doughnuts67/iStock via Getty Images

National Grid (NYSE:NGG) is a British-focused utility I’ve been writing about for some time. In this article, I’m going to revisit the results of this surprisingly resilient business that’s been holding up well this year, but might be trading at a bit of a premium if we look at sector multiples, peers and forecasts.

Let’s see if this company can deliver any sort of significant, realistic alpha as we move forward.

Revisiting National grid – High visibility and good cash flows

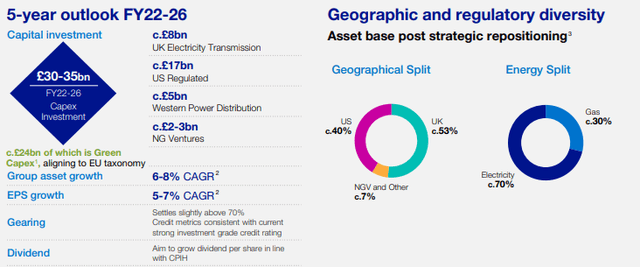

The outlook for a business like National grid is much-improved over the past few months. The market downturn has made recession-resistant asset owners and fully regulated players in the market so much more attractive. NGG’s 5-year outlook for the market has improved, where the company now expects an upward limit of £35B worth of CapEx investment until 2026E, while growing EPS by 5-7% during that time.

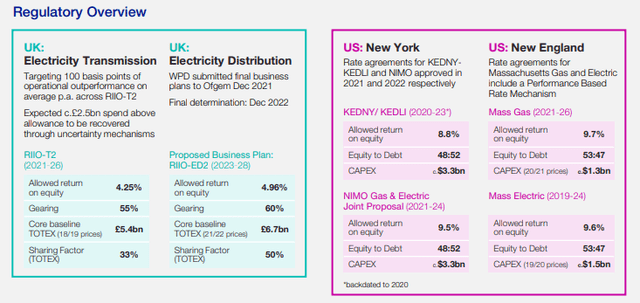

A company like NGG is seeing improvements in profit for electricity transmission and distribution, as well as gas. While the company’s US operations are posting somewhat lukewarm results in terms of overall profit, the company’s balance sheet remains exceedingly strong with 64% fixed rate debt and an interest coverage ratio of 4.7X, well above Moody’s FFO interest cover of 4.5X.

As with all utilities, NGG is a bit at the mercy of the regulators – and there are plenty of those for the company given the business’s split operations of the UK and US, with plenty of individual specifics for the areas.

NGG is one of the world’s largest publicly-listed utilities. They’re also facing one of the largest set of challenges out there, including delivering efficient energy for its customers, enabling the green energy transition with a net-zero target in less than 30 years, while pleasing shareholder returns. This is what drives the company’s very ambitious spending plan that targets upwards of £35B worth of investments, with most of that sum going into eligible electricity investments, and very little going into gas emissions, transmission, and other areas.

The company delivered an absolutely stellar FY21/22 set of results, with underlying operating profits close to £4B, which was 4% above consensus and 5% above what I expected out of the company myself. The reason for the outperformance? The UK electricity distribution segment reached very impressive levels of operating cash flow, supported by significant RoE of 13.6% or 400 bps above the allowed level, thanks to impressive CapEx and incentives on service quality.

The company’s outlook came in weaker than analysts expected overall. 2021, however, gave a very high comparative base to put these results next to, and any growth from this is an impressive feat. The group confirmed its 5-year outlook, which is what we see above, even if some were disappointed by the fact that the company did not guide for increased midterm results.

The fact is, NGG is a bit of a perfect inflation hedge – it has been for a long time. I see the company’s 7% CAGR upward EPS target as conservative – and I would expect closer to possibly 8-9%. There’s something wrong with the considered equation of limited EPS growth but a significantly growing dividend due to CPIH-indexed inflation, while managing aggressive CapEx over a 5-year period. I consider the company’s prospects to be more solid than this, because of these indexed inflation clauses, its CapEx plans, and the various company plans to integrate operations, divest NECO and NGG as well as a 50% stake in a JV in order to re-allocate capital and capture further synergies.

There’s more to NGG’s near-term future than this conservative guidance would suggest – and it’s important to remember that NGG’s attractiveness is exactly because of that protected dividend. It’s my view that NGG offers one of the best “hybrid” profiles in terms of investments, with a mix of floating-bond type investments while remaining exposed to the equity market.

While the company has certainly dropped down, as we’re moving into the current rate environment, this has only made the company’s now-5% yield more appealing and put more upside to it. Also, that drop is significantly lower (less than 1%) on a market day when most stocks seem down more than 3%. No, there’s a lot to like about NGG here – and that’s why I recently started a small starter position in the business with the intention of slowly building more, as it hopefully drops even further.

Fundamentally speaking, this is a very attractive utility – especially after a YTD drop of 10%.

Let’s look at that valuation.

NGG – the Valuation

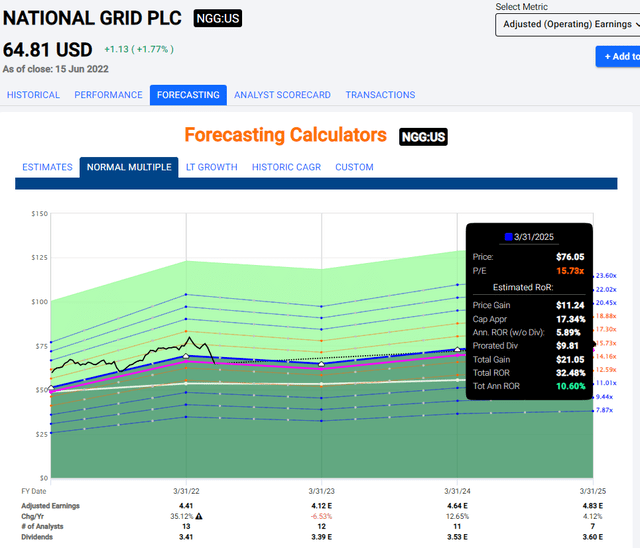

Current expectations for NGG are rather modest. The company is expected to grow EPS by around 3.5% on average until 2025E, including a 6.5% 2023E drop. I believe these analysts are overstating the downside somewhat – but I don’t mind, given that these expectations are part of what has pushed NGG to trading at below 15X P/E, when it is usually well above that 15X P/E level.

At current pricing, the company yields 5% and has a 3-year upside of no less than 10.6% annually, or 32.5% total RoR until 2025E.

Not enough?

Consider and remember for a moment that you’re really talking about essentially a hybrid bond-proxy. These are utilities and transmissions to millions of customers across New England and the UK – these are incredibly stable operations with indexation for inflation. That’s exactly what we want to hear in the current environment – that we are, in fact, indexed and protected against what inflation may come.

For those reasons, here is the real upside for NGG.

Is it the “best upside” ever? No – of course not. That’s not why I am writing this article about NGG. I’m writing because this is a BBB+ rated safe utility investment and perhaps one of the best of its kind, with proven stability over a long period of time. It doesn’t have the same volatility as some of your southern European utilities may experience, such as Enel (OTCPK:ENLAY). Not that I am saying I think Enel isn’t a great investment – it’s one of my largest utility plays – but NGG is certainly less volatile, and structured more like one would consider a bond proxy.

Current targets for this supposed bond proxy come to $70.22 on an average level, which gives us an upside of about 7-10% depending on what share price and day you’re looking at. I consider this to be an accurate level/accurate target for the company.

Looking at various ways to value NGG, we see that the company’s book value implies a massive undervaluation of the company’s assets. Yield, P/E and NAV are somewhat more modestly discounted and only imply a single-digit upside (still valid), but it is book value that we find some of the more interesting comps. Peers to NGG are companies like E.ON (OTCPK:EONGY), SSE (OTCPK:SSEZY), Snam (OTCPK:SNMRY), and others – and to these, the company is undervalued in every single way.

Though again, not by much.

The undervaluation is there – it’s just around 10%. If you want more, you may have to wait, and if we don’t get there, you’ll have missed that opportunity to pick up NGG at 5% yield.

I decided to pull the trigger on my order here – and you may indeed decide to do the same.

I consider the company a “BUY”, with a price target of $70/share.

Thesis

The current thesis for National Grid is:

- While an excellent company with an appealing portfolio, NGG is about to take on copious amounts of leverage to improve its assets while doing very little to its dividend – though inflation will now do something to offset that.

- With an improved valuation, I now consider NGG to be a “BUY”.

- I would now be interested in buying the company, and I’m bumping my PT up to $70/share.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment