Drew Angerer

Co-produced with PendragonY.

The Oracle of Omaha on Saving Money

Warren Buffett isn’t the only one telling people that saving money is important to a secure future. As far back as Benjamin Franklin, we have been told that a penny saved is a penny earned. And who can forget Aesop’s Fable about the grasshopper and the ant and how poorly the grasshopper did when times got hard?

Some might think that with inflation being so high that it isn’t important to save right now, but in fact, now is the time to be saving. Many pros say you will need at least three months of expenses saved (and maybe even more). With inflation pushing those expenses up, more savings will be needed.

“The biggest mistake is not learning the habit of saving properly”

It is important to get into the habit of saving. Without that habit, it is all too easy to succumb to the lure of some shiny new toy.

How do you get into that habit? Make it automatic. Many employers allow payroll deductions for your retirement account. You can set up an automatic withdrawal at your bank as well. If you never touch the money yourself, you won’t be tempted to spend it and rather save it.

Successful savings is a matter of training yourself. By making most of your savings automatic it will be easy to repeat the behavior until it is habitual. The easier it is to do, the sooner it will become a habit.

“Do not save what is left after spending, but spend what is left after saving”

This is similar to that saying of pay yourself first. Figure out how much you need to fund your retirement account and emergency funds, and then put a plan together to save those funds. Spend the remainder on day-to-day expenses only once you have put the cash into savings that your plan requires. So you buy a new car only when you have the cash after funding your savings. The same goes for that shiny new toy that seems essential.

When you get a raise at work, don’t rush out and spend all the new cash. Instead, devote half of the raise to increasing the amount you put into savings. When you start working, you should put enough cash into your 401k to get the full employer match. Then each year, adding half your raise, you will increase your savings while still having more money to spend. And it won’t take long before you hit the maximum contribution limits.

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down”

Everyone talks about investing in quality, but what does that really mean? Far too many analysts describe quality in ways specific to their investment strategy. This can be confusing or even counter-productive if you use a different strategy. So let’s take a step back and define quality in a strategy-agnostic way.

Quality is best measured by one or more metrics that are easily understood, easily calculated, and predictive of an investment’s ability to achieve one’s investment goals. Easily understood and easily calculated are things like revenue, GAAP earnings, FFO (Funds from Operations), and NII (Net Investment Income). Then you choose from these metrics the ones that best measure the current abilities of the company or fund, and then further narrow the metrics down to those that also are the best predictors of future performance.

For a closed-end fund (“CEF”), for instance, the metric that best measures current performance and is a good predictor of future performance is NII and the related UNII (Undistributed Net Investment Income). These metrics can help you determine if the current distribution is covered by the most repeatable source of cash for a fund. And that will let you judge how safe the distribution is. And for an income investor, the safety of the distribution is critical to investment success.

Using the Income Method, we can make picks that will generate the cash we need to pay expenses in retirement. Before we retire, this income can be used to buy more income-producing assets that grow our portfolio’s income at an even faster rate than just what we can save each month.

Pick #1: PTY – Yield 10.7%

PIMCO Corporate & Income Opportunity Fund (PTY) is our all-time favorite bond fund. It has been through many ups and downs. Times of the financial crisis, mortgage meltdowns, rising rates, declining rates, COVID, and inflation. PTY is one of those stocks we have routinely recommended adding to. It has often been a great place to put spare cash at the end of the month.

One often hears that unrealized gains are comparable to dividends – they aren’t. Those who say they are, aren’t taking cash out of their brokerage accounts.

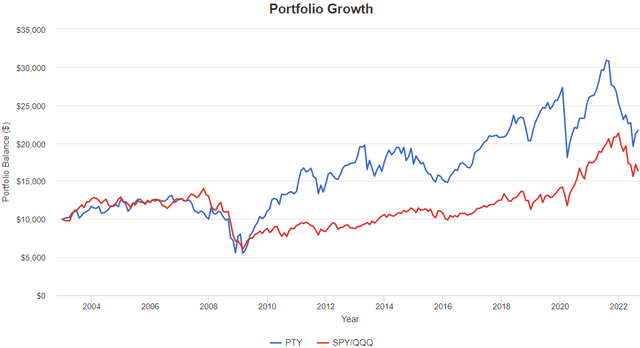

Say you retired when PTY IPO’d and got a lump sum to invest. You invest $10,000 in PTY and another $10,000 split evenly between Invesco QQQ ETF (QQQ) and SPDR S&P 500 Trust ETF (SPY). Note, this is about as great timing as you could have gotten for investing in SPY or QQQ since they were both at extreme lows following the dot-com bust.

There are a million ways to chart it. Just reinvesting the distributions has the SPY/QQQ combination coming out ahead. That, however, isn’t what a retired investor would be doing. Just look what happens when the investor takes out just $85 a month. That works out to be $1020 a year or about 10.2% of the original investment. (Source: Portfolio Visualizer)

So while the SPY/QQQ combination might look better when re-investing all distributions, in the real world, where one needs cash to pay expenses, PTY is better. When you are retired, you don’t have the luxury of just letting your money sit there for 20 years. You need cash. You need it today, you need it next month, you need it every year for the rest of your retirement. Which will be how long?

What is the huge difference? The income. PTY produced a high enough dividend to cover your cash withdrawals, plus it produced enough for you to buy more shares.

Earlier we talked about picking quality, and what that meant in a general way. What does it mean for PTY? For a CEF like PTY, that means we can have a metric like NII (Net Investment Income) that tells us how well-covered the distribution is. This is an important metric because it is that distribution that produces the income we will use in retirement to help pay our expenses. And what has the NII coverage of the distribution done? Back in January, the 6-month rolling coverage ratio of NII to distribution was ~114%, and, as reported for the end of July, that has improved to ~131%. This means the distribution is even safer now than it was seven months ago. That is quality!

Pick #2: PFFA – Yield 9%

Virtus InfraCap U.S. Preferred Stock ETF (PFFA) is an exchange-traded fund (“ETF”). This means that it has mechanisms that ensure it is always trading close to NAV – unlike a CEF, which allows the price to trade at a substantial premium or discount. As an actively managed ETF, PFFA has several features that set it apart from index-tracking passive ETFs.

First, PFFA is leveraged. PFFA uses modest leverage of 20-30% of gross assets. This helps juice returns and takes advantage of preferred shares having stable prices relative to common shares.

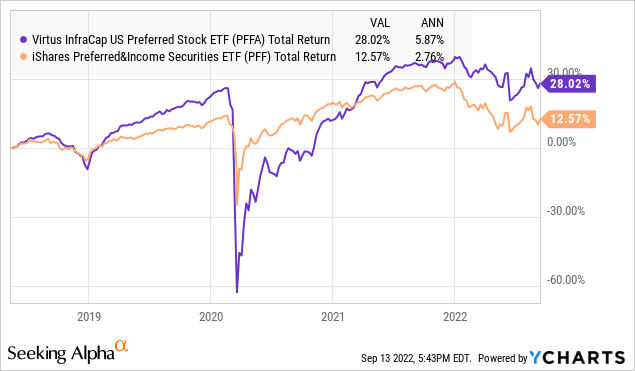

It has become commonplace for ETFs to just copy an index. That is a reason why we usually like CEFs better, as they are actively managed. Passively managed ETFs buy or sell stocks based on what the index holds without any due diligence or consideration. ETFs become the quintessential “dumb money” that pours into investments based on a predetermined formula. However, PFFA doesn’t follow an index. The picks are hand-selected and weighted by management. It’s harder work, and the management fee for the fund is more in line with what you see with a CEF than an ETF. We think that this active management is worth every penny, as PFFA has had a total return of more than double iShares Preferred and Income Securities ETF (PFF), a passively managed ETF that tracks a preferred stock index.

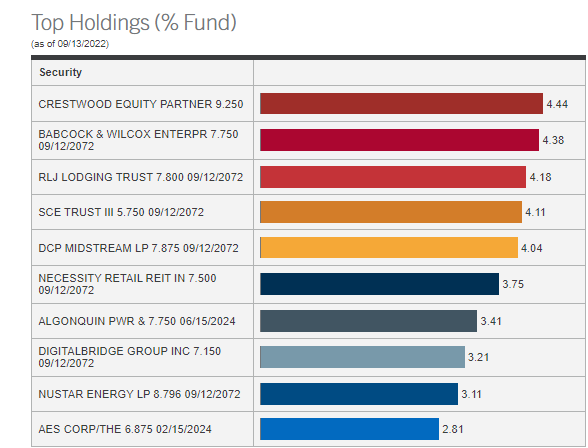

When we look at PFFA’s portfolio, we aren’t surprised by the outperformance. Like HDO, PFFA has been focusing on preferred shares in companies that have high cash flow and pay high yields. Their holdings consist of a lot of MLPs, REITs, and utilities.

In the top holdings, we see many names that are in the HDO portfolio.

Virtus PFFA Website

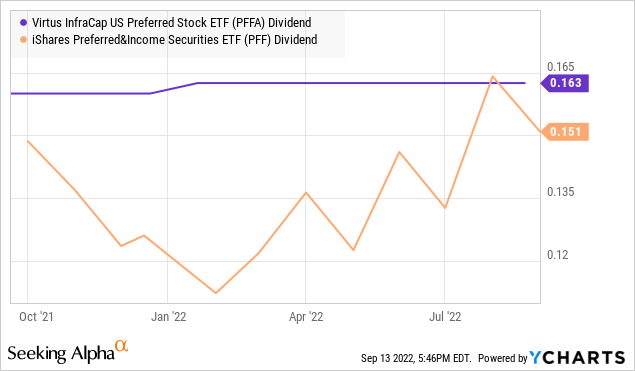

PFFA has also paid a more constant and higher dividend, which is a sign of the quality we want in an income investment.

And not only is the dividend from PFFA larger than that from PFF, but with the share price of PFFA being only about $22 compared to $33, you get even more bang for your buck.

Dreamstime

Conclusion

Most people don’t have billions of dollars they need to put to work, so they will need to pick different stocks than Warren Buffett for their portfolios. His more general advice, like how to save and put those savings to work, can be followed even when one picks very different stocks. Investors will do better to apply the principles Warren talks about while not exactly copying his portfolio. After all, we don’t have access to the leverage he can bring, his research, or the economies of scale that his billions afford him.

The Income Method can be used before retirement to provide extra cash to add to our savings. This will supercharge the growth of the income our portfolios produce. After we retire, this immediate cash will help us pay our expenses even when share prices are down. As income investors, we aim for an average yield of 9%. PTY and PFFA are picks that enable us to hit that target yield with a reliable dividend stream.

Be the first to comment