VioletaStoimenova/E+ via Getty Images

After a prolonged period of hyper-growth during the COVID-19 pandemic, video-conferencing company Zoom Video Communications (NASDAQ:ZM) is starting to see slowing revenue growth and weakening customer monetization in its core business. The company also recently issued a disappointing topline outlook for FY 2023 due to normalizing business conditions that no longer support triple-digit annual revenue growth rates. Since shares of Zoom Video are still expensive based on revenues and estimates are falling hard, the stock, I believe, is set to continue to revalue to the downside!

Massive post-pandemic revenue slowdown

During the pandemic, Zoom Video was a big winner for obvious reasons. With COVID-19 condemning a lot of employees to remote work, companies rushed to adopt Zoom’s video-conferencing technology, which resulted in a period of hyper-growth for the start-up. However, the pandemic is wearing off and people are returning to their offices, which results in fundamentally altered growth prospects for Zoom Video. At the height of the pandemic, the start-up doubled its revenues from $328M to $664M in FQ2’21, but growth prospects have moderated greatly in the last few quarters.

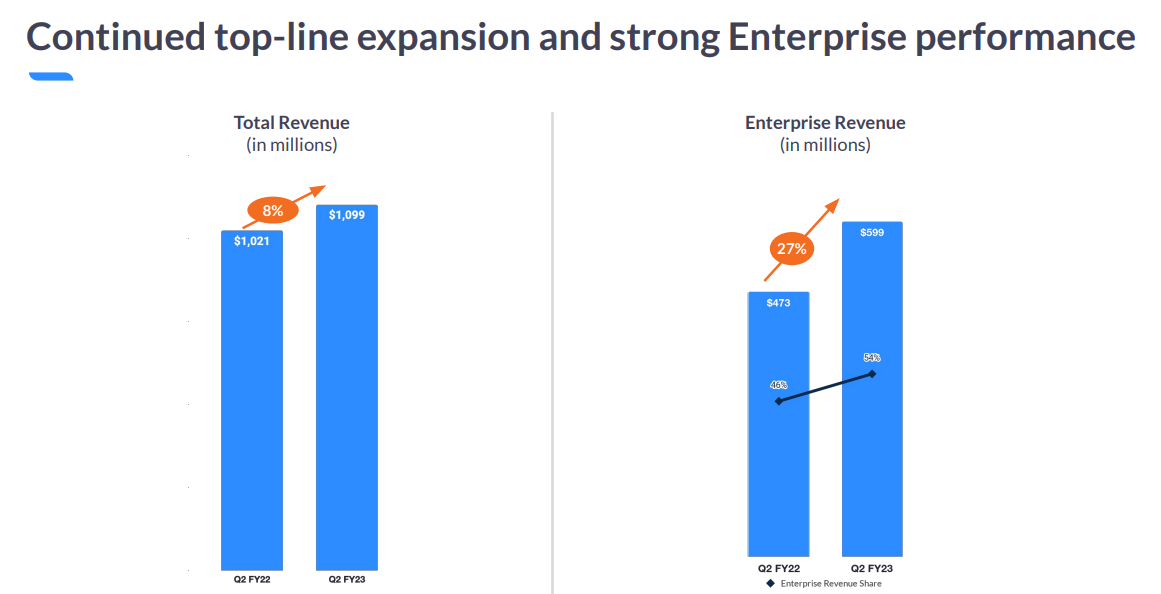

In FQ2’23, Zoom Video generated $1,099.5M in revenues, showing only 8% year-over-year growth. In the year-earlier period, Zoom Video grew its consolidated revenues 7 times faster, at a rate of 54%. While total revenue performance was weak in the last quarter, enterprise customers are still a bright spot for Zoom Video because they are still adopting the firm’s products and services rapidly. Enterprise revenues grew 27% year over year to $599M in FQ2’23 which was in part driven by 18% growth in Zoom Video’s Enterprise customer base. The firm had 204,000 Enterprise customers at the end of FQ2’23.

Zoom Video: FQ2’23 Revenue Growth

Net dollar expansion rate is declining

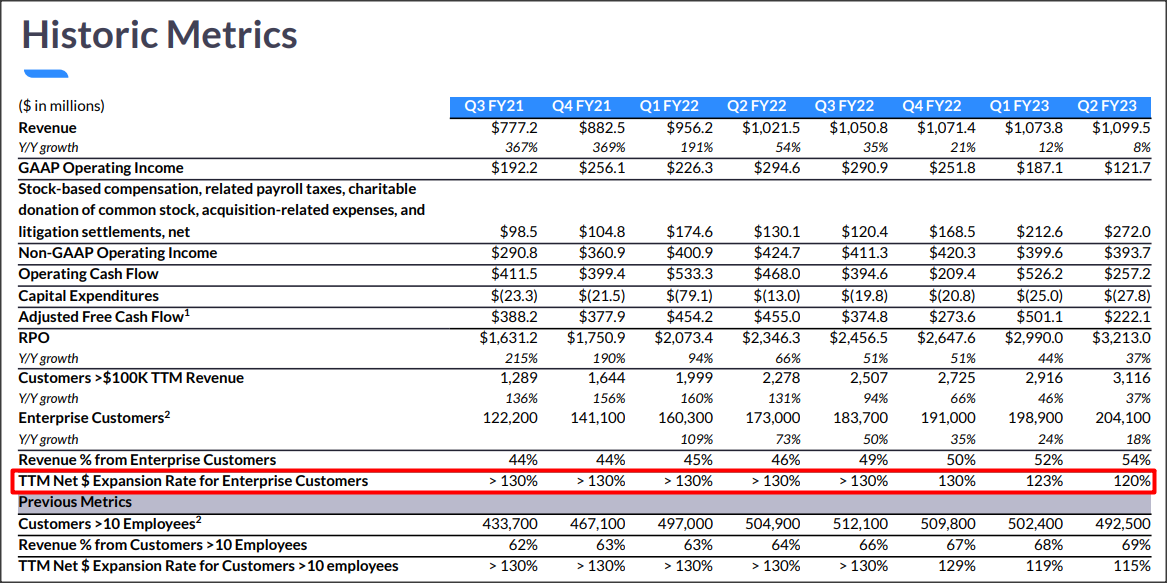

What I see as a potential problem for Zoom Video is that not only is topline growth slowing, but customer monetization is weakening at the same time. Zoom Video expresses its customer monetization with a ratio called net dollar expansion rate/NDER. This figure measures internal revenue growth and shows how much existing cohorts of customers are increasing their spending on the company’s products and services over time. Zoom Video’s NDER measure dropped to 120% in FQ2’23, showing two consecutive quarters of contraction. During the pandemic, Zoom Video’s net dollar expansion rate was 130% or higher, which means that customers are dialing back their spending on the Zoom Video platform.

Zoom Video: FQ2’23 Key Metrics

Outlook for FY 2023

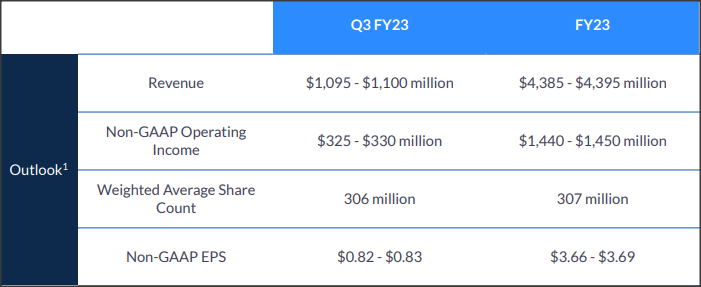

For the current fiscal year, Zoom Video projects to generate $4.385-$4.395B in revenues and the company downgraded its forecast from $4.530-$4.550B which was issued just three months ago. In FY 2022, the company generated $4.10B in revenues, meaning the current outlook implies only 7% year-over-year growth which, for a company like Zoom Video, is exceptionally poor.

Zoom Video: FY 2023 Outlook

How fast will Zoom Video grow?

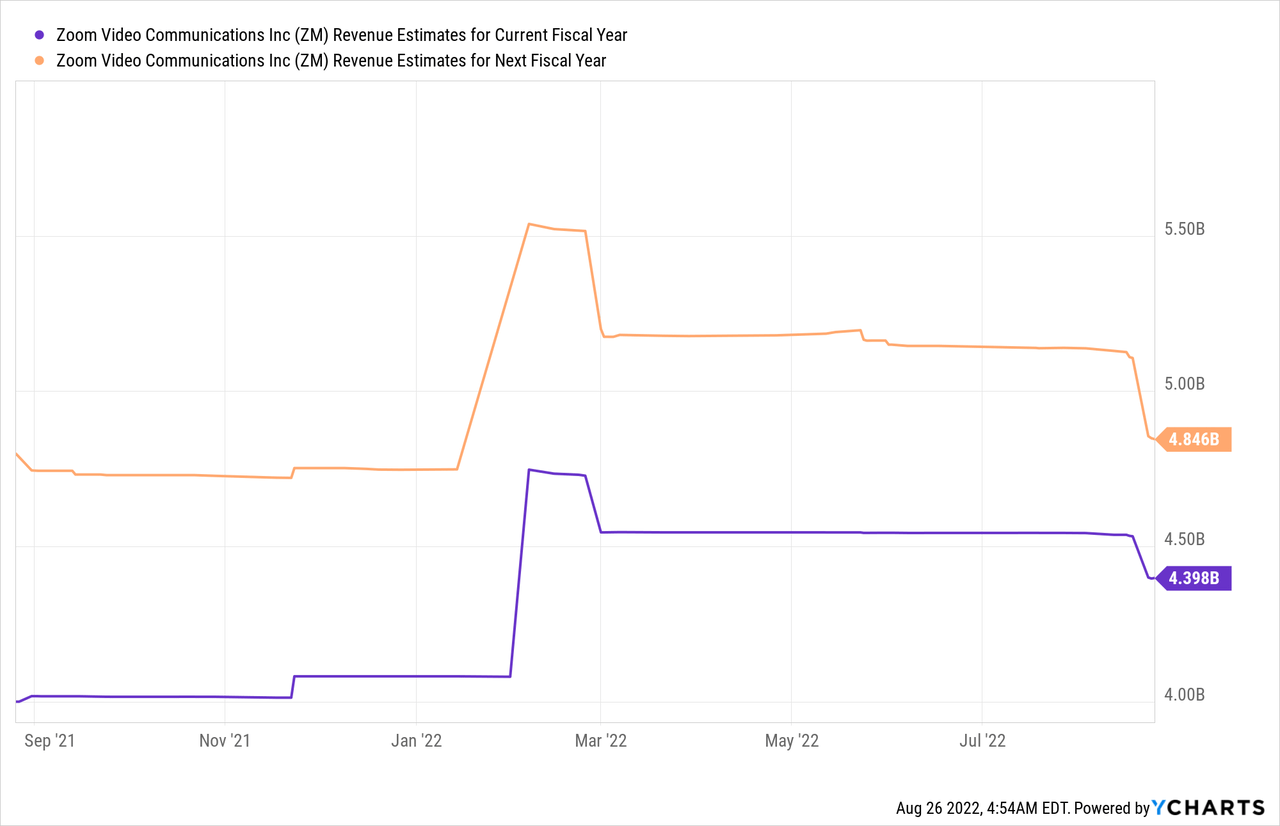

The expectation is for the company to grow its topline to $4.40B in FY 2023 and $4.85B in FY 2024, implying year-over-year growth rates of just 7% and 10%. However, after the company submitted its outlook for FY 2023, revenue estimates have dropped off, which is a direct reflection of Zoom Video’s moderating growth.

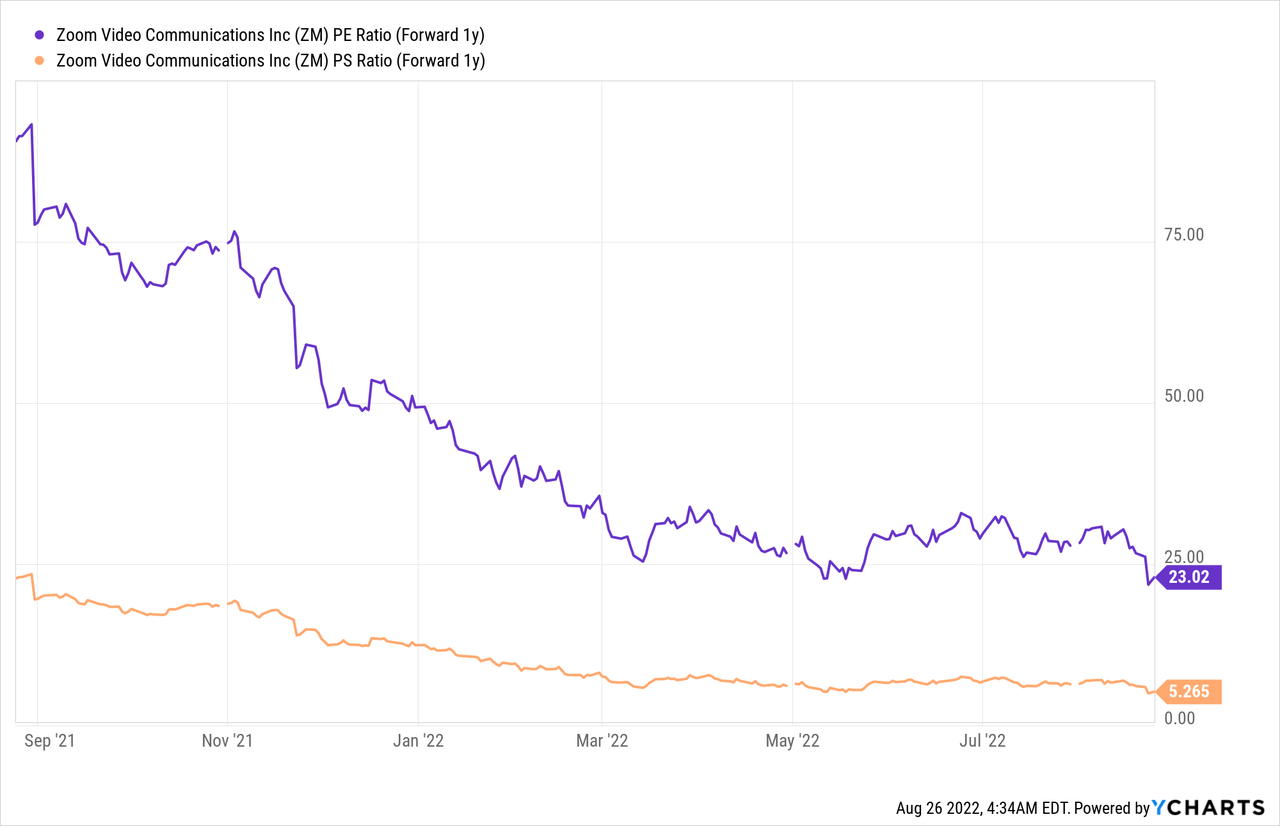

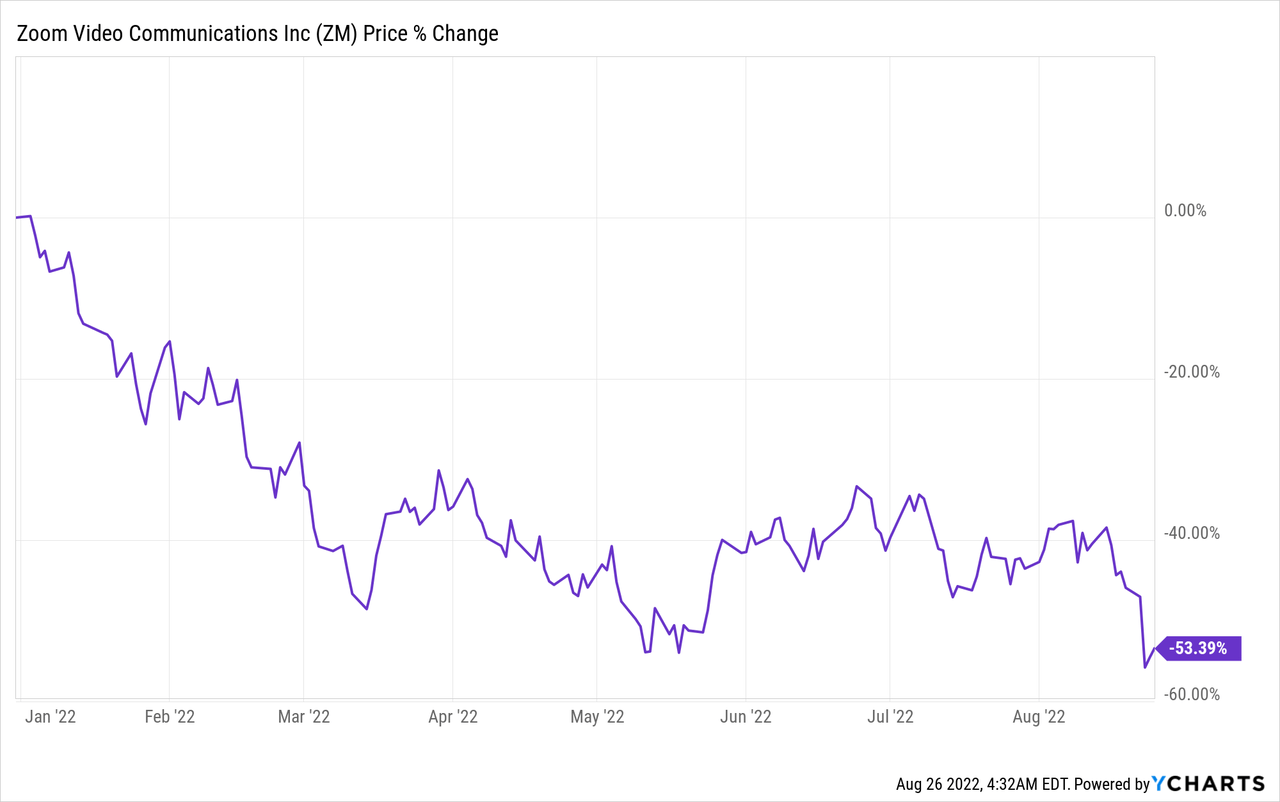

The big problem that I see with Zoom Video is that the stock remains expensive on a price-to-revenue as well as a price-to-earnings basis, despite already dropping more than 50% this year. Since reaching a high of $568.34 in October 2020, Zoom Video’s shares have declined 85%. Despite such a massive draw-down, shares of Zoom Video still have a price-to-revenue ratio of 5.3 X and a price-to-earnings ratio of 23.0 X. Considering that the video-conferencing company is projecting to grow revenues only at single digits this year, I believe shares are wildly overvalued.

Risks with Zoom Video

The company will continue to expand and add enterprise customers to its platform, but the Zoom Video platform as a whole will grow a lot slower than in the past. What I see as a major commercial problem for Zoom Video is the slowdown in the net dollar expansion rate, which indicates weaker customer monetization and a growing hesitancy among the company’s enterprise customers to ramp up platform spending. Since customer monetization is weakening at the same time as the firm is losing revenue momentum, Zoom Video is facing a broad deterioration of platform metrics.

Final thoughts

The (growth) party is clearly over for Zoom Video and the problem is that despite a downward revaluation of 53% year-to-date, the stock is still very expensive based off of revenues and earnings. Considering that the video-conferencing company’s revenues are now only growing in the single digits and that management just reduced its growth outlook for FY 2023, the stock has a highly unfavorable risk profile!

Be the first to comment