24K-Production

Introduction

In September, I wrote a bullish article on SA about apparel company Jerash Holdings (NASDAQ:JRSH) in which I said that it looked cheap but that FY23 would be challenging as major customers were placing smaller orders, and this means that the product mix has to shift to lower margin items.

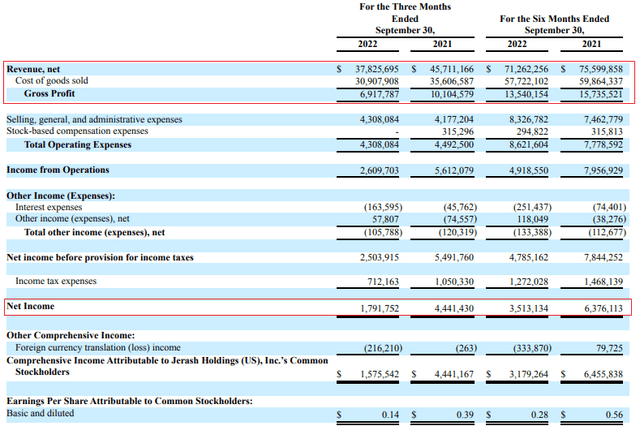

Well, Jerash recently released its Q2 FY23 results and it seems that I might be on the right track as revenues declined by 17.3% while the gross profit margin shrank to 18.3% from 22.1% a year earlier. This company is still on my watchlist but I think this is the wrong time to open a position. Let’s review.

Overview of the Q2 FY23 results

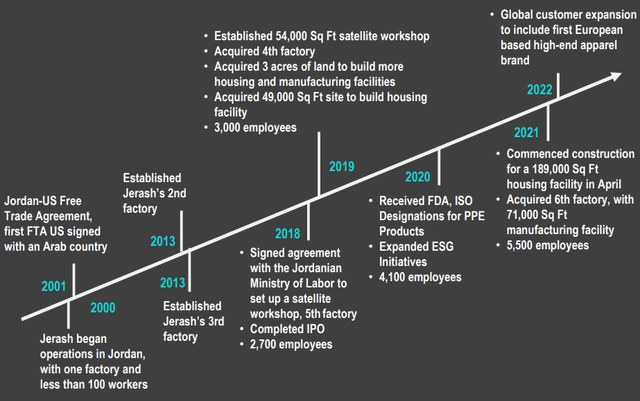

In case you haven’t read any of my previous articles about Jerash, here’s a short description of the business. The company is involved in the manufacturing of t-shirts, polo shirts, pants, shorts, and jackets for major U.S. brands such as The North Face, Calvin Klein, and American Eagle, and its production facilities are located in Jordan. The reason for this is that labor is cheap in the latter and the two countries have a free trade agreement which means that the exports of Jerash are exempt from customs duties and import quotas. This puts it at a significant advantage compared to competitors from other countries with cheap labor (e.g. China). At the moment, Jerash has a total of 6 factories near the city of Amman with a combined annual production capacity of about 14 million pieces.

Jerash

Turning our attention to the Q2 FY23 financial results, you can see from the table below that revenues decreased by 17.3% year on year while the net income halved as the company is feeling the effects from the pressure of high inflation, and interest rates on apparel retail sales in the USA. Also, Jerash revealed on its Q2 FY23 earnings call that revenues were about $4 million lower than expected due to shipment delays as retailers sell through excess inventories. Overall, I think that Q2 FY22 results will be difficult to replicate for years to come as they received a significant boost from pent-up demand following the peak of the COVID-19 epidemic.

Jerash

As you can see from the table above, the gross profit margin continues to be significantly lower compared to FY22 due to a shift in the product mix to apparel items with lower margins. Things look grim for Q3 FY23 as Jerash expects to book revenues of between $33 million to $35 million compared with $36.8 million a year earlier. The gross margin for the full year is forecast to be between 16% and 18%.

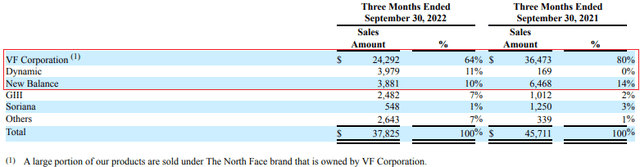

On a positive note, Jerash has begun manufacturing its first products for Skechers and Timberland and the first shipment took place in October. The orders are for an estimated 700,000 pieces annually and have lower margins compared to the current mix, but I think that this is a step in the right direction as the company has a high customer concentration risk at the moment. In Q2 FY23, the top 3 clients accounted for a total of 85% of revenues. Lower orders or the loss of any of them could have a significant impact on the financial results of Jerash.

Jerash

Jerash mentioned on its earnings call that it’s continuing to receive inquiries from other major brands, and I find it encouraging that it recently inked a memorandum of understanding to establish a joint venture company with Busana Apparel Group, which has 30 manufacturing facilities in Indonesia and Ethiopia. The joint venture company will produce garments for retail customers of Busana that aim to diversify geographically.

In other positive news, Jerash is building a new dormitory for about 1,500 workers which is expected to be ready in the first quarter of 2023. This facility should allow the company to save about $0.5 million per year on rental expenses.

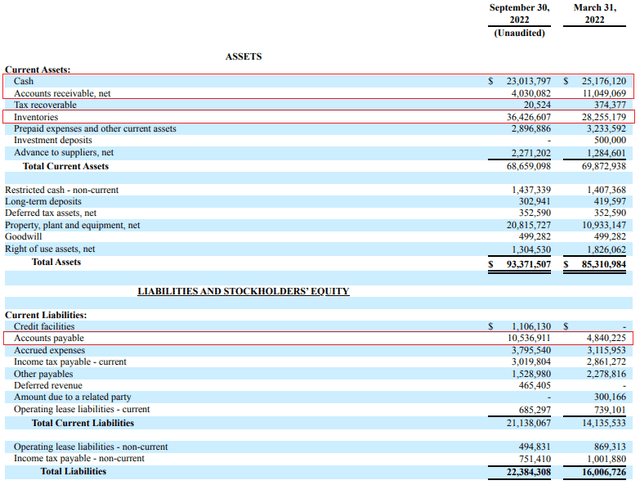

Turning our attention to the balance sheet, I think the situation looks good as Jerash had just over $23 million in cash and cash equivalents at the end of September. Net cash provided by operating activities was $10.1 million for Q2 FY23 thanks to a $7 million quarter-on-quarter decrease in accounts receivable and a $6.3 million increase in accounts payable. However, I find it concerning that inventories are at high levels.

Jerash

Looking at the valuation, Jerash has a net cash position of $20.4 million and its enterprise value stands at just $33.5 million as of the time of writing. Not bad for a company with EBITDA of $5.5 million in a challenging quarter. Yet, I just don’t think this is a good time to buy as the weak global macroeconomic environment should put pressure on its financial results for at least two more quarters and there are few catalysts for the share price at the moment. The major one I can think of is the company’s $3 million share buyback program, under which it still has $2.5 million available. The quarterly dividend is at $0.05 per share, and I don’t expect it to be increased in the near future.

Investor takeaway

Global economic downturns are not easy on companies involved in discretionary goods and it seems that Jerash has at least a few challenging quarters ahead from a financial standpoint. The company has a strong balance sheet and is still profitable thanks to the free trade agreement between Jordan and the USA but orders from its major customers have generally been smaller so far in FY23. In addition, the product mix has been shifting to lower margin items.

Overall, Jerash looks undervalued considering the enterprise value is just $33.5 million but this seems like the wrong time to open a position. I think risk-averse investors should void this stock for the time being.

Be the first to comment