chameleonseye/iStock Editorial via Getty Images

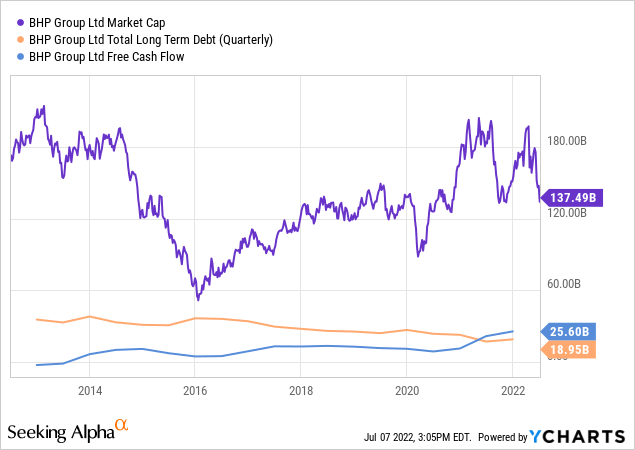

As copper and commodity prices continue to get smashed, BHP Group Limited’s (NYSE:BHP) share price is pulling back as well. Copper went to its lowest in nearly 20 months on persistent worries about a potential recession. Demand for metals isn’t exactly helped, as the dollar has been ascending to a nearly 20-year high vs. the euro. China continues to deal with COVID-19 with a unique strategy, and this is weighing on iron ore prices. BHP’s market cap is back to $137 billion. It has around $6 billion of net debt and generates $8.5 billion in free cash flow. Its cash flow is unlikely to hold up and is notoriously volatile, but that’s not the end of the world as its capital structure appears quite robust.

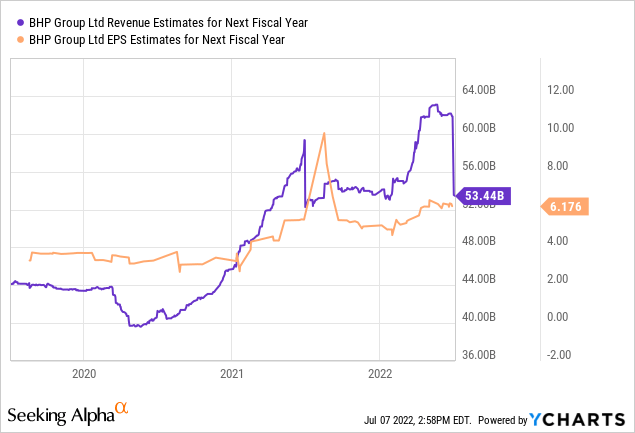

Recession fears are reflected in analyst estimates for revenue and to a lesser extent EPS in the next fiscal year.

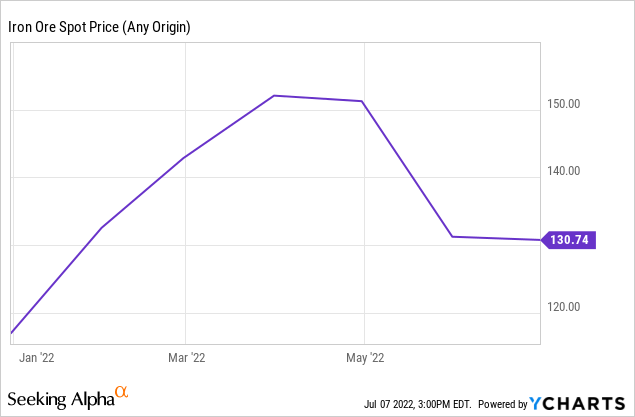

It would be surprising if these were being adjusted upwards, as iron ore prices have recently retreated:

What’s maybe been overlooked by the market is how much this company has been de-risked. It used to generate a lot less cash flow, but it had a lot more debt:

Sure, commodities have been trending down lately, and there’s good reason to expect free cash flow from operations to follow. Maybe we will have a recession.

Analysts are admittedly correctly calibrating forecasts downwards. But I do see some things I like.

I’m far from certain BHP will beat on revenue or EPS on these one-year forecasts but think it can generate reasonable returns even if circumstances deteriorate a bit further from here.

I’m not entirely sure if commodities, as a sector, will be as fickle and notoriously prone to drawdowns as they’ve been in the past. China won’t be growing as explosively as it has in the past. What’s sometimes forgotten is how 6% or even 4% growth of what’s now a huge pie (2nd largest GDP in the world) still requires enormous growth in real numbers. At the same time, slower-growing (but huge economies) like the U.S. and the Euro area are undergoing an energy transition. An energy transition that requires a lot of commodities such as windmills, solar panels, batteries, other energy infrastructure, and electric vehicles all require lots of steel, copper, nickel, carbon, etc.

Where European oil majors are sometimes investing heavily in next-generation energy assets themselves like windmill parks or solar energy parks as well as hydrogen assets, BHP seems to take a more cautious approach. David Lamont, CFO, said the following in a recent shareholder Q&A session:

So if you look at the renewable energy space, we certainly think the best thing that we can do to help the decarbonization and that energy transition is continue to mine effectively copper, which goes into the solar side of things and is critically important. And we also continue to support the steel industry, which is paramount into the wind farms. And we think by doing that and looking at our capabilities, which are far more orientated towards mining, gas and oil rather than infrastructure, we’re going to get a better payback than actually going into those areas.

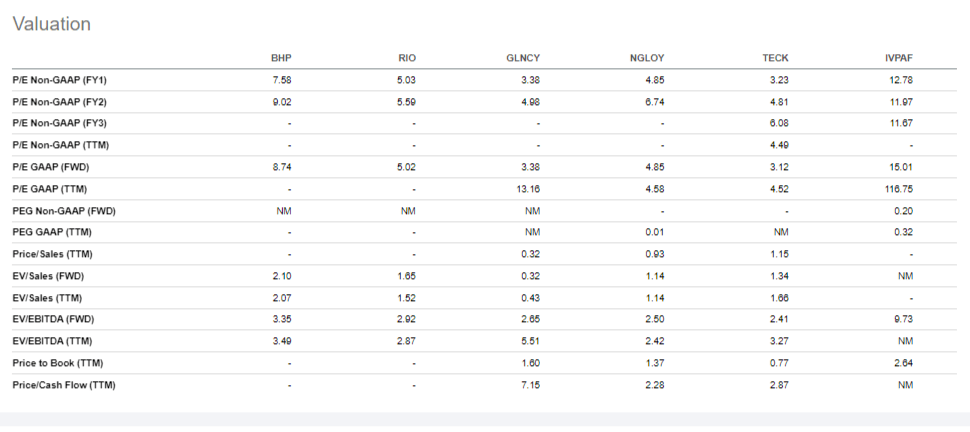

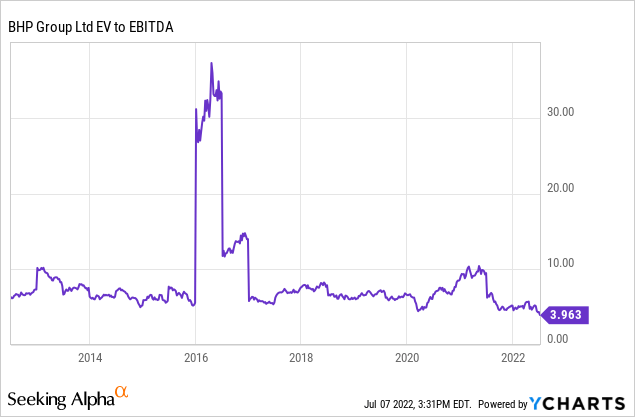

With a P/E of 7.5x and EV/EBITDA of something like 2.5x BHP just looks very cheap to me.

I pulled up Seeking Alpha data to get an overview of valuations across the larger mining conglomerates like Rio (RIO), Vale (VALE), Glencore (OTCPK:GLCNF), etc. BHP is certainly not an exception in terms of trading at a low multiple.

Valuations Mining Industry (SeekingAlpha.com)

It is actually fairly common for miners to trade at low valuation multiples when the going is good. Usually, that’s some kind of peak earnings period and the market (usually correctly) anticipates a normalization.

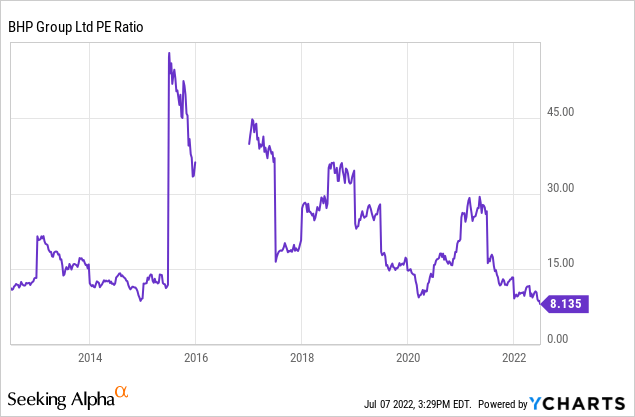

However, since 2012 BHP rarely traded at such a low P/E multiple:

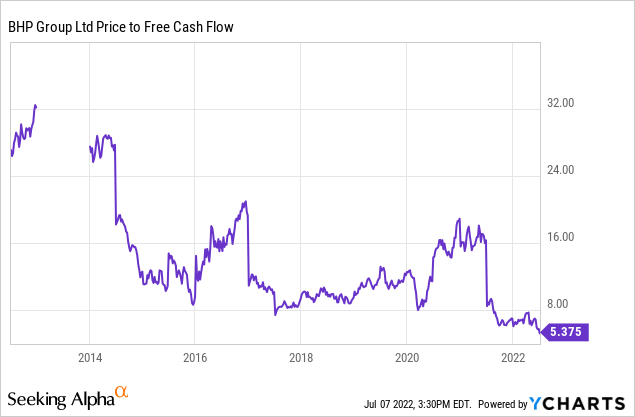

or price to free cash flow multiple:

or EV/EBITDA multiple:

It is almost as if the market is pricing in the mother of all recession coming up. It just seems doubtful to me a recession would cause a long-lasting and devastating blow to commodity prices this time around.

For one thing, I haven’t really seen big mining conglomerates make enormous CapEx investments in many, many years. They make some investments but not really the huge capital allocation deployments we saw when China was truly booming.

Meanwhile, if we have a recession, I wouldn’t be surprised if we saw some intervention from the fiscal side to nudge the energy transition forward. In my humble opinion, the energy transition is going to be on the agenda whether we’re in a recession or not, and that should provide a bit of a floor to BHP.

I tend to keep an eye on the big miners because I want to keep tabs on what kind of supply is coming online and how they’re thinking about the future. There are some smaller companies that I really like. If I look at the valuations and about possible future paths for commodities, they pretty much all look kind of attractive to me.

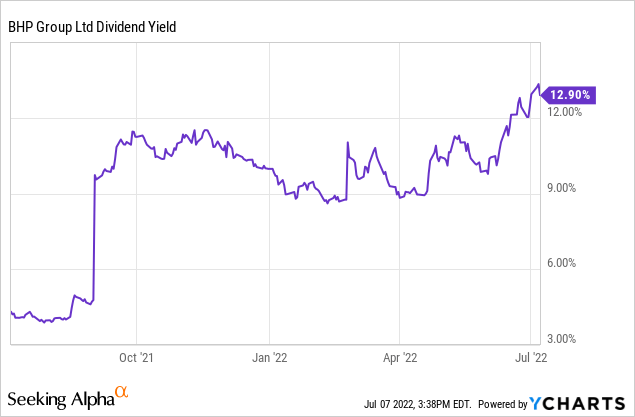

I don’t think I’ll be buying BHP any time soon. I’m leaning more towards a Glencore and have some option contract exposure to Vale. BHP would make a lot more sense to me if I wanted a holding that 1) generated quite a bit of dividend. The current TTM yield is astounding.

The company is also committed to paying out 50% of its free cash flow. This is very attractive, as this could be a lot of money if commodities hold up better than expected. 2) A holding that was able to exhibit quite a bit of mark-to-market volatility but with little risk of permanent loss of capital. 3) Liked iron ore a little bit more as BHP has a very strong position in this metal.

BHP looks like a fine hold to me. It could be a great thing for some investors. For now, I’m passing on BHP in favor of other exposures in the space that better suit my investing requirements and preferences.

Be the first to comment