SergeYatunin/iStock Editorial via Getty Images

Introduction; Thesis

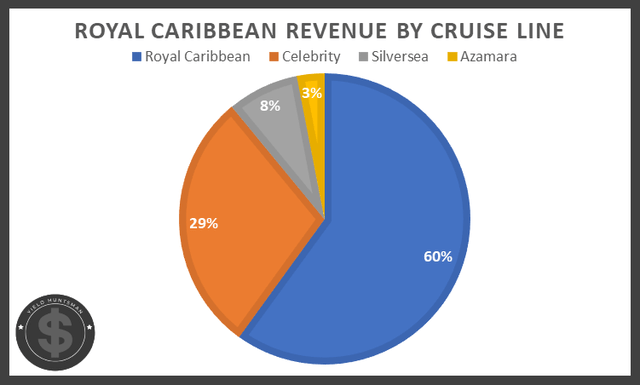

Royal Caribbean Cruises (NYSE:RCL) operates through three primary cruise lines to deliver a multitude of cruising itineraries around the globe. They currently function with 62 passenger ships, including five of the world’s largest, with an additional 11 on order for eventual service. With 54 years of experience in the industry, they have done an excellent job with capitalizing on the potential their ships contain and monetizing passengers to the best of their ability. Their combined 24% share of the global cruising market places them 2nd in passenger capacity and enables them diversification both in terms of cost and available itineraries.

Yield Huntsman and Royal Caribbean Cruises

These lines, at one point, contributed to more than $10B in annual revenue; however, more recently, they generated a mere fifth of what they once did. Reflecting this, share prices fell from all-time highs around $135 to the low $20s, and following a brief recovery, shares are again trading at an extremely low valuation. With ship occupancy rates continually trending higher, a number of operational improvements should aid in driving shareholder returns well above their historic highs. In combination with share prices reaching a significant level of technical support, now is an excellent time to build a position in Royal Caribbean Cruises.

Improving Operations

It is no doubt difficult to look past the financial challenges brought on by the Coronavirus, especially within the cruising industry. Nevertheless, Royal Caribbean boasts improvements to several key metrics that should, eventually, outweigh the difficulties faced throughout much of 2020 and 2021. Empowered by an improving fleet of ships, greater occupancy rates are allowing the company to take advantage of the highest revenue per passenger seen. Add in their ability to adjust prices accordingly, Royal Caribbean should exit the pandemic operationally stronger than ever.

Additional Ships

Since the beginning of 2021, five impressive ships have been added to the, now, 100% operating fleet. Given every market in which they operate, except China, is now open for cruising, Royal Caribbean intends to take full advantage of their ship-building abilities with the planned addition of 10 vessels. These additional ships, including a new “Icon Class” that’s expected to perform alongside their largest ships in terms of size, are intended to add to the now-positive operating cash flow. The continued fleet expansion signals not only the additional demand that the company is facing from vacationers but the certainty among management that such investments are worthwhile.

Greater Load Factors

While not yet at pre-pandemic levels, strong ship occupancy rates are expected to continue rising, even with a larger fleet for passengers to fill. As of the first quarter, ships were operating with approximately 68% of their rooms occupied; this figure was expected to be in the upper 70% range by the time they report Q2 earnings (August 2nd). Despite lower load factors, bookings for this period are looking immensely strong in terms of cruising demand. Chief Executive Officer Jason Liberty had the following to say during the first quarter earnings call:

Bookings improved each week during the first quarter, as the impact from Omicron faded. For the past eight weeks, bookings have been meaningfully higher than 2019 with particular strength in North American itineraries” (Q1 Earnings Call).

Fortunately, Royal Caribbean is not taking for granted this opportunity to heavily monetize additional passengers when, in recent years, they’ve been unable to. In turn, this has yielded record revenue per passenger that should continue when load factors return to normal.

Record Revenues Per Passenger

Making use of both additional ships and larger crowds being brought to their cruise lines, Royal Caribbean has recently recorded its highest-ever revenue per passenger. Versus the same period in 2019, revenue per guest is up 4% and management attributes this feat largely to their newly implemented pre-cruise planning system that incentivizes greater spending before even setting foot on their ships. These customer deposit balances increased by $400 million throughout the first quarter and point to greater spending not only on current voyages but also on future cruises, considering 27% of these credits are eventually dedicated to such expenditures.

Pricing Flexibility

As cruise capacity increases, management is also taking note of their passenger’s willingness to spend while both planning and on their vacations. As you can imagine, ship occupants are relatively limited in terms of purchasing food and basic necessities, and with that, Royal Caribbean is working to maximize their prices accordingly. Especially attractive is their observation that passengers easily accommodate those heightened prices given the cruise environment.

[W]hat we do see is as the consumer begins to gravitate towards higher pricing, as they get calibrated to what they’re paying for a hotel room, or they are paying for other services and restaurants and so forth” (Q1 Earnings Call).

With an increase in passengers that can be accommodated, the ability to further monetize said customers should translate into a future of immense revenue for Royal Caribbean.

Valuation

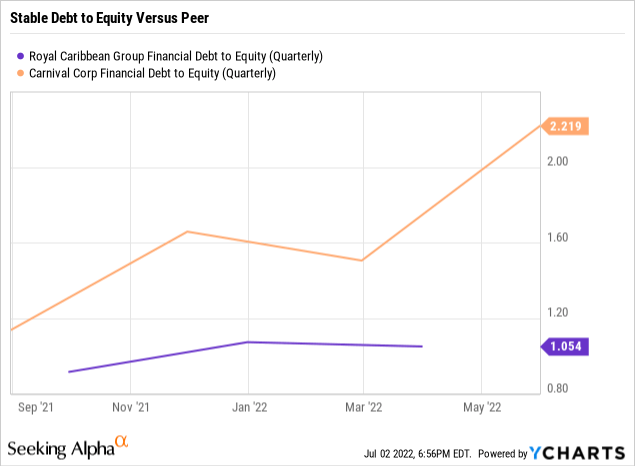

The loss of profitability for Royal Caribbean makes certain valuation methods relatively difficult, especially when accounting for their previously robust earnings. Despite this, management expects profitability for the latter half of 2022 and combined with lessening debt loads and improving operations, the current valuation appears to offer a deep discount to what is possible in the coming months once the balance sheet has mostly recovered. In looking to public comparables to gain an understanding of where Royal Caribbean stands, it seems competitors like Carnival Corporation (CCL) are maintaining high debt levels despite no near-term expectations of profitability. On the other hand, Royal Caribbean has been paying off higher-interest debt thanks to their touted liquidity and refinancing outstanding loans.

Unlike peers, limited leverage is being put to use by Royal Caribbean (demonstrated by a moderate Debt to Equity Ratio) to both sustain and grow operations. Their smaller debt loads are especially attractive in combination with high liquidity that should allow them to weather most additional, short-term, challenges. As Chief Financial Officer Naftali Holtz stated in their first quarter earnings call:

Ending the quarter with $3.8 billion in liquidity. We have ample liquidity to allow us to continue our recovery trajectory” (Q1 Earnings Call).

This robust, and improving, balance sheet should alleviate recent fears that have put immense pressure of the company’s valuation; additionally, measures are being put into place to counter future risks to their recovery.

Risks Moving Forward

Despite the operational improvements highlighted above, the risks which initiated this steep fall in revenue remain to some extent; however, management is fully acknowledging these risks and moving to limit their influence. Beyond the obvious impacts of the Coronavirus, heightened inflation and gas prices still present a moderate level of risk to Royal Caribbean’s return to normalcy. On the former, inflation has caused prices for most foods and employees to increase; however, given the earlier-mentioned pricing power that cruises maintain given their enclosed environments, this risk has been mitigated quite well as prices onboard can comfortably increase in line with inflation. Turning to gas prices, management openly discussed this risk and made mention of what they’re doing to lessen this difficulty:

On the fuel side, we continue to optimize consumption and have partially hedged rate below market prices, which is mitigating the impact on our fuel costs” (Q1 Earnings Call).

In addition to hedging 55% of their fuel expenses for 2022, 8 of their most recent ships are in the range of 30%-35% more fuel-efficient than their predecessors. This trend is set to continue given the planned implementation of liquefied natural gas. This fuel is cheaper than low-sulfur gas used by other ships and also less-wearing on engine components, together, creating a more cost-efficient solution to continued sailing.

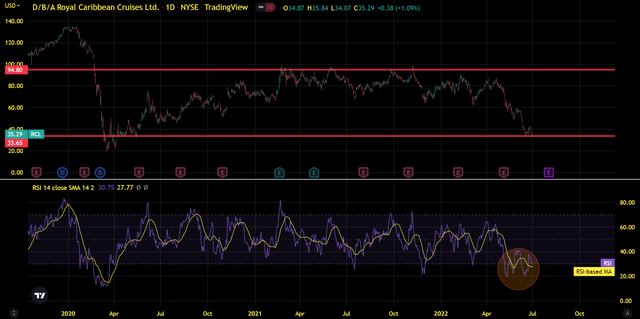

Technical Analysis

As shares trade at prices not seen since cruising was suspended worldwide, the potential for a strong comeback now is far stronger than it was then. Fundamental strength should continue improving in light of the numerous favorable trends. Considering the risks which investors have priced in and the ability for management to adjust accordingly to these potential challenges, the selloff appears to offer an excellent opportunity to build a position as cash flow, and other metrics, turn positive.

Based off a channel that has formed over the past two years, shares appear to be finding support previously established in the $30 region. This, coupled with an entrance into oversold territory according to the Relative Strength Index (RSI), points to a promising short term rebound in share prices. As this short-term rebound occurs, there’s a strong likelihood that the expected improvement in fundamentals continues these gains, perhaps to levels achieved in 2021.

Final Thoughts

Fearing whether Royal Caribbean had a viable plan to overcome additional challenges in both the near and long-term future, share prices now trade very close to where they were during the Covid-induced crash of 2020. Despite these fears, numerous catalysts have placed Royal Caribbean on an excellent trajectory for both their recovery and future growth. In order to take advantage of these promising trends, especially as technical factors look to ignite a short-term increase in share prices, now appears to be an excellent time to build a position prior to this immense value being realized.

Be the first to comment