Morsa Images/DigitalVision via Getty Images

Hooker Furnishings (NASDAQ:HOFT) reported their January-end Q4 results [it is to be noted that Hooker operates on an odd January year-end]. The quarter was a weak one, impacted by rising freight costs, reduced vessel space and the Covid-related factory shutdowns. The company posted an EPS loss of ($0.33), missing the one analyst estimate of $0.10. Net sales were $134.8 million, which is a decline of 13.2% compared to the same period of last year. Despite the consecutive soft quarters, overall full-year results showed decent revenue growth. The company reported consolidated net sales of $593.6 million for its fiscal year ended January 30, 2022, a $53.5 million, or 9.9%, increase compared to a year ago. The revenue gain was driven by sales increases of over 20% in both the Hooker Branded and Domestic Upholstery segments compared to the prior year, partially offset by a 1.2% sales decrease in the Home Meridian segment. Net income for the fiscal year was $11.7 million, or $0.97 per diluted share and operating income was $14.8 million, compared to a loss of $14.4 million the previous year. A $44.3 million ($33.7 million net of tax) non-cash intangible asset impairment charge contributed to the prior year’s operating deficit.

While HOFT’s stock’s total return is approximately -11% since our initial Seeking Alpha recommendation, we still believe the stock is undervalued, and positive drivers for furniture demand include some permanent WFH [Work From Home] effect even post-Covid, people migrating out of large cities and high tax states for numerous reasons, the Millennial generation buying houses, still low interest rates in a historical context, etc. A strong housing market and record price increases would tend to validate our positive housing thesis, in our opinion. We believe that most of the bad news has already been priced into the stock price, as the stock is up 3% after the weak result. The backlog, which has grown surprisingly well, is now valued at $340 million, which is 57% that of net sales of the current fiscal year. The Asian suppliers are currently operating at around 85% to 90% capacity and will reach 100% capacity during the first quarter of fiscal 2023 but the impact of the same won’t be reflected until the second quarter. But concerns are weighing on all cyclical stocks, including rising interest rates and inflation, recessionary risks, US consumers spending being impacted by inflation, ongoing global logistics constraints, and rising house prices possibly crowding out furniture budgets, etc.

There are numerous positives for the stock, but also some significant concerns, which makes it a tricky cyclical company to analyze when the economic and interest rate outlook is uncertain.

Given HOFT’s huge net cash position and low valuation levels, we think the downside risk is mitigated, and overall risk-reward is still favorable.

Valuations and Price Target

The company has an undervalued P/E of 4.5x. We arrived at this by deducting $8.07 net cash from the stock price of $18.24 and dividing by $2.10 EPS based on our forward FY01/2024 estimates. After factoring in recent uncertainties regarding rising interest rates, slowing consumer spending, and overall inflationary pressures, we are decreasing the price target for HOFT at $31.10, representing 71% upside from the current market price. We reached this price target by taking a conservative P/E multiple of 14.8x. Because of the downside risks and tricky economic scenario for cyclical companies, we are not adding back net cash and are keeping our target price conservative.

Segment Reporting – Hooker Branded

Net sales increased by $38.3 million, or 23.5% as compared to prior fiscal year. The bulk of shipments in the Hooker Branded segment had price increases in place by the end of fiscal 2022, which were enacted in July 2021 to offset higher ocean freight and product expenses we had seen up to that date. However, due to lesser inventory availability in the fourth quarter, sales volume fell, resulting in lower operating income than in the fourth quarter of fiscal 2021. Incoming orders increased by 24.2% compared to the prior year period and backlog remained historically high and nearly doubled as compared to the prior year.

Home Meridian

This segment was worst hit by Covid-19 and subsequent supply chain disruptions. The shutdown of facilities in Vietnam and Malaysia also had a detrimental impact on this segment. Net sales of this segment decreased by 1.2% compared to the prior year period. HMI reported a $21.3 million operating loss for the year. Higher freight costs, exit costs from the RTA furniture category, and significant chargebacks from the Clubs distribution channel contracted gross margin by approximately 530 bps in the fiscal year. Current and expected future freight costs, continued poor profitability and excess chargebacks forced HMI to exit RTA furniture category and Clubs channel and incur one-time order cancellation costs of $2.6 million and $0.9 million respectively. With a goal of being in stock in a new 800,000-square-foot Georgia warehouse to service growing channels such as brick-and-mortar retailers, the interior design trade, and eCommerce, the company is now focusing its working capital and resources on solid businesses like Pulaski, Samuel Lawrence, ACH, and PRI.

Domestic Upholstery

Net sales increased by $18.6 million, or 22.2%, in fiscal 2022 due to double-digit sales increases at all three divisions. For the fiscal 2022 fourth quarter, Domestic Upholstery net sales increased by $3.2 million or 13.5%. However, compared to the preceding year and pre-pandemic levels, gross margin declined as this segment faced manufacturing constraints that harmed profitability, including early-year foam shortages, higher raw material and freight prices, and labor shortages and inefficiencies. Incoming orders climbed by 38%, and this segment ended the year with a 122% higher order backlog than the previous year.

4Q results: Weak Result with Strong Backlog

The company managed to outperform the market consensus of $131.55 million with net sales of $134.8 million, down 13.2% from the same period previous year. The decline was driven by a 23.7% or $18.9 million revenue decrease at HMI and an 11.8% or $5.8 million sales decline at Hooker Branded. These lower sales were slightly offset by a $3.2 million or 13.5% increase in Domestic Upholstery sales during the fourth quarter. The company recorded a $5.3 million consolidated operating loss, compared to $10.5 million in operating income the year before. In the fourth quarter of fiscal 2022, the company lost $4.0 million, or ($0.33) per diluted share, compared to $8.5 million, or $0.71 per diluted share, in the same period of fiscal 2021. Inventory unavailability due to Asian factory shutdowns, high freight costs, a decline in eCommerce and hospitality furniture sales, and the Company’s planned exit from unprofitable businesses and channels all contributed to the company’s fourth quarter consolidated net loss, which was driven by a $12.0 million operating loss at HMI. The backlog, which has grown surprisingly well, is now valued at $340 million and incoming orders remained historically high.

Cash and cash equivalent is 44% of the Market Cap

Hooker had a cash balance of $69.4 million at the end of fiscal 2022 year-end, an increase of $3.5 million compared to the balance at the fiscal 2021 year-end. To arrive at our total net cash figure of $95.8 million, or $8.07 per share (44% of current stock price), we have included “cash surrender value of life insurance” of $26.4 million since we believe it to be a near-cash item which is fairly liquid. As a result, Hooker has a very attractive cash position with $95.8 million ($8.07 per share) on the B/S, or 44% of the market cap.

Work From Anywhere Trend

According to recent research, many businesses are adopting “work from anywhere” and have gone completely remote or offered part or all of their staff the option to work from any place. Their working methods may differ, but they all meet workers’ rising desire for more flexibility and better work-life balance in a post-Covid atmosphere and competitive labor market. Employee happiness is at an all-time high, and employee retention is at an all-time high. People who work from home would require more space, which will raise the demand for large residences and furniture.

Key downside risks

Rising Interest Rates: According to the Mortgage Bankers Association’s seasonally adjusted index, total mortgage application volume declined by 6% last week compared to the prior week. If borrowing rates continue to rise, we may see a further drop in home purchases which is not good news for furniture companies.

Increasing Inflation: A commodity trading business, as we all know, has a higher correlation with market inflation. Increasing raw material prices put downward pressure on the company’s margins, as it did in the previous quarter. However, this is not the sole effect of inflation on the commodity market. Another effect is a reduction in consumer consumption. US personal consumption expenditures (PCE) surged 6.4% in February over the past year, the Commerce Department reported. This increasing inflation is not a favorable scenario for HOFT.

Recession: Many economists believe the United States will enter a recession next year as the Federal Reserve raises interest rates to combat rising inflation. If this turns out to be the case, consumers will stop purchasing high-priced furniture.

Real estate market: Housing boom continues

The U.S. has seen a record housing market with residential homes seeing an unprecedented surge in demand. Currently, the demand for houses is outstripping supply, with 30-year fixed mortgage rates still hovering around 4.9%. Lower inventory on the market has led to increased prices, but still demand remains resilient. The strong job market and rapid wage growth is supporting housing demand despite the increasing rates and appreciation in home prices, but purchasing activity is being restrained by insufficient for-sale inventory.

The U.S. housing market has been on an upward trend due to millennials starting families, remote workers looking to relocate, and the prospect of rising mortgage rates fueling a buying frenzy before it becomes even more costly to borrow.

Bloomberg

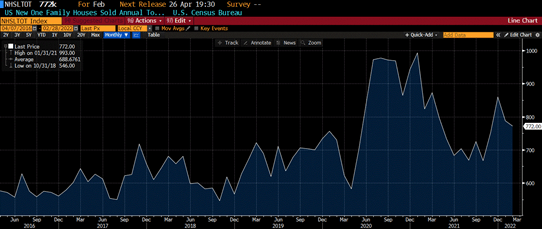

The NHSLTOT Index is computed by taking the number of houses sold in the US and dividing it by the seasonally adjusted number of houses sold in the USA. The graph illustrates that housing demand is still high, and it is too early to claim that the housing market has hit a saturation point.

Conclusion

Although Hooker had consecutive disappointing quarters, the stock still looks undervalued, in our opinion. The Vietnam and Malaysia facilities should reach 100% capacity in the coming quarter. The backlog, which has grown surprisingly well, is now valued at $340 million and incoming orders remain historically high. We believe positive drivers for furniture demand including some permanent WFH effect even post-Covid, people migrating out of large cities and high tax states for numerous reasons, the Millennial generation buying houses, still low interest rates in a historical context, etc. are still intact. Given HOFT’s huge net cash position and low valuation levels, we think the downside risk is mitigated, and overall risk-reward is still favorable. Because of the downside risks, we are not adding back net cash and are keeping our target price conservative. As a result of this, we believe the stock has 71% upside from the current market price.

Be the first to comment