Eoneren

Harmonic Inc. is music to my ears – and portfolio

Shares of Harmonic Inc. (NASDAQ:HLIT), a video, broadband, and media transformation company offering “smarter, faster, simpler solutions,” are up 5% over the last month. Year-to-date, the stock is +16%. Offering broadcast TV and video streaming services, Harmonic’s software-as-a-service (SaaS) solutions, tech support, and other diversified offerings have allowed this company to gain market share and momentum. After a record positive earnings of 30% for the third quarter, Harmonic is capitalizing on intelligent connectivity and cloud-native solutions, accelerating the communications industry through digital transformation.

Harmonic Inc.

-

Market Capitalization: $1.51B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/3): 8 out of 648

-

Quant Industry Ranking (as of 11/3): 3 out of 51

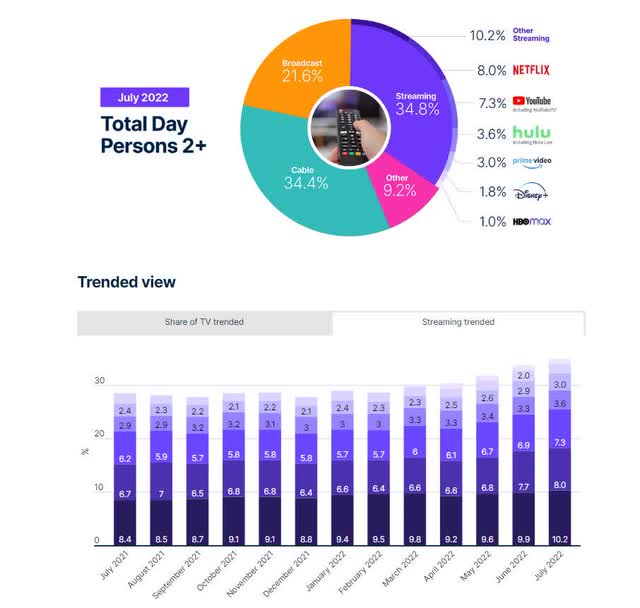

Streaming services have become the dominant form of U.S. TV viewing, according to a July 2022 Nielsen report. Capturing larger audiences amid the pandemic lockdown, which remain committed to streaming, an average of 190.9B minutes of streamed content per week has allowed companies like Harmonic to expand globally via cloud-based platforms.

Streaming As Dominant TV Viewing (Nielsen Report)

With more than 5,000 media companies and more than 20 worldwide offices, HLIT offers next-generation technologies for customers and has experienced tremendous growth over the last year.

HLIT Growth and Profitability

Offering an excellent record of positive earnings, which include ten consecutive top-and-bottom-line earnings beats, Harmonic Inc. reported its latest Q3 EPS of $0.13 vs. the consensus estimate of $0.10 on Oct. 31, 2022, and revenue of $155.74M (+23.3% Y/Y) beat by $2.47M. HLIT has expanded its customer footprint in Latin America, EMEA, and APAC, driven by the demand for high-profile live sporting events. With Latin America primed as one of the fastest-growing streaming markets, Harmonic’s tech solutions have teamed with DirecTV GO and companies like General Communication Inc. (GCI) to deliver ultra-fast services. DirecTV GO recently announced expanded streaming through Harmonic in Latin America.

“Latin America is the second fastest-growing streaming market in the world, and we’re excited to help DirecTV GO unlock the power of the cloud while delivering video content to more screens. As DirecTV GO expands its streaming service, our cloud SaaS platform will enable linear channel delivery reliably and at scale, ensuring the best linear experience for subscribers,” said Diego Scillama, VP of Video Sales and Services, Latin America, at Harmonic.

HLIT Growth Grade (Seeking Alpha Premium)

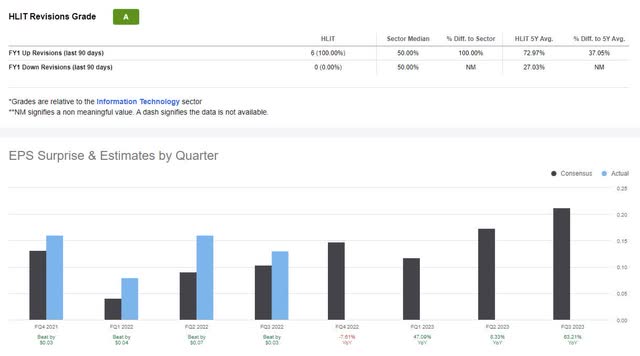

Harmonic’s video segment revenue was responsible for 20% growth, with its underlying SaaS +69% year-over-year. Its Cable Access segment produced $81.2M in revenue, +62% YoY, and there was a 60% increase in the Broadband division and a 64% increase in Video SaaS. The results led to a rise in full-year 2022 EBITDA guidance and six analyst FY1 Upward revisions over the last 90 days.

HLIT EPS & Revisions Grade (Seeking Alpha Premium)

Positive results have led Harmonic to a multi-year video-segment strategy involving more live sports streaming, whose transformation forecasts more than 45% SaaS revenue growth compounded annually through 2025. Customers’ desires for increased internet speeds and connectivity have also led to HLIT expanding its fiber business on the heels of over $10M of fiber solution orders.

“We’re increasingly convinced that our fiber and converged cable plus fiber solutions are winners. The fiber represents a significant addressed market expansion opportunity, and then fiber will be a key contributor to our longer-range market leadership and growth. Looking ahead to the remainder of 2022 and beyond, we remain confident that our broadband access business is uniquely positioned for sustained growth. We have a very strong backlog, great customer relationships, technology, and service capabilities that are truly unique in the market, and we’re investing and working hard to stay out in front.” –Patrick Harshman, Harmonic Inc. President & CEO.

Harmonic is meeting consumer demand and staying at the forefront of the market. Operating margins have reached five-year highs, gross margins are up 50.9%, and its sales pipeline is strong through broadening its network to larger media accounts. With continued strong cash flows, Harmonic has a solid outlook with bullish momentum and comes at a relatively discounted valuation.

Harmonic Inc. Valuation and Momentum

On a longer-term bullish trend, with shares 36.4% above its 200-day moving average, HLIT’s share price has been on an uptrend. Over the last year, the stock is +32%, showcasing substantial quarterly outperformance of its sector peers.

HLIT Momentum (Seeking Alpha Premium)

A+ momentum speaks volumes about this stock, complementing its not so discounted D valuation. Although its trailing PEG of 0.08x showcases a -84.32% difference to the sector, most of its other underlying valuation metrics indicate the stock is overvalued, so some prudence is required when investing in this stock at its current price.

HLIT may not be in the top tier of communication equipment companies in terms of valuation, but taking into account its collective traits, which include A+ momentum, and A’s for EPS Revisions and Growth, this stock is one to consider for a portfolio.

Conclusion

Harmonic Inc. is on an uptrend and continues to crush earnings, with 10 consecutive top-and-bottom-line earnings beats, offering growth and sustainability. Through its network, HLIT is expanding its technologies and partnering with some of the biggest names, like DirecTV, to deploy media, entertainment, and live sports. These strategic business decisions are capturing market share, allowing Harmonic to scale and grow.

There are many Top Technology Stocks, with few as dynamic with their in-depth video streaming solutions and offering technical assistance regarding the cloud, SaaS, and IP workflows. Although we’ve seen a contraction in the market, HLIT’s success has not wavered and maintains strong demand, pricing competition, and excellent profitability. Cloud technologies are the future of streaming services and broadband solutions. Harmonic Inc. is expanding how people stream, work and play through seamless integration. With a strong outlook and guidance, consider Harmonic Inc. for your portfolio.

Be the first to comment