | 9.8 |

| Postal Realty Trust (PSTL) | 12.3 | 21.7 |

| Cousins Properties (CUZ) | 11.7 | 10.6 |

| Hudson Pacific Properties (HPP) | 7.5 | 14.7 |

| City Office REIT (CIO) | 8.1 | 2.4 |

Takeaway

At this point in time, Easterly Government Properties still strikes me as an interesting prospect. Admittedly, fundamentals have not been perfect. But management has done a pretty solid job, nonetheless. This year should mark another year of top line growth, and profitability improvements should cost the company to be slightly cheaper than it would be if we used 2021 results. Pricing is somewhat mixed relative to when I last wrote about the firm. But on the whole, the company doesn’t seem materially different in price from them. Factoring them the high-quality business model that investors are buying into, and I cannot help but to retain my ‘buy’ rating on it for now.

Be the first to comment