Michael M. Santiago/Getty Images News

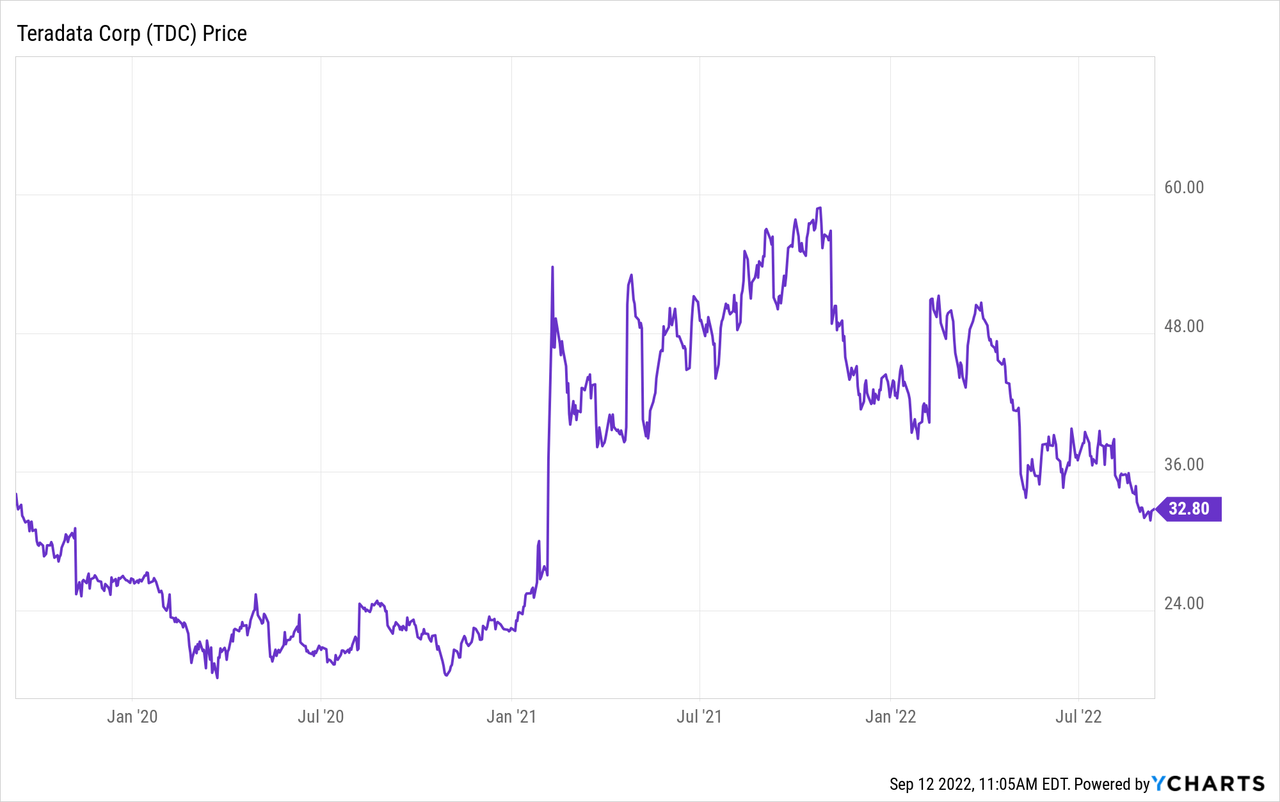

The stock of Teradata (NYSE:NYSE:TDC) is up 40% since my initial coverage on Seeking Alpha in late 2020 (see TDC: The Stock May Have Bottomed Out). However, the stock is down 35% over the past year due to a couple of very weak quarters that were negatively impacted by Putin’s horrific war-of-choice on Ukraine (and TDC’s exit from Russia) and foreign-exchange headwinds due to the strong US dollar. However, the severe drop in the stock price offers investors an attractive entry point in my opinion. I say that because TDC should generate ~$400 million in free cash flow this year (and next), and with an EV of only $3.38 billion, that equates to an FCF yield of 11%+. Teradata is a BUY.

Investment Thesis

As I have been reporting on Seeking Alpha, TDC pivoted to a SaaS-based annual recurring revenue (“ARR”) business model a few years back by providing leading-edge data analytics via its Vantage Platform across the “big three” public cloud providers (AWS, Azure, and GCP). That being the case, the company should be able to leverage that model to deliver increased margin and free cash flow, assuming it can continue to provide excellent data analytics and customer service in order to scale up the platform.

However, two weak quarterly reports in a row have pushed the stock down some 35% over the past year and have practically cut it in half since the high near $60 was put in back in late 2021:

That said, the basic investment thesis is still valid in my opinion. And although TDC isn’t growing as fast as some of its competitors, the stock also trades at a deep discount that appears to be somewhat irrational in my opinion given its strong FCF generation profile. Meantime, according to Fortune Business Insights, the global data analytics market is expected to grow at a CAGR of 13.2% through 2028 to reach ~$540 billion.

Let’s take a closer look at TDC’s most recent quarterly report.

Earnings

Teradata delivered its Q2 EPS report on August 4th, and it was, well, rather dismal. Revenue of $430 million was a miss and down 12.4% yoy. GAAP earnings were a loss of $0.04/share (as compared to +$0.39/share in Q2 of last year) while non-GAAP EPS was $0.33/share, a $0.04 beat but down from $0.74 in Q2 of FY21.

CFO Claire Bramley summed up the quarter during the Q2 conference call:

Total revenue was $430 million, a 12% decrease year-over-year as reported and an 8% decrease in constant currency. Recurring revenue was $345 million, an 8% decrease year-over-year as reported and a 5% decrease in constant currency. As a percentage of total revenue, recurring revenue was 80% in the second quarter, a new high for Teradata. There was a negative year-over-year impact in the reported growth rate of approximately 15% of total revenue and approximately 14% for recurring revenue. Both were affected by the ceasing of operations in Russia the impact of upfront recurring revenue and currency headwinds.

Clearly, exiting from Russia combined with the strong U.S. dollar was a one-two punch to Teradata in Q2.

However, there is some good news:

- Recurring revenue now represents 80% of total revenue (that is up two percentage points sequentially).

- Despite the headwinds, gross margin was relatively healthy at 61.2%.

- Free cash flow generation was $102 million.

- The company reiterated its full-year FY22 FCF guidance of ~$400 million. That equates to an estimated $3.87/share based on the average of 103.5 million fully diluted shares outstanding at the end of Q2. And, as mentioned before, an 11%+ FCF yield.

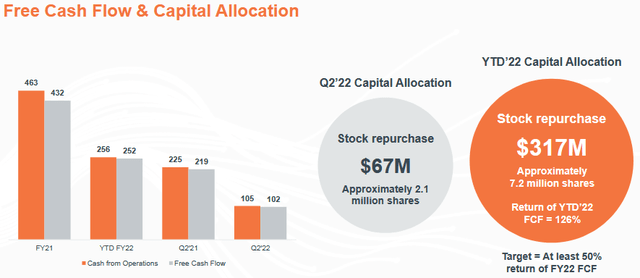

Share Buybacks

The graphic below details what Teradata is doing with all that free cash flow – share buybacks:

Teradata (Teradata’s Q2 Presentation)

Year-to-date, Teradata has spent $317 million (i.e., considerably more than the company’s YTD free cash flow generation of $252 million) to buy back ~7.2 million shares. That works out to an estimated $35/share while the stock is currently trading at $32.90. Not a great “bargain” for shareholders so far this year. This, of course, points out the risks of companies that are stuck on delivering all of its “shareholder returns” in the form of buybacks as compared to a more equitable mix of dividends and buybacks. These types of buyback plans are typically much more beneficial to the executive management teams as compared to the ordinary shareholders, in my opinion.

However, I would be remiss to point out that the average fully-diluted outstanding share count at the end of Q2 was down 9.2 million share yoy (8.2%). That is obviously a very meaningful reduction and should Teradata ever steady itself and become a more stable deliverer of FCF (and revenue growth), shareholders will benefit on a per-share basis.

Going Forward

For Q3 FY23, the company has given the following guidance:

- GAAP diluted EPS in a range of $0.01-$0.05/share.

- Non-GAAP diluted EPS in a range of $0.27-$0.31/share.

And for FY22, the company expects total revenue to decline by the mid- to high-single-digit range on a yoy basis (low single digits on a constant currency basis). Clearly, the near-term outlook is still quite challenging for Teradata. The point being, there appears to be no hurry for investors to rush into the stock. Instead, I advise investors to take advantage of market volatility and try to pick up shares under the $30 level.

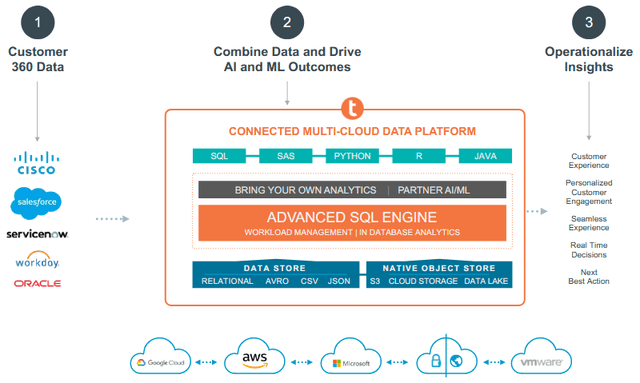

On a longer-term basis, and as licensed hardware sales continue to decline, Teradata will increasingly rely on its software subscription-based data-analytics platform to drive revenue and margin growth. The following diagram illustrates Teradata’s positioning in order to leverage public-cloud providers in order to help drive better business outcomes for its customers from the use of AI & ML fueled data analytics:

Teradata (Teradata Investor Day Presentation)

Along these lines, Teradata continues to nurture strategic relationships with cloud hyperscalers like Microsoft (MSFT) Azure and Amazon (AMZN) AWS in order to progress its go-to-market strategy and make it easy to add Vantage customers to its platform.

Teradata continues to believe this business plan will lead to $1 billion in ARR by FY25. That should enable the company to generate an estimated ~$550 million of FCF on an annual basis. If so, the company’s current market cap of $3.45 billion is clearly significantly undervalued (i.e., only an estimated 6x FY25 FCF).

Risks

Teradata has already reaped the rewards of leveraging its large installed base of enterprise customers by migrating them to its cloud platform. In order to re-accelerate growth, the company will have to go toe-to-toe with competitors and add new customers by increasing its market share.

On that note, Teradata faces a plethora of data-analytics competitors, including companies like Snowflake (SNOW) and Datadog (DDOG). And, I would not count out Broadcom (AVGO) going forward, given its already solid enterprise software operations and the potential that the VMware (VMW) acquisition could actually go through. No doubt, Broadcom CEO Hock Tan fully understands the potential and critical nature of AI & ML fueled data analytics working on large datasets to improve its customers’ business outcomes.

Note that, in great contrast to Teradata, Snowflake grew revenue by a whopping 82.7% in Q2 while Datadog grew revenue by 73.9% in Q2. However, also note that SNOW and DDOG trade at forward P/E multiples of 1,104x and 127x, respectively, while TDC trades with a forward multiple of only 20.3x. Clearly, TDC is the “value” of this technology sub-sector.

In Q2, the Americas segment (“AMS”) accounted for $249 million in revenue (58%). That being the case, TDC will continue to face a significant FX headwind due to the strong U.S. dollar. However, should the Fed begin to slow and/or stop significant interest rate increases (much of which has likely already been factored in by the market), that could provide welcome relief for the company.

Teradata’s balance sheet is rock solid, with $545 million in cash and long-term debt of only $497 million (or net cash of $48 million).

Summary & Conclusion

Despite Teradata’s obvious and strong headwinds, the stock has fallen far enough that it has entered into the “buy zone” on the basis of its strong FCF generation profile, its solid balance sheet, and its meaningful share buyback program that has reduced the outstanding share-count by 8.2% over the past year. While competitors are growing revenue much faster than TDC, their valuation levels are sky-high in comparison while TDC is delivering the strong FCF now. In fact, Teradata’s current FCF/EV ratio is 11%+.

Teradata could earn $2/share in FY23. A 20x multiple implies that shares could trade up to $40 over the next 12 months (or up 20%+ from here). TDC is a BUY.

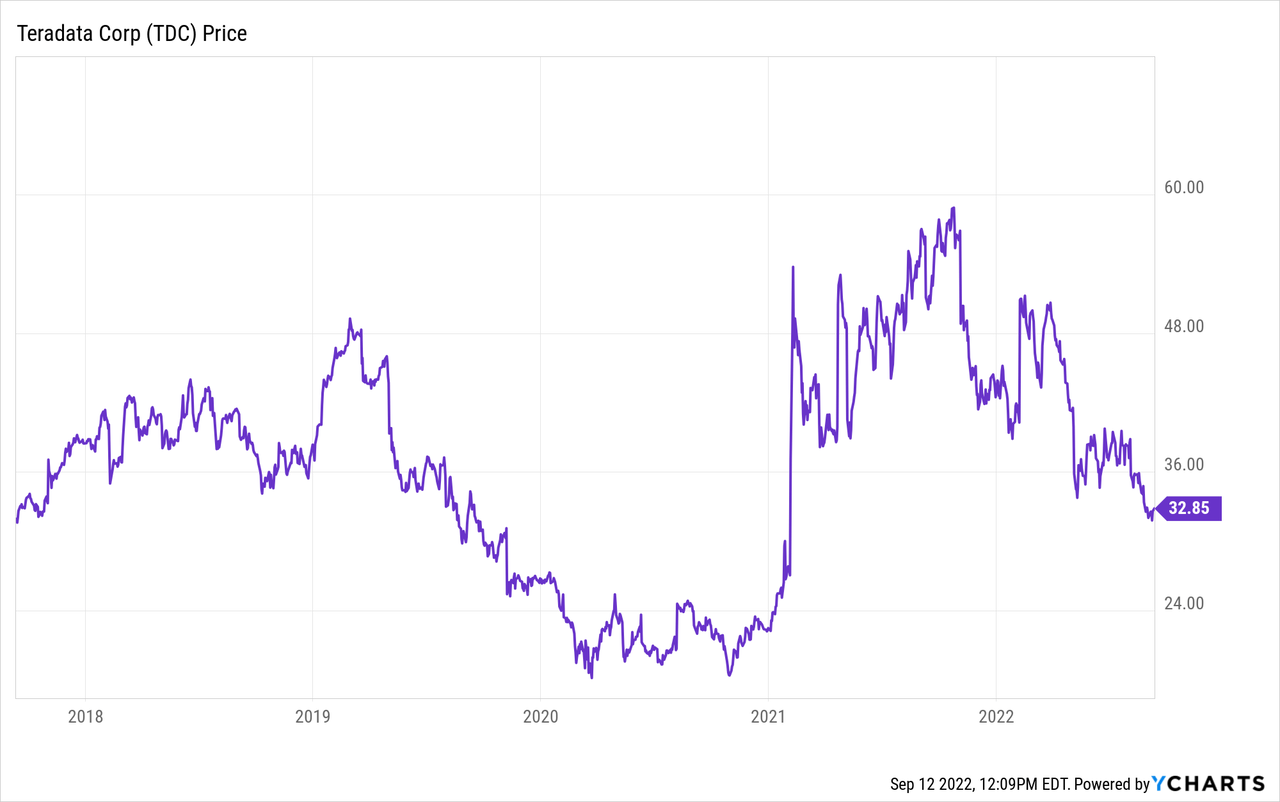

I’ll end with a five-year price chart of TDC and note that the stock is now below the price at which it was back in 2017. That was arguably before Teradata made its strategic pivot to the SaaS-based business model that is the reason that the company, today, is delivering such strong free cash flow:

Be the first to comment