Zach Gibson/Getty Images News

Dominion Energy (NYSE:D) stock slumped 3% on November 4 even as the company reported better than expected earnings for the third quarter of 2022.

Dominion Energy’s Q3 Results

The Virginia-based company reported adjusted earnings of $1.11 per share, from revenue of $4.39 billion. This compares with the consensus forecast for non-GAAP earnings of $1.08 per share and revenue of $3.98 billion.

Meanwhile, last year’s third quarter saw adjusted earnings of $1.11 per share and revenue of $3.18 billion.

Looking forward to the next quarter, management expects similar earnings for Q4 2022, with operating earnings expected to fall between $0.98 to $1.13 per share. This is somewhat higher than the consensus analysts’ forecast of $1.07 per share.

Management also narrowed its 2022 full year operating earnings guidance range to $4.03 to $4.18 per share, from a range of $3.95 to $4.25 previously – and against the consensus forecast of $4.11.

All in all, this seemed like a pretty solid set of results, with updated guidance for the next quarter in-line with, or slightly above, previous targets and analysts’ expectations.

Business Review Announced

Disappointing news, however, came from a warning that macroeconomic challenges, together with increased investment needs, could affect the company’s ability to deliver on its medium term targets.

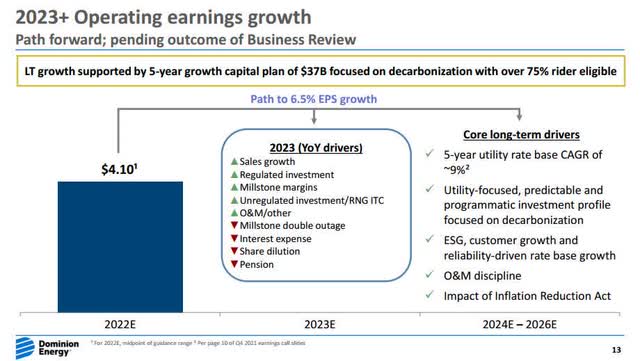

Management announced a “top-to-bottom business review” with the goal of ensuring that Dominion Energy continues to be best positioned to create significant long term value for shareholders. And in the absence of a new capital allocation strategy, the company could miss its 6.5% medium term EPS growth target.

Dominion Energy Q3 Earnings Presentation

For 2023, we see paths to achieving our existing targets, as we expect we could overcome the macroeconomic challenges with increased unregulated investment activities and other initiatives.

However, these non-regulated earnings drivers, among other parts of our business, are subject to the review we announced this morning. So I would caution that outcomes consistent with our existing guidance are only achievable in a status quo result to our review.”

Chief Executive Officer Bob Blue, Dominion Energy Q3 2022 Earnings Call

The company has as yet provided scant details on what actions it is planning on, but confirmed that it remained committed to its current regulated business profile. Management also added that it was not looking at any proposals that would affect the dividend. Aside from that, we can only wait for further details, which the company expects to provide from early 2023.

Regulated Assets

A further alignment to state regulated assets could make sense. Dominion Energy’s capital spending pipeline is growing at its fastest pace ever, with the utility giant planning to spend some $37 billion in growth capex between 2022 and 2026. Investments in zero carbon electricity generation, energy storage, electricity transmission and gas distribution have resulted in a spending spree which transitions Dominion Energy further towards clean energy and state-regulated assets.

Dominion Energy Q3 Earnings Presentation

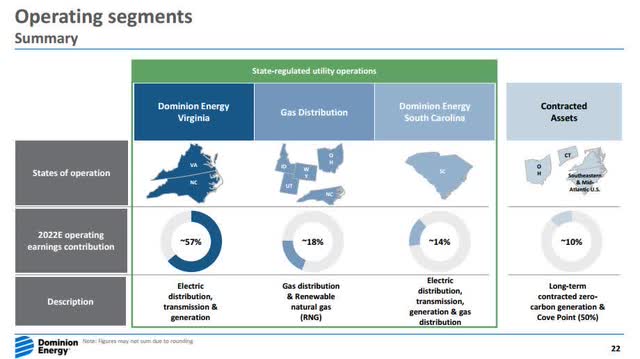

State regulated utility operations now contribute 90% of its operating earnings, up from 65% from 2018. The remaining 10% comes from contracted assets, which includes its 50% stake in the Cove Point LNG terminal, which is currently operated by Berkshire Hathaway Energy’s BHE GT&S subsidiary.

Dominion Energy is a natural monopoly in much of what it provides, with no effective competition. A focus on regulated operations should therefore translate into predictable revenues and low borrowing costs. Lower business risks, including reduced exposure to commodity prices, are in turn expected to underpin attractive risk-adjusted shareholder returns.

It could put Dominion Energy in a unique position to potentially enjoy faster growth ahead too, due to long-term secular growth drivers, including rising EV adoption, data center demand growth and accelerating decarbonisation efforts. Dominion Energy’s rate base is forecast to grow by around 9% per annum over the next five years – somewhat higher than its EPS growth target.

Double-edged Sword

The regulatory environment can be a double-edged sword, though, as the company needs to work closely with regulators to approve rates that it can charge to consumers – this ultimately determines what they can earn.

Regulators are obliged to strike a balance between keeping consumer rates affordable and adequately attracting enough private capital to sufficiently finance capital spending required to meet infrastructure needs.

We can see this at play with Dominion Energy’s regulated offshore wind farm off the coat of Virginia. The state regulator has been insisting on a performance guarantee for the CVOW project, which would force Dominion to fund the cost of replacement power if output from the wind farm falls below its expected 42% net capacity factor, as measured on a three year rolling average.

Dominion has said that insisting on the guarantee will prevent the project from moving forward, as it may not fairly account for unusual weather patterns or events. In a proposed settlement agreement, filed on October 28, it has sought to replace this guarantee with a cost sharing approach that would see the company share responsibility on cost overruns from its construction.

It is now up to the Virginia SCC to decide whether to approve this settlement. But whatever the result, it’s clear that Dominion Energy’s fortunes aren’t entirely under its own control.

Valuations

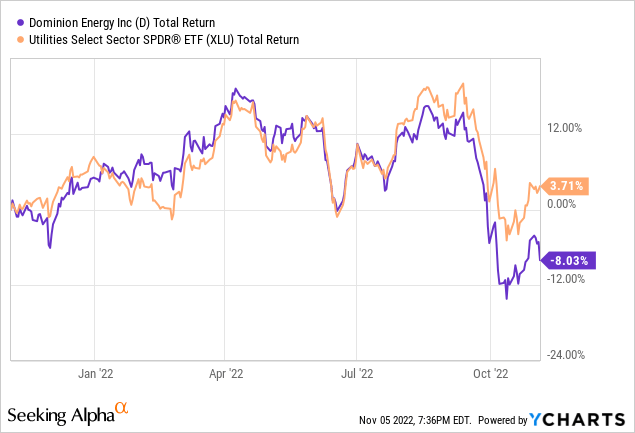

Uncertainty surrounding the CVOW project has played its part in Dominion Energy’s recent stock price underperformance. Investors now also need to contend with additional risks coming from its upcoming business review.

Up until around September, its stock performance over the past year has largely tracked the rest of the utilities sector. Dominion Energy has since diverged from sector peers, with a total return of -8.0% over the past 52 weeks, compared to +3.7% for the sector.

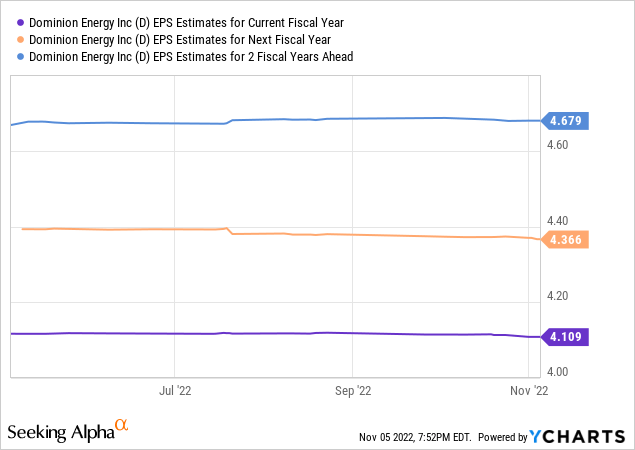

But earnings expectations have barely budged. The consensus EPS forecast for the current financial year has fallen by just 0.2% over the past 6 months to $4.11, while the figure for 2023 is down 0.7% to $4.37. Meanwhile, EPS for 2024 has been revised upwards by 0.1% to $4.68.

Dominion Energy now trades at a noticeable discount to the sector, with a forward P/E of 16.3 and a dividend yield of 4.0%. This compares favorably to the sector average forward P/E of 18.8 and average dividend yield of 3.0%.

Final Thoughts

Despite regulatory and macroeconomic risks in the medium term, I reckon Dominion Energy is attractively positioned to benefit from changing energy trends. The shift towards regulated infrastructure assets, particularly electricity transmission and generation, is expected to benefit its long term earnings outlook, as well as improve revenue reliability.

Be the first to comment