Just_Super

A lot of SPAC deals were disasters, but some companies were just irrationally thrown away due to the stock market not understanding the business. Ouster (NYSE:OUST) continues to build a large order book as the company moves closer and closer to scale Lidar sensor production. My investment thesis remains ultra Bullish on the stock with the company releasing new sensors and cutting costs to eliminate share dilution going forward.

Misunderstood Story

The stock has fallen below $1, as the market doesn’t appear to understand the opportunity ahead by pricing the stock for eventual death already. Ouster provided the following customer statistics for Q2’22:

- ~90 new customers in Q2

- 80 multi-year SCAs, up 8 from prior quarter

- 600+ customers across 50 countries

- $575 million in contracted revenue opportunity through 2026

When a company like Innoviz Technologies (INVZ) reported a $6+ billion order book, the market is going to yawn at the order book of Ouster. The market is wrong due to the order books not being comparable.

The Automotive companies have programs that last 5+ years where they lock in billions in Lidar sensor orders. Ouster has been focused on the industrial and robotic markets were customers tend to buy off the shelf or via shorter term SCAs of a couple of years.

A company might order 10x the product over the next 5 years, but the amounts aren’t always captured in the official order forecasts. After all, Ouster has over 600 customers now and less than 15% have signed strategic agreements with forecasts captured into the order book.

Ouster reported $10.3 million in revenue for Q2’22 with gross margins of 27%. The company guided to 2022 revenues of only $40 to $55 million with supply chain issues impacting supplies and more specifically demand. After reporting sales of $19 million in the 1H22, Ouster is forecasting revenues of anywhere from $21 to 36 million in the 2H22. Naturally, a number closer to the higher end, or at least where the company tops $15 million in quarterly revenues for Q4, alters the view on the stock.

Analysts still generally buy into the concept that more and more end products will hit production scale in 2023 driving sales up to material levels at $111 million next year. A lot of investors likely see the sector not developing beyond the current infancy levels with revenues only slowly marching up.

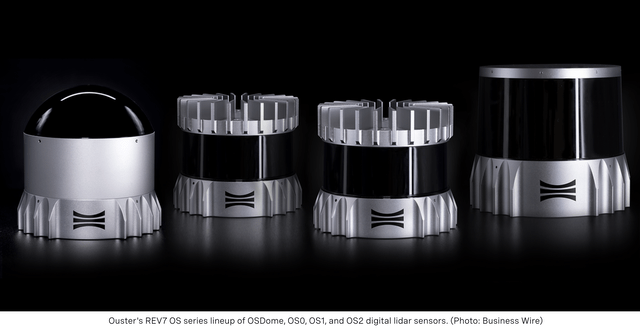

The company released the L3 chip on October 19 with several new REV7 sensors. The new Lidar sensors deliver double the range, enhanced object detection along with increased precision and accuracy, typical of digital chips.

Surviving To Thrive

Ouster made a very important move following the Q2’22 earnings report. The company cut the Q2 expense run rate by 15% via cost controls and a 10% headcount reduction.

The digital Lidar sensor specialist didn’t eliminate any development plans in the process, but the company did suspend the ATM stock purchase plan. Ouster sold $15 million worth of shares in Q2 to bolster the cash balance to $160 million at the end of June.

Ouster spent ~$36 million on operating expenses in Q2 and around $28 million when excluding the stock-based compensation of $8 million. Further stripping out depreciation and amortization expenses and the company has a quarterly opex cash spend in the $26 million range. A 15% reduction in quarterly cash spend amounts to ~$4 million per quarter or $16 million per year in opex.

Ouster forecasts the 2023 cash spend of $107 million suggesting somewhere around $20 million was being spent on capex and inventory build. The company plans to reduce somewhere around $125 million in annualized cash expenses to only $107 million now, or around $27 million per quarter.

With Ouster generating up to 30% gross margins, the company could quickly provide $4.5 million in gross profits on $15.0 million in quarterly revenues. The cash losses will quickly disappear as quarterly revenues top $20.0 million and reach $30.0 million during 2023 with 40% margins.

With 175 million shares outstanding, the stock has a cheap market value nearly equal to the current cash balance. The company cutting the cash spend to avoid dilution here helps Ouster survive long enough to eventually thrive as the demand for Lidar sensors explodes in the next decade.

Elevated Risks

The company is still in near pre-revenue phase with quarterly revenues of only $10 million. The Lidar market is still in infancy and any slower development than expected will push out the path to profits and could require Ouster to raise additional cash and dilute shareholders.

In addition, the adoption of Lidar remains a major risk to sector participants. Tesla (TSLA) is moving forward with a self-driving solution that doesn’t even utilize Lidar. As well, a competitor could develop a better Lidar solution causing Ouster to lose future orders and limited cash could leave the company without the funds to improve their technology to grab future contracts.

In essence, an investor in the stock has to realize a loss of capital is a really possibility. Naturally, the stock wouldn’t trade below $1, if risk of loss of capital didn’t exist in the view of the market.

Takeaway

The key investor takeaway is that the market still doesn’t completely understand the Ouster business model with a lot of future revenues from industrial and robotic customers not captured via existing SCAs. Customers planning to spend $100 million in 2023 could spend multiples of those levels by 2024 and 2025 and beyond.

Ouster isn’t priced for the massive Lidar opportunity ahead. The stock looks scary trading below $1, but the price isn’t backed up by logic providing huge opportunity ahead for investors.

Be the first to comment