Mongkol Onnuan

Brief History

Sampo (OTCPK:SAXPF) (OTCPK:SAXPY) has emerged from being a major player in the Finnish insurance market in the 1980s to becoming the leading Nordic insurer in several of its business lines. The ride has been fairly profitable as Sampo’s shares have returned about 12.9% p.a. since its listing in 1988 (dividends reinvested).

Sampo started out as a pure insurance business. In 1999 the company merged with Finnish bank Leonia (previously named Postipankki) and became briefly known as Sampo-Leonia, a financial services company providing insurance, banking and savings services. In the year 2000 Sampo-Leonia merged with asset manager Mandatum and the name was changed back to Sampo. The new CEO at the time, Björn Wahlroos, wished for the group to become a full-service financial firm, focusing less on insurance and more on banking. However, it became apparent that the insurance business was more lucrative and when Danske bank offered to buy the bank business back in 2007 (good timing), the offer was too good to refuse for Sampo. The price paid was extremely good for a bank (~16x P/E and 3.6x P/B) so you can hardly blame them for selling out. Sampo also moved the P&C insurance business of Sampo in 2000 to the insurer If and remained as a significant owner in the business as part of the transaction (~38% ownership). In 2004 Sampo bought the remaining shares of If which has since then become their crown jewel.

As CEO Björn Wahlroos identified himself more as a banker than an insurer, he invested part of the proceeds of the Sampo Bank sale in another (listed) Nordic bank called Nordea (OTCPK:NRDBY). Nordea being much larger however, Sampo could only afford a minority position of about 10% at first although it was increased to over 20% in later years. Another noteworthy investment was the initial stake in Topdanmark in 2007, another listed Nordic insurer from Denmark. This stake has over the years increased to being slightly shy of 50%. Following the global financial crisis, banking is not what it used to be and over a decade later the current CEO, Torbjörn Magnusson, took the initiative in 2021 to divest the Nordea shares. The last shares were sold in the 2nd quarter of 2022. The total return on the Nordea journey was, according to Sampo, about 9-10% p.a. Torbjörn has also been active on the acquisition front with the 70% stake in Hastings in 2020, a digital motor insurer in the UK (has about 8% of the market), and the remaining 30% in 2021. It’s a significant step into a new market and offers potential for increased earnings power in the mid-term. The UK market is however much more competitive than the Nordic market, so time will tell how the Hastings investment will fair.

The market

Sampo’s main market is the Nordic insurance market with about 90% of its premium income being generated here in 2021. The rest comes from UK (8%) and the Baltics (2%). The Nordic insurance market is fairly concentrated with a few players having a large share of the market. The listed players in the Nordics are the following:

- Tryg (Danish)

- Topdanmark (Danish)

- Alm. Brand (Danish)

- Gjensidige Forsikring (Norwegian)

- Protector Forsikring (Norwegian)

- Sampo (Finnish)

I have these six listed Nordic peers as a yardstick for the market. There are a few similar sized non-listed competitors as well. I believe it’s reasonable to assume that including them in the peer group wouldn’t change the takeaways from this section. The market is being further consolidated as there has been quite a few major acquisitions in the recent past. For example, Tryg acquiring RSA Scandinavia and parts of Codan and Alm. Brand acquiring other parts of Codan.

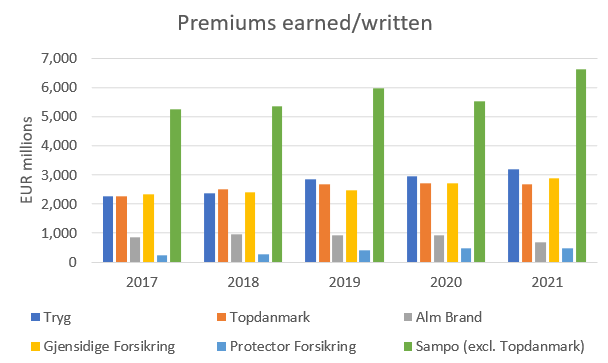

Nordic insurers premium earned/written (Companies financial reports)

Sampo is clearly the market leader from a size perspective using premiums earned as a size measure. Remember that Sampo also owns almost 50% of Topdanmark (excluded from Sampo’s figures). Tryg and Gjensidige are having a healthy competition for the runner up position. It’s also good to remember that there are countries and niches where the competitors are the market leaders. For example Gjensidige is the market leader in Norway which is its home country. Sampo is however in the top three spot in all four Nordic countries.

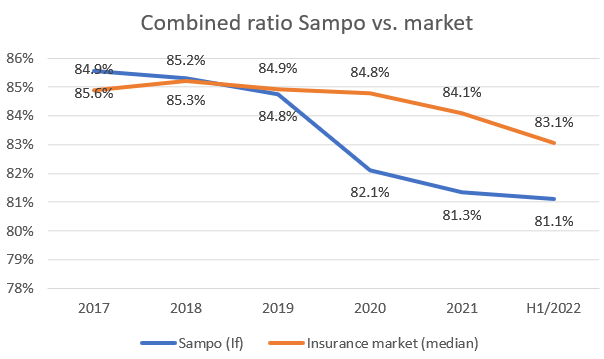

Nordic insurers combined ratio (Companies financial reports)

Price competition is not as aggressive in the Nordics as in other markets, which can be seen from the low combined ratios.

It’s fair to say that Sampo has been underwriting as well or better than the market over the recent five-year period. Sampo’s financial targets in the near term is to produce a combined ratio below 86% and is currently performing well below that level. With this said, combined ratios will most likely increase from these very low levels even for the Nordic insurance market. I expect Sampo to produce, at a minimum, combined ratios at the same level as the market as a whole (although it’s probable that every investor thinks the same way about their company investments).

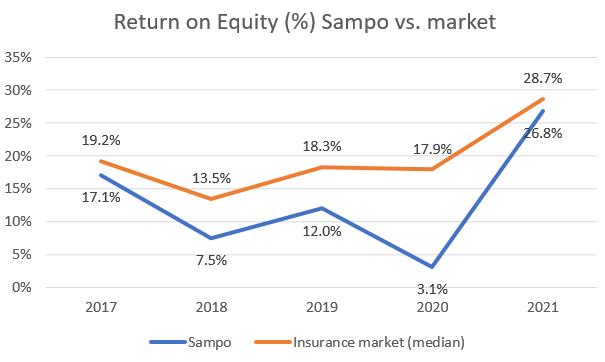

Nordic insurers Return on Equity (Companies financial statements)

The Nordic insurance market is also quite profitable as can be seen in the graph above. Here Sampo has been lagging the market, especially during the 2018-2020 period. Sampo’s size may play a factor here but as a shareholder, I’m not satisfied by that explanation. The reason may be business mix as Sampo underwrites life insurance as well although the peers also have life insurance operations in different scope. The other reason may be a different investment portfolio to its peers, producing lower investment income and gains. Sampo also owned a large chunk of the Nordic bank Nordea which hasn’t produced stellar returns during this period. Sampo has also been overcapitalized for a while (although they have distributed generous dividends and share repurchases for the better part of a year now). The answer is probably some combination of all of the above and as long as the combined ratio, which I consider the most important metric in this business, stays at or below the market level the ROE should reflect this over the long-term.

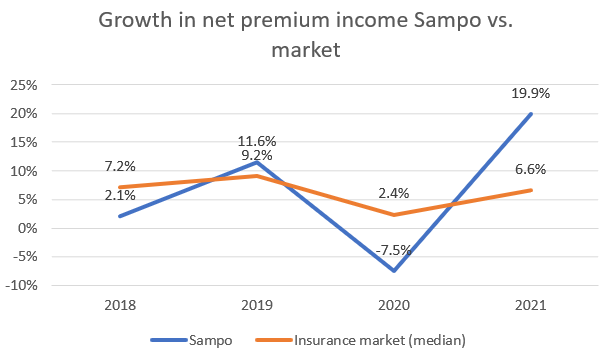

Nordic insurers growth rates (Companies financial statements)

The Nordic insurance market grows in the mid-to-high single digits in a given year. Year 2020 seemed to be an outlier due to the pandemic. Sampo has grown more or less in line with the market. Year 2021 was also boosted by the acquisition of Hastings, their latest addition that operates in the UK market. Sampo aims to grow their underwriting profit in the mid-single digits in the near term. This is of course the way it should be in the insurance business. Namely profitability above growth as anybody can grow by price cutting the competition. It may feel good for a few months or even years but sooner or later, the lax underwriting standards will come back to haunt you as losses.

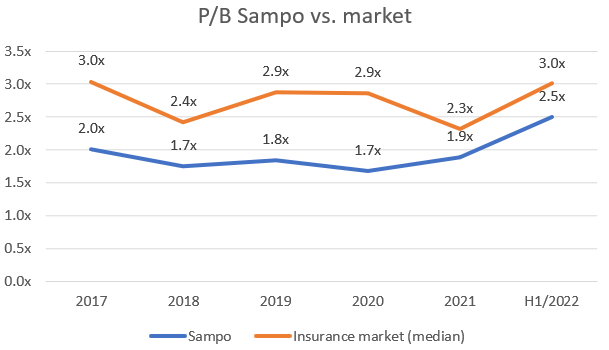

Nordic insurers valuation by P/B (Companies financial statements)

One would assume that Sampo would be assigned a premium valuation as (1) it’s the market leader in the Nordics, (2) has the lowest combined ratio of the peer group, (3) is growing at about market levels. This is not the case as can be seen in the graph above. The reason may be the lower Return on Equity or the fact that Sampo had a large bank investment in the past. Banks normally trade well below insurance businesses in the Nordics, perhaps at 1.0-1.2x book value. It will be interesting to see if Sampo’s valuation will increase in the medium term due to the divestment.

Business segments

Sampo operates under five business segments. These are:

- If is a P&C insurer in the Nordic region across all major insurance segments

- Topdanmark is the second largest non-life insurance company in Denmark in addition to being one of the larger life insurance providers there. Topdanmark has recently announced that the life insurance business will be divested to Nordea

- Hastings is a motor and home insurance provider in the UK market

- Mandatum is a financial services company providing asset and wealth management, life insurance and other financial services to private, corporate and institutional clients. Mandatum has over €11 billion in AUM

- Holding is the parent company of Sampo and in charge of capital allocation decisions. With the divestment of Nordea, there’s only a few unlisted assets on its balance sheet which it expects to exit in the mid-term

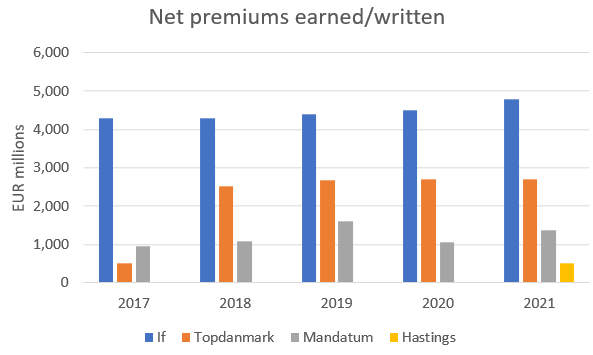

Sampo premiums development by business segment (Sampo financial statements)

To get a feel of the relative importance of the segments we can look at how topline compares during the last five-year period. It is clearly the largest segment. It bears mentioning that only about half of Topdanmark’s topline and earnings is attributable to Sampo as they own almost 50% of the company but have consolidated the full amount on their income statement and balance sheet. Mandatum’s total and about half of Topdanmark’s figures relate to premiums written (i.e., not exactly apples-to-apples) as Mandatum focuses solely and Topdanmark partly on life insurance and do not report premiums earned in these segments which is typical. Hastings was acquired in late 2020 and is still relatively small compared to the rest of the group.

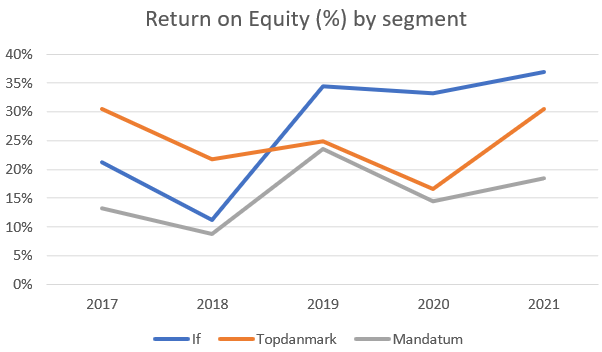

Sampo ROE by business segments (Sampo financial statements)

All segments have produced attractive returns on equity. Especially If has been able to outperform the market in all years except 2018. P&C insurance is the most profitable business line Sampo has at the moment.

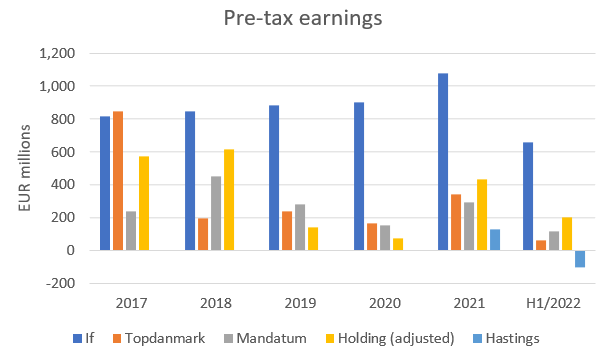

Sampo pre-tax earnings by business segment (Sampo financial statements)

Pre-tax earnings tell the same story so I won’t dive too much into the figures here. It should be noted that I have adjusted Holding’s numbers for impairments of -€899 million in 2020 and an equal positive number in 2021 (i.e., net impact €0 million looking at both years together). Holding’s relative importance will decrease as Nordea was divested and won’t be part of the figures going forward.

Strategy

Sampo has been making significant strategic moves since Torbjörn Magnusson became CEO in 2020. I’d like to highlight the ones I consider most significant for us shareholders.

Becoming more insurance focused

With the divestment of Nordea, Sampo is now almost solely focused on insurance. I say “almost” solely due to them still owning the asset management business of Mandatum. There has been speculation around them divesting the asset management business and even listing it on the stock exchange. These rumors may be true or not but there have been actions by Sampo that would support it. With the transfer of Sampo’s investment operations to Mandatum and separating Mandatum’s asset management business from the life insurance business the path for a potential divestment has been made.

Potential exit from life-insurance

Sampo could also be considering divesting Mandatum’s life insurance business. With the signed sale of Topdanmarks life insurance business in 2022 and the sale of Mandatum’s life insurance in the Baltics in 2021, it seems that Sampo is shifting their focus away from the life insurance business altogether.

UK expansion

With the proceeds from the Nordea sales, Sampo could afford expanding via acquisition to the UK. This is a significant move in my opinion and if all goes well, will add to the earnings power of the group. The UK market is much more competitive and less consolidated than the Nordic market which creates opportunities and challenges. As a shareholder, I’m satisfied with the move as it has satisfactory potential in the long-term. I’m also careful in setting my hopes too high as it’s too early to tell how this venture will fair.

Buyout of Topdanmark

I think it’s fairly certain that Sampo will acquire the rest of Topdanmark in the mid-term period. The latest increase in shares was in Q4 2021 and Q1 2022 although the increases were rather small. The divestment of Topdanmark’s life insurance business surely makes the company even more attractive for Sampo to acquire. The problem in my eyes seem to be the high valuation of Topdanmark. Historically it has traded at a P/B above 3.5x compared to Sampo’s below 2.0x. It seems that management has taken an opportunistic approach to the buyout, buying shares here and there when they feel the price is right. They also made a mandatory bid of the whole company back in 2017 for DKK 183 per share when their ownership breached 1/3 of the company (now trading at about DKK 360 per share by the way – a ~100% increase). Back in November 2021 when they increased their stake in Topdanmark the price ranged from DKK 342 to 354 per share i.e., not far from today’s prices. The dilemma is that if you assume that the market expects Sampo to buy the whole company, the price will stay buoyant at a price the market thinks Sampo could buy the business at. The market capitalization of Topdanmark is around €5 billion so Sampo would need about half of that sum to make the acquisition. Sampo is in a strong financial position with net debt around zero and could, in my opinion, easily finance the acquisition via the debt markets. However, it bears mentioning that Sampo has been returning capital to shareholders via extraordinary dividends and share buyback for the last twelve months which will naturally increase capital efficiency but will also limit the financial flexibility Sampo has in acquiring Topdanmark.

The Dividend

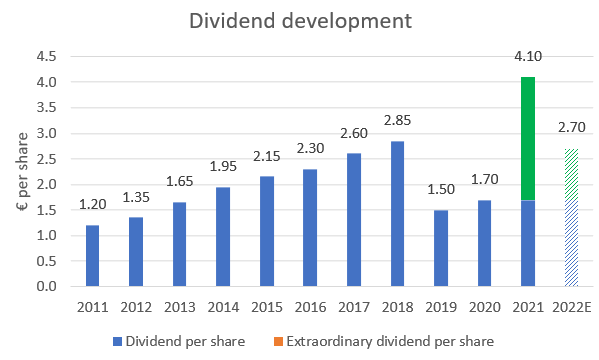

Sampo dividend development (Sampo financial statements)

Sampo has been a generous dividend payer over the last decade. The 2019 year was highly dissatisfactory when Sampo cut their dividend almost in half. The reason for the cut was communicated to be the low yield environment in fixed income and Nordea, their significant bank investment, reducing their dividend. Part of the reason was probably also due to the fact that Torbjörn Magnusson had just taken the role as CEO at Sampo and could now in the beginning of his tenure make some significant changes more seamlessly. All in all, it was probably in the shareholder’s best interest. With the recent extraordinary dividend and share buybacks, Sampo has either way returned almost the same amount of capital as it would have if the dividend hadn’t been cut.

Sampo’s management has stated that an extraordinary dividend, a new share buyback program or some combination of both will be communicated in conjunction with the 2022 financial results. I believe Sampo will make a recurring (insurance) dividend of €1.70 (in line with previous) and an extraordinary dividend of €1.00 in 2022. This implies a ~4% recurring dividend yield and total yield of about 6% at the current share price.

Valuation is below fair value in my eyes

Sampo is currently trading at around 2.5x P/B and an adjusted P/E of 15.3x. To minimize the noise that surrounds the earnings of insurance companies I like to focus on P/B. The earnings are heavily impacted with unrealized gains on investments, the significant divestments and acquisitions that has been occurring in the industry (which impacts continuing operations), the different tax rates in the Nordic countries and the different lines of businesses of the insurance players (life insurance, non-life insurance, banking and asset management). Below P/B of the closest peers.

| Median | 3.0x |

| Company | P/B (TTM) |

| Tryg | 2.2x |

| Topdanmark | 6.3x |

| Alm. Brand | 1.0x |

| Gjensidige Forsikring | 4.0x |

| Protector Forsikring | 3.5x |

| Sampo | 2.5x |

Sampo is valued slightly below the market. I could, however, see Sampo being valued at a premium to the market due to their market leading position and very efficient operations (low combined ratio, If’s high ROE, strategy becoming more focused). However, let’s not get carried away and instead assume Sampo could trade at 3.0x book value which is what the market is trading at. Sampo’s current book value per share is €17.7. Multiplying that by 3 would imply a market price of €53.1. At a current share price of €44.3 it would indicate an upside of almost 20%. You could argue that my 3.0x P/B multiple is fairly aggressive. I agree that it may be a stretch but considering Sampo’s operating metrics are better than the markets, you could just as easily make the case that Sampo should be valued at a premium P/B of say 3.5x or 4.0x. If I’m wrong and the current P/B of 2.5x is right, you would be buying Sampo at a fair price and expect a total return in the high single digits as long as they can grow their underwriting profit at that rate. The return consists of a recurring dividend yield of around 4% in addition to price appreciation of around 2-5% from the excess growth of the underwriting operations.

At a price of €44.3 there’s a sufficient margin of safety for me, which is why I rate Sampo a buy.

Be the first to comment