Joe Raedle

Spirit Airlines (NYSE:SAVE) is amidst an M&A bidding war between Frontier (ULCC) and JetBlue (JBLU) which have left shareholders unclear about the direction of the company. Frontier and Spirit announced a definitive merger agreement in February 2020 with JetBlue making an unsolicited offer afterwards which represented an overall higher valuation of SAVE.

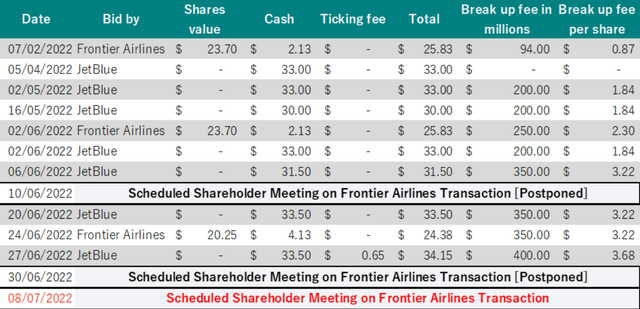

Both Frontier and JetBlue increased their original offers since and most recently in June. The latest Frontier offer of 1.9126 ULCC shares and $4.13 stands at a total value of $25.22 per SAVE share as of today. JetBlue’s all cash offer is at $33.50 per share. SAVE is at a current price of $24.03 which implies a spread of 4.95% and 39.41% respectively. Below is a table outlining the deal history from a recent SA article by Dhierin Bechai.

Despite the higher valuation represented by the JetBlue deal SAVE management has continued to support the Frontier merger not only in words but by continuing to move the shareholder meeting knowing that Frontier does not have the votes to pass the deal. Just today SAVE management indicated they are moving the shareholder meeting for the fourth time to July 27th instead of July 15th. It was originally scheduled for June 10th.

The ongoing delay is a distraction for management and the company overall. This new delay comes just days after Frontier CEO publicly asked SAVE management to delay the vote because they didn’t have enough support for the merger. Frontier also indicated they have no plans to raise their offer price any further.

Discovery Capital Management Letter

There’s a perverse dynamic at play which the recent letter from Discovery Capital Management to SAVE’s board highlighted. While the date of the shareholder meeting has been postponed for a total of 47 days at this point the record date in terms of being eligible to vote in this meeting remains May 6th. Given a review of trading volume since the May 6th record date Discovery Capital Management estimates that 55% of current SAVE shareholders are unable to vote upon the merger. This is on a transaction which has seen material changes since May 6th given both offers were increased in June. It’s worse than just current shareholders not being able to vote, it also means the May 6th record date owners of those 55% of shares still retain the right to vote despite not being owners in the company.

Spirit management has created a situation where the shareholder vote could be decided by a majority who do not actually own shares in the company anymore. With management continuing to support the Frontier merger despite the overall better implied return of JetBlue’s offer, I believe that the continued delay of the shareholder vote is a deceptive tactic as it creates a further disconnect of interest between shareholders of today and shareholders of May 6th. A simple way to resolve this would be to update the record date for the vote. In their letter, Discovery Capital Management suggested a change of the record date to June 30th which would allow owners who have bought since the updated offers came in the ability to vote.

This letter was made public before Spirit’s most recent announcement shifting the vote again. Given that the record date remains May 6th in this most recent announcement, it seems that management did not heed this recommendation. The vote record date and volume in the name has created a disconnect of economic rights for shareholders who have bought in since May 6th and perhaps represents the majority of owner interest at this point. This could be a significant point of contention and potential lever for litigation if the Frontier offer does move forward.

Where does that leave things?

While I do not know for sure the likelihood of the deal moving forward I note that despite ongoing efforts SAVE has not been able to get the votes to push a Frontier merger across the board. With Frontier’s most recent request to delay the shareholder vote they noted that, “We still remain very far from obtaining approval from Spirit stockholders based on the proxy data we received as of July 8, 2022.” As more attention has come to this bidding war it’s seemed as if the basic math involved has built momentum for JetBlue’s offer given it provides SAVE shareholders a more stable all-cash offer valuing the company at a higher price.

Spirit management has consistently maintained that the Frontier deal offers a more plausible path to regulatory approval. The implication is that the JetBlue offer, while higher, is too risky from a regulatory perspective and therefore not realizable. In reality, both will likely face intensive regulatory review given consolidation of the airline industry already. JetBlue management has made a sizable bet that they could navigate this regulatory process successfully with their $33.50 per share offer supported by an $3.68 per share break-up fee in case it doesn’t.

With the shareholder vote to agree on the Frontier merger moved yet again there remains uncertainty in the direction of Spirit. Seemingly due to there not being enough support of the merger the vote has been delayed four times while management works to make the case that a significantly lower Frontier offer is somehow more beneficial to shareholders, and they still haven’t succeeded. This suggests to me that there is continued support and likely growing momentum for the JetBlue offer. JetBlue has already responded to the recent vote postponement by stating that they are “now standing ready to enter into a binding merger agreement with Spirit as soon as practicable and at the latest, immediately following Spirit shareholders voting against the Frontier transaction on July 27, 2022.”

And there’s likely growing pressure added by the disconnect in voting record date and continuing postponement of the vote overall. It’s not tenable for Spirit to continue to push the date back while Frontier has made it clear they have no intention of increasing their offer. Additionally, the longer this goes the more disconnect is created between current shareholders and May 6th voters. At this point the only thing left to do is vote. Overall, I expect that the Frontier deal will be voted down as I don’t see anything changing the narrative in the coming two weeks. In the case of the deal being voted down we could see shares of Spirit jump closer to the JetBlue offer price of $33.50.

Asymmetric Risk from Vote’s Binary Outcome

I think there’s asymmetric risk involved here. The upcoming catalyst will be the July 27th vote which I’ve argued is unlikely to be moved again. In that vote there are two possible outcomes: either the merger with Frontier is approved or not. In the case that the merger is approved, the return stands currently at 4.95%. If the merger is not approved, it’s likely SAVE will immediately jump closer to the $33.50 per share value offered by JetBlue’s deal which would be a 39.41% return.

|

Scenario 1: Frontier Merger Approved |

Scenario 2: Frontier Merger Rejected |

|

|

Expected Reaction |

SAVE will stay near current levels or shift upwards towards Frontier’s offer value of $25.22. |

SAVE will move closer to JetBlue’s $33.50 per share offer price |

|

Price Target |

$25.22 (as of 7.13) |

$30.00 |

|

Implied Return |

4.95% |

24.84% |

|

Days In Position if Entered Today |

14 days |

14 days |

|

Implied annualized return |

129.05% |

647.61% |

One thing to note here is that the value of the Frontier merger changes daily depending on their stock price. Investors should monitor ULCC in order to best understand the value they are getting for their shares in terms of the deal. With Scenario 1 there is a risk of collapse in ULCC price which would adversely impact returns. For reference, a 10% decrease in ULCC’s price would adjust the value of their offer to $23.48 per share of Spirit. Looking at SAVE’s share price of $24.03 this would be a decrease in value of 2.3. Additionally, I’d note that it’s unlikely that SAVE will trade at $33.50 immediately so I have set my price target ~10% below its value to be conservative.

All in all, I think there is an asymmetric arbitrage opportunity represented in the Spirit bidding war which shareholders may benefit from with a direct catalyst in the coming vote scheduled for July 27th. Despite this being the fourth date set for the vote, I believe it’s unlikely the vote will be postponed again. The vote itself represents a binary outcome where I suspect on the one side there is minimal loss to capital and on the other side a potential for a 24.84% return in 14 days.

Be the first to comment