Araya Doheny/Getty Images Entertainment

In June 2022, we published an article on Seeking Alpha about Colgate-Palmolive Company (NYSE:CL), titled, “Colgate-Palmolive has historically performed well in the low consumer confidence environment.” In that article, we looked at four periods in the last 20 years, when consumer confidence in the United States was falling or was relatively low, and compared the performance of CL stock with the broader market. We also highlighted that we liked the firm’s strong track record of dividend payments, but pointed out the risks of the relatively high payout ratio compared to the sector median. Several macroeconomic headwinds were also mentioned, including elevated raw material prices and the geopolitical tension in the Eastern European region, which could negatively impact the firm’s financial performance in the near term.

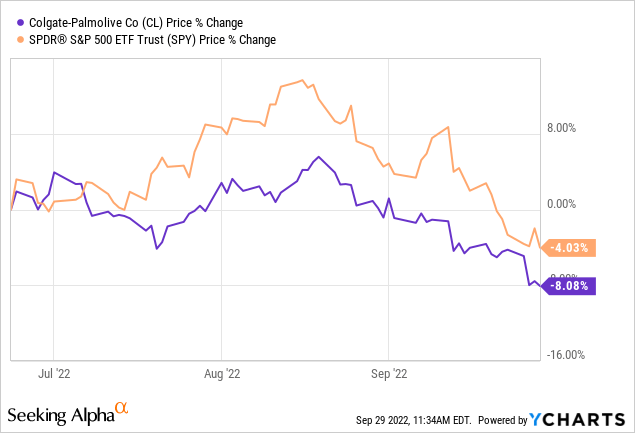

Since then, the stock price has declined by about 8%, slightly underperforming the broader market.

Today, we are going to give an updated view on the firm, taking the latest news and information into account.

Macroeconomic environment

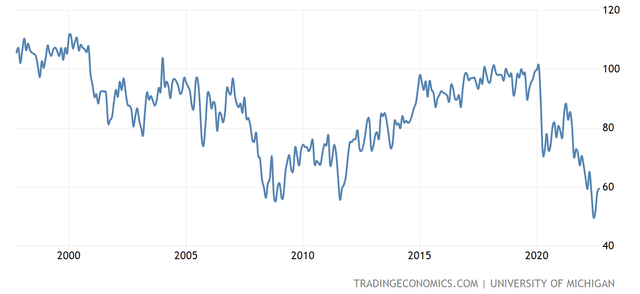

Consumer confidence

Consumer confidence remains at extremely low levels despite the recent bounce in August. As pointed out earlier, the demand for Colgate-Palmolive’s products is thought to be relatively inelastic and not directly dependent upon consumer confidence. This was one of the main advantages that we mentioned in our previous article.

U.S. Consumer confidence (Tradingeconomics.com)

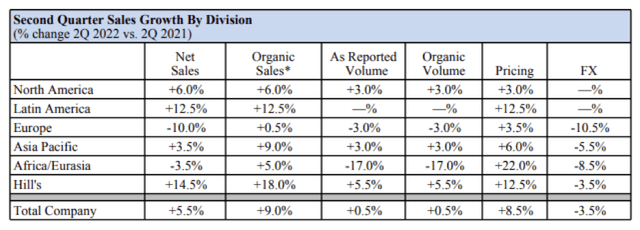

The second quarter earnings result also support this thesis. Sales have increased at a higher-than-expected rate, which we believe provides evidence that the demand for CL’s products indeed remains high:

Net sales increased 5.5%; Organic sales* increased 9.0% with growth in every division and all four categories.

The main reasons for growth were summarized by management:

Our focus on premium innovation, brand building and digital capabilities drove broad-based organic sales growth, with growth in every division and all four of our categories, including double-digit organic sales growth in oral care and pet nutrition. […] We are especially encouraged by the increase in our global toothpaste market share year to date led by share growth in the U.S. where our focus on more premium innovation is driving share gains.

Q2 sales growth by division (CL)

This better than expected performance, also resulted in an upward revision of the full year 2022 guidance in terms of revenue growth.

Raw material prices

Raw material prices continue to remain elevated. Although the prices of many commodities have substantially come down from their peaks, reached earlier this year, they are still higher than before the pandemic. We believe these elevated costs are likely to keep negatively impacting the firm for the rest of the year.

In the second quarter earnings presentation, the firm also pointed out that these forces were responsible for the 13% decline in EPS and the 300 basis point contraction in the gross profit margin.

As expected, significant increases in raw and packaging material and logistics costs continued during the quarter and currencies remained volatile in many parts of the world.

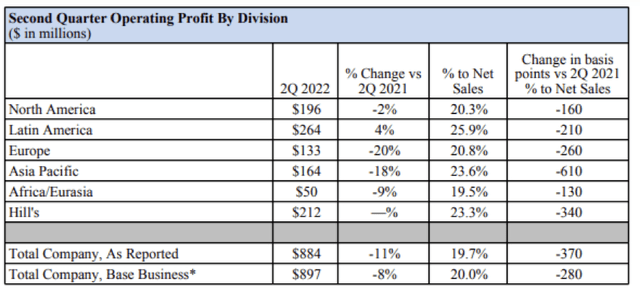

FX headwinds

As mentioned above, the foreign exchange headwinds are substantial for CL’s business.

Q2 operating profit by division (CL)

A significant portion of the revenue is being generated outside of the United States, therefore we expect the strong USD to continue to have negative impacts on the firm’s financials.

Also promising that management is actively working on counter acting these headwinds, for example by managing pricing and accelerating growth plans.

We acted boldly on pricing and are accelerating our revenue growth management plans, including additional pricing, in the balance of the year. We are also increasing our efforts around funding-the-growth and other productivity initiatives to help offset these headwinds.

Expansion of pet food business

In many cases, we like when businesses keep investing during downturns and economic uncertainty, in order to reach their long term targets. And this is exactly what CL does.

The Hill’s pet food segment is the fastest growing segment of the firm. Net sales have increased by 14.5% year-over-year. For this reason, we like CL’s strategy of improving and expanding this part of their business.

It was recently announced that CL invested $700 million to purchase three dry food manufacturing plants across three states, which could enable CL to expand its production capacities. The aim is to be able to meet the demand for science-led pet nutrition diets, a trend that is gaining traction now.

We believe this expansion is a positive development and it could fuel CL’s revenue and earnings growth in the years to come.

To sum up

The demand for CL’s products remains strong. Net sales have grown across all the business segments. As a result, the firm has revised its full year sales forecast upwards.

The fastest growing division of the firm was Hill’s. For this reason, we appreciate CL’s efforts of investing $700 million into their pet food segment to increase their capacity of dry food manufacturing. This investment aims to enable meeting the demand for the pet food products and fuel growth for the years to come.

Macroeconomic headwinds, including elevated raw material prices and the strong USD, continue negatively impacting the firm’s margins and net income. We believe that this situation is not likely to dramatically improve in the near term, partially due to the highly uncertain geopolitical situation in Europe.

For these reasons, we maintain our “buy” rating on Colgate-Palmolive.

Be the first to comment