todamo/iStock via Getty Images

Investment thesis

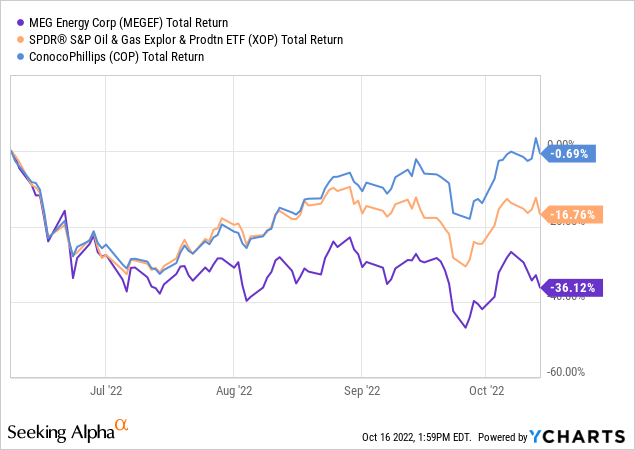

MEG Energy Corp. (OTCPK:MEGEF) has underperformed relative to the oil sector since early June, when oil stocks came down from their YTD highs. However, while some tickers such as ConocoPhillips (COP) have almost made up for the drawdown, MEG is still 36% below its earlier high:

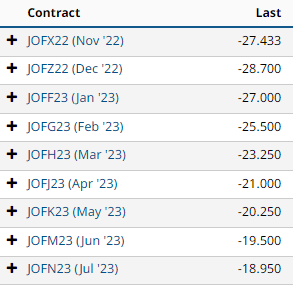

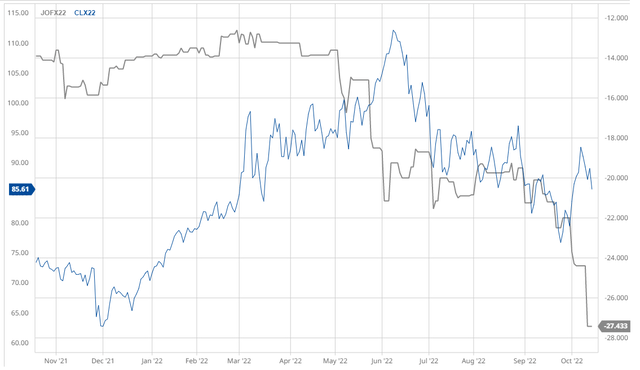

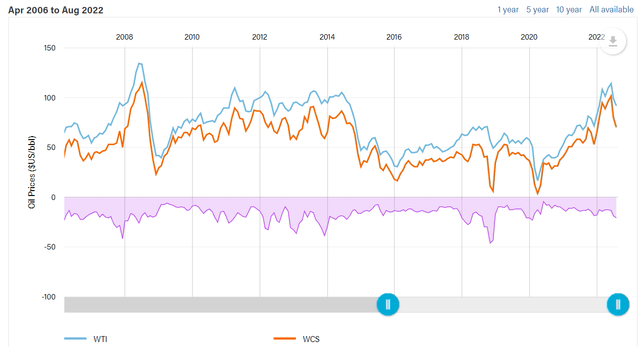

WTI crude oil (CL1:COM) prices have obviously fallen, but the differential between WTI and the Western Canadian Select (or WCS) benchmark for heavy Canadian oil has simply exploded:

This likely puts more pressure on MEG, relative to U.S. companies which can sell at narrower differentials.

According to MEG’s management, the likely culprits for the widened differential are the global realignment of crude oil flows driven by the Russia sanctions and the Strategic Petroleum Release (“SPR”) releases in the U.S.

However, the SPR releases are scheduled to end soon while the post-Russia flows should stabilize at some point; Russian exports may also decline soon, even taking net product off the global market. Both factors will be positive for WTI, but the WCS-WTI differential should also revert closer to its 2021 levels. WCS futures also suggest this may happen.

If the differential indeed narrows, MEG should relatively outperform its U.S. peers in 2023.

Background

MEG Energy is a low-cost, low-decline Canadian heavy oil producer which has embarked on a strong cash return program. The company is focused on in situ thermal oil production in the southern Athabasca oil region of Alberta in Canada. MEG’s main operation is the Christina Lake project, which is estimated to contain 2.0 billion barrels of gross proved plus probable (“2P”) bitumen reserves. The company’s latest presentation guides towards 92,000 – 95,000 bbl/d average production for 2022.

Some of the frequently cited selling points for MEG include:

Low valuation

MEG is trading at less than 3x forward cash flow.

Strong cash return framework

As MEG reduces its debt, it is going to eventually devote 100% of its free cash flow to shareholder returns.

In the second quarter, MEG initiated its share buyback program and continued to make significant progress on debt reduction. Year-to-date, we have applied over C$1 billion of free cash flow to debt repayment and share repurchases.

Low-decline assets

The company estimates its 2P reserves life index at 55 years.

Limited hedges

As MEG enters into minimal hedges, it has more torque to the higher oil prices:

Are we thinking about hedging WTI? No, our philosophy on hedging has not changed and just to repeat it. We hedge to protect our capital program. And we look at what commodity price WTI would have to be for the year.

This year, it turned out that we would need at an average price of US$45 WTI to have sufficient funds flow to cover our capital program, we thought that that was highly unlikely and decided the probability of that was very, very low, and we weren’t going to hedge. That will be the same way we look at hedging WTI and if we were going to hedge WTI on a go-forward basis.

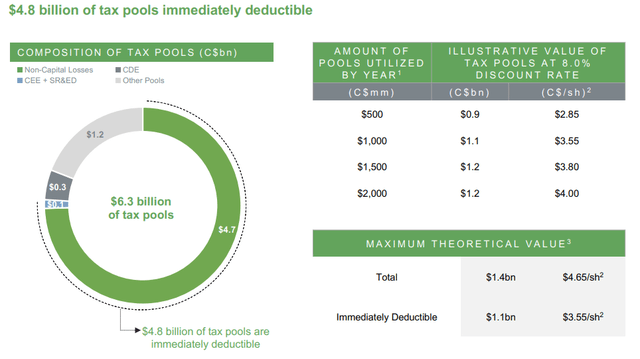

Tax pools

MEG boasts massive tax pools (i.e., accumulated tax losses) which will offset future cash taxes and directly increase free cash flow:

We should acknowledge, though, that the company should soon move into a higher royalty rate regime in Canada, by virtue of hitting a capex recovery target.

The WCS differential is a problem

With Canada historically lacking sufficient pipeline capacity for U.S. exports (although the situation seems to be improving), the WCS-WTI differential has gone through the roof before:

Notably, the differential went above US$40 in November 2018, prompting Alberta to impose a production curtailment back in December 2018.

In 2020 and 2021 the differential averaged respectively US$12.60/bbl and US$12.78/bbl. However, it started widening around the Russian invasion of Ukraine and by August 2022 it was already US$21.03.

The position of MEG’s management on the widening differential was articulated by the company’s CEO during the Q2 earnings call:

One of the things that has happened as a result of Russian Ukrainian sort of conflict is that Russia has had to find a home for its [barrels] and it had to find a home quickly.

What we have seen happen in the market is there [are] barrels, which are heavy sour barrels, have been marketed to both China and India. And what we have seen is they have been marketed at a fairly deep discount, a deep enough discount to stop some of those U.S. Gulf Coast barrels moving across the dock and moving to Asian markets in particular India.

So if we look at that dynamic that existed in late Q4 [of 2021], and early in Q1 of this year, you would have seen two million to four million barrels a day or a month of product heavy product moving across the dock to Asia, those volumes have dried up. As you know, Indian companies and Chinese companies source those barrels from the deeply discounted Russian market.

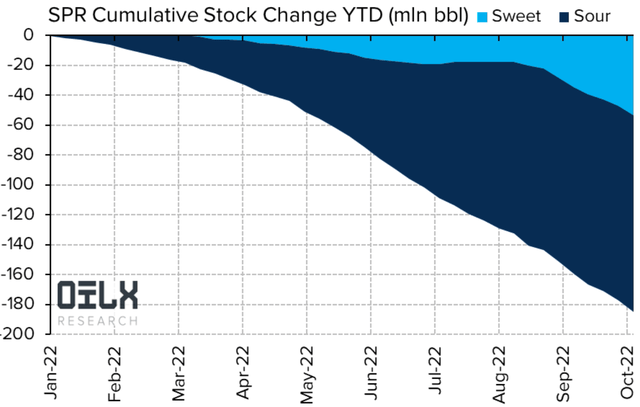

So that would be the number one factor that is driven an increase of sort of supply on the U.S. Gulf Coast of our product that is broadened as a differential. You are right, the SPR releases have had an impact, but that impact was about a million barrels a day, it is winding, as they get towards the end of the program, it is currently down at about 700,000 barrels a day. And in that September 16th to October 21st period it is going to drop down to about 550,000 barrels a day a product, and that product is now going to be predominantly light as opposed to heavy.

So our view is on both of these factors is that you know, a deeply discounted Russian barrel is what you would do if you were Russia and trying to find a home for your product quickly. But we don’t think that that is going to persevere or continue, the market will take or tighten up that arbitrage. And we do believe that Asian suppliers will be back buying product across the dock. And we are seeing early indications of that already in the coming month.

With respect to the SPR, that program is winding down, I think the Biden Administration pointed to how they were going to start refilling the SPR as early as 2023. So we fully expect that these differential levels will return to where they were prior to the conflict, the Russian, Ukrainian conflict.

The SPR releases have indeed been massive:

The start of the releases also coincides with the time when the WCS differential started going up. As the SPR program ends, WCS should close some of the gap to WTI.

As for Russia, the story is perhaps more complex. The 2022 year has seen a massive realignment of the global crude oil trade. Russian flows have been re-directed from Europe to India and China, which may have resulted in a temporary buildup of sour heavy oil at the U.S. Gulf Coast, to MEG’s point. However, realigning the global flows doesn’t put more net product on the market. So, it looks plausible that once the new flows stabilize, the demand pull on Canadian oil should resume.

There also hypotheses that Russia may start experiencing material production declines soon, as the EU embargo on Russian oil imports by sea enters into force this December. The EU and G7 efforts to impose a “price cap” on Russian crude, through denying maritime transportation services (e.g., tanker insurance) on oil sold above a certain cap, may also limit further Russian exports.

The futures curve does suggest the WCS differential may normalize, so the above theories may have some credibility:

barchart.com

If the WCS differential doesn’t narrow or widens even further, this should benefit Canadian producers who have their own refining capacity such as Cenovus Energy (CVE).

Conclusion

MEG Energy is a solid value play, but has been lagging the broader oil sector since June. The likely culprit for this underperformance is the widening WCS-WTI differential, which puts MEG at a disadvantage relative to U.S. producers.

Historically, the WCS differential has reverted to its mean after such spikes, and there is no reason to believe this time it would be different. The SPR releases will end and the global oil flows will sooner or later readjust for the Russia factor.

While MEG has been underperforming U.S. oil equities since early summer, MEG may relatively outperform next year as the WCS gap narrows.

Be the first to comment