Mark Wilson/Getty Images News

In a recent article, we highlighted how Blackstone Inc. (BX), the biggest private equity firm in the world, is now loading up on real estate investment trusts (“REITs”) following the recent crash in their share prices.

They have one of the best track records in real estate investing, so when they talk, we listen, and lately, they have talked a lot about REITs:

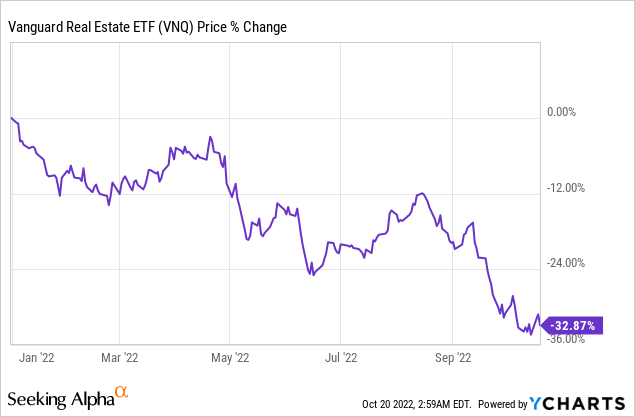

“In real estate, while the public REIT index (VNQ) fell 17% in the quarter, our Core+ funds were up 2.3%. I’ll do that again for you. The index is down 17%, we were up 2.3%.” Steve Schwarzman, CEO of Blackstone.

“The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time.” John Gray, COO of Blackstone.

Both of these executives are self-made billionaires who made their fortunes in real estate asset management. Many view them as the equivalent of Warren Buffett in real estate investing, so these statements shouldn’t be taken lightly.

And it is not just talk!

So far into 2022, they have acquired 4 different REITs for a total of nearly $30 billion. Since then, share prices have only dropped lower which leads us to think that there will be many more buyouts in the coming quarters:

And Blackstone is not alone.

Their biggest rival, Brookfield Asset Management Inc. (BAM), which is led by self-made billionaire Bruce Flatt, is also aggressively going after discounted REITs.

In case you aren’t familiar with Brookfield, it is the second-largest private equity firm in the world with ~$750 billion of assets under management, and real estate accounts for over a third of that.

Bruce Flatt, often called Canada’s Warren Buffett, has led Brookfield for 20+ years, and his track record has even bested that of Berkshire Hathaway (BRK.A, BRK.B).

Brookfield

His strategy is simple: he looks for real assets that are temporarily discounted due to near-term concerns that won’t materially affect the long-term fundamentals. Put simply, he is a value investor that mainly focuses on real estate, infrastructure, energy and renewables.

What has he been buying lately?

You guessed right: REITs.

Already early into the pandemic, Bruce Flatt was already very vocal about the opportunity in the REIT sector. In late 2020, he noted that:

“Probably the greatest discount out there between what you would see as value and price is in REITs and real estate securities… I would say one of the great purchases today is real estate securities because you are buying them at a fraction of what you would trade them at in the private sector… REITs that have high-quality assets trade at enormous discounts to the tangible value of their assets.”

Shortly after that, he took Brookfield Property Partners (BPY) private in a $5.9 billion transaction in 2021 because it was severely discounted by the public market.

Later in 2021, Brookfield also bought a stake in British Land (OTCPK:BTLCY), which is one of the biggest REITs in the UK, again at a large discount to NAV.

They did not stop there.

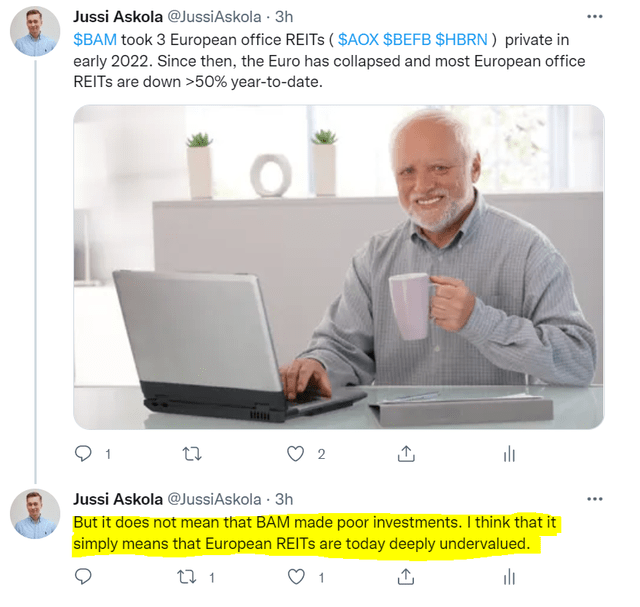

In early 2022, they then took three other European REITs private. The biggest of the three, Alstria, is a German office REIT that they bought for €4.1 billion. Interestingly, they actually paid a premium to its NAV and since then, German office REITs and the Euro have both collapsed, which probably means that Brookfield is even more bullish at today’s valuations.

They also bought Irish office REIT, Hibernia, for €1.1 billion, and a Belgian office REIT, Befimmo, for another €1.4 billion.

So that’s €7 billion worth of European REIT buyouts in 2022 alone!

Then in July, they closed an even bigger deal. In partnership with DigitalBridge (DBRG), they purchased a 51% equity stake in the cell tower business of Deutsche Telekom (OTCQX:DTEGF, OTCQX:DTEGY), which valued it at €17.5 billion. KKR (KKR) was also bidders on this deal, but it fell short of Brookfield’s offer.

Deutsche Telekom is not a REIT, but this business is very similar to that of cell tower REITs American Tower (AMT) and Crown Castle (CCI).

Finally, in a recent interview with Bloomberg, Brookfield noted that they have $110 billion of cash to invest and see “tons of opportunities” in the public market for take-private transactions of undervalued listed companies.

“There cannot be a better time to be a value investor.” Anuj Ranjan, Global Head of Business Development at Brookfield

So, clearly, they are on the same page with Blackstone.

What are they seeing in the REIT market that others are missing?

It is quite simple actually.

Valuations are heavily discounted, with a number of REITs trading at just half of the value of the real estate they own, net of debt. They are so heavily discounted because their share prices have crashed, even as property values remained more or less the same in 2022.

REITs sold off heavily due to fears of rising interest rates, but what the market appears to have missed is that REITs use little debt and have long maturities. Therefore, the negative impact is not significant in most cases, and besides, interest rates are only rising because of inflation, which is highly beneficial for REITs since it leads to growing rents and replacement values. The positive impact of inflation is often greater than the negative impact of rising rates and this explains why more than half of REITs have actually hiked their dividend in 2022, even as their share prices dropped lower.

We suspect that a lot of money was pulled out of REITs because public investors commonly see them as income vehicle. With Treasuries now yielding over 4%, they have other alternatives, and it caused REIT share prices to decline drastically.

But this does not mean that private property prices are going to decline. In fact, so far, prices have not changed much because NOI has kept rising rapidly, and cap rates have only expanded a bit.

As I recently tweeted, REIT investors appear to have forgotten about inflation, but private equity players haven’t. A 4% yield on a Treasury (IEF) results in a negative 5% return after taxes and inflation, which simply isn’t sustainable for most investors, and this is why most landlords aren’t selling their properties to move into Treasuries or bonds. It also explains why cap rates and property values haven’t changed much. Real estate provides inflation protection, which is badly needed these days, and this is why investors are willing to accept lower spreads/returns to get it.

Private equity players understand this and this is why they are now loading up on REITs while they are heavily discounted.

But there are over 200 REITs out there and a lot more if you include international markets.

What are the best opportunities?

At High Yield Landlord, we are heavily investing in those REITs that are likely buyout targets for private equity players like Brookfield and Blackstone.

A good example would be BSR REIT (OTCPK:BSRTF / HOM.U), which owns highly desirable apartment communities in Texan cities where rents are rising rapidly. It is currently priced at a near 40% discount to NAV and the board recently approved a buyback plan to create value for shareholders.

It would be an ideal buyout target for most private equity players, but also larger apartment REITs like AvalonBay (AVB) because it is hard to find a portfolio of Texan communities these days, especially at such a steep discount to fair value.

BSR REIT

In addition to buyout opportunities in the U.S., we are also buying the dips in Europe.

Brookfield invested heavily in European REITs in early 2022, and since then, the Euro has collapsed and European REITs have seen their share prices cut in half.

Uncertainty is high in the near term, but if you have a long-term horizon, this is a fantastic opportunity to buy real estate at a steep discount to long-term fair value. Some European REITs trade as low as 30 cents on the dollar at the moment!

Bottom line

“Every crisis we have is always the worst crisis we’ve ever had. If you a long term plan, these things come and go. You can capitalize on these situations.” Bruce Flatt, CEO of Brookfield, September 29th, 2022

This quote is a good summary of why Bruce Flatt and Brookfield are loading up on REITs today. They offer an opportunity to buy real estate at a steep discount to fair value due to near-term concerns that will be forgotten a few years down the line.

The real estate is not going anywhere and good properties always recover and continue to appreciate in the long run.

In a way, buying REITs today feels like buying homes following the great financial crisis. They were already deeply discounted, but most didn’t have the courage to buy them as they feared that prices would only keep dropping lower. But then the market recovered and those who bought properties made a killing in the recovery.

Be the first to comment