Darren415

This article was first released to Systematic Income subscribers and free trials on July 8.

The first half of the year has been a painful one for most income assets. In this article we discuss how we view the income landscape as well as the opportunities we are seeing at present.

Our key takeaway is that, while the last few months have been tough, the repricing in income assets has also ensured that income portfolios can deliver sustainable and attractive levels of income going forward. The second takeaway is that the current market environment is unusual in that both credit and duration risk are attractively priced.

Finally, as CEF and BDC discounts have widened to historically wide levels they now present much more attractive income vehicles than they did for most of 2021.

Feel The Burn

About a year ago we discussed how the prevailing market environment of high valuations and low yields presented two difficult scenarios for investors.

The first scenario was that yields would start to move higher on the back of a normalization in the macro picture, persistent inflation and a rise in credit spreads as the macro cycle matured. In this scenario income assets would perform poorly but reinvestment opportunities would improve due to the rise in available yields.

The second scenario was that yields would remain low for an extended period of time, perhaps suppressed by moderating inflation and a Fed not keen to rock the macro boat. Income prices would remain level but reinvestment opportunities would be unattractive.

Although the first scenario would be much more damaging for income assets it was, in fact, our preferred outcome. This was because the scenario of suppressed yields would inevitably translate into lower income levels in investor portfolios as securities were redeemed and reissued at much lower coupon levels. High asset prices would also deliver miserly yields on dividend reinvestments.

In short, the market that we have gone through over the last six months, is “short-term pain, long-term gain”. Short-term pain because the back-up in yields has led to a sharp drop in asset prices. But long-term gain because this rise in yields will allow investors to grow the income levels of their portfolios over time by reinvesting dividends at higher yield levels as well as increasing the supply of higher-coupon securities.

Some Biases Worth Keeping In Mind

No doubt many income investors are spending their time going through any number of readily-available mid-year outlooks, provided by brokerages and retail fund managers.

However, as with anything, investors should be aware of the relevant agency issues with retail research. What we have found time and again is that retail research has a key bias which is to avoid strong recommendations of higher-yielding assets. For example, when the macro picture is healthy and valuations are expensive the view will always be – well you shouldn’t hold any, say, high-yield corporate or municipal bonds because the compensation is not very attractive.

And when the macro picture is weak and valuations are cheaper the view will tend to be – well no, you shouldn’t hold any high-yield bonds now because risks have increased and we could start to see more defaults coming. It is as though retail research commentary is always waiting for a situation where the macro picture is very strong but, for some bizarre reason, valuations are super cheap also. Needless to say, this situation will never come about.

This bias is likely there to ensure that retail investors can never hold it against the brokerage research analysts that they bought something on a bullish call which didn’t work out, perhaps, because prices kept moving even lower. At the end of the day, research analysts are not really part of the core business. It’s not there to make the right calls – rather, it’s there to provide some window dressing on the actual business of money management or brokerage.

Having a sense of this bias is important because missing out on very attractively priced assets can be as bad for investor long-term wealth as going through a huge drawdown, having bought at the peak.

And Our Outlook

The current environment is a very unusual one for income assets. We like to approach the income market from (at least) two dimensions. The first dimension looks at the two key risks: credit risk and duration risk and, specifically, the compensation that the markets are offering to investors for taking them.

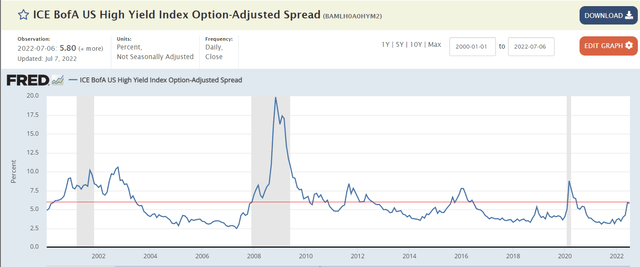

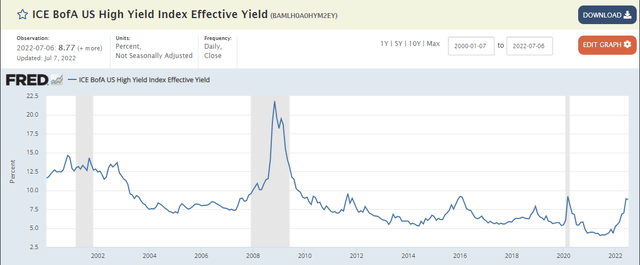

We like to proxy credit risk by looking at high-yield corporate bond credit spreads which are shown below. Credit spreads are just the additional yield compensation offered by junk bonds over Treasuries. Here, the story is that spreads have increased dramatically from their 2021 levels when they bounced from close to 3% to around 5.8% now. Current levels have only been exceeded during the three previous recessions this century as well as the 2015 Energy shock and the 2012 Euro crisis.

Three additional points are worth making. First, non-banking crisis recessions have tended to be more mild than their bank-crisis counterparts. Banks are currently in much stronger shape than they were prior to the GFC so if there is any consensus here it’s that banks are not going to be very interesting over the coming recession just as they were pretty boring during the COVID shock. This suggests that the next recession, if it comes about, is likely to look more like 2001 than like 2008 i.e. we could see credit spreads peak closer to 10% rather than 20%.

Two, outside of the dotcom-bubble non-banking crisis recession, credit spreads don’t tend to trade above a level of 5-6% for an extended period of time.

Three, the Fed is likely to have less scope in supporting markets this time around than they had during previous recessions particularly if inflation remains well outside of their target range (last PCE reading being 6.3% versus a target of 2%). This might cause a recession to be more prolonged than it would otherwise be.

These additional factors present a mixed picture – the market has already moved a big way towards pricing in a recession, however, if we do enter a recession, we shouldn’t expect as sharp a rally as we enjoyed in the second half of 2020.

All in all – credit risk is priced attractively. Of course, nothing says it won’t become even more attractive however, in our view, compensation for credit risk is pretty good.

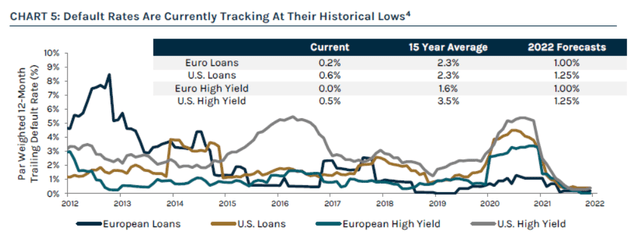

Obviously, compensation for credit risk doesn’t exist outside of fundamentals. The consensus is that the actions of the Fed should lead to lower aggregate demand, a drop in corporate earnings, rising interest expense and more corporate defaults. That doesn’t sound amazing and it’s not. However, it’s important to point out that the starting point is a very good one. Default rates are running at rock bottom levels.

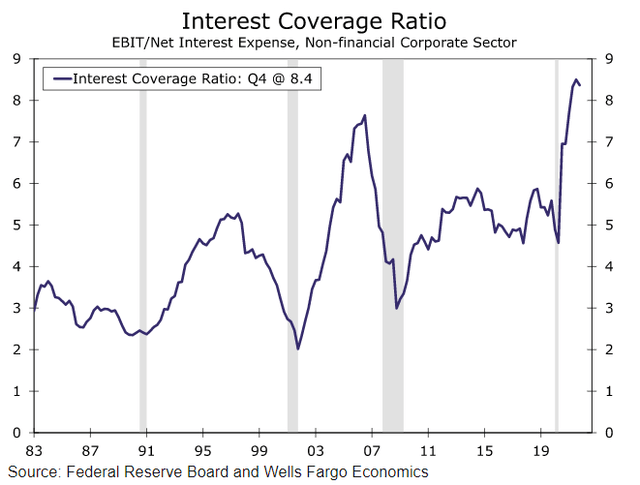

And corporate interest coverage is at a 40-year high.

Both of these indicators will worsen but they will worsen off a very strong level, allowing investors to monetize high yields for a while with a low default rate drag.

Let’s turn to the other key risk for income investors – duration risk. There are many ways to measure compensation for duration risk. The more intuitive ones are nominal and real Treasury yields.

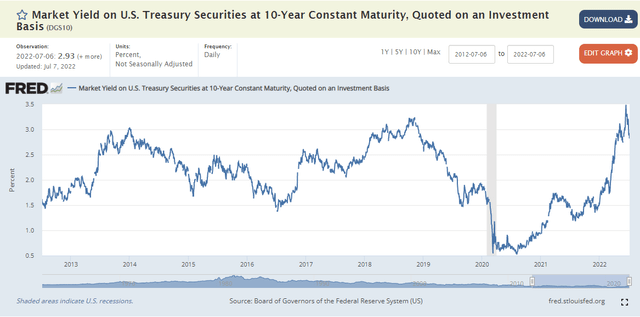

10Y nominal Treasury yields are close to their 10Y highs.

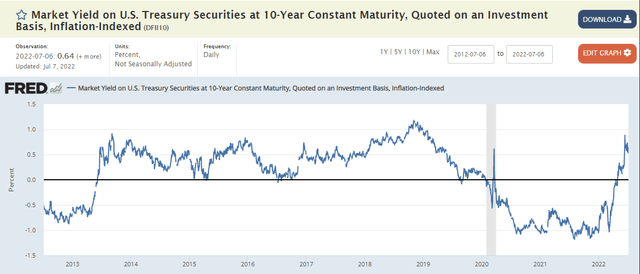

Their real counterpart (i.e. adjusted for inflation expectations) is not quite at the 10Y high but it’s at the higher part of the range.

In short, compensation for taking duration risk is reasonably attractive at current levels.

What is very unusual about the current market is the fact that both credit and duration risk compensation is fairly attractive. This doesn’t tend to happen. This is because when credit risk compensation is high (i.e., when credit spreads are wide such as when we are in a recession) duration risk tends to be not well compensated (because Treasury yields tend to fall in recessions) and vice-versa.

What this means is that when we put the two parts together and look at something like high-yield corporate bond yields (i.e. the sum of Treasury yields and credit spreads) we see that the current figure has only been exceeded this century outside of the GFC during the dotcom recession and even then not by a huge amount.

The good thing about the high level of yields is that it affords investors a large margin of safety. For example, the current yield of 8.8% means yields can push higher by around 2% over the next year i.e. to nearly 11% without delivering a negative return to investors holding high-yield corporate bonds at the current default rate. This is because the income from the asset class will cover the mark-to-market loss of a 2% rise in yields (going by a roughly duration of 4 in the sector).

The second key dimension of our approach looks at the individual investment vehicles on offer such as bonds, preferreds, CEFs and BDCs. For instance, when underlying asset valuations are attractive and discounts to NAV are large it is more attractive to take exposure via leveraged and discounted vehicles such as CEFs and BDCs and vice-versa.

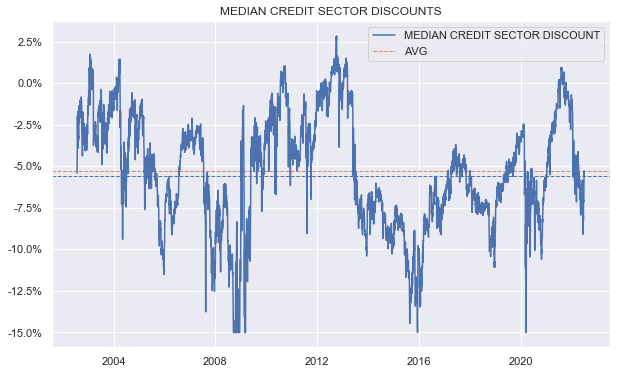

Discounts tend to track the broader market environment so it’s little surprise that they have widened this year. The median CEF credit sector discount stands a bit wider of its median level this century as the following chart shows.

Systematic Income

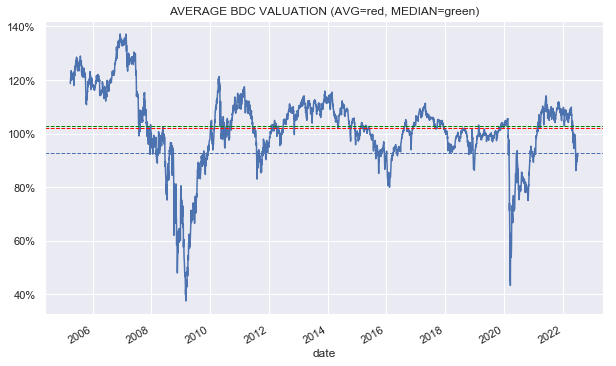

BDC discounts are somewhat more attractive although this is biased lower somewhat by the fact that Q2 NAVs have not yet been released which we expect to be around 2-4% lower. However, this would still put the sector discount wider of its historic average.

Systematic Income

Overall, we find CEFs and BDCs much more attractive to allocate to currently as their discount valuations are on the cheaper side of history, if not as cheap as they were just a couple of weeks ago. The fact that CEFs and BDCs carry leverage is also a positive given underlying asset yields are relatively high as well which allows the leverage to deliver a higher level of yield than it did in 2021.

What We Are Doing

This year we have been increasing our exposure to CEFs and BDCs on the back of wider discounts and higher underlying asset yields.

In the CEF space we like both corporate credit risk as well as household risk.

We continue to like funds like:

- Credit Suisse High Yield Bond Fund (DHY) with a 9.9% yield

- Western Asset Diversified Income Fund (WDI) with a 10.5% yield

- PIMCO Dynamic Income Opportunities Fund (PDO) with a 10.5% yield

In the BDC space we like the following:

- Oaktree Specialty Lending (OCSL) with a 9.8% yield

- Golub Capital BDC (GBDC) with a 9% yield

- Blackstone Secured Lending Fund (BXSL) with a 12.9% yield

This combination of duration-focused CEFs and floating-rate focused BDCs allow us to capture the attractive level of duration risk compensation (via CEFs) as well as the recent rise in short-term rates (via BDCs).

Be the first to comment