Mario Tama/Getty Images News

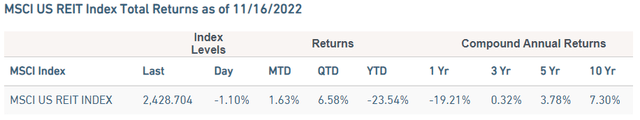

Investing broadly in REITs over the last 5 years has produced an underwhelming result.

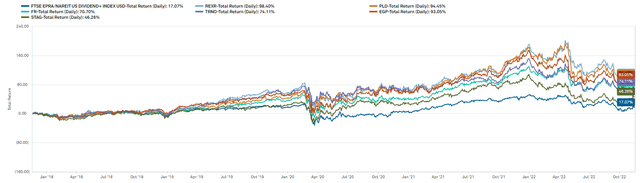

However, if you had exposure to the industrial sector, you were much more handsomely rewarded. If you owned Rexford Industrial Realty (NYSE:REXR) you would have nearly doubled your money, even after taking a beating in 2022.

The whole industrial sector has been pummeled this year and REXR has taken it among the hardest, now down more than 32%.

A number of factors/concerns have contributed to the recent investor exodus from the sector, but I would argue that many of these issues don’t fully apply to Rexford.

1)Rising interest rates hurt REITs.

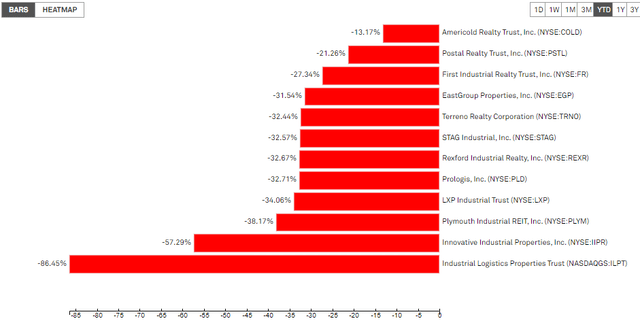

There may be some truth to this for highly levered REITs facing near term maturities, but REXR has very low leverage and well staggered debt maturities.

Historically, when Rexford has pursued new investment, instead of taking on debt they go to the capital markets with follow-on offerings of their common shares. Just last week they put out a secondary offering of 11,500,000 shares and netted more than $600 MM to fund their acquisition pipeline.

2) Amazon has pulled back in the market, creating a looming logistics supply glut.

Earlier this year we described how Amazon’s (AMZN) decision to slow its breakneck pace of distribution expansion caused fallout for EastGroup Properties (EGP) and the whole industrial sector. In the months that followed, one industrial REIT after another described sustaining demand and double digit rent rolls.

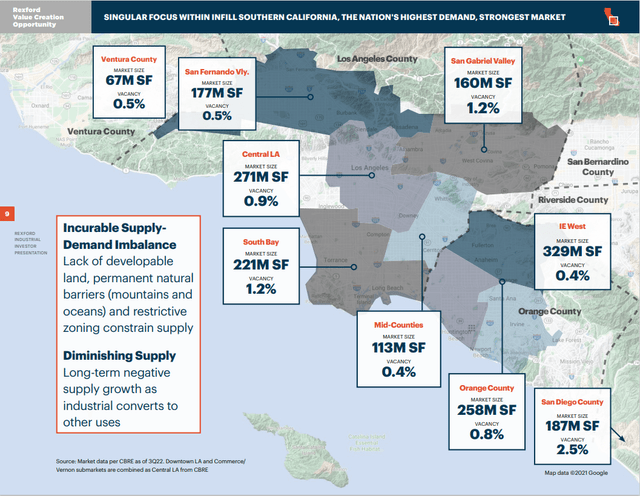

As for Rexford, it operates in its own Southern California microcosm. REXR describes its markets as constrained by an incurable supply demand imbalance and Rexford’s portfolio vacancy is consistently below 2%.

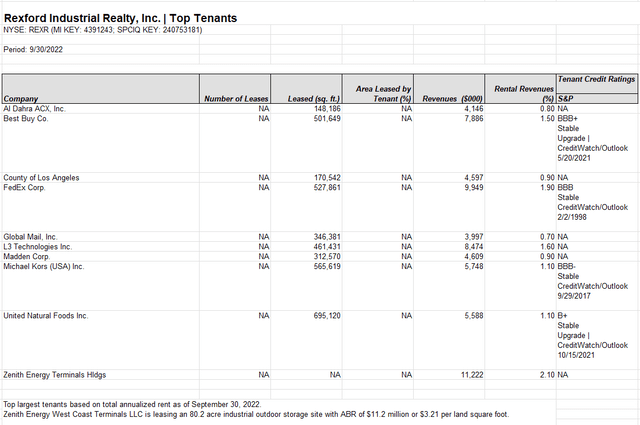

While Amazon is certainly in the Southern California market, they don’t even appear on REXR’s top tenant list.

3) Cap Rates are Rising

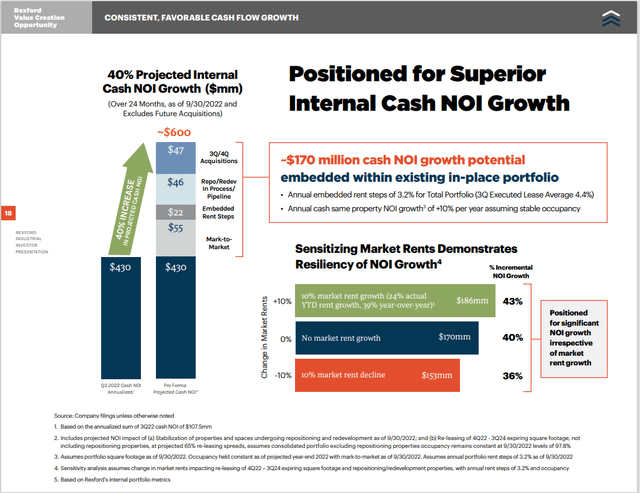

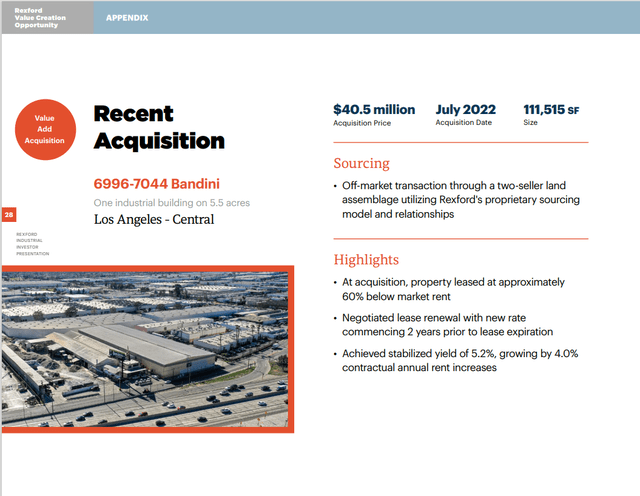

Higher interest rates are, indeed, slowing transactional activity and forcing many would be buyers to the sideline. Rexford has such a dominant presence in its SoCal markets that it feels confident that it can still acquire accretively and grow NOI faster than cap rates can rise.

Every acquisition has its own story within this strategy and here is one recent example.

4) REXR dividend pales vs the riskless yield (10 Year Treasury).

In response to Fed actions, yield on the 10y US T-Note has risen from 1.52% at the start of the year to as high as 4.22%, recently. Rexford is a proud serial dividend hiker and earlier this year boosted the payout by an impressive 31.25% to an annual rate of $1.26/share. Understandably, income investors are unimpressed because, even at the beaten down share price of ~$56, this translates to a rather anemic 2.25% yield.

But wait, recent market dislocation has presented new opportunities to attach REXR’s growth and capture a superior yield as well.

The Dislocated Preferreds.

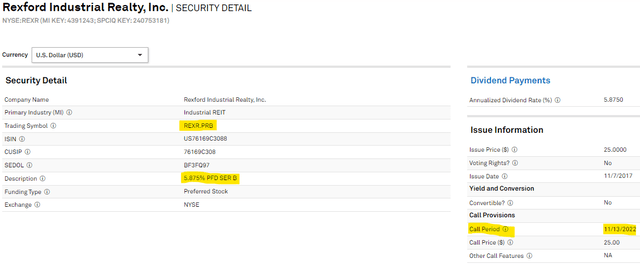

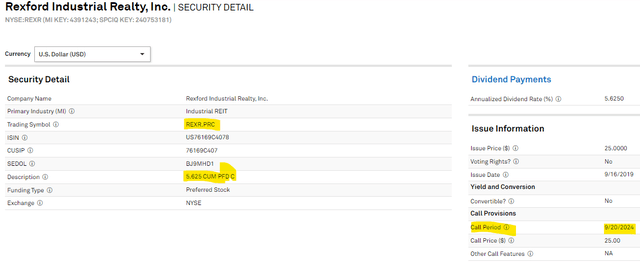

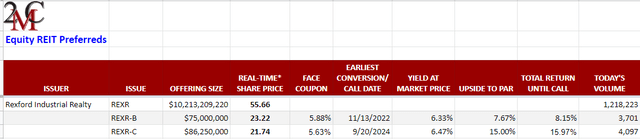

Rexford’s common shares have not always garnered such superior P/FFO multiples, so five or six years ago they, like many REITs, opted to issue relatively high coupon preferreds. They issued three separate Series and redeemed the Series A when it became callable in 2021. The Series B and C remain, and their particulars are described here:

Series B

Series C

While both of the preferreds had traded above par earlier this year, when the Fed began its rate hiking campaign, prices fell along with other fixed income securities. Our theory is that not only do preferred share prices decline in the face of rising interest rates, they can also suffer due to their relative lack of liquidity. A supply/demand imbalance develops, and opportunities can arise.

Purchasers today captured yields at cost in the 6.40% range and, if and when rates recede, a 10 to 15% upside when the shares are called.

In the frenzied market declines of September and early October, these shares traded as low as $19.59. With new CPI data and another Fed hike likely in December, you might do well to put these issues on your radar for the prospect of better prices presenting amidst market chaos.

The Takeaway

Rexford Industrial’s operating performance is truly impressive and you can see more details in their November REIT World Presentation.

Income investors might like to have REXR’s growth cake and eat fat dividends, too.

Be the first to comment