Suphachai Panyacharoen/iStock via Getty Images

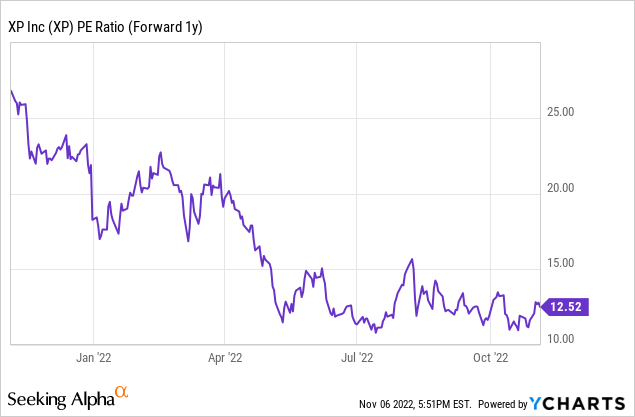

Leading Brazilian technology-driven brokerage platform XP Inc (NASDAQ:XP) released a mixed quarterly KPI update ahead of the upcoming earnings release. At this point in the rate cycle, it was perhaps unsurprising that net inflows have begun to cool sequentially even as overall assets under custody ((AuC)) trended higher. The key positive from the release, however, was XP’s additional product lines, such as pensions, cards, and credit, all of which grew strongly despite the macro headwinds. Building a more ‘sticky’ suite of offerings for its client base is key, as it paves the way for margin-accretive gains of wallet share over time. Backed by a significant excess capital position, XP remains a best-in-class investment platform in Brazil positioned to navigate the worst of the rate hike cycle. With the election overhang also lifted, XP offers investors a compelling play on a market upturn at an undemanding low-teens P/E valuation.

XP’s Latest KPI Update Is A Mixed Bag

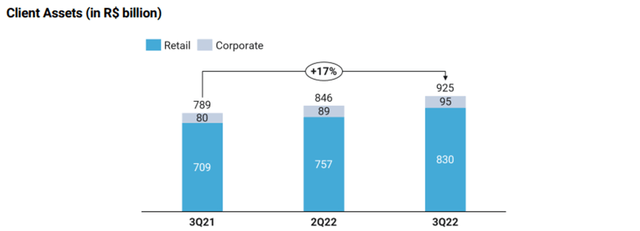

Heading into Q3, investor concerns around revenue yield pressure and an AuC growth slowdown were top of mind. After all, we are in the midst of an accelerated rate hike cycle, which typically entails a rebalancing of flows toward fixed-income products over equities. Yet, XP defied the macro headwinds this time around on the AuC front, with assets growing 17% YoY (or 9% QoQ) to R$925bn in September. Of note, the asset growth even outpaced active client additions, which were up 15% YoY at an impressive 3.8m this quarter.

XP Inc

Supporting the AuC growth was ~R$43bn in market appreciation, and R$35bn in net new money (NNM) flows. Of the R$35bn net inflows, the vast majority (R$32bn) was from retail and R$3bn from corporate flows. The overall metric represented a deceleration from the R$43bn in the prior quarter, however, with retail leading the slowdown at an R$8bn negative delta relative to Q2. Still, XP’s long-term value proposition as a differentiated distribution channel capable of taking share from retail banks remains intact; this should shine through as the macro headwinds eventually fade.

Growing Traction In Banking And Additional Products

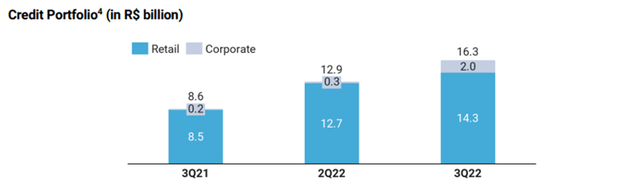

The biggest surprise from the KPI update, though, was the strong growth in XP’s banking vertical. In particular, the rise in the credit portfolio balance to R$16bn or 1.76% of AuC (+88% YoY) was a key positive. The growth was achieved without sacrificing asset quality as well – NPLs remain at 0%, and portfolio duration stands at a very healthy 3.2 years. Of note, the overall mix is benefiting from a higher corporate portfolio share at R$2bn this quarter (up from R$300m in Q2).

XP Inc

Elsewhere, pension AuC came in strongly at R$58bn. XP’s proprietary pension business AuC was the key contributor at R$39bn, adding R$4bn (or +7% QoQ) for the quarter. Card payment volumes also stood out, rising an impressive +103% YoY to R$6.6bn. While this was a deceleration from the +160% in Q2, another quarter of triple-digit % growth indicates outsized client penetration of the product. Coupled with the recently launched digital account, growing traction here bodes well for the long-term outlook. These products not only expand the suite of monetizable offerings within the XP ecosystem, but also move the company another step closer to establishing a ‘sticky’ one-stop platform for retail flows.

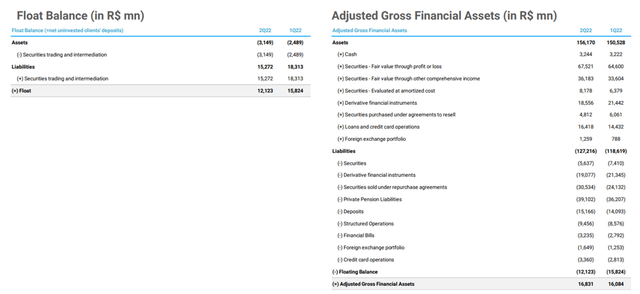

Optionality From The Excess Capital Position

Having consistently delivered profits and completed one round of capital raising (~R$1.5bn in November 2020), XP’s excess capital position has increased significantly in recent years. Some of the proceeds have been allocated to reinvestments (mainly internal financial advisors) and acquisitions, but the vast majority remains on the balance sheet. As a result, gross financial assets stand at a massive R$16.8bn. Relative to its equity, XP’s total assets (ex-securities trading) provide more than adequate coverage, placing leverage well below even the incumbent banks.

XP Inc

Yet, XP has reiterated that it will not be distributing its excess capital anytime soon. Per management, the focus is on maintaining an adequate buffer against the macro uncertainty, along with M&A optionality (both growth acquisitions and buying back Itau’s (ITUB) stake in XP). While this seems prudent, the hesitance to return capital has created a perception issue – the flip side of more capital and more resilience is lower ROEs and, thus, lower valuations. There is a clear path to regaining the valuation premium typically assigned to an asset-light business model, though, and I expect management will be more open to paying dividends as the macro headwinds ease.

Look Past The Near-Term Volatility

Overall, XP’s operating data for Q3 2022 was a mixed bag. On the one hand, soft quarterly inflows could weigh on the retail revenue yield for the quarter. Yet, the continued growth in total AuC is impressive, even though recent market appreciation has helped. The growing traction across XP’s new business verticals like credit and pensions, which have been consuming investments, also bodes well for incremental growth opportunities in the coming years.

In the meantime, the excess capital position offers downside protection, and even if management is holding off on dividends in light of an uncertain macro backdrop, the capital return optionality is valuable. Yet, the market is skeptical, and XP is now trading at a steep discount to historical levels and its long-term earnings growth potential. Given the prospect of a post-election upturn in market activity as well, the stock looks compelling at the current low-teens P/E.

Be the first to comment