kelvn/iStock via Getty Images

Okta (NASDAQ:OKTA) crumbled after releasing second quarter earnings results in which the company revealed sales integration issues with its Auth0 acquisition. The stock was already trading cheaply prior to the fall and is now trading at deeply undervalued multiples. This is a stock that, just one year prior, was considered to be one of the highest quality names in the tech sector and one deserving of an ultra-premium multiple. If and when the company moves past its near term issues, I expect a significant re-rating to take place, leading to tremendous return potential for patient investors.

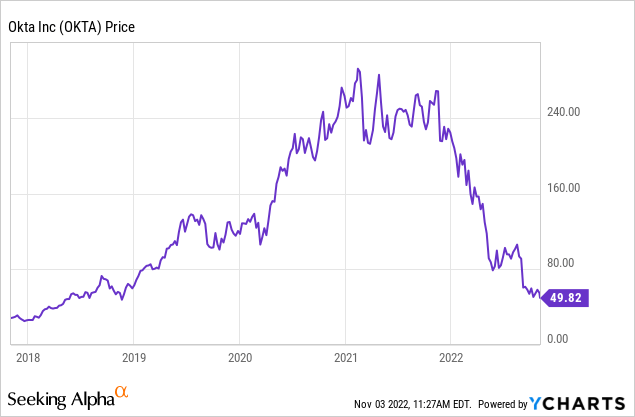

OKTA Stock Price

After a stunning 82% decline from all time highs, OKTA now trades lower than it did in 2018.

I last covered OKTA in August where I predicted the company to deliver a strong second quarter earnings result. That prediction did not pan out, as the stock proceeded to decline over 30% in a single trading session.

What is OKTA?

OKTA is an identity management company. In short, it provides “login” services for its customers. It is most well known for its “single sign-on” product which allows users to access all applications using just one login.

Okta

This service provides convenience while increasing security for both customers and customers’ customers.

OKTA Stock Key Metrics

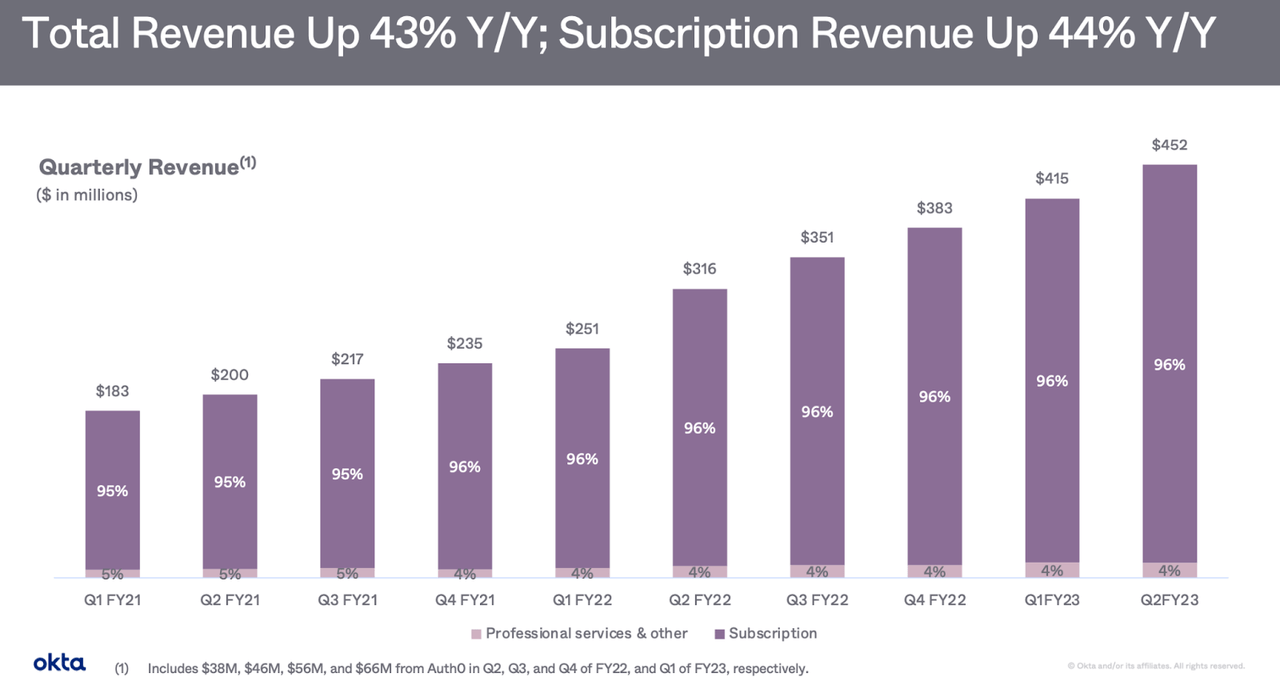

OKTA delivered 43% year-over-year revenue growth to $452 million. The company had previously guided for up to $430 million in revenue.

Q2 FY23 Presentation

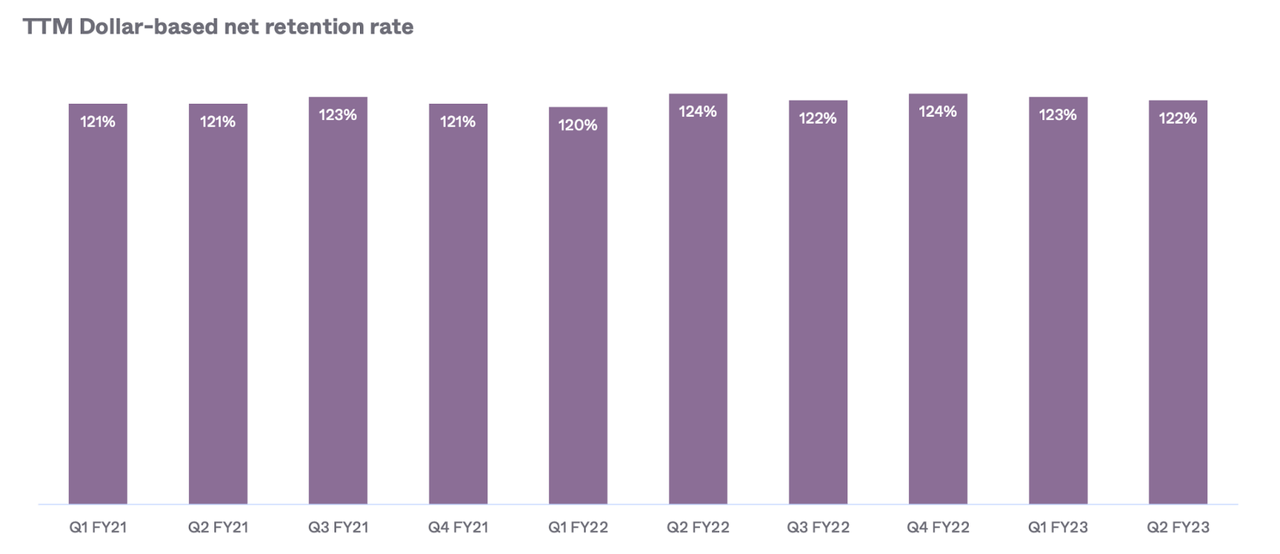

Dollar-based net retention stood strong at 122%. A high and sustainable dollar-based net retention rate may imply the ability to sustain high growth rates over the long term.

Q2 FY23 Presentation

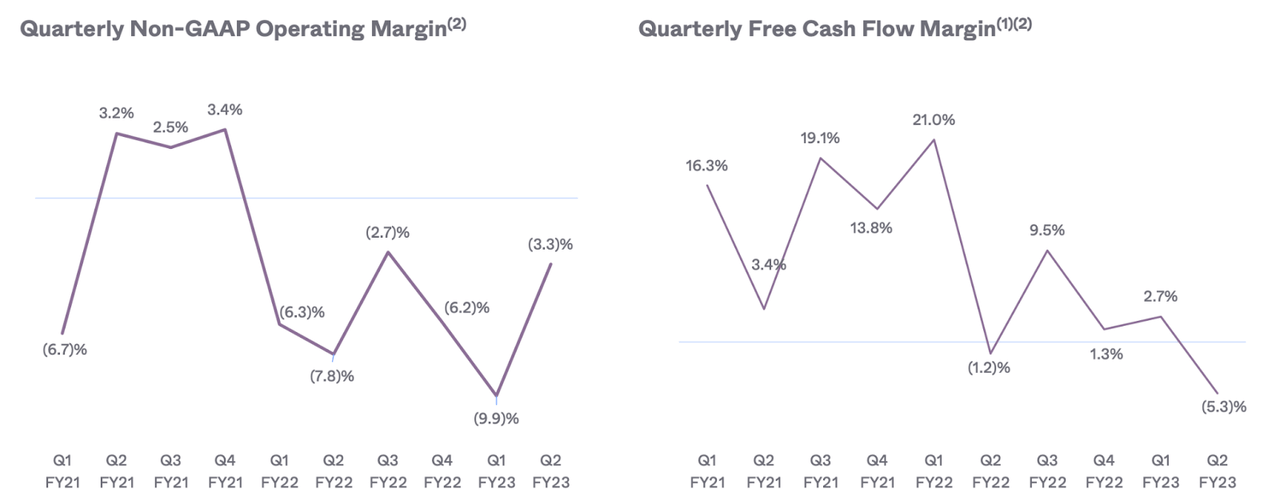

OKTA was still not profitable even on a non-GAAP basis though it is very close to breakeven and is already essentially there on a cash flow basis. Management guided for a return to positive free cash flow in the third quarter with the fourth quarter expected to be the seasonally strongest cash flow quarter.

Q2 FY23 Presentation

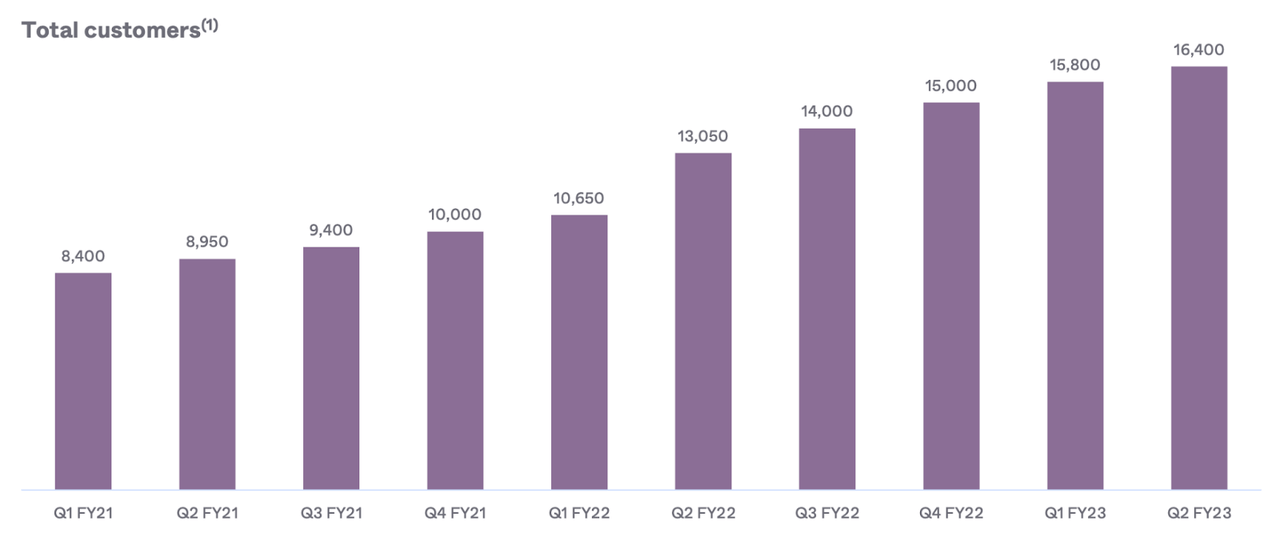

Total customers grew by 25.7%. While many of these customers are still small and thus not so impactful to overall revenue numbers, the strong customer growth may help sustain strong growth rates over the long term due to the high net retention rates.

Q2 FY23 Presentation

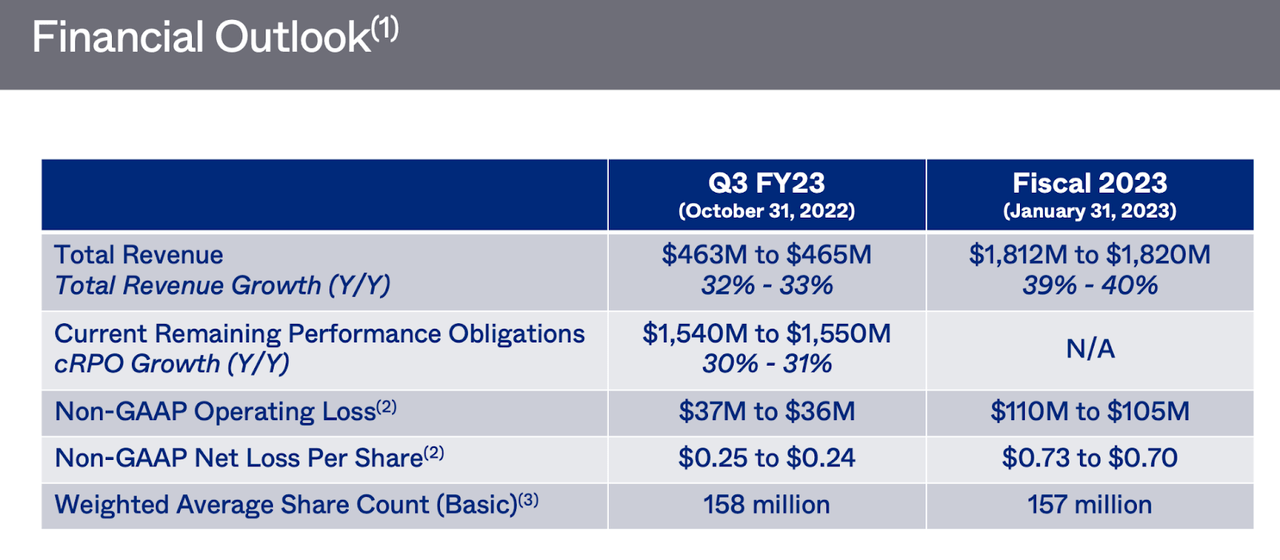

Looking forward, OKTA guided for up to $1.82 billion in full year revenues (up from $1.815 billion previously), representing up to 40% growth. That implies up to 33% revenue growth in the next quarter and 27% growth in the fourth quarter.

Q2 FY23 Presentation

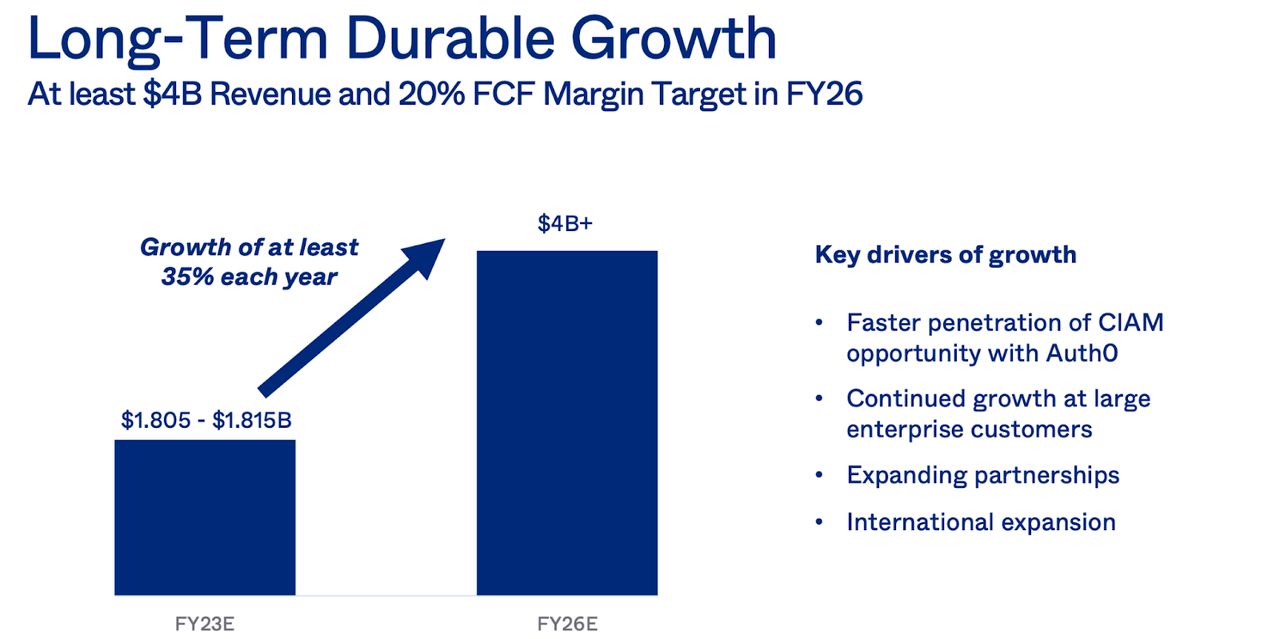

OKTA lowered its FY23 billings outlook by $140 million to be up to $2.05 billion, representing 27% year-over-year growth. On the conference call, management also stated that it was “reevaluating” their fiscal 2026 targets. Recall that OKTA had previously guided for over $4 billion of revenue by 2026.

Q1 FY23 Presentation

I suspect that retracting that guidance most fully explains the bearish reaction to the earnings release. What caused the increased uncertainty? OKTA noted that its security incident from earlier this year still does not appear to have had a significant impact on their business. While OKTA noted that it was seeing some impact from inflation and macro headwinds, management mainly blamed sales integration challenges related to its previous Auth0 acquisition. It seems that the sales teams from both organizations were confused on how to sell both products – management also noted that employee attrition was high in the quarter. I expect OKTA to be able to eventually move past these near term hiccups, but removing long term guidance may have been the last straw for many investors, as that visibility in forward growth was arguably a huge driver of previous investor love for the stock.

Is OKTA Stock a Buy, Sell, or Hold?

At some level, the fate of the stock rests on management’s ability to fix its sales integration issues and return to rapid growth rates. Management did appear confident on the call:

So we know there’s market fit. We know we can grow this thing. It’s just about the integration of the sales teams and what that drove in terms of attrition, and some of the things we’ve talked about in terms of optimizing how we get that back on track to achieve this strategic imperative, which is we have to be the winner and the opportunity is tremendous in this long-term customer identity market.

Yet at the same time, one could make the argument that these valuations are not very demanding and do not require perfect execution to generate solid returns. OKTA recently traded at just 4.4x sales. I can see the company eventually sustaining 30% net margins over the long term. Applying a 20% forward growth rate and 1.5x price to earnings growth ratio (‘PEG ratio’), I could see the stock trading at 9x sales – implying 100% potential upside. That fair value estimate shoots up higher if OKTA can return to a 30%-35% growth rate and sustain that. I wouldn’t be surprised if returns prove to be front-end weighted with the main catalyst being a resolution of its sales integration issues.

What are the key risks here? It may take a while for management to move past the sales integration issues – or even worse, they might never be able to right the ship. In that case the projected return profile would decline considerably though I’d continue to argue that the current valuation has already priced this in. A long term risk is that of competition. Microsoft (MSFT) with its Azure Active Directory product is a formidable competitor. It is possible that as the identity market becomes saturated, these companies will begin taking market share from each other – it is not entirely clear who would prove to be the winner of such a scuffle.

OKTA is priced just like any other beaten-down tech stock, but I can see it re-rating higher once it fixes its issues. As discussed with Best of Breed Growth Stocks subscribers, a diversified basket of tech stocks may outperform the market from here. OKTA is one of my higher conviction ideas in the tech sector – a growth monster trading with significant multiple expansion potential.

Be the first to comment