simonkr/E+ via Getty Images

All of our previous articles on Sibanye Stillwater (NYSE:SBSW) discussed investment positions for those seeking long or short position. Although we did include a parsimonious price-level analysis, this article intends to discuss Sibanye’s pivot into foreign mining projects and its lithium aspirations.

Sibanye-Stillwater has opted to exercise its pre-emptive option and boost its stake in a Finnish lithium project. The option includes an increase to a 50% holding in Keliber at the cost of approximately $152 million.

Furthermore, Sibanye could also offer to buy minority shareholders out for roughly $466 million. Keliber aims to be the first fully operational lithium producer in Europe with a targeted output of 15 000 metric tons/year by 2024.

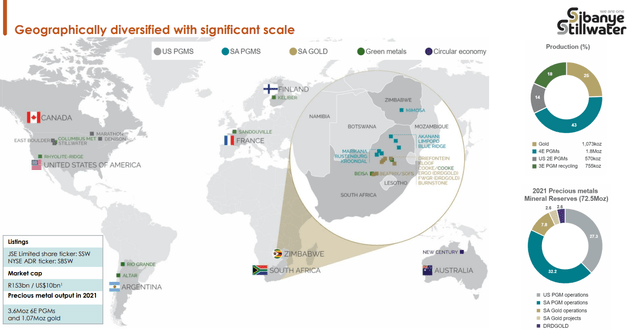

This move is another sign of Sibanye’s attempt to diversify its global portfolio and be less concentrated on its South African mining projects, which could add much efficiency to the company; here’s why.

Going Green With Lithium

Sibanye’s expansion into lithium is another indication of the company’s strive toward being a key player in the renewable energy space. The firm’s platinum group metals portfolio is expanding rapidly, which could already provide it with a stronghold in the renewable upstream space. However, a move into lithium would seal the deal.

The company’s Keliber acquisition isn’t Sibanye’s only lithium interest. In fact, the South African mining house is developing the Rhyolite Ridge lithium-boron project in the US. The Rhyolite Ridge project is a joint venture with ioneer Ltd., with many claiming that it could be the largest lithium mining operation in the world.

Sibanye-Stillwater

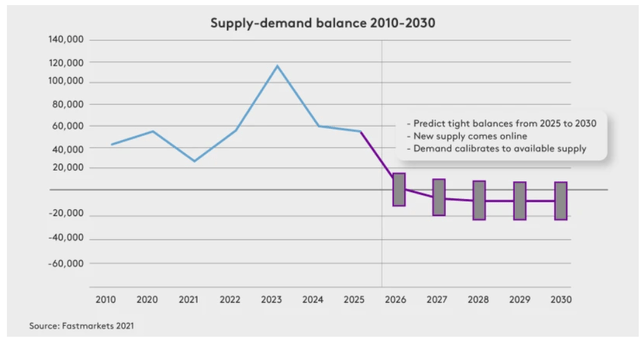

Sibanye’s role in global lithium could be pivotal. According to Fast Markets, we’ll likely run at a supply surplus. However, the tides might shift in 2025 as battery-powered energy uptake grows exponentially. In essence, it’s forecasted that the development of lithium mines will happen slower than what people are predicted to utilize battery-powered energy.

Fast Markets

South African Concerns

It’s well-known by now that Sibanye-Stillwater’s CEO, Neal Froneman is sceptical on the future of the South African mining industry. Although Froneman rates South Africa’s mines highly, he believes that the political climate within the nation isn’t conducive to developing successful precious metal assets.

Furthermore, Sibanye’s looking to offload two of its flagship goldmines, namely Beatrix and Kloof, which is an indicator of the firm’s possible extraction from the nation. Although Sibanye’s platinum group metals (PGM) division in South Africa is robust, Sibanye mines 20% to 25% of its PGM materials in the United States, and the firm may seek to gear more towards foreign assets in the future.

We think there’s no way Sibanye will let go of its Marikana mine in South Africa, but the company will likely seek new pastures for much of its other operations in South Africa.

Sibanye’s gradual diversification away from South Africa could be a positive for its shareholders as operational challenges in South Africa are becoming rife. For instance, the country’s struggling with an ongoing energy crisis, limiting Sibanye’s energy supply and eroding its income statement with cost concerns. In addition, the country’s risk of civil unrest is at an all-time high, with Lloyds increasing South Africa’s state re-insurance (Sasria) rate by 1000% in April this year. Lastly, Labor Unions are becoming a persistent concern for Sibanye, with its Gold and PGM miners striking twice in the past three years, causing operational disruptions.

For those who’re interested, below is a video of Paul Miller discussing challenges in the South Africa’s mining industry.

The strange death of the SA mining industry | Paul Miller – YouTube

Taking a look at Sibanye’s price level

Sibanye stock is undervalued and pays solid dividends. At a price-to-earnings ratio of 3.47x (72.50% below the sector median), a price-to-sales of 0.66x, and a dividend yield of 12.83%, there’s no doubt that Sibanye stock provides the potential for both capital appreciation and income-based gains.

The one valuation risk worth noting is a trade-off between intrinsic value and dividend payments. Sibanye will likely never reach its relative valuation threshold as it pays out nearly half its earnings in cash dividends (48.22%), eroding investors’ residual value.

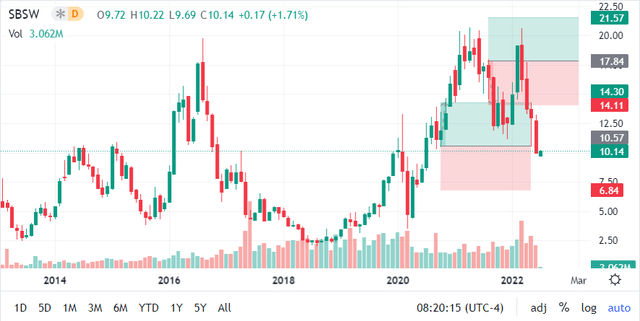

Nonetheless, after a nearly 40% year-over-year drawdown, a value gap may be in play.

| Price-to-Earnings | 3.47x |

| Price-to-Sales | 0.66x |

| Dividend Yield (fwd) | 12.78% |

Source: Seeking Alpha

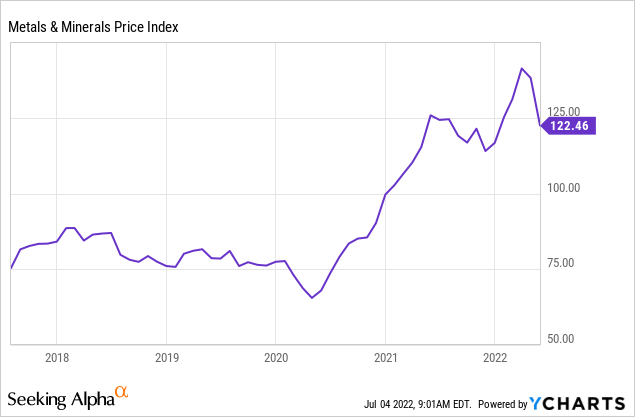

Although technical analysis doesn’t tell us much in isolation, it can be helpful to discover price level when combined with fundamental analysis. Considering Sibanye’s relative valuation metrics, its recent sell-off, and the resilience of commodity prices, there’s a chance that it could rebound soon.

As I drew on the chart, Sibanye stock has a support level at just over $10.14 with a resistance level at around the $17.80 level.

Seeking Alpha; TradingView

Concluding Thoughts

Sibanye’s latest lithium expansion indicates the company’s pivot into a horizontally integrated renewable energy model. Another key takeaway is the company’s attempt to escape its heavy reliance on the South African mining space.

Sibanye’s diversification strategy could benefit its overall business model as it would de-risk its business model and allow it to garner a large portion of the renewable supply-side market share.

Lastly, relative valuation and technical analysis metrics suggest that Sibanye stock is undervalued. However, please beware of the dividend payout and valuation trade-off, which could cause its valuation metrics to be misinterpreted.

Be the first to comment