BalkansCat/iStock Editorial via Getty Images

Telcos are boring companies. In many cases, they are seen as a cash cow with limited growth headroom. Having recognised this problem, telcos have attempted to diversify into other areas, but their diversification track record has been spotty at best cue AT&T and Verizon. It is thus no wonder that investors are highly sceptical and keeping away from this industry (it has the third-lowest EV/EBITDA industry valuation behind coal and upstream oil & gas).

Amidst spotty diversification track records, there are some outlier telco companies that stand out with well-executed entry into new high-growth sectors. Turkcell (NASDAQ: TKC) is one of the outliers.

With its share price near an all-time low of US$2.97, TKC is trading at an attractive valuation. TKC has all the hallmarks of a well-run company: credible market leader, solid balance sheet and multiple growth opportunities. However, given the significant near-term country risk, I would categorise TKC as a watchlist buy opportunity.

1H FY22 Financials Review

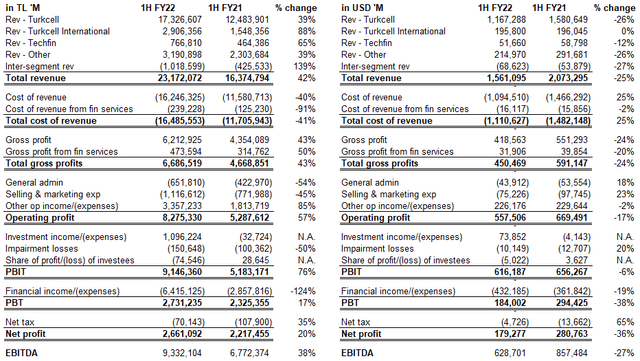

In 1H FY22, TKC reported stellar double-digit growth rates. However, the numbers must be reviewed on a constant USD basis, especially for investors looking to invest in USD-denominated ADR shares.

Table 1: Turkcell’s 1H FY22 vs 1H FY21 Financials in TL & USD ‘M

Turkcell’s 1H FY22 Financial Report

Once depreciation of Lira against USD is factored into the YoY comparison, the picture looks vastly different. The Lira depreciation over the past year has adversely impacted revenue and profitability in USD terms. YoY, Revenue declined by 25%, EBITDA declined by 27% and Net Profit declined by 36%.

Investment Thesis

Despite the negative performance in FY22, TKC remains an intriguing investment opportunity with (i) best-in-class operator, (ii) solid balance sheet and (iii) successful diversification into high-growth sectors

Best-in-class operator

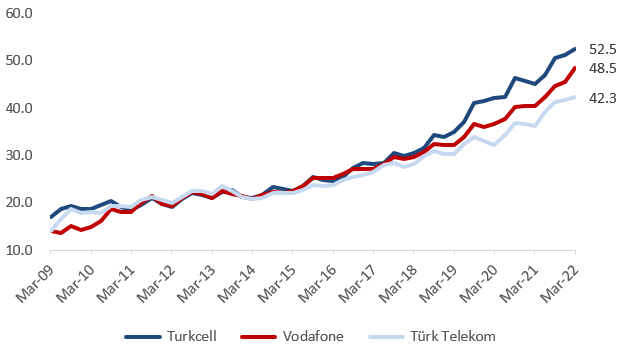

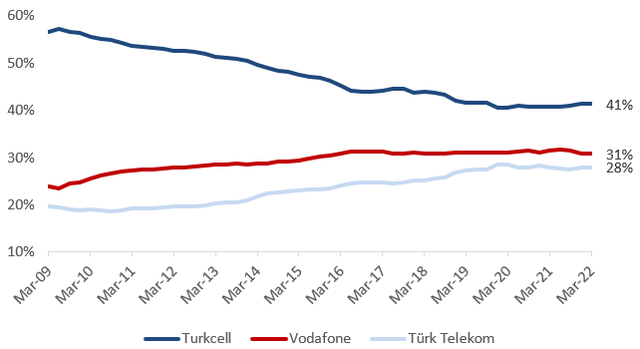

Figure 1: Turkey Mobile Market Share

TKC is the dominant telco operator in Turkey with the highest subscriber market share in the mobile market. While market share has declined from a high of 57.1% in 2009, it has since stabilized at ~41% in recent years (refer to Figure 1). Management has managed to achieve this feat by focusing on service, leading to churn rate declining from a high of 34% in 2010 to 2% in 2021.

Figure 2: Turkey Mobile ARPU in TL per user

ICTA, Q1 2022 Market Data

TKC’s dominance is also evident in the widening ARPU versus peers. TKC has been able to carve a niche in becoming more sticky with consumers likely through a combination of better cell service and bundle offerings.

Solid balance sheet

TKC has a solid balance sheet with low leverage. As of Q2 22, TKC’s net debt to EBITDA is at a manageable 1.2x. Additionally, debt is well hedged against foreign currency fluctuations with a net US$149m exposure with the majority of the debt (62%) due in 2025 and beyond. TKC’s management has also strategically bought back USD7.3 million Eurobond at 8-10% discount to face value. Overall, TKC’s balance sheet is well-positioned to withstand adverse impact from further Lira depreciation.

Successful diversification into high-growth sectors

TKC has diversified into 3 key areas: 1) digital services, 2) digital business solutions and 3) techfin services.

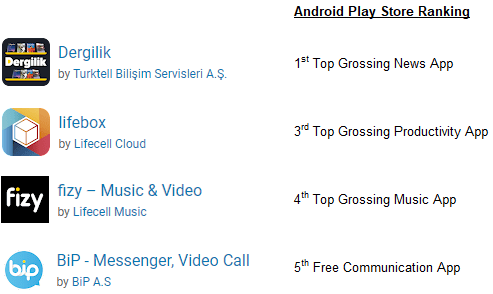

Table 3: Top Ranking Turkcell Apps

AppBrain, Sep 22

Under digital services, TKC has several top mobile apps in multiple categories on the Google Play Store (Android’s Turkey market share is 85%). Digital services segment has been experiencing strong growth with 31% YoY revenue growth in FY21. The company is also actively expanding its services overseas through partnerships.

Digital business solutions and techfin services have experienced skyrocketing growth in 2Q 22. The former’s revenue is up 85% YoY. For the latter, Paycell’s (payment app) revenue is up 78% and Financell’s (digital loan provider) revenue is up 65%.

As Turkey moves towards increased digitalization, these new business segments are well-positioned to continue its strong growth trajectory.

Risks

Despite Turkcell being a solid business that has diversified into new high-growth sectors, investors have to remain wary of the elevated country risk.

Sustained lira depreciation

The President of Turkey, Erdogan has gone all-in to prioritise growth over curbing inflation. Apart from cutting interest rate (high of 19% in Mar 2021 to 13% in Aug 2022), the skyrocketing energy cost has also contributed to significant Lira depreciation (37% decline against USD YTD). Additionally, Turkey’s Central Bank has limited reserves to defend the currency. It’s a perfect storm for further downside to the Lira (Fitch projected Lira to fall against USD from 18 to 20 by year-end).

Upcoming political uncertainty

Erdogan’s growth-orientated policy has been targeted to position him to win the upcoming June 2023 Presidential election. In the wake of sustained high inflation, there is significant discontent among the population against Erdogan’s rule. Early polls are showing that AKP (Erdogan’s party) and its ally (MHP) are unlikely to win against a six-party opposition. Given Erdogan’s record of authoritarianism, it is unlikely that he will leave office peacefully which might throw Turkey into a period of political upheaval.

Valuation

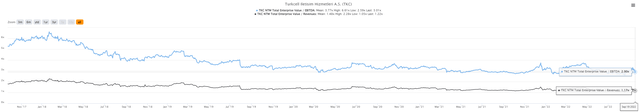

Historical valuation

TKC is trading near its 5-year low valuation in terms of NTM EV/EBITDA and NTM EV/Revenues. A reversion to its 5-year mean valuations will translate to an average target price of US$4.19, a significant 41% upside.

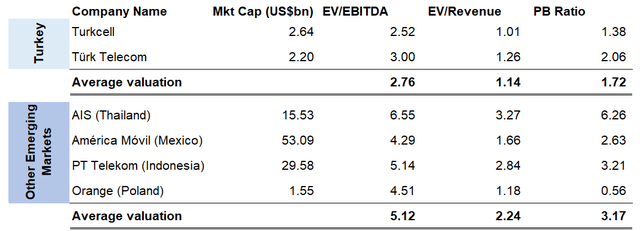

Peer valuation

Table 2: Peer valuation comparison between local and emerging market peers

MarketScreener (using FY23 estimates)

Turkish telcos trade at a significant discount compared to their emerging market peers. I believe the key reason is the rapidly depreciating Lira, which positions foreign currency deposits or export-orientated Turkish companies as better investment propositions compared to Turkish telcos. This valuation gap will likely remain till the Lira is stabilized.

Conclusion

Despite its attractive valuation, the country risk is too high to recommend a buy at this time in point. Nonetheless, TKC remains an excellent company that should be on investors’ watchlist to revisit when there is more clarity on the economic and political situation in Turkey (likely by the next Turkish election in Jun 23).

Be the first to comment