Jean-Luc Ichard/iStock Editorial via Getty Images

This article was prepared by Navyanshi Nayan in collaboration with Dilantha De Silva.

Microsoft Corporation (NASDAQ:MSFT), which is part of the model dividend portfolio at Leads From Gurus, has come under pressure along with other tech companies this year. The tech giant has lost almost a third of its market value in 2022, pushing its valuation below the 5-year average from a price-to-earnings ratio perspective. The company not only has to deal with challenging macroeconomic conditions that have forced the company to lay off thousands of employees but also fight it out with regulators to get the green light to complete the acquisition of Activision Blizzard, Inc. (ATVI). This analysis aims to determine whether MSFT is an appealing buy ahead of the FTC’s decision on the Activision deal.

What Is Microsoft’s Deal With Activision?

Last January, Microsoft announced its plan to acquire Activision Blizzard (ATVI), one of the world’s leading game developers and interactive entertainment content publishers, for $95 per share in an all-cash transaction valued at $68.7 billion. Activision owns well-known gaming franchises such as Warcraft, Diablo, Overwatch, Call of Duty, and Candy Crush.

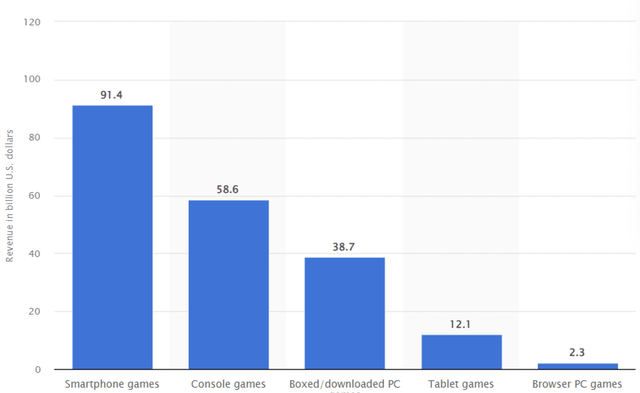

With the increasing use of smartphones, gaming has become the most popular and fastest-growing form of entertainment. Although gaming consoles remain a key platform for smart games and applications, mobile platforms are gradually taking over as the preferred platform due to their affordability and functionality. According to Microsoft, mobile gaming is the most popular platform today with nearly 95% of all players worldwide playing games on mobile. Further, Statista data reveals that smartphone games will account for 45% of global video gaming revenue in 2022, and with the increasing adoption of smartphones on a global scale, mobile games revenue is expected to surpass $100 billion by 2023. With the acquisition of Activision, Microsoft aims to enter the multi-billion-dollar gaming market and develop AAA-rated games while distributing Activision’s most immersive franchises to players across the world.

Exhibit 1: Video game market revenue worldwide in 2022 by segment

Statista

Source: Statista

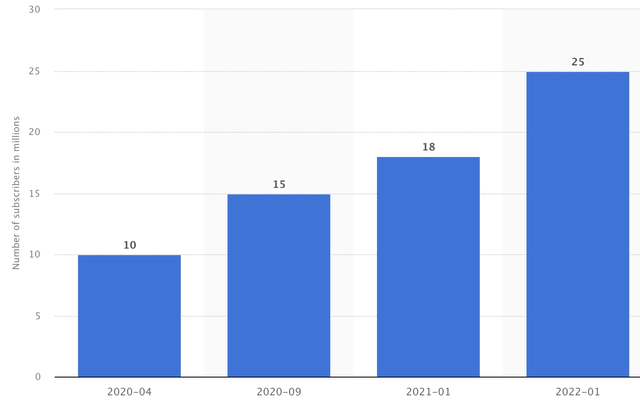

According to a new study by data.ai and IDC, users around the world downloaded 1.1 billion mobile games per week in the first quarter of 2021, an increase of 45% compared to pre-pandemic levels, and the mobile games segment is poised to take over 61% of the total gaming market share in 2022. The Activision deal will help Microsoft accelerate its gaming penetration across mobile, PC, console, and cloud platforms, as well as provide building blocks for the metaverse. Most importantly, the acquisition will strengthen Microsoft’s Game Pass portfolio, which currently has over 25 million subscribers.

Exhibit 2: Number of Game Pass subscribers

Statista

Source: Statista

Game Pass provides players with a subscription option, lowering the cost of games and allowing developers to bring more games to more players. Microsoft intends to include Activision Blizzard games in Game Pass, as well as broaden its appeal to mobile gamers who appear to have more diverse preferences. Furthermore, through its cloud game streaming technology, the company hopes to enable players to play traditional Activision Blizzard console games on other platforms. The cloud platform will expand mobile gaming opportunities and create new distribution channels for game developers outside of mobile app stores to create immersive experiences for players.

The deal, however, has brought gamers some unsettling news: the company may withdraw franchises such as Call of Duty from PlayStation. However, the company has stated on numerous occasions that it intends to keep Call of Duty on PlayStation for “several more years” beyond the expiration of the current Sony-Activision deal. Microsoft has promised that the same version of Call of Duty will be released on PlayStation on the same day it is released elsewhere.

Since the deal’s announcement, regulators have increased their scrutiny of the transaction due to anti-competitive concerns.

Is Microsoft Allowed To Buy Activision?

As Microsoft stated in January, the acquisition would propel Microsoft to become the world’s third-largest gaming company by revenue, trailing Tencent and Sony Group Corporation (SONY). The deal, however, has drawn international attention. The first is the Federal Trade Commission, which is investigating the deal both from a consumer perspective and a business perspective. The watchdog will evaluate how this deal may affect workers after Activision was accused of discrimination and a hostile workplace while taking into consideration how this deal will affect the competition in the market. The FTC’s decision is expected in November. The antitrust regulator in the UK, on the other hand, is more concerned about the ability of Sony to compete with Microsoft if this deal goes through.

Microsoft has a strong console ecosystem and is well-positioned to compete in the cloud gaming market. The UK’s Competition and Markets Authority (CMA) is concerned that Microsoft’s acquisition of Activision will strengthen its position and harm competition in the market for cloud gaming services, which is still in its early stages.

Furthermore, Microsoft’s dispute with Sony over Activision’s popular game Call of Duty, which the market believes Microsoft will make an Xbox exclusive, is putting additional strain on the deal. Although Microsoft Gaming CEO Phil Spencer has stated that Call of Duty will be available on PlayStation for several more years, Sony believes that this assurance is insufficient and that Microsoft made this statement to alleviate regulators’ fears and close the deal. Sony believes that “several years” will most likely refer to three.

PlayStation chief Jim Ryan said in an interview with Games Industry Biz:

Microsoft has only offered for Call of Duty to remain on PlayStation for three years after the current agreement between Activision and Sony ends. After almost 20 years of Call of Duty on PlayStation, their proposal was inadequate on many levels and failed to take into account the impact on our gamers. We want to guarantee PlayStation gamers continue to have the highest quality Call of Duty experience, and Microsoft’s proposal undermines this principle.

According to industry reports, Sony has postponed its annual PlayStation Showcase event which was scheduled for October 20 because the company believes that multiple new “exclusive titles” will strengthen Microsoft’s acquisition of Activision Blizzard. UK regulators are looking at whether Microsoft’s takeover of Activision will negatively affect PlayStation and the competitiveness of the market.

The CMA claims that the deal is the largest ever in the gaming industry, and Microsoft’s complete control over Activision’s powerful catalog could harm the industry by impairing its competitors’ ability to compete fairly.

In response to the CMA’s reference decision, Microsoft stated on October 11 that Sony’s PlayStation has been the largest console platform for over 20 years and is more than double the size of Xbox, and that it was not credible to suggest that its dominance would be challenged by losing access to one title. Furthermore, the company stated that it wants people to have access to “more games, not less.” Microsoft has stated that it has no intention of taking Call of Duty away from gamers and has committed to making the same game available on both Xbox and PlayStation on the same day. To support its claim, Microsoft, in a statement, stated explicitly why keeping Call of Duty on PlayStation is important for the company:

The value of Call of Duty depends on its community of gamers, the majority of whom are on PlayStation. Keeping Call of Duty on PlayStation is, therefore, a commercial imperative for the Xbox business and the economics of the Transaction. As such, Microsoft has offered Sony a contractual commitment to continue supplying it with Call of Duty, including new releases with feature and content parity. The Referral Decision fails to explain why, in the CMA’s view, Microsoft would make such commitments publicly and privately, if it had no intention of honoring them. Microsoft would not do this... Microsoft has been clear that it is counting on revenues from the distribution of Activision Blizzard games on Sony PlayStation as part of its business case for the acquisition.

Although Microsoft claims the CMA has accepted Sony’s complaints without an “appropriate level of critical review,” the regulator is continuing with its in-depth investigation, the results of which will be published by March 1.

For now, Microsoft is yet to receive the green light from regulators in Europe and the United States to complete the acquisition of Activision Blizzard.

What Should Investors Watch Going Forward?

It is reasonable to assume that the deal, if completed, will have tremendous implications for the gaming industry and Microsoft as digital subscriptions will bring in a new generation of gamers and open new opportunities for Microsoft to expand its gaming business. Despite the ongoing conflict, several analysts have stated that the deal would not be anti-competitive if competitors were given access to Activision games, as Microsoft has already promised.

There is a chance that a regulatory body will block this $70 billion deal, but this does not guarantee that Activision’s games will remain in the market as they are now. Despite being a gaming industry powerhouse, Activision continues to face financial and internal organizational challenges. Activision Blizzard has also warned that if the deal falls through, it may be forced to lay off employees due to financial difficulties and be forced to ground some of its existing franchises.

This is not to say that there are no other likely candidates who could acquire Activision. However, only a few companies, such as Alphabet Inc. (GOOG) and Meta Platforms, Inc. (META) are capable of purchasing and investing in the gaming industry at this scale. With all these tech behemoths currently embroiled in legal battles in Europe and China, it seems highly unlikely that one of these tech companies will bid for Activision in case Microsoft’s deal fails to win the approval of regulators. None of these tech giants has an active interest in gaming as much as Microsoft, which has been in the gaming space for over ten years. Microsoft’s acquisition of Activision not only makes sense, but the company’s resources and talent will help keep studios’ beloved games while also expanding the experience to new gamers.

Assuming the Activision acquisition will go through, Microsoft will be the world’s third-largest gaming company by revenue, trailing only Tencent and Sony. If the deal fails, Microsoft will pay a $3 billion breakup fee but the company is confident of receiving regulatory approval. A failed transaction is very likely to hurt Microsoft’s market value as well.

Microsoft, at this point, seems the best home for Activision’s assets, and we believe the deal will eventually receive the approval of regulators.

What Is The Long-Term Prediction For MSFT Stock?

Despite macroeconomic uncertainties, Microsoft still has a long runway for growth as the company expands into new business verticals. The company reported moderate growth in FQ4 due to an increase in operating costs and its decision to scale back operations in Russia. However, its cloud business performed well. On a constant currency basis, the company recorded 46% year-over-year revenue growth for Azure and other cloud services in FQ4 2022, driven by growth in consumption-based services. Azure is the fastest-growing segment as transitioning to the cloud has become an important part of almost every business. The Office 365 Commercial product line saw revenue increase by 19% YoY on a constant currency basis driven by Office 365 E5. The number of Office 365 E5 seats increased by more than 60%, accounting for 12% of the Office 365 installed base. LinkedIn revenue increased by 29% in constant currency driven by significant investments made in the creator studio.

Growth will slow in the coming quarters due to macroeconomic headwinds. The company recently announced its third round of layoffs, following the company’s slowest revenue growth in more than five years in the fiscal quarter that ended Sept. 30. On October 25, the company is expected to announce FQ1 2023 results, which will provide an accurate picture of the company’s current challenges and progress.

On the bright side, the company is strengthening its presence in the creator economy. Microsoft recently announced the release of four new tools: Microsoft Designer, Microsoft Clipchamp, Microsoft Create, and Image Creator to gain traction among creators in an era where the creator economy is expected to grow exponentially. With the social media industry rapidly changing, Microsoft’s entry into the creator economy is a significant step forward and will support Microsoft’s long-term growth ambitions as digital transformation gathers pace. This global-scale digital transformation which is revolving around remote working, cloud computing, digital assets, AI-driven business processes, and automation might hit roadblocks in the short run, thereby making it difficult for Microsoft to maintain stellar growth. In the long run, however, Microsoft will come out as one of the biggest winners of the ongoing digital transformation, which is why investors need to double down on every opportunity to invest in Microsoft at cheaper prices.

Takeaway

Regardless of whether the Activision deal goes through or not, Microsoft is becoming very attractive as Mr. Market continues to punish tech companies this year. If the deal is approved, which is very likely to happen, Microsoft will be looking at a tremendous market opportunity that could open doors to bring in billions of dollars in annual recurring revenue with its subscription business. In the long run, we believe Microsoft will emerge as one of the few tech companies with a stable, recurring revenue stream thanks to its subscription-focused business model. This makes Microsoft a very appealing company for income investors who prioritize safety and growth over high yields.

Be the first to comment