ymgerman

This article was co-produced with Chuck Walston.

Citigroup (NYSE:C) is a chronic underperformer among banking stocks. Even shares of scandal ridden Wells Fargo (WFC) outperformed Citi over the last decade.

One cause of the poor record lies in a standard measure of a bank’s profitability. Known as return on tangible common equity (ROTCE), it measures the profit on shareholder’s capital, excluding goodwill, intangible assets, and preferred equity. (ROTCE is reported as a percentage. A higher number equals greater profits.)

Over the last few years, while peers posted an average ROTCE of roughly 13%, Citi routinely posted an ROTCE just above 10%. Now consider that the Office of the Comptroller of the Currency fined the bank $400 million for its failure to address long-standing systemic issues, and you understand why investors have shunned Citigroup.

However, management is addressing those problems and reshaping the bank’s business model. Unfortunately, unraveling the causes of the bank’s miscues will take time. Meanwhile, Citigroup trades well below tangible book value and offers a well-covered dividend with a robust yield.

Understanding Citigroup’s Strengths And Weaknesses

To dissect Citi, one must understand that the bank’s strengths are all too often also its weaknesses.

Ranked as one of world’s largest banks, Citi has approximately 200 million customer accounts and conducts business in more than 160 countries and jurisdictions. This broad geographical reach means the bank provides services few can match. For example, it is of particular value for clients with cross-border needs.

At the same time, it requires the bank to adhere to a plethora of regulations, a complex and expensive undertaking. Furthermore, due to its size, the bank has limited branch coverage in most of its markets. In fact, within its home base in the U.S., Citigroup does not hold the number-one share in any of its metro areas.

This results in the bank having difficulty developing a low-cost deposit base and has contributed to the poor performance of the bank’s.

In addition to these shortcomings, Citigroup attracted the ire of banking regulators. Labeled by MSNBC as the “biggest banking blunder,” a $900 million mistaken transfer of funds to Revlon Inc.’s (OTCPK:REVRQ) lenders resulted in the Federal Reserve Bank and the Office of the Comptroller of the Currency fining Citigroup $400 million.

Unfortunately, regulators have previously focused their attention on Citi. Consent orders dating back to 2013 and 2015 concern the firm’s internal controls over data, compliance, and risk management.

Considering that the Revlon mishap occurred in 2020, it illustrates the limited progress management made correcting the bank’s deficiencies.

More recently, the Federal Reserve and FDIC advised Citigroup of the bank’s “shortcoming” in its 2021 “living will” plan.

A “living will,” refers to a banking institution’s plans to liquidate should an economic shock force it into bankruptcy. Following the Great Recession, the eight largest U.S. banks were required to submit living wills, and Citigroup’s plan is the only one that failed to pass the scrutiny of the Fed and FDIC.

If the problems are not corrected, regulators stated the bank could face, “additional [regulatory] requirements.” Citi now has until January 31 to address the issue.

Although analysts do not see this as a major hurdle, it nonetheless highlights the bank’s shortcomings.

Most pundits believe the Revlon debacle hastened the retirement of CEO Michael Corbat and his replacement by Jane Fraser. However, during Corbat’s reign, he worked to cut costs, close branches, and initiated a series of divestitures.

The fact that the bank still has numerous operational deficiencies highlights the enormous task that Fraser faces.

Fraser’s Fix-It Formula

CEO Jane Fraser plans to sell or wind down 14 of the international consumer banking units. The current plan is to exit markets in Asia, Europe, the Middle East and Mexico.

Most of the assets are considered inefficient and of such small scale that they are incapable of competing against local rivals. The sales are projected to free up billions in capital and lessen some of the regulatory burdens inherent in Citi’s far-flung operations.

In June, the bank completed the sale of its Australian Consumer Business. Since then, Citi has entered into deals to sell its retail banking businesses in Bahrain, Malaysia, Vietnam and Thailand.

The sale of its Bahrain operations are expected to result in a regulatory capital benefit of $40 million, while those in Malaysia, Vietnam and Thailand should result in a regulatory capital benefit of $1 billion.

The sale of the bank’s consumer units in India, Taiwan, and Indonesia should be completed in 2023.

Citigroup is also in the process of winding down consumer banking operations in South Korea and Russia. The firm will wind down the consumer business in the U.K. to focus on the wealth franchise in that country.

In total, management forecasts the sale and/or closure of the targeted operations will free up at least $10 billion in capital.

Fraser’s plan will enable the bank to focus resources on the wealth, Institutional Clients Group, and North America Consumer.

A Speed Bump Or…?

A linchpin in Citi’s efforts lies in plans to sell its operations in Mexico.

Ranked among the largest banks in Mexico, Citibanamex has been quite profitable. In 2021, it generated an ROTCE above 27%. There are analysts that forecast a deal for the bank will land in a range of $7 billion to $8 billion. The sale is also expected to free up a minimum of another $4 billion to $5 billion in capital.

However, billionaire Carlos Slim’s Grupo Financiero Inbursa SA is no longer among the group of prospective buyers. He bowed out after Grupo Financiero Banorte exited the bidding for Citibanamex.

That leaves Grupo Mexico SAB competing against a consortium of international and local investors that include Banca Mifel SA.

This raises the question: will Citibank be forced to sell the business in Mexico for a bargain basement price or opt to continue operations in that country?

Either scenario would mark a significant setback in management’s efforts to simplify operations and garner the capital needed to pursue the more profitable facets of Citi’s business.

Where Citi Shines

There is an arena in which Citigroup excels. The bank’s Treasury and Trade Solutions (TTS) enables businesses to operate globally by providing cash management and liquidity services. TTS is connected to 270 clearing systems and can facilitate the movement of money in 140 currencies.

TTS garnered 21% of Citigroup’s revenue in 2021. In Q2, TTS also generated half of the bank’s deposits and notched the best quarter for the business in a decade.

TTS revenues surged 18% in Q1, 33% in Q2, and 40% in Q3, driven by growth in net interest income, as well as strong fee growth with commercial and large corporate clients.

In 2021, TTS generated about 13% of Citigroup’s net interest income (NII) and also averaged an approximate 22% return on tangible common equity between 2017 and 2021.

Something To Monitor

Banks must maintain a reserve to meet capital requirements in the event of a severe economic downturn. Referred to as CET1, the Federal Reserve’s annual stress tests determine the minimum amount banks are required to hold in reserve.

Last year, Citi’s minimum CET1 requirement was 10.5%; however, the regulatory capital requirement has been increasing, resulting in the bank devoting larger sums to CET1.

At the end of last quarter, the bank had a CET1 ratio of 12.2%, well above the 11.5% CET1 requirement of October 1st.

However, in January, the bank’s CET1 requirement will hit 12%, and management plans to build to a CET1 target of 13% by midyear of 2023.

The increasing CET1 requirement means Citigroup lacks the capital needed to repurchase stock. However, a study of earnings calls indicates management is bent on restarting share buybacks once the company clears the CET1 hurdle, a pivotal point considering the stock’s current undervaluation.

…given where we’re trading, it makes a lot of sense to be doing buybacks. And so we will likely continue to lean that way as opposed to doing a lot to change the dividend.

– Mark Mason, CFO, Q1 earnings call

We know how important buybacks are to shareholder value creation, in particular when we are trading at these levels, and are committed to restarting them as soon as it is prudent to do so.

– Jane Fraser, CEO, Q2 earnings call

…I know where we trade in terms of book value and I’d love to be in a position where we were buying back given that valuation.

– Mark Mason, CFO, Q3 earnings call

Debt, Dividend, And Valuation

Citi’s debt is rated BBB+/ Stable by S&P, A3 by Moody’s A3, and A by Fitch.

The current yield is 4.47%. The payout ratio is 27.53%, and the 5-year dividend growth rate is 16.27%.

Citigroup trades for $44.51 a share. The one-year average price target of 18 analysts is $58.65. The price target of 5 analysts rating the stock following the Q3 report is $60.30.

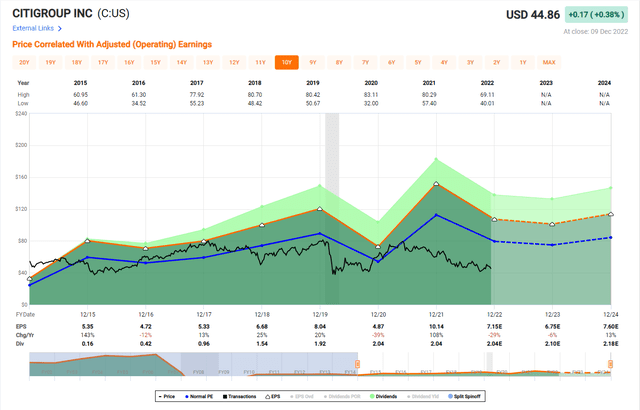

Citigroup has a forward P/E of 6.38X, well below the stock’s average P/E over the last 5 years of 9.56x.

Citigroup’s price/tangible book value is 0.51. To place this in perspective, JPMorgan Chase (JPM) and Bank of America (BAC) have tangible book values of 1.70 and 1.39, respectively.

Is Citigroup A Buy, Sell, Or Hold?

As banks go, Citigroup might be described as a jack of all trades and master of none. However, despite its shortcomings, the bank holds a leading market share in treasury and trade solutions and has the second-largest share in fixed-income and equity markets.

Fraser’s plan is to focus on areas where the bank holds an advantage while pivoting away from the bank’s less profitable operations. Of course, Citigroup must also address regulatory issues.

With 10,000 employees devoted to the turnaround, Citigroup has been spending heavily to modernize the bank. Those costs are projected to increase by 7% to 8% by year’s end and should climb into 2023.

Nonetheless, it is heartening to know the bank is on track to meet management’s 7%-8% growth rate, excluding the impact of divestitures. Berkshire Hathaway’s recently acquired position in Citi, initiated at prices well above the current valuation, is also reassuring.

I rate Citigroup as a Speculative BUY.

The bank’s transformation, assuming it is successful, will take years and undoubtedly hit the occasional speed bump. Investors in Citigroup must be patient and be prepared for the long haul.

In the meantime, shareholders can pocket a rather robust yield and hope the bank restarts share repurchases while the stock trades well below tangible book value.

Be the first to comment