imaginima/iStock via Getty Images

EchoStar (NASDAQ:SATS) is one of the leading providers of satellite internet in the US, through its wholly owned subsidiary HughesNet. Additionally, the company has minor segments abroad.

The company is currently under heavy capacity constraints because its satellites cannot increase their services without affecting service quality. SATS is planning to launch a new satellite in Q1’23 that can double or triple its current capacity for the US.

With a good financial position and current net income from core operations in the order of $100 million, the stock is priced for growth at a $1.6 billion market cap.

Assuming a similar cost structure after the launch of its new satellite, I assume SATS might need to grow its operating profits by 60% in order to justify its current price. That might be possible although risks are still present, and anyways it would require time.

With the current market offering similar growth-prospect companies trading at much lower multiples, SATS does not seem particularly cheaply priced.

However, a very aggressive share repurchase program could substantially reduce the share count, therefore, increasing EPS and probably the share price.

Note: Unless otherwise stated, all information has been obtained from SATS’ filings with the SEC, particularly its FY21 10-K annual report.

EchoStar and the internet satellite industry

EchoStar is originally a spin-off company from Dish Network (DISH). The company operated a series of broadcast satellites. Then in 2011 it acquired HughesNet, entering the internet satellite business.

Between 2017 and 2019, the company divested most of its broadcast satellites operations to DISH in exchange for DISH shares. Therefore, since 2019, EchoStar is actually mostly Hughes, the satellite internet provider. There is another segment related to EchoStar’s original services but today it accounts for an insignificant amount of revenues, less than 1%.

Satellite industry Porter forces

In its segment, Hughes is a leader, accounting for 54% of the VSAT market. Its biggest competitor is Viasat (VSAT) in the US.

This is a market with huge barriers to entry, given that it requires capital intensive, half a decade long investments in satellites, facilities and infrastructure. It is, though, a market prone to rivalry, given that gaining a customer has a very small effect on costs at the margin.

In the broader internet market, satellite does not represent a big percentage. It mostly caters to clients that are not covered by cheaper and faster terrestrial based alternatives. The threat of substitutes in this market is very high.

The core of Hughes’ client base is people or organizations that cannot access other forms of internet, otherwise they would choose the alternative. Particular use cases are rural areas. This source of demand is shrinking as terrestrial based alternatives increase their infrastructure coverage.

There is some hype that IoT and connected objects will increase the demand for satellite connections. However, Hughes’ network is based on geostationary satellites that stay fixed at a point in the sky. These satellites can be easily connected to fixed antennas, but are not as good for connecting moving objects, like IoT or connected cars, because they need rotating antennas. The investments in low earth orbit, LEO satellite constellations, like the famous Starlink, tries to solve this future problem. EchoStar has a small stake in this market through OneWorld, the recently bankrupt and revamped LEO satellite company.

Therefore, from the demand side one could argue that Hughes’ market is either shrinking or at least not growing too much, in terms of quantities of customers. The market can always grow in terms of quantities demanded, by increasing the quantity of data transmitted. However, these scale improvements usually result in a race to the bottom prices.

On the supply side, SATS deals with a concentrated market of manufacturers of satellites and launchers, a more diversified market of electronic equipment providers and a relatively strained technical human resources market. The company’s median compensation is $112 thousand a year, according to its latest proxy report.

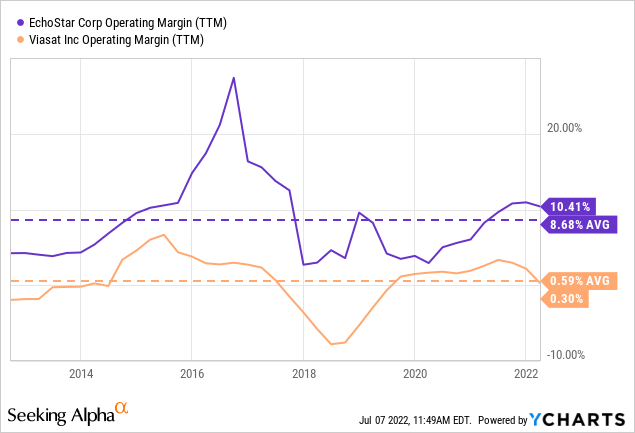

So from a Porter’s perspective, the satellite internet market is not great, with high rivalry, threat of substitutes and bargaining power of suppliers. This has a depressing effect on Hughes and Viasat’s operating margins.

EchoStar’s structure

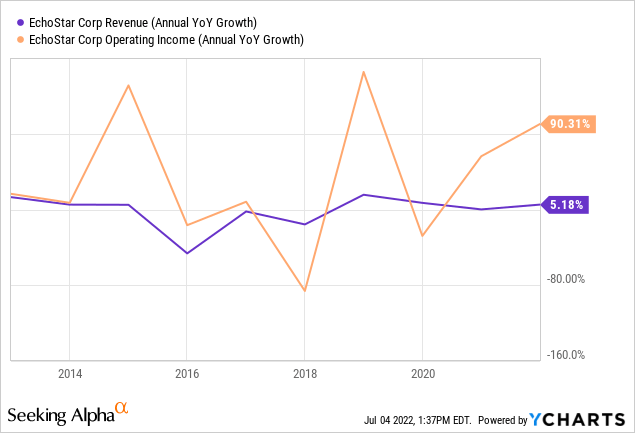

SATS’s cost structure can be characterized by high operating leverage, as can be noted in the chart below, small movements in revenue generate enormous movements in operating income.

This is understandable given the previously mentioned high costs of entry of the industry. The company cannot adjust all the infrastructure needed to provide the services at some level of capacity at short or even medium notice. In the margin, small changes in revenue do not produce the same changes in costs.

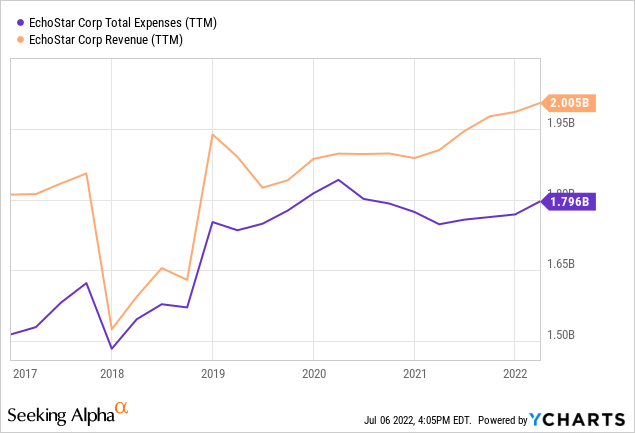

Like the chart below shows, there is a modification of expenses that move in line with changes in capacity, but once a capacity is set, the margin can expand a little bit by increasing revenue.

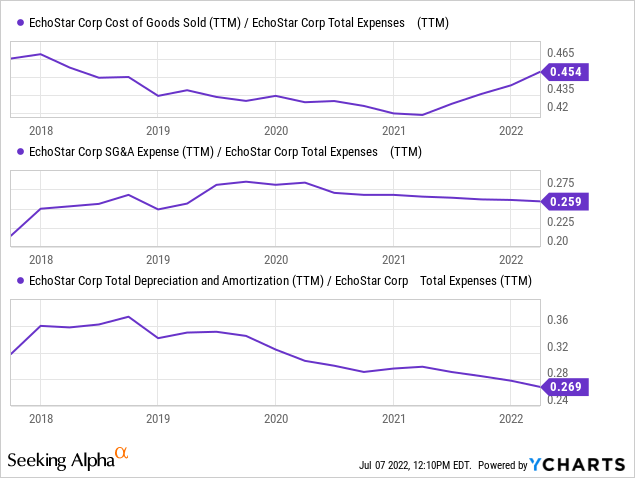

SATS’ cost structure is divided between CoGS (which excludes depreciation), SG&A and depreciation expenses, as the charts below show.

CoGS represent the equipment directly expensed, like the modems or small consumer type antennas, and organization costs of the infrastructure, like the technicians. It also includes the cost of connecting to the internet infrastructure, as SATS also has to pay terrestrial carriers.

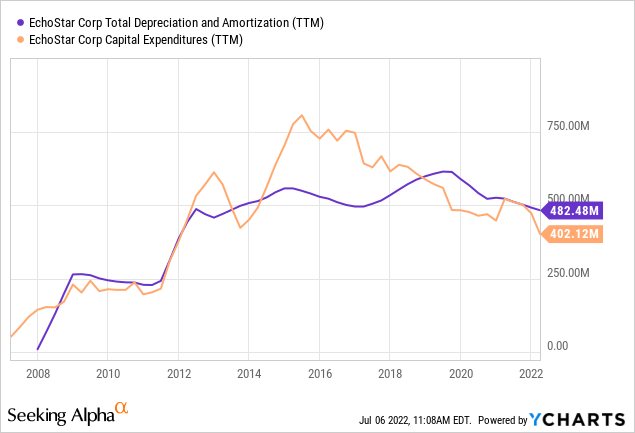

Another big portion of SATS’ expenses is depreciation, which has moved more or less in line with capital expenditures for the last few years. The core capital expenses happen at the terrestrial infrastructure level, particularly in things like customer antennas, that depreciate quickly. Satellites represent 50% of gross PP&E, but only 25% of depreciation and one third of capital expenses.

Financial structure

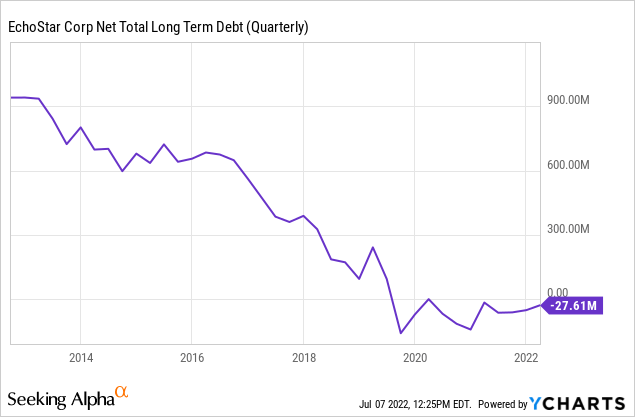

At the financial level, SATS is currently very well capitalized, with very low net debts as of Q1’22.

The company has $1.5 billion in notes that mature in 2026 and pay a weighted average of 6%, that is $90 million a year.

From those interests, SATS capitalizes a significant portion. In 2021, with more debt than today, the company capitalized $40 million out of total $130 million in interest. As of 1Q22, with lower, $90 million yearly interest expenses, the company is still capitalizing up to $10 million a quarter. Only the non-capitalized portion should be considered for profitability calculations given that the rest is indirectly expensed with PP&E.

To compensate for that debt, SATS has approximately another $1.5 billion in cash and marketable securities, mostly debt securities.

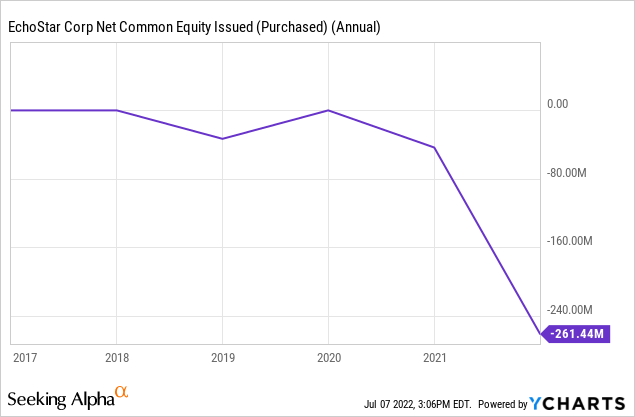

The company has not engaged in significant share dilution, quite the contrary it has repurchased a significant amount in the last few years, particularly in 2021 with 10% of the share base.

[object HTMLElement]

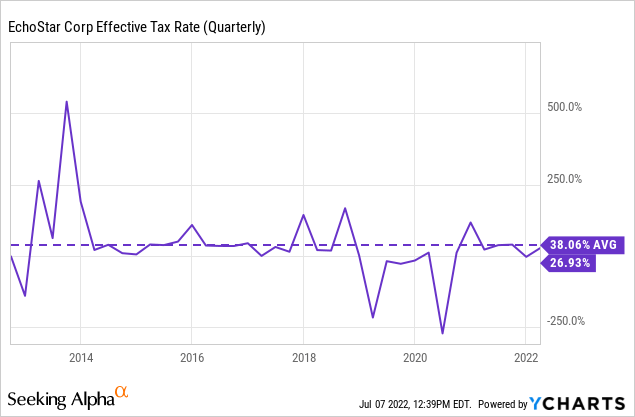

Taxes

Being an international company, SATS suffers from the usual higher income tax rate. This is the result of having NOLs in countries where there might not be probable future income to match. For example, in 2021, $40 million out of the $65 million tax provision comes from allowances, meaning NOLs that are not recognized because they cannot be matched in the future.

Cash flows

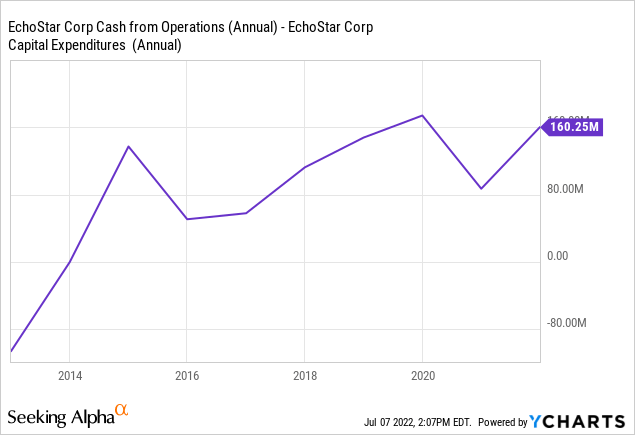

With depreciation matching capital expenditures, and interest recognized as operating cash outflows, SATS’ CFO minus capital expenses represents well the company’s EBT from core continued operations. The chart below already accounts for interest, both the expensed and the capitalized.

Income generation with Jupiter 3

SATS is planning to launch a much higher capacity in 1Q23, called Echostar XXIV or Jupiter 3. The satellite is planned to expand the company’s capacity to bring services by 100% or even 200%.

According to the company’s satellite fleet description, the previous satellites Echostar XVII and XIX, have a capacity of 120 and 260 Gbps respectively. Jupiter 3 is expected to have a capacity of 500 Gbps, therefore, almost tripling total capacity. The fleet also includes other leased satellites but they serve Latin America, not the US, where the core business is generated.

Using the model exposed above, the company currently has an operating income generating capacity of about $210 million. From that, $50 million have to be subtracted for non capitalized interests yearly. Then a 40% tax rate has to be applied, rendering about $100 million in net income, without considering one time items or other investments (totaling $300 million, mostly private equity and debt investments).

To justify the current $1.6 billion market cap with an expected earnings yield of 10%, the company should be able to earn $160 million. If we invert the process above, we arrive at around $320 million in operating income. This means around a 50% increase in income, which at current margins of 10%, should amount to $3.2 billion in revenue, or an 88% increase in revenue.

Some things have to be considered also.

First, can the company improve its margins with the new capacity? Second, can the company increase revenues at the same level that it increases capacity?

We saw that operating margins did not improve significantly for much of the past decade despite similar technologically advanced launches. This is probably related to the competitive forces described, mostly competition from Viasat, other forms of internet and, in the future, LEO internet.

With respect to Viasat, the company plans to launch three new satellites to cover the globe, each with 1 Tbps capacity. The first one, competing with Hughes in North America, is also planned for Q1’23. This means the market will suffer from increased capacity next year.

I am no expert on the satellite internet market, but the competition landscape and the launch of competing capacity by Viasat make me think that the beneficiaries of the technological improvements will be customers, through better services at the same or similar prices, rather than the companies, through either increased revenue, margins or customer counts.

These satellites require years of planning, in the case of Jupiter 3 it was commissioned in 2017. Once the satellite is up in space a big portion of costs are sunk, because terrestrial facilities and infrastructure also have to be prepared in advance. At that point companies have a big incentive to increase utilization at the expense of margins.

In my not expert opinion, it is akin to two steel manufacturers building a new decade long factory each that will respectively double or triple each one’s capacity. The result will probably be more competition, not more profits.

Management and shareholders

SATS is controlled by Charles Ergen, its founder and also controller of Dish Network. Ergen has 60% of the stock and 92% of the votes. In my opinion this is usually a plus, having a single person at the helm with interests aligned with shareholders rather than accountable to no-one directors.

Management compensation does not seem excessive at $7 million, for a company generating almost $100 million in net profits.

Finally, in Q1’22 the company announced a change of CEO and the resignation of its Chief Strategy Officer. I do not know what this means for the business but it is interesting that it happens less than a year before an important strategic milestone.

The repurchase program

The company has a $500 million share repurchase program, not accounting for the 10 million shares repurchased last year. At current market caps, and considering that 60% of stock is already owned by Ergen, the program could potentially affect stock prices. At current prices the program represents 25 million shares, with a float calculated at 35 million shares.

Ergen cannot sell his shares to the company because he has class B, non publicly traded shares, therefore, the repurchased shares have to come from float.

If all shares are repurchased, this could bring outstanding shares to 65 million, which paired with our calculated net income from core operations of $100 million yields income of about $1.5 per share.

Of course, it would be difficult to purchase 25 million shares out of a 35 million float without severely modifying prices. Or maybe not, if added by the current bear market. As of Q1’22, the company has purchased $33 million.

Conclusion

From a market perspective, the business SATS participates in is not great. It is unclear whether or not the expected increase in satellite capacity will be transformed into increased profits that can justify current prices.

Therefore, from a purely business perspective, current prices do not seem great, especially compared with companies with better competitive environments trading at lower multiples.

However, the share repurchase program could have substantial effects on both EPS and stock prices. Some readers may want to speculate on that possibility.

Be the first to comment