IvelinRadkov

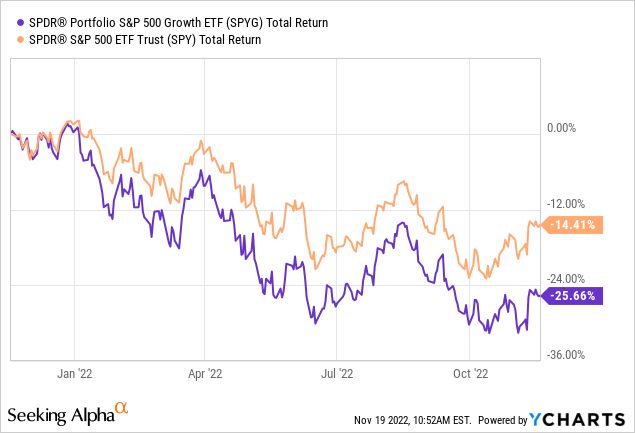

As they say in sports, sometimes the best offense is a good defense. That saying can also apply to investing – especially during bear markets. As a result, today, I’ll take a close look at one of State Street Global Advisors’ funds: the SPDR Portfolio S&P 500 Value ETF (NYSEARCA:SPYV). The goal of the SPYV ETF is to track the total returns of the S&P 500 Value Index through a portfolio of stocks that exhibit the strongest valuation metrics such as: book value, P/E ratio, and price-to-sales. The SPYV ETF is a relatively cost efficient fund (a 0.04% expense fee); it provides a modicum of income (a 30-day SEC yield of 2.15%); and it has a solid long-term performance track record that has delivered a 10-year average annual return of 10.8%. During the 2022 bear market, it has outperformed the S&P 500 – as represented by the (SPY) ETF – by over 11%:

Investment Thesis

Growth stocks are typically characterized by impressive growth in sales and cash-flow. As a result, the market tends to reward them with higher price-to-sales and P/E ratios. The downside, of course, is that these stocks are risky because if the growth narrative doesn’t pan out, the stocks have farther to fall given their relatively higher valuation.

On the other hand, “value” stocks typically represent companies that, relative to the broad market, are viewed as being “on sale”. Value stocks typically have proven and established business models that generate reliable profits and cash-flow. Value stocks tend to trade at lower price-to-sales and P/E ratios because their growth rates are slower. While these stocks are less risky, the downside is that in up-market cycles, they can underperform growth stocks and even the broad market averages. For years, that was the case during the bull-market prior to 2022.

All that said, my followers know I am a big fan of building and maintaining a well-diversified portfolio through the market’s up-n-down cycles. That being the case, in my opinion the discussion of growth vs. value is not an “either/or” proposition: it is “both”. That is, a well-diversified portfolio that holds both growth and value investments should, overall, achieve what should be considered a happy medium: GARP (or, “growth at a reasonable price”). The question then becomes how to build such a portfolio that gives an investor reasonable exposure to both growth and value.

Today, I’ll take a look at the SPYD ETF to see if it might be a nice addition to the value bucket of your portfolio.

Top-10 Holdings

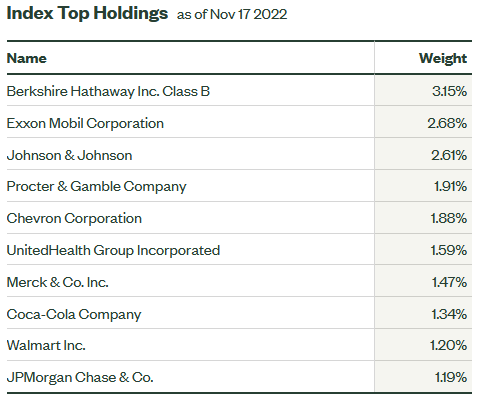

The top-10 holdings in the SPYV ETF are shown below and were taken directly from State Street’s SPYV ETF homepage. The top-10 holdings equate to what I consider to be a relatively well-diversified 18.9% of the entire 445 stock portfolio:

State Street Global Advisors

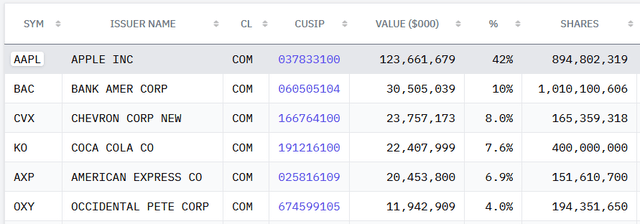

The #1 holding is the Warren Buffett headed diversified conglomerate Berkshire Hathaway (BRK.B) with a 3.2% weight. As I pointed out in my recent Seeking Alpha article on the (VOOV) ETF, Berkshire’s latest SEC Form 13-F filing revealed the company’s top-6 holdings (as of 9/30/2022) are as follows:

13f.info

As can be seen, Apple (AAPL) represents 42% of Berkshire’s stock holdings and is far and away the company’s #1 position (larger than the next 5 positions combined). Berkshire is also heavily invested in oil & gas with Chevron (CVX) and Occidental Petroleum (OXY) equating, in aggregate, to 12% of its portfolio of stock holdings.

While Buffett himself loves dividend paying companies, it is important to point out that Berkshire itself does not pay one. That is unfortunate considering that several of Berkshire’s holdings pay nice dividends – including Chevron – which throws off a $5.68/share annual dividend. Note Chevron is also the #5 holding in the SPYV ETF with a 1.9% weight.

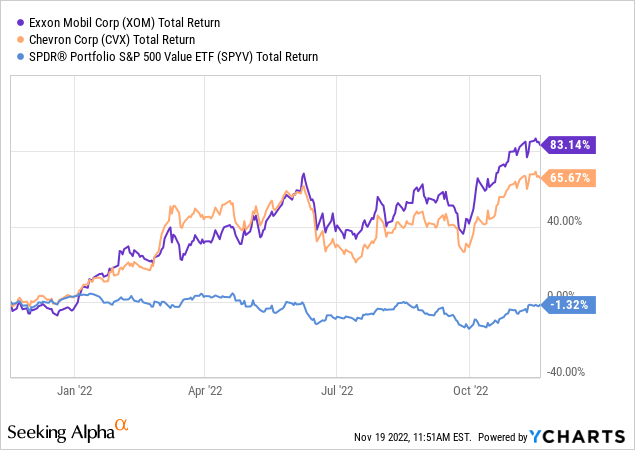

Exxon (XOM) is the #2 holding in the SPYV ETF, with a 2.7% weight. Exxon is performing much better for shareholders since Engine #1 won three board seats and strongly recommended Exxon restrain the over-spending that caused the company to post a negative shareholder over the “lost decade”. As a result of its decreased cap-ex budget, and combined with relatively high oil & gas prices, Exxon has delivered record free-cash-flow this year and XOM stock (as well as Chevron) has responded quite dramatically to the upside, and has obviously been responsible for an out-sized portion of the SPYV’s returns over the past year:

The #6 and #7 positions are two healthcare related companies: UnitedHealth (UNH) and Merck (MRK), with a combined weight of ~3%. Healthcare is considered to be a relatively defensively oriented sector. UNH is up 18% this year, while big-pharma company Merck is currently yielding 2.65%.

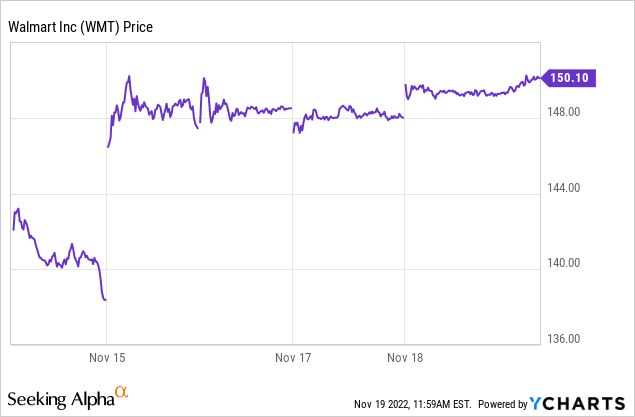

Two relatively defensive consumer staples companies – Coca-Cola (KO) and Walmart (WMT) – hold down the next two positions in SPYV’s top-10 list and equate to a combined weight of 2.5%. Walmart popped ~$10 higher on Tuesday after delivering Q3 results that surprised analysts and were a big beat on both the top- and bottom-lines:

The top-10 list is rounded out by JPMorgan Chase (JPM) with a 1.2% weight. Financial companies are generally expected to benefit in a rising rate environment because they can profit off the interest rate margin (the delta between the interest rate the bank can borrow money at relative to the interest rate at which it is able to lend money). JPM yields 3% but is down 18% over the past year and trades at a relatively low-valuation (P/E=11.5x).

Overall, the SPYV ETF portfolio trades at a significant valuation discount as compared to the broad S&P 500:

| P/E | Price-to-Book | Yield | |

| SPYV ETF | 15.2x | 2.73x | 2.25% |

| S&P 500 | 20.6x | 3.96x | 1.65% |

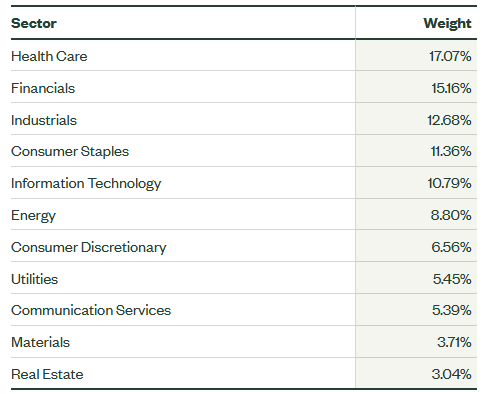

Lastly, and as expected, overall the SPYV ETF portfolio is overweight in the healthcare, consumer staples, financials, and energy sectors:

State Street Global Advisors

Performance

As mentioned in the bullets, the SPYV ETF has a very solid performance track record, with a 10-year average annual return of 10.8%.

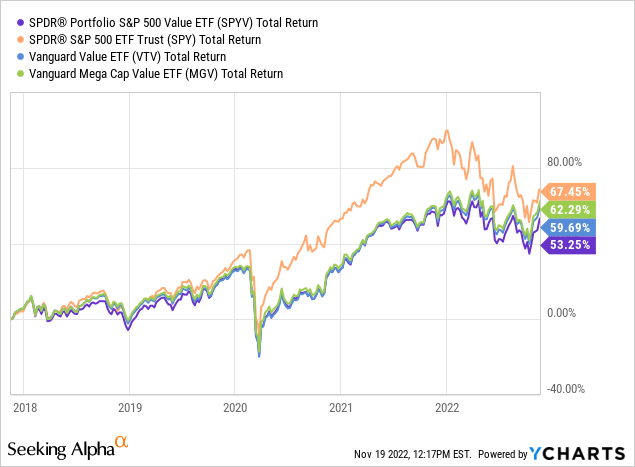

The following graphic compares the 5-year total returns of the SPYV ETF with that of the broad S&P 500 as represented by the SPY ETF as well as that of its value oriented peers: the Vanguard Value ETF (VTV), and the Vanguard Mega Cap Value ETF (MGV):

As can be seen, despite the 2022 bear market, the S&P 500 has beaten all the value oriented ETFs over the past 5-years. However, if we look at only the value ETFs, the SPYV fund comes in last by a significant margin and the overall winner is the MGV ETF. While the MGV ETF has a slightly higher expense fee as compared to the SPYV ETF (but only 3 basis points), it has the advantage – in my opinion – of a much more concentrated portfolio of 144 stocks versus 445. That being the case, its weightings in winners like Exxon and Chevron are significantly higher, as is the dividend yield (2.46%).

Risks

While the downside risks of owning virtually any “value” fund are – in my opinion – considerably less than owning the S&P 500 or the Nasdaq-100, these ETFs are certainly not immune to the headwinds of the overall macro-environment: continuing shutdowns in China and supply-chain challenges related to the global pandemic, higher inflation, higher interest rates, and the impact of Russia’s horrific war-of-choice on Ukraine that has broken the global energy & food supply chains. The war has led to rampant inflation across the globe. Any or all of these factors can (and have) led to a significant slow-down in the global economy could cause a potential severe recession and a related downdraft in the stock market.

As a result, I advise investors who are considering establishing a position in the SPYV ETF (or, better still, MGV …) to scale in over time. That way, you won’t regret having gone “all in” at the top of a “bear-market rally,” and you will have been able to take advantage of market volatility in order to dollar cost average into your position during down-cycles.

Summary & Conclusion

The idea of investing in value stocks makes sense and appeals to me. However, the SPYV ETF suffers from the same implementation issue as does the VOOV ETF I covered yesterday. Both hold over 440 stocks within the S&P 500 – and they can’t all be the “best” value stocks, right? That being the case, I favor Vanguard’s MGV ETF, which holds only the best 144 value stocks within the S&P 500. While the fee is a bit more (3 basis points), you will more than recoup that small expense through a higher dividend yield and better performance. While I rate SPYV a buy as I believe it will likely outperform the S&P 500 over the next 6-9 months given the current macro environment, I think the MGV is the superior value fund and the better choice for investors who want to build and hold a well-diversified portfolio for the long-term.

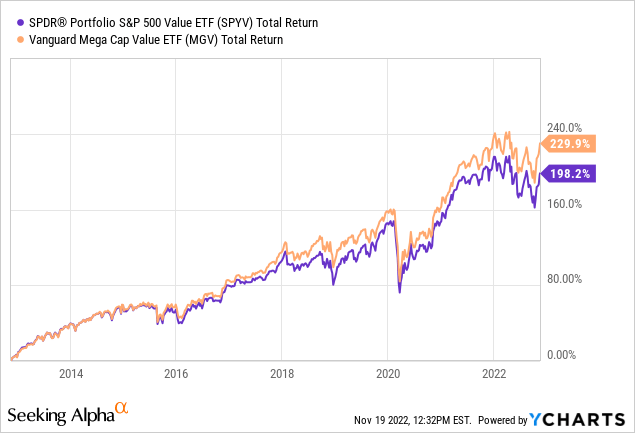

I’ll end with a 10-year total returns comparison of the SPYV and MGV ETFs:

Be the first to comment