Dilok Klaisataporn

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on August 12th, 2022.

Tortoise had previously announced several shareholder-friendly moves to make its funds more attractive to investors. We explored more of those moves in an earlier article. After the 2020 energy bloodbath and massive deleveraging in the closed-end fund space – particularly those with energy exposure – investors have been very hesitant to buy up these shares.

I certainly don’t blame anyone. I swore off pure-play energy funds myself, so I completely understand. I even cashed in on some sizeable profits by selling off Kayne Anderson NextGen Energy & Infrastructure Fund (KMF) earlier this year. Leverage and an extremely volatile sector just don’t mix well. I learned the lesson finally after the 2020 crash, but had also been investing in energy through 2014 and 2016. Oil also led to poor results in the energy sector with the downturn.

With all that being said, I think energy and, more specifically, fossil fuels will play a role in the future in some capacity indefinitely. I prefer to invest in fossil fuels with flexible funds, such as Tortoise Energy Infrastructure Corp (NYSE:TYG). However, I’m also invested in other solid individual companies that are sizeable enough to remain relevant such as Chevron (CVX) and Enterprise Products Partners (EPD). TYG is a fund that will allow exposure to various energy and infrastructure plays.

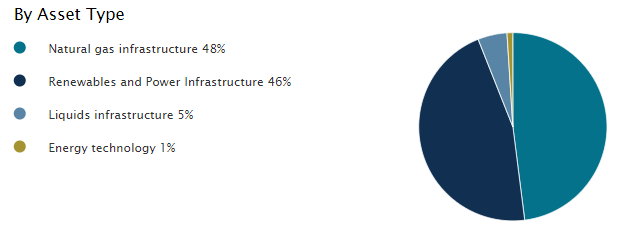

TYG Asset Type (Tortoise)

Conditional Tender Offer Triggered

Today I wanted to touch on TYG again because there has been an update on the proposed conditional tender offers they had previously announced. They posted recently that the conditions have been met, and a tender offer will commence “on or around October 3rd, 2022.”

Tortoise and the Board of its closed-end funds previously announced its approval of conditional tender offers as part of the discount management program. A Fund would conduct a tender for 5% of the Fund’s outstanding shares of common stock at a price equal to 98% of net asset value (NAV) if its shares trade at an average discount to NAV of more than 10% during either of the designated measurement periods. The first measurement period for 2022 ended on July 31, 2022 and it has been determined that a tender offer will be executed in each fund. The tender offers are expected to commence on or around October 3, 2022. The Funds will issue a press release announcing the tender offers on the day the tenders commence. The Funds’ portfolio managers, officers and Board of Directors will not tender their shares. The second conditional tender offer measurement period is from August 1, 2022 through July 31, 2023.

This is relevant to several of the funds offered by Tortoise, but as a holder of TYG, I’m focusing on that name specifically. What we discuss will still be relevant for the other funds, though; Tortoise Midstream Energy Fund (NTG), Tortoise Pipeline & Energy Fund (TTP), Tortoise Energy Independence Fund (NDP) and Tortoise Power & Energy Infrastructure Fund (TPZ).

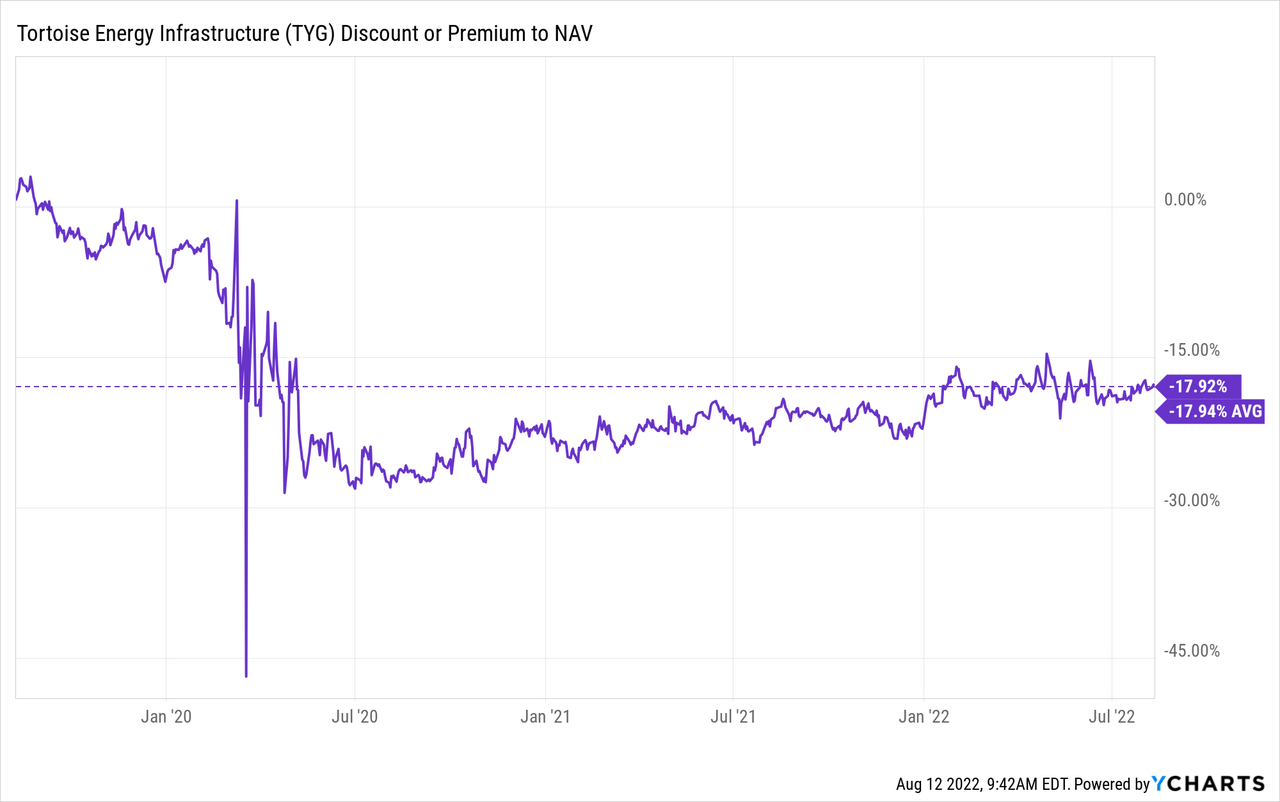

As we can see, TYG was clearly at a much deeper discount than 10% for much longer than the measurement period used. Since that 2020 collapse, closing that discount has been a slow, long grind.

YCharts

Here’s Why You Should Participate

I believe this tender offer is worth participating in if you are a shareholder of TYG. That’s even if you don’t really want to reduce your exposure to the fund. It’s because you can ultimately rebuy your position later and potentially accumulate even more shares or an equal number and keep the cash difference.

Here is some math behind it, but note that these aren’t the actual figures that will be used. This is just an example of what could happen based on today’s numbers.

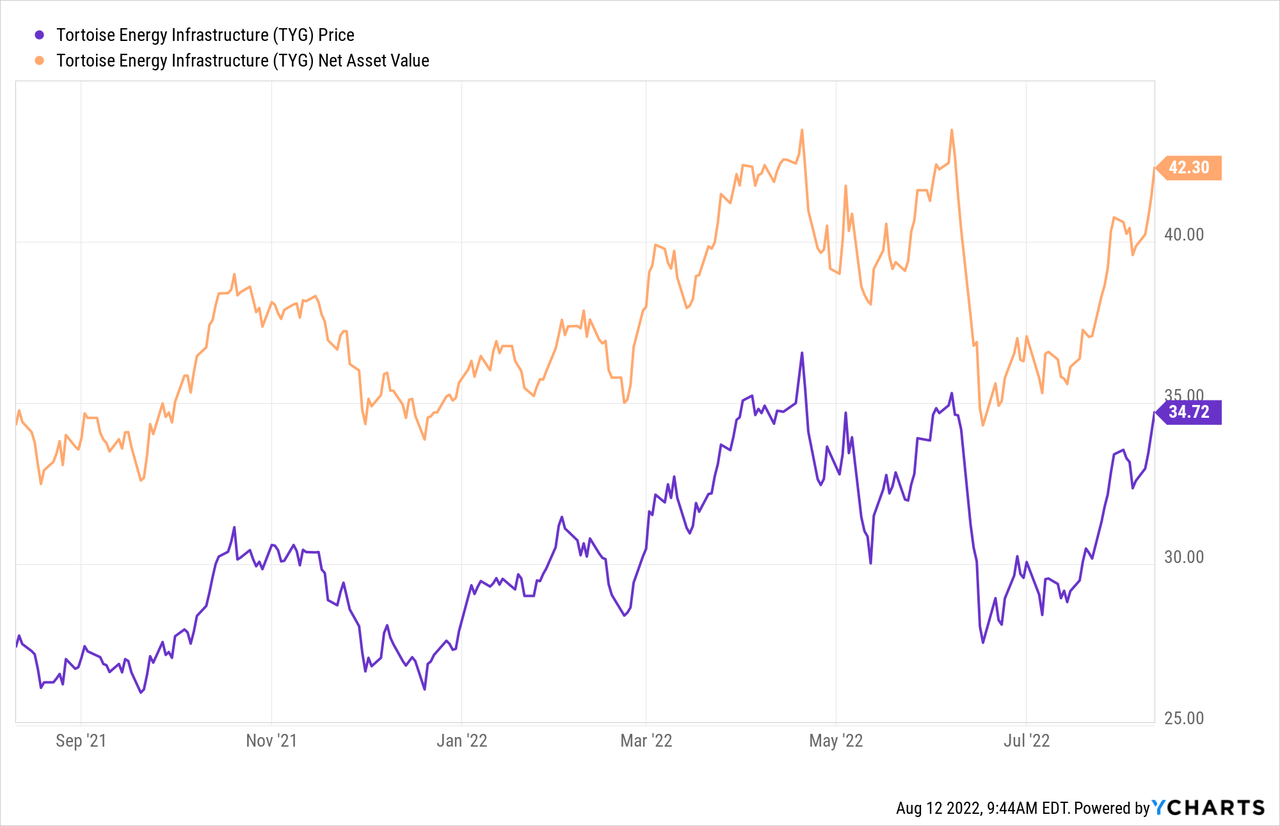

YCharts

Looking at the share price and the NAV today, we can see a large divergence between the two. Thus, how we arrive at the 17.92% discount and why this offer makes sense for shareholders.

Let’s say you have 1000 shares of TYG. We will just use a nice simple round number to help illustrate. They will buy up to 5% of the outstanding shares at 98% of the NAV.

Again, we are just using today’s prices as an example since we won’t know the exact NAV in the future. That would be $42.30 with the latest close. 98% of that comes to a repurchase price of $41.454.

The 5% is the minimum amount too. It will be higher because they specifically state that; “The Funds’ portfolio managers, officers and Board of Directors will not tender their shares.”

On top of this, there will be several shareholders that don’t participate simply because they might not know what’s going on. That’s what we’ve historically seen with these offers. Something like 8 to 10% is achievable that we might experience for those that offer. Trying to stay conservative with my guess, but it could be even higher.

For this exercise, though, we will just say that only 5% are tendered if you participate with 100% of your shares. That would mean 50 of your 1000 shares would be tendered. That would result in proceeds of $2072.70.

Now, you could take that amount of money and repurchase shares in the open market at the $34.72 that shares closed at today. That would result in a total number of 59.7 new shares. 60 if you throw in a couple of bucks to top it off. That would then take your total share count to 1010 by doing nothing but reaching out to your broker to say you want to participate and then buying shares back.

Of course, this example was only 1000 shares. The more shares you own, the better the outcome. You can easily see that if you wanted to repurchase only your 50 shares back to round off your 1000 share exposure again, you’d even have some cash left over.

The Risks Of This Play

Like all investments and strategies, there are risks. TYG still holds significant energy exposure, so it is a volatile fund. For this tender offer play, here are a couple more factors to consider that could work against us.

For one, the price of TYG should rise now that this tender offer is in play. After the tender offer, there is generally a post-tender slump. In this case, the slump should be relatively minimal, with only a 5% tender offer. As a shareholder, if you were looking to repurchase after the tender offer, it could work out even better in this scenario as you could pick up an even greater number of shares.

Alternatively, the opposite could happen. There is generally a delay that can be up to a week from what I’ve experienced. That is when the shares are tendered to when the cash arrives in your account. As a personal example, Voya Prime Rate Trust announced the results of the tender offer on January 6th, 2021; I didn’t receive the cash in my Fidelity account until January 12th, 2021.

In between that time, shares could rifle higher, which would cause you to repurchase even less than you otherwise might have been able to. The risk here is also minimal, in my opinion, based on the post-tender slump that could be experienced.

The potential post-tender slump and the fund’s volatility is one reason I don’t believe it is worth playing unless you are already a shareholder or wouldn’t mind being one. At a 5% tender offer, you might be left with a significant position that you can’t unload profitably. Thus, wiping out the gains you’d make on the tendered shares. As a shareholder that is already happy with my position and exposure in the fund, it is definitely worth playing, in my opinion.

Other Relevant Shareholder-Friendly Move

TYG has been in a big transition too, which is why I believe it is more appealing. The greater flexibility for one thing after the crash, but this latest tender offer is just yet one more example. Additionally, while it is structured as a C-Corp, they have intentions to qualify as a regulated investment company. That’s an important transition on its own because that means no more taxes on the fund level. This is also the intention of NTG for holders in that fund.

Each of TYG and NTG, was previously taxed and, as such, was obligated to pay federal and state income tax on its taxable income. Beginning with the fiscal year ending November 30, 2022, TYG and NTG intend to qualify each year for special tax treatment afforded to a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code (“IRC”). In order to qualify as a RIC, TYG and NTG must satisfy income, asset diversification and minimum distribution requirements. As long as it so qualifies, TYG and NTG will not be subject to U.S. federal income tax. TYG and NTG intend to distribute at least annually substantially all of its income and gains. Undistributed income and gains are subject to a 4% U.S. federal excise tax unless sufficient distributions have been made to satisfy the excise tax avoidance requirement.

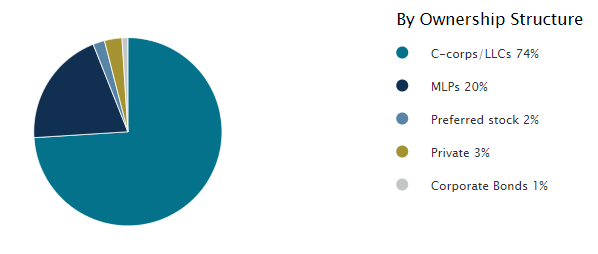

This is a move that makes sense for the fund and is also shareholder friendly for investors. The reason they couldn’t previously qualify was their higher exposure to MLPs. To qualify as an RIC, you need 25% or less exposure to MLPs. With the world of MLPs shrinking through conversion to C-corp, MLP-focused funds are becoming less relevant. Whatever your view on MLPs or the energy space, I believe this highlights how Tortoise is a management team that can evolve and adapt to changing circumstances.

TYG Structure Weighting (Tortoise)

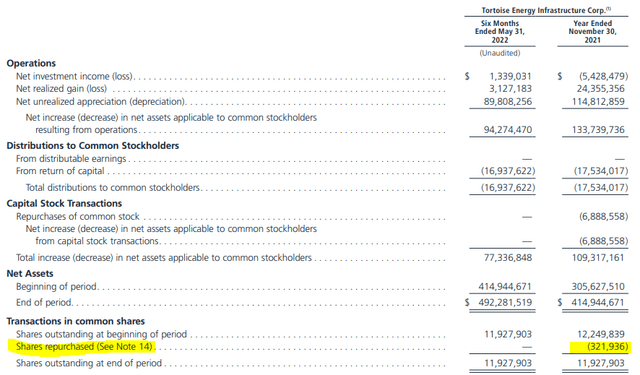

Finally, they have a repurchase plan in place. Over the past six months reported, they did not repurchase any shares but were actively rebuying them in the previous fiscal year. With the fund’s discount, repurchasing shares could still make sense.

TYG Semi-Annual Report (Tortoise (highlights from author))

Conclusion

The history of the fund is a hard thing to get over for many investors. I understand that we only want to see funds that go up and never have anything bad happen. That doesn’t happen in the leveraged world of energy funds. Their history is volatile and shaky, though it’s been a solid run since the March lows. I view the latest moves as positive, a fund sponsor that is trying to do something rather than nothing. If we can continue to get the energy and infrastructure space to cooperate by providing strong returns, then we will continue with attractive results.

Be the first to comment