Sky_Blue

In March 2022, Cheniere Energy Partners (NYSE:CQP) entered into an agreement to purchase 140,000 MMBtu per day of natural gas at a price based JKM for a term of approximately 15 years beginning in early 2023. JKM price increased significantly from below $5/MMBtu in March 2022 to more than $50/MMBtu in August 2022. In its quarterly financial results, CQP has to recognize this gas supply agreement at fair value. However, the company cannot recognize the associated sale of LNG before beginning the underlying operations. This accounting flaw caused the company to report a net loss of $2.2 billion in the first nine months of 2022. Thus, CQP’s net loss in the previous quarters is misleading. As the company starts selling the LNG associated with its long-term natural gas agreement, it will report strong quarterly results which are reliable. CQP is a buy.

3Q 2022 highlights

In its 3Q 2022 financial results, CQP reported total revenues of $4976 million, compared with 3Q 2021 revenues of $2324 million, driven by hiked LNG revenues and skyrocketed regasification revenues. CQP’s adjusted EBITDA increased from $738 million in 3Q 2021 to $1471 million in 3Q 2022, driven by increased margins per MMBtu of LNG, and increased volumes of LNG delivered. CQP’s LNG exported volume increased from 307 TBtu in the third quarter of 2022 to 366 TBtu in the third quarter of 2023. The company’s number of cargos increased by 20% YoY to 103 in 3Q 2022. CQP’s LNG volume loaded increased by 18% YoY to 363 TBtu in the third quarter of 2023. The company’s net income of $381 million in 3Q 2021 turned into a net loss of $514 million in 3Q 2022, due to non-cash unfavorable changes in the fair value of commodity derivatives. “Substantially all derivative losses are attributable to the recognition at fair value of our – Integrated Production Marketing (IPM) agreement with Tourmaline, a natural gas supply contract with pricing indexed to the Platts Japan Korea Marker (JKM), the company explained. In the third quarter of 2022, CQP recognized $1.3 billion of non-cash unfavorable changes in fair value attributable to the Tourmaline IMP agreement due to the significant appreciation in the forward JKM curves.

Our IPM agreement is structured to provide stable margins on purchases of natural gas and sales of LNG over the life of the agreement and has a fixed fee component, similar to that of LNG sold under our long-term, fixed fee LNG SPAs. However, the long-term duration and international price basis of our IPM agreement make it particularly susceptible to fluctuations in fair market value from period to period. In addition, accounting requirements prescribe recognition of this long-term gas supply agreement at fair value but does not currently permit fair value recognition of the associated sale of LNG, resulting in the incompatibility of accounting recognition for the purchase of natural gas and sale of LNG,” the company stated.

The market outlook

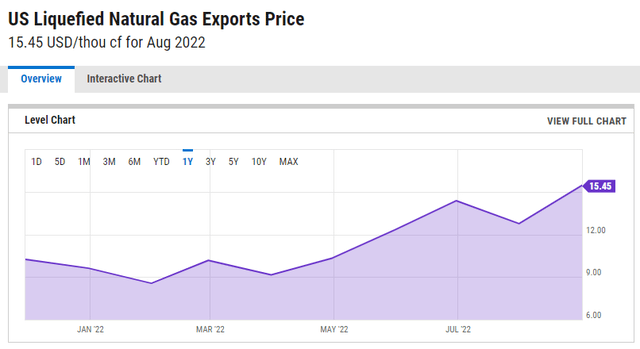

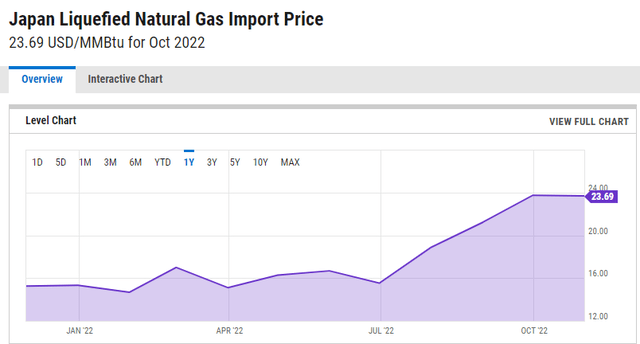

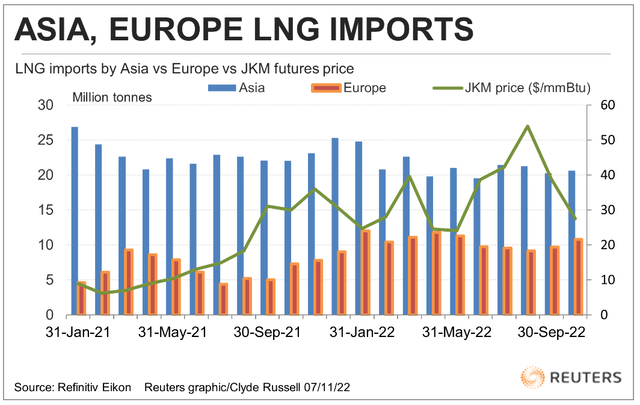

Figure 1 shows U.S. liquefied natural gas export price increased from $8.56 per thousand cubic feet on 31 January 2022 to $15.45 per thousand cubic feet on 31 August 2022. Figure 2 shows that Japan’s liquefied natural gas import price increased from $14.69 per thousand cubic feet on 31 January 2022 to $21.21 per thousand cubic feet on 31 August 2022 and to $23.69 per thousand cubic feet on 31 October 2022. According to Figure 3, JKM’s price decreased from more than $50 in August 2022 to below $30 in September 2022. Meanwhile, Europe’s LNG imports increased in the past two months. Also, Asian LNG imports increased to more than 20 million tonnes in September 2022.

According to EIA, U.S. LNG gross export in 3Q 2022 was 10.02 Bcf/d and is expected to increase to 11.75 Bcf/d in 4Q 2022. EIA expects the U.S. LNG gross export to increase from 11.01 Bcf/d in 2022 to 12.34 Bcf/d in 2023. Compared with the first ten months of 2021, Russian natural gas pipelines to European Union decreased by 50% in the first ten months of 2022 and will decrease further until the end of the year. As European Union was able to import 30 Bcm of Russian gas supply in the summer of 2022 and due to China’s COVID-19 restrictions that decreased its LNG imports, EU gas storage sites are now 95% full. However, Russian gas pipelines to the EU could cease completely and China’s COVID- lockdowns will eventually finish. Thus, the EU will need to increase its natural gas imports from the United States. “Europe could face a gap of as much as 30 billion cubic meters of natural gas during the key summer period for refilling its gas storage sites in 2023,” IEA explained. Thus, according to the LNG prices and LNG demand outlook in 2023 and due to its IPM agreement, CQP is well-positioned to make huge profits in the near future.

Figure 1 – U.S. LNG export price

Figure 2 – Japan LNG import price

Figure 3 – LNG imports by Asia vs. Europe vs. JKM futures price

CQP performance outlook

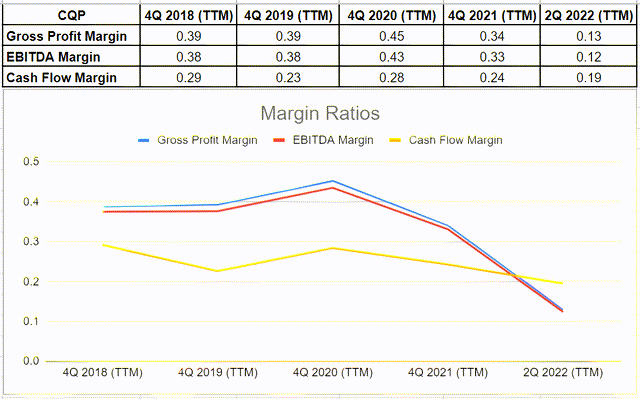

Generally, margin ratios capture the capability of the company to convert sales into profits in different measurements. In this regard, I would investigate Cheniere Energy’s gross profit, EBITDA, and cash flow margin conditions and compare them with previous years. CPQ’s gross profit margin has waned since 2020. In detail, after increasing to 0.45 in 2020, its profit margin decreased to 0.34 in 2021 and dropped deeply to 0.13 in 2Q 2022 (TTM). Additionally, the cash flow margin indicates the relation between operating cash flow and the company’s total revenue. It is obvious that CQP has been able to convert its revenue more slowly compared with recent years. Its cash flow margin plunged by 20% to 0.19 in TTM versus its amount of 0.24 at the end of 2021. Furthermore, after an increase to 0.43 in 2020 versus its previous level of 0.38 at the end of 2019, CQP’s EBITDA margin has fallen and finally sat at 0.12 in TTM compared with its previous level of 0.33 at the end of 2021. These numbers indicate that Cheniere Energy is not able to convert its revenues into profits (see Figure 4). However, we know that this drop in the company’s gross profit margin is due to non-cash unfavorable changes in the fair value of commodity derivatives. With the beginning of 2023, as the company’s IPM agreement will come into effect, CQP’s gross profit margin, EBITDA margin, and cash flow margin will improve significantly.

Figure 4 – CQP’s margin ratios

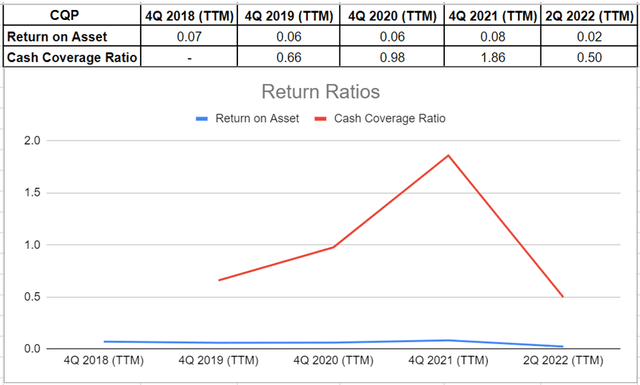

Also, the return on assets ratio reflects how much profit a company can generate for every dollar of its assets. ROA of CQP has dropped to 0.02 in TTM versus its previous level of 0.08 at the end of 2021. Similarly, its return on equity dropped to 0.50 in TTM after a boost to 1.86 at the end of 2021. This ratio indicates the net income of the company, which is relative to the shareholders’ equity. The return on equity ratio is crucial as it measures the rate of return on the money that has been invested into the company (see Figure 5). Again, as the company has not been able to recognize the LNG sale associated with its IPM agreement (due to accounting incompatibilities), its current return ratios are misleading. However, in the near future, CQP’s return on asset and cash coverage ratio will improve considerably.

Figure 5 – CQP’s return ratios

Summary

In September and October 2022, JKM price decreased and with the current trend, CQP’s non-cash unfavorable changes in fair value of commodity derivatives in 4Q 2022 will be lower than in 2Q 2022 and 3Q 2023. However, CQP’s non-cash unfavorable changes in the fair value of its commodity derivatives will hurt the company’s 4Q 2022 financial results. In 2023, the company will be able to recognize the associated LNG sales in its financial results. Thus, the company’s net income will turn into a reliable profitability metric again. The company is well-positioned to benefit from the market condition. I am bullish on CQP.

Be the first to comment