Robert Way/iStock Editorial via Getty Images

A fear-induced drop is highly anticipated as the global economy is expected to slow down this year. While things seem uncertain, looking for a well positioned company that can weather out the anticipated recession like Capri Holdings Limited (NYSE:CPRI) will provide investors and traders with good reward opportunities in today’s economic status.

Capri Holdings is a global luxury fashion company with a portfolio of brands that includes Versace, Jimmy Choo, and Michael Kors. Their products cover most of the ‘fashionista’ needs, starting from luxury footwear, handbags, jewelries, perfumes, and innovative ready-to-wear accessories such as smart watches, etc.

Capri Holdings Limited has been able to grow its net income at a CAGR of 14.82% over the last 3 years by controlling its margins well. This is impressive considering today’s economic headwinds, especially compared to its peers. CPRI also has a better balance sheet than its pre-pandemic level, making it well positioned in the anticipated global recession.

The company has currently dropped 43% from this year’s high, offering a better margin of safety. According to my DCF analysis, Capri Holdings should trade at an average price of $68ish, making it an attractive stock at today’s price.

Company Background

CPRI was founded in 1981 and continues to show resilience as it combats headwinds from supply shortages, which snowballed into rising inflation and today’s conflict between Russia and Ukraine. Despite such headwinds, CPRI generated a record gross margin of 65.94% in FY2022. This is thanks to the company’s effective store optimization program which forced several store closures, as well as the efforts to reduce operating hours, inducing cost savings.

According to the management, they successfully closed a total of 167 out of its planned 170 retail stores and incurred impairment charges amounting to $14 million as of FY2022. Hence, there is a probability that we might see a continued decline in its impairment charges in its future financial report.

CPRI’s FY2023 will be interesting as the management resumed their major multi-year ERP upgrade and expects a portion of the system to go live in their Q1 2023. A brief background on the company’s ongoing information technology upgrade: this was postponed during the peak of the pandemic in order to preserve their liquidity. Additionally, they are raising their CAPEX budget for FY2023 to $300 million, which comprises store openings, IT upgrades, including enhancement of their digital platforms.

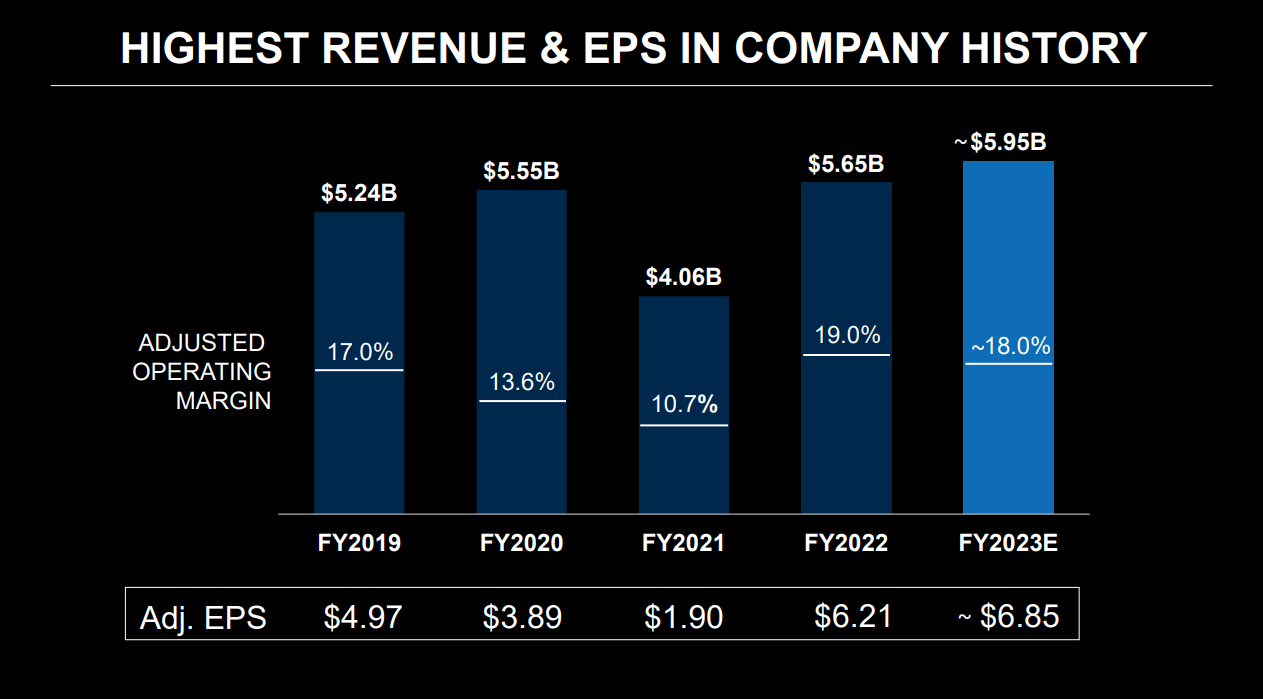

Although the management cut its top line outlook in FY2023 amounting to $5.95 billion, compared to the $6.1 billion announced on their Q3 2022 report, this will still produce a positive growth for the company compared to its $4.06 billion in FY2021, $5.55 billion in FY2020 and $5.23 billion in FY2019. Considering the management’s anticipated double-digit growth in its diluted EPS of $6.85 for FY2023 and its strong share buyback catalyst with its $1 billion share buyback authorization, CPRI remains an investable stock.

In my opinion, CPRI is attractive with its controlled margins and its confident management. It is also on the right track with its growing digital presence, making it a good buy ahead of its store openings catalyst.

Path Towards its $7 Billion Top Line and ~20% Operating Margin

One of the interesting catalysts of CPRI is its long-term target by the management as quoted below.

…The power of Versace, Jimmy Choo and Michael Kors as well as the proven resilience of the luxury market reinforce our optimism for the future and our ability to achieve $7 billion in revenue and a 20% operating margin over time. Source: Q4 2022 Earnings Call Transcript

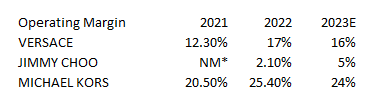

CPRI: Improving Margin (Source: Company Filings, Prepared by InvestOhTrader, *At Loss)

With its current performance, as shown in the image above, where all of its segment’s operating margin expanded at today’s market sentiment and considering its ongoing improvement in its technology systems, I believe a 20% operating margin overtime is highly achievable, especially considering its improving outlook for FY2023 to be around 18% better than its current 17.76% performance.

CPRI managed to increase its customer database by 11.5 million new customers this FY2022 and with its $300 million CAPEX budget catalyst for FY2023 in place, I believe there will be new stores opening which may support its long term $7 billion revenue target.

A Less Risky Bet

Considering the current supply chain issues enhanced by the pandemic, it is surprising to see an improving cash conversion cycle of 101 days in FY2022, better than 116 days in FY2021 and 108 days in FY2020.

CPRI managed to deleverage and generate an improving figure in its long term debt amounting to $1,131 million, better than $1,220 million in FY2021 and $2,012 million in FY2020. This figure translated to an improving debt to equity ratio of 1.19x, better than 1.6x in FY2021 and 2.02x in FY2020.

In today’s rising rate environment, the management successfully hedges its interest obligations and expects a net interest income of approximately $9 million in the next fiscal year. With its improving profitability and liquid balance sheet, where its long term debt of $1,131 million is comprised of $497 million related to its 2018 Term Loan Facility, which matures in 2023, and $450 million in Senior Notes due in 2024, I believe the company maintains a liquid balance sheet that can weather out the anticipated recession.

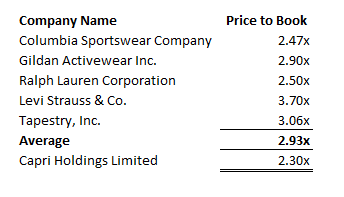

Investigating its trailing P/B ratio of 2.30x compared to its 5 year average of 3.09x, we can see that CPRI is getting more fundamentally attractive as its price drops, and in my opinion, it will get more attractive at its potential fear induced drop.

CPRI: Undervalued Vs Peers (Source: Data from SeekingAlpha.com. Prepared by InvestOhTrader)

Columbia Sportswear Company (COLM), Gildan Activewear (GIL), Ralph Lauren Corporation (RL), Levi Strauss & Co. (LEVI), Tapestry, Inc. (TPR).

Putting its peers’ P/B ratio into consideration as shown in the image above, we can safely assume that CPRI is one of the undervalued bets as of this writing.

Getting Cheaper and Cheaper

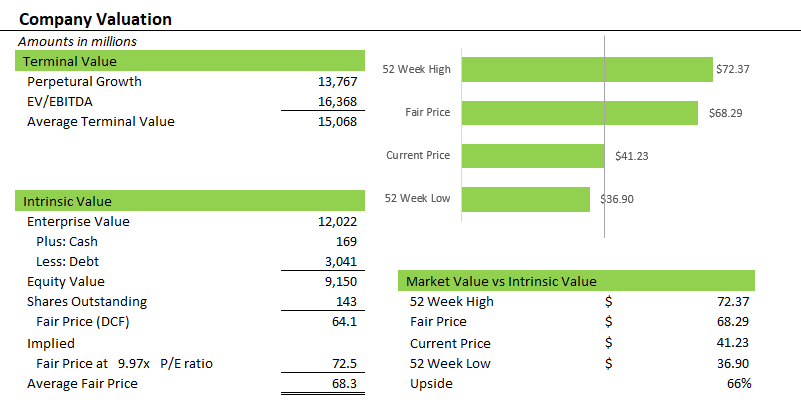

CPRI: Company Valuation (Source: Prepared by InvestOhTrader)

Capri Holdings is getting cheaper again compared to its intrinsic value of around $68, derived from the average of simple relative valuation and DCF model. Looking at its trailing P/CF ratio of 8.36x compared to its forward P/CF ratio of 5.24x, it tells investors and traders that the company’s cash flow is improving, which is important especially in today’s uncertainties.

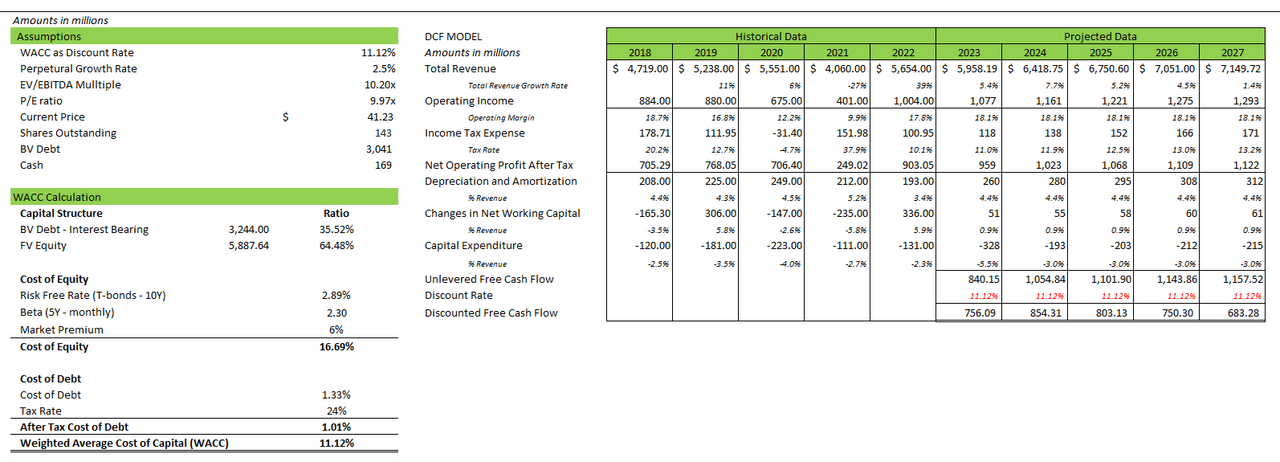

CPRI: DCF Model (Source: Prepared by InvestOhTrader)

I used an analyst estimate to complete my DCF model. I assumed a flat 18.1% operating margin all throughout the model. Additionally, I used the management’s forecasted figure on its effective tax rate and CAPEX budget for FY2023. Lastly, I calculated CPRI’s weighted average cost of capital and used it as my discount rate to arrive at a conservative intrinsic value.

Risk Note

Although CPRI remains cheap, future demand might be heavily affected as inflation eats up consumers’ disposable income. Hence, this might add up to the uncertainties from COVID-19 and the war in Ukraine, as quoted below.

Additionally, we now expect the expanded COVID-related restrictions in China will negatively impact revenue by approximately $50 million. As a reminder, our guidance previously incorporated the impact of the war in Ukraine, which we estimated represented approximately $100 million in fiscal ’23. Source: Q4 2022

On the bright side, although there is a slowdown in consumer spending, I believe a positive outlook on US employment for 2022 and 2023 may support future spending. A miss on its top line revenue consensus estimate may indicate demand weakness that investors and traders should monitor.

Sitting Near Support

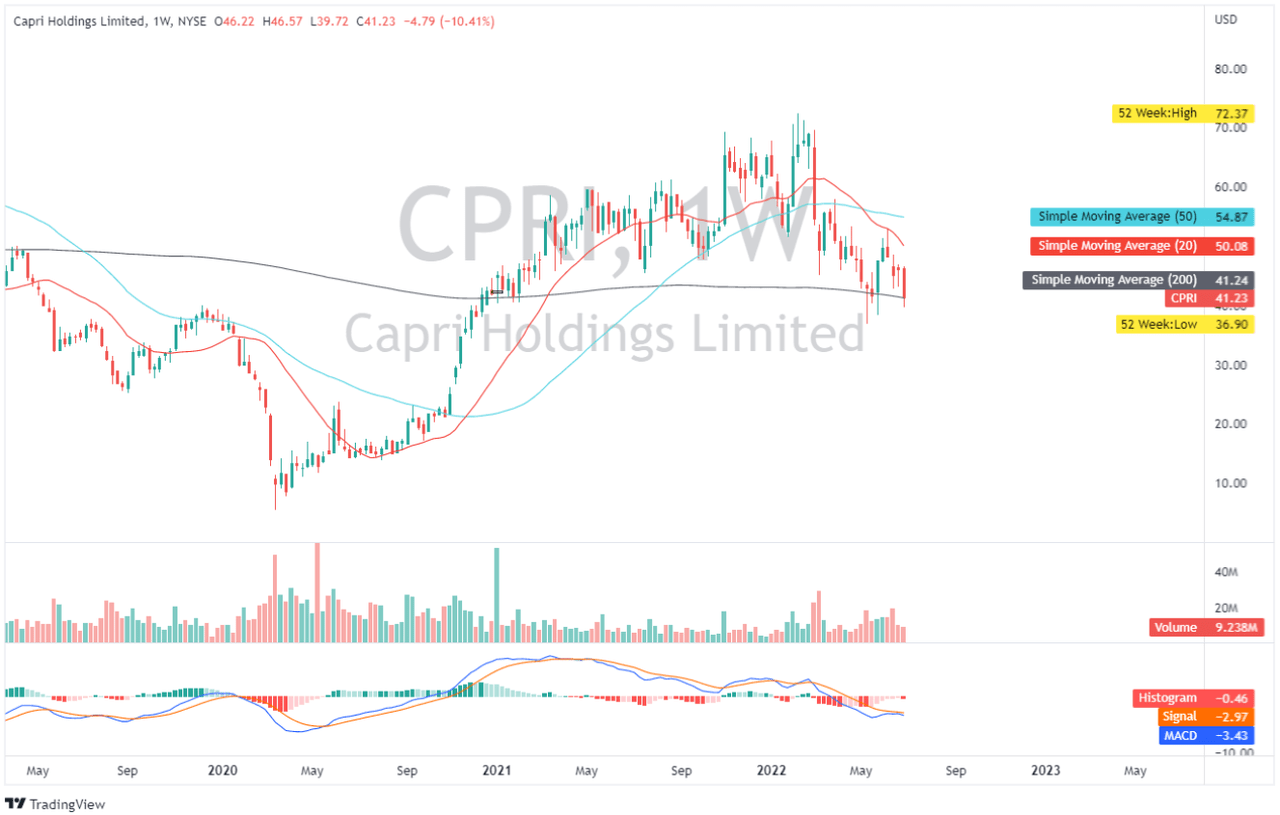

CPRI: Weekly Chart (Source: TradingView.com)

Looking at the chart above, we can see that CPRI is currently sitting at its 200 day simple moving average. I believe the $36 to $41 zone is a strong support to monitor. If it does not hold, we might see it react around $30 support. Looking at its MACD indicator, it remains below zero, indicating bearish sentiment. However, a potential bullish crossover may induce a short-term bullish move.

Conclusive Thoughts

On top of its controlled margin and exciting long-term top line outlook from management, CPRI now benefits from its digital presence and its e-commerce operation actually contributes 17% of its net revenue aligned with today’s digitalization.

CPRI Keeps Improving With Its Record Top Line and Adj. EPS (Source: Q4 2022 Investor Presentation)

With its stable demand outlook, improving profitability, better balance sheet, and strong buyback catalyst, I believe CPRI is worth buying during its weak quarters ahead of its H2 2023.

Thank you for reading!

Be the first to comment