Bet_Noire

This article was co-produced with Cappuccino Finance.

I am a huge advocate of creating passive income. Warren Buffett once said,

“If you don’t find a way to make money while you sleep, you will work until you die.”

I don’t want to be quite as dramatic as our uncle Buffett, but it sure is nice to have some passive income. Since it doesn’t cost your time, it’s very scalable.

Owning a self-storage facility is one effective strategy to generate passive income. If you choose the right location and property manager, the business can be quite successful.

But there is an even more passive and safe way to play in this space. This involves owning REITs that focus on self-storage facilities. The self-storage industry has been growing at a rapid pace in the last decade or so, and I expect that growth to continue for a while.

The following three REITs own large portfolios of self-storage facilities and pay solid dividends. Given their strong asset base and fundamentals, I think it’s a great idea for any passive income-loving investors to consider some of these shares.

CubeSmart (CUBE)

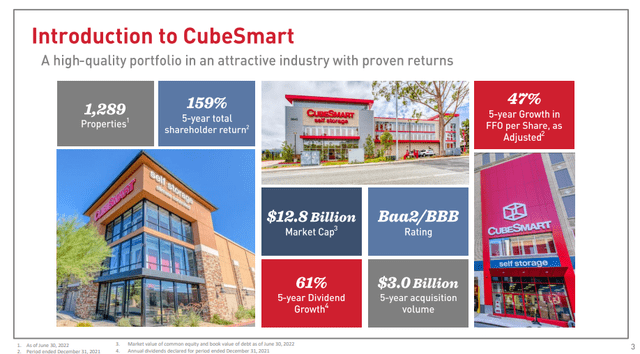

CubeSmart owns, operates, manages, acquires, and develops self-storage properties in the U.S. They have over 1,200 properties, and their growth in the past several years has been outstanding.

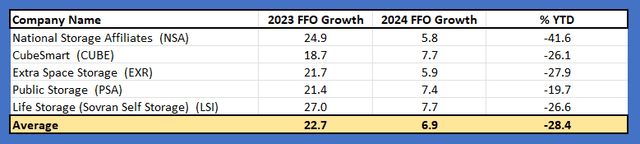

Their FFO per share grew 47% in the past 5 years, and the 5-year total shareholder return has been 159%.

Given they acquired $3.0 B worth of assets in the past five years, I expect their strong growth trajectory to continue in the future.

CubeSmart has been growing at a steady pace following a disciplined investment strategy. They focus on submarkets with attractive demographics for long-term growth, and they acquire properties in lease-up to generate elevated returns.

Also, CubeSmart often partners with local developers to gain local market expertise. Given that, it was not surprising to see their number of properties grow from 456 to 1,289 in a little over 10 years.

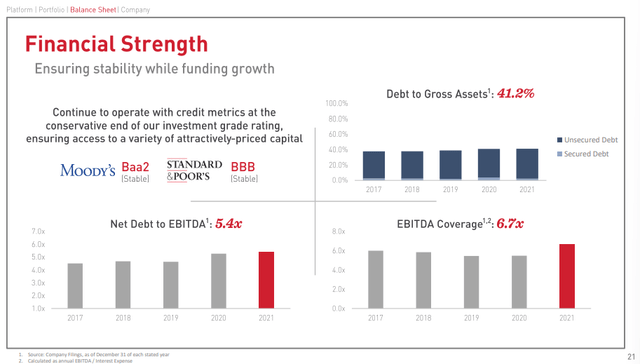

CubeSmart has a very strong balance sheet and capital structure. Their Net Debt to EBITDA stands at 5.4x and EBITDA coverage is at 6.7x. Moody’s and Standard & Poor’s rated CubeSmart at Baa2 and BBB, respectively.

Their debt maturity schedule is very well managed, and it is spread throughout the next several years.

Also, they have ample liquidity ($6.4 B raised since 2010) to support their growth trajectory.

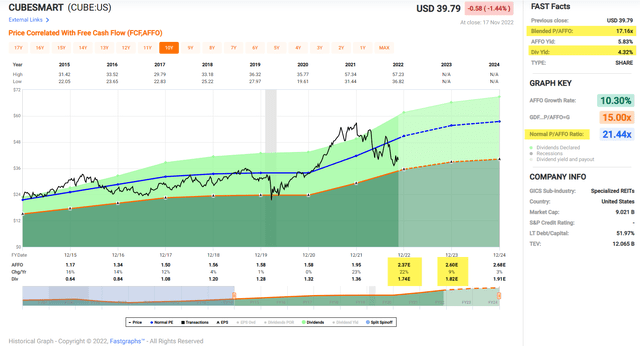

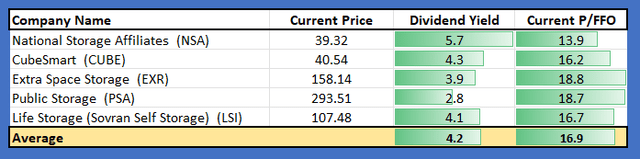

Currently CubeSmart pays a dividend of 4.3% yield, and it is safe at this point. Their cash dividend payout ratio is at 65.05%, and FAD payout ratio is at 61.04%. Their dividend growth rate has been solid. The dividend growth rate for the past 10 years has been 18.31% per year CAGR. I expect this strong growth trend to continue well into the future.

Extra Space Storage (EXR)

Extra Space Storage owns, operates, manages, acquires, and develops self-storage properties. They have two distinct business segments: self-storage operations and tenant reinsurance.

Their self-storage operations include rental operations of store spaces, and the tenant reinsurance activities include reinsurance of risks relating to the loss of goods stored in the spaces.

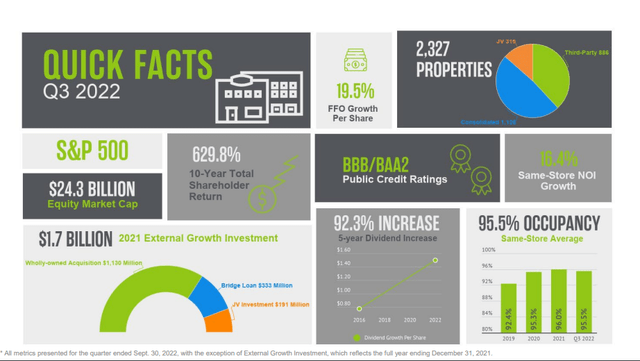

Extra Space Storage business has been growing substantially. They have over 2,000 properties, and their dividend has grown 92.3% over the past 5 years. Their storage units are 95.5% occupied.

All of this contributes to a great total shareholder return, which has been 629.8% over the past 10 years.

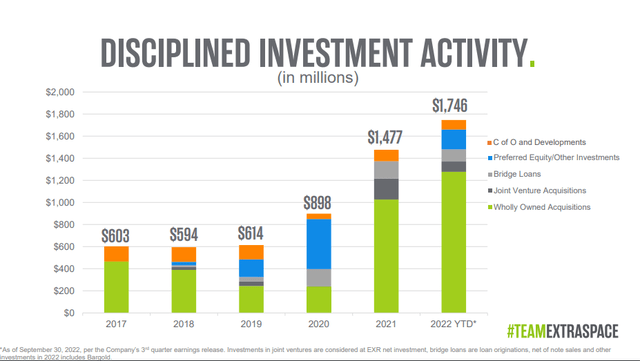

To maintain their impressive growth trajectory, the Extra Space Storage team continues to invest a substantial amount. Since 2017, they invested more than $590 M each year, and the figure substantially rose in the past couple of years.

Fueled by this substantial input, the number of Extra Space Storage branded properties grew from 910 in 2012 to 2,327 in 2022. Given their continued investment, I expect the trend to continue in the future.

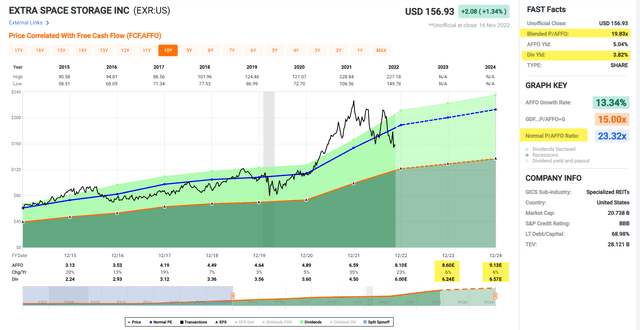

Extra Space Storage is undervalued at this point. Their valuations metrics like P/AFFO of 24.69x and P/FFO of 17.24x are nearly 25% lower than their 5- year average values. Also, based on the iREIT equity rating tracker, the margin of safety for Extra Space Storage is at 9%.

Also, their 3.8% dividend is safe. The cash dividend payout ratio is at 67.05%, and FFO payout ratio is at 69.61%.

Public Storage (PSA)

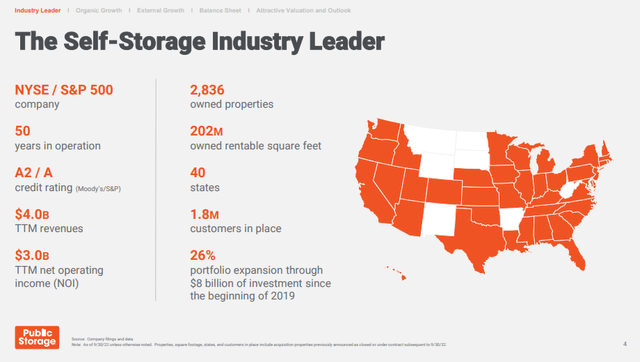

Public Storage owns and operates self-storage facilities and other related operations including tenant reinsurance and third-party self-storage management. They own more than 2,800 properties in 40 different states. Since 2019, Public Storage invested over $8 B on acquisitions, development, and redevelopment.

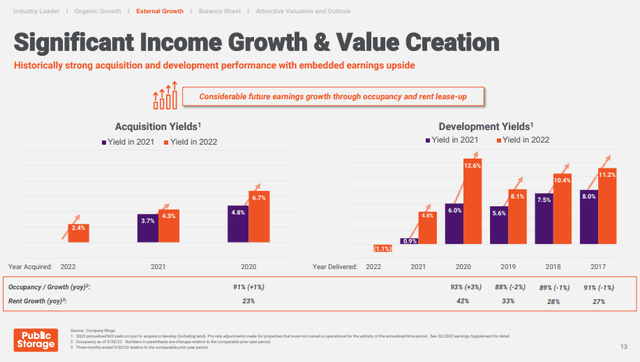

Public Storage has a strong track record of successfully acquiring and developing their properties. They have been adding value through acquisitions and development, and the yield from their investment has been strong.

Additionally, thanks to the strategic placement of their properties, the occupancy of the properties is strong. The occupancy rate has stayed above 88% since 2017.

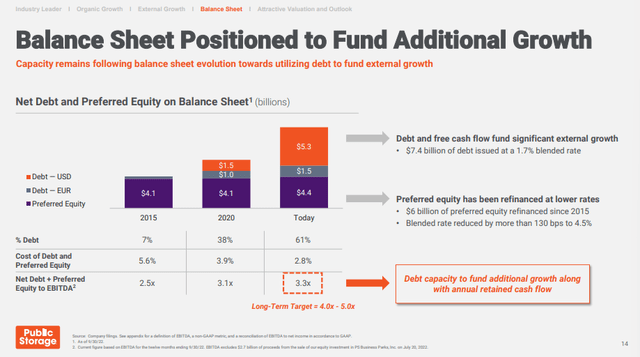

Public Storage has a strong balance sheet and favorable capital structure to support their growth. Their Net Debt + Preferred Equity to EBITDA stands at 3.3x, and their cost of debt and preferred equity is at 2.8%. Combining this solid capital structure with their strong free cash flow, I believe they will be able to support their growth in the future.

The 2.8% dividend yield may be lower than the other two options, but it is also a very safe yield. The cash dividend payout ratio is 50.91%, and their FFO payout ratio is at 52.25%.

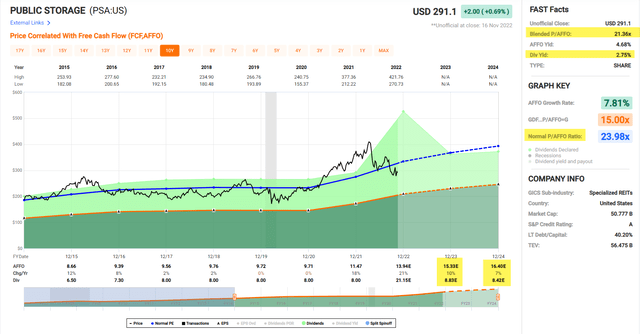

The recent drop in stock price of Public Storage has made their valuation very favorable. The current P/AFFO of 26.05x and P/FFO of 17.09x are significantly below their 5-year average. Their stock price is clearly undervalued. Also, iREIT rating tracker shows that the margin of safety on Public Storage is at 8%.

Risk

Inflation shows some sign of easing, causing the overall market to rally in the past couple of days. Even though I’m very happy to finally see some hopeful signs from the inflation figure, it’s still too early to say that we are out of the woods.

If the inflation readout in December is disappointing, the market will react very poorly. Therefore, investors should stay cautious and continue to keep their eye on macroeconomic trends.

More specific to the self-storage space, its recent meteoric growth has been greatly assisted by the large number of relocations during and since the pandemic. I expect the number of moves might stay higher than the pre-pandemic level for a while, as more and more people settle into a post-pandemic lifestyle.

However, I don’t expect the self-storage businesses to maintain the extremely impressive growth rates of the past year or so. Therefore, the investor should be somewhat cautious about the growth rate for the industry and keep their expectations in check.

Conclusion

The self-storage industry is a great place to put your money.

It has been growing substantially in the past several years, and I expect the industry still has more room for growth. The growth rate might not be quite as high as during the pandemic era, but the demand for self-storage is still there.

The three companies in this article are leaders in the industry, and they have been growing steadily in the past several years and are backed by strong fundamentals. I expect them to continue their trajectory and reward investors with a dividend as well as stock price appreciation.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment